- The entire worth locked on Lido Finance went previous $8 billion in January.

- Regardless of the feat, the protocol’s native token was down 5.82% at press time.

Lido Finance [LDO] had a rollicking begin to 2023 after it eclipsed MakerDAO [MKR] to grow to be the largest decentralized finance [DeFi] protocol, as per DappRadar. Furthermore, the entire worth locked (TVL) of Lido’s sensible contracts went previous $8 billion in January 2023, which amounted to features of over 36%.

4/ @LidoFinance has additionally overtaken @MakerDAO as the largest DeFi platform available on the market, with a rise of 36.77%. They now have greater than $8B locked of their platform.

— DappRadar (@DappRadar) February 2, 2023

Learn Lido’s [LDO] Value Prediction 2023-24

ETH 2.0 behind the expansion?

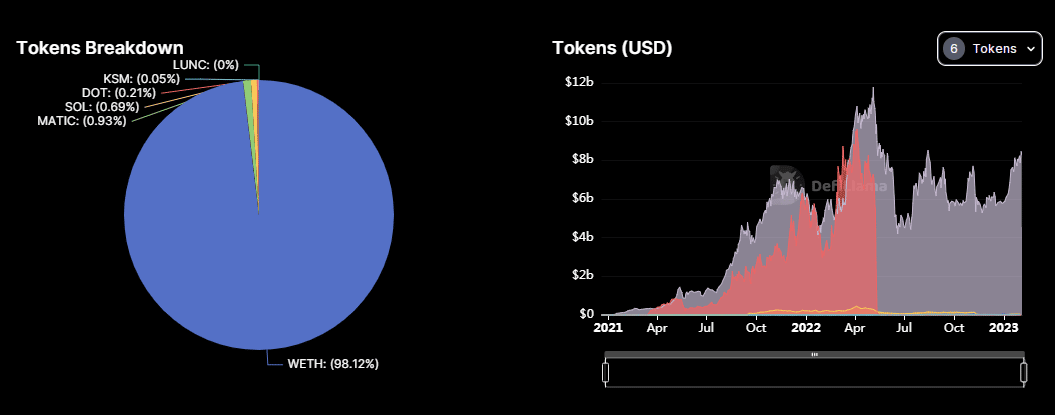

Lido’s progress may very well be attributed to the growing recognition of liquid-staking protocols, which elevated manifold following Ethereum’s [ETH] transition to the Proof-of-Stake (PoS) algorithm. Information from DefiLlama confirmed that about 98% of the TVL locked on Lido got here from the locked ETH tokens, which surged by 30% throughout January.

Supply: DeFiLlama

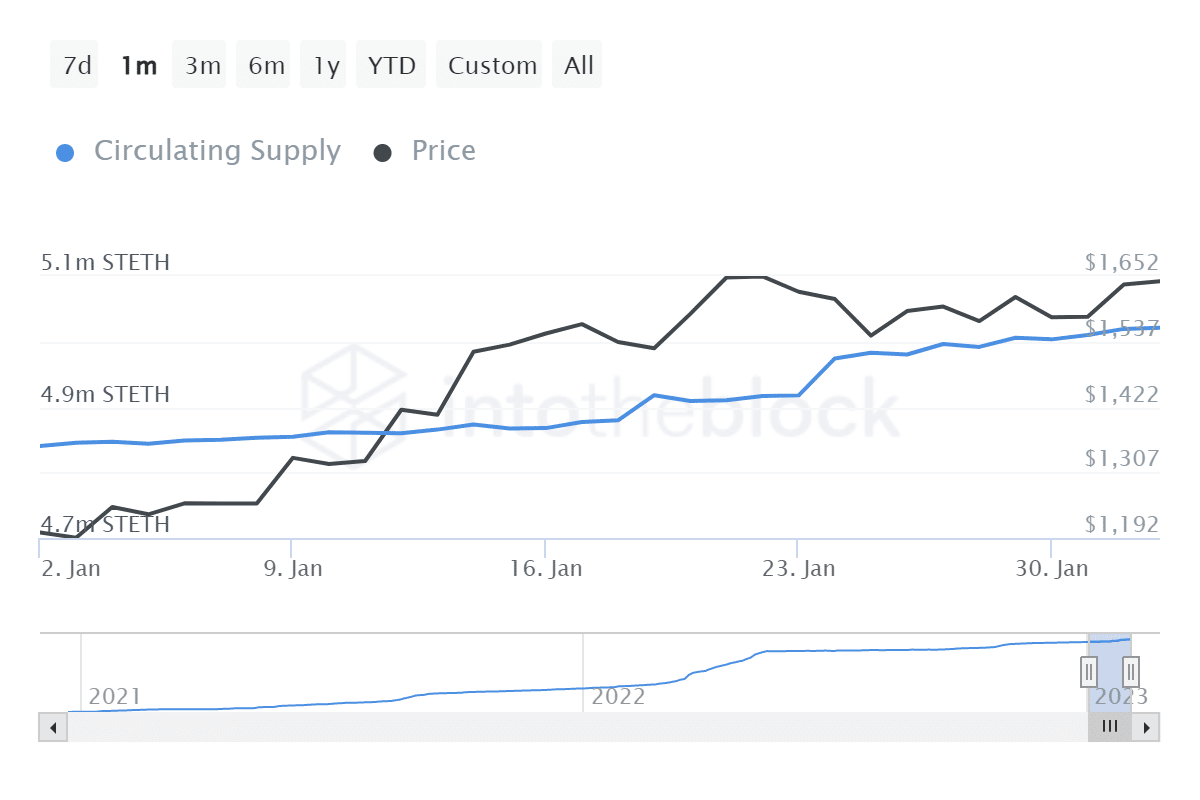

One other notable growth was the sharp improve in ETH staked with Lido Finance ever since Ethereum builders confirmed the roll out of Shanghai Improve. The chance to earn rewards on their locked tokens may have escalated staking exercise.

As per IntoTheBlock, the ETH staked with the protocol was over 5 billion at press time.

Supply: IntoTheBlock

Staking rewards invitations customers

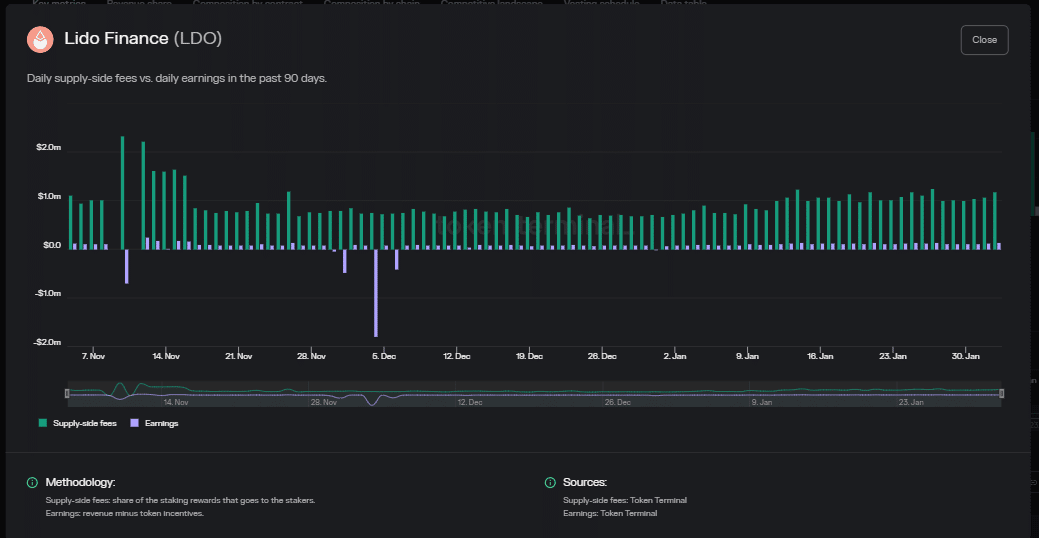

The protocol remained profitable for staking, which was supported by the info from Token Terminal. The provision-side charges, or the rewards accrued to the stakers, rose by greater than 30% within the 30-day interval. On the identical time, the protocol’s earnings jumped by 65%

Supply: Token Terminal

Nevertheless, Lido Finance’s diminishing market share within the ETH staking market was regarding. As per Dune Analytics, its share was simply 29% at press time. Furthermore, it confronted elevated competitors from centralized exchanges like Coinbase.

Is your portfolio inexperienced? Try the LDO Revenue Calculator

LDO in purple territory

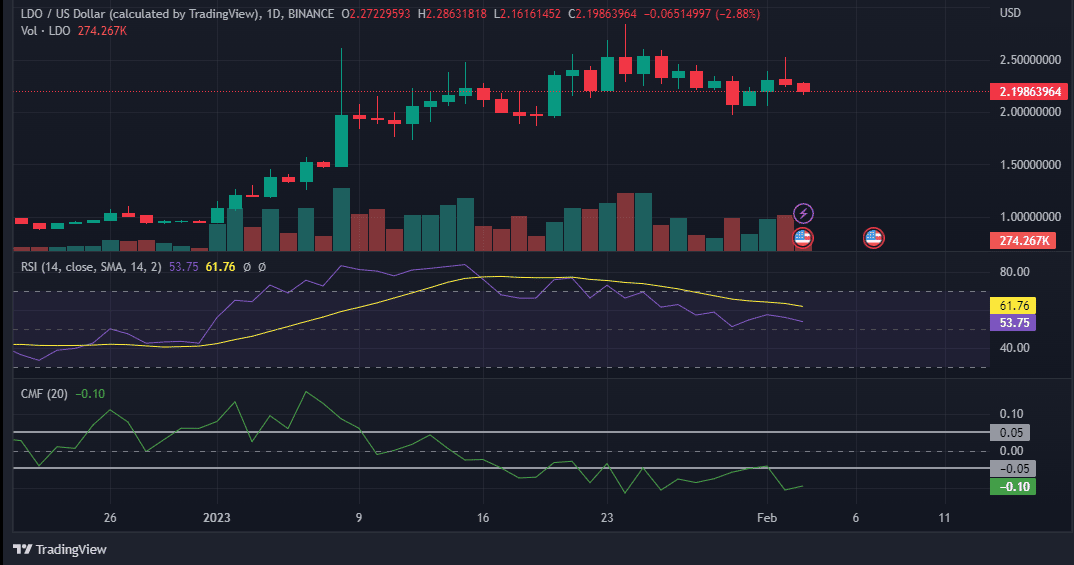

The protocol’s native token didn’t react positively to this large milestone. LDO dipped by 5.82% on the time of writing with a considerable drop in buying and selling quantity as properly, knowledge from CoinMarketCap confirmed.

A take a look at technical indicators revealed the gloomy image. The Relative Power Index (RSI) had shaped a bearish divergence with the worth for the latter a part of January. Although it was above impartial 50 at press time, there was a excessive probability of strengthening promoting stress within the coming days. The Chaikin Cash Circulation (CMF) was deep within the detrimental territory, which gave a robust indication of bearish sentiment.

Supply: TradingView LDO/USD