On March 24, zkSync formally introduced the mainnet. There may be additionally Layer 2, which has acquired a big funding from traders. After Arbitrum, many individuals are wanting ahead to the subsequent main airdrop of this challenge. Let’s be taught extra about zkSync with Coincu on this article.

What’s zkSync?

zkSync is a Layer 2 scaling resolution that gives cheaper and faster transactions than the Ethereum community itself (Layer 1). Layer 2 options shift the vast majority of exercise away from Layer 1 whereas retaining its safety and finality.

zkSync is a scaling resolution created by Matter Labs that makes use of ZK Rollups know-how to chop prices, pace up transactions, and guarantee safety on Ethereum.

The quick growth of the Ethereum ecosystem has resulted in community congestion, and there’s an pressing want to handle the difficulty of transaction pace and price. In consequence, a number of Layer 2 tasks utilizing varied applied sciences, akin to zkSync, Arbitrum, Optimism, and Polygon…, have been created to handle the aforementioned difficulties.

zkSync, like Arbitrum and Optimism, is a Layer 2 scaling resolution for Ethereum. The excellence is that Arbitrum and Optimism – the market’s greatest Layer 2 ecosystem – are each based mostly on Optimistic Rollup, whereas zkSync relies on zk Rollup.

Let’s take a fast have a look at the variations between the 2 types of options. They’re, in essence, logically opposed. zk doesn’t belief all validators and depends on zero-knowledge proofs to validate every end result, whereas Optimistic Rollup – proof of fraud trusts everybody and waits for others to object.

Optimistic, in different phrases, is a extra lax verification approach that minimizes the complexity of verification and computation effort. In the meantime, ZK appears to be more durable, but the complexity and growth cycle is prolonged.

How does it work?

ZkSync’s working methodology relies on Rollups.

zkSync is Matter Labs’ first product constructed on the ZK Rollups structure, serving as an Ethereum Layer 2. On zkSync, monies are held on the principle community (on-chain) on the sensible contract, however computation and information storage is completed off-chain.

To validate the correctness of the Rollup block on the principle chain, a zero-knowledge proof – SNARK sort zero-knowledge proof will probably be constructed. Subsequently zk-SNARK is principally a Zero Information verification approach.

SNARK verification is considerably cheaper than every transaction verification, and maintaining the state off-chain is loads cheaper than storing on EVM. In consequence, scalability (100-200 instances main community capability) and price reductions are potential.

The next assurances are supplied by the zkRollup structure:

- Validators can by no means be corrupted or stolen (in contrast to Sidechains).

- Even when the validator stops cooperating because of information availability, customers might all the time purchase cash by the zkRollup sensible contract (in contrast to Plasma).

- To keep away from fraud, customers or trusted third events don’t have to be on-line (in contrast to anti-fraud options akin to cost channels or Optimistic Rollups).

To place it one other means, zkRollup strictly inherits L1’s safety.

On the zkSync ecosystem, the price of every transaction has two parts:

- Off-chain: The price of storing state and producing a SNARK (zero-knowledge proof).

- On-chain: For every zkSync block, validators should pay Ethereum fuel to confirm SNARK. This payment is dependent upon the present fuel value within the Ethereum community.

Matter Labs’ merchandise

zkSync Lite

It is a product that was launched in June 2020 underneath the title zkSync 1.0, with the aim of simply offering a cost mechanism, and didn’t but embody sensible contracts. zkSync issued an replace (v1.x) in Might 2021 that provides NFT and swap functionality.

This Ethereum scaling mechanism is able to processing as much as 3000 transactions per second (TPS). However, when the community expanded in dimension, the need for elevated throughput necessitated the creation of a brand new model: zkSync 2.0.

zkSync Period

That is model 2.0. Period’s first model included new options akin to Account Abstraction and EVM assist by Solidity and Vyper. It already helps sensible contracts, in addition to its personal programming languages, Zinc and zkPorter.

zkPorter

zkRollup with on-chain information provisioning and zkPorter with off-chain information provisioning are included in zkSync 2.0. It is a Matter Labs byproduct that raises community TPS extra rapidly.

Excellent options of zkSync

A few of the following widespread facets might clarify why the zkSync resolution has gotten a lot consideration locally:

- Mainnet-level safety with out third social gathering dependencies.

- Switch ETH and ERC-20 tokens to L1 with on the spot affirmation and a time restrict of not more than 10 minutes.

- Extraordinarily low transaction charges (roughly 1/100 of the mainnet value for ERC-20 and 1/130 for ETH).

- No registration is required to obtain cash.

- Fee for current Ethereum addresses (together with sensible contracts)

- Charges are conveniently payable when tokens are transferred.

- Withdraw to mainnet in simply 10 minutes. Asset deposit and withdrawal instances are a lot shorter than Arbitrum’s Optimistic Rollup know-how and Optimism.

- EVM permissionless appropriate sensible contract.

- Multisig assist.

ZkSync Period

To grasp Period, we should first grasp the notion of zkEVM. That is an Ethereum digital machine compatibility approach designed to make sure that the expertise and software performance on Layer 2 will not be considerably completely different from these on Layer 1. EVM eliminates the necessity for builders to replace the code or keep away from utilizing EVM (and sensible contract) instruments whereas creating or migrating sensible contracts to extra scalable options that keep Layer 1 decentralization and safety.

zkEVM is a partly developed approach based mostly on Zero-Information Proof that’s separated into 4 classes relying on compatibility with EVM, with classes 1–4 more and more lowering compatibility with EVM.

The staff highlighted the usage of zkEVM know-how to advertise interoperability with EVM sensible contracts after altering the title to zkSync Period. The Matter Labs staff has been exploring the implementation of zkEVM on the pilot community for over a yr and on the official community since October 2022 and has additionally been subjected to a number of audits.

Options

Superior to Optimistic Rollups

Initiatives utilizing Optimistic Rollups akin to Arbitrum and Optimism, in addition to tasks utilizing Zk Rollups akin to zkSync and Starkware, are all main open options for Ethereum. However, the zkSync staff claims that ZK Rollup has many advantages over Optimistic Rollup, together with:

- Transaction Validation Time: ZK Rollups are faster than Optimistic because it doesn’t have to attend 7 days to validate the transaction’s validity.

- Capital effectivity: Not like Optimistic Rollup, deposits, and withdrawals of belongings on ZK Rollup wouldn’t have a 7-day wait, leading to elevated capital effectivity.

Account Abstraction (AA)

Account Abstraction allows a personal account to be transformed into a wise contract with its personal logic by changing Externally Owned Accounts (EOA) into Sensible Contract Accounts (CA).

This zkSync function gives the next advantages:

- There is no such thing as a want for a seed phrase to keep away from shedding or hacking your pockets. AA helps biometric authentication by household or mates.

- Pay Charges in Any Token: Allows one pockets to assist or sponsor different wallets by buying and selling for them and changing different tokens to ETH for charges. Paymasters are the title given to this kind of account.

- Signing many transactions without delay: Allows customers to pool transactions in a batch and signal them abruptly, saving time on processing every transaction one after the other.

- Prospects might use the AA perform to plan computerized cash transfers, renew membership funds, and so forth in a decentralized means.

zkEVM

zkEVM is a brand new ZK-Rollup know-how that was created in early 2021 and is extraordinarily appropriate with EVM.

There are nonetheless a number of limitations to the ZK programming language. One of the important impediments is the number of varied programming languages, which makes it troublesome for builders to program in lots of languages.

This makes it troublesome to create dApps with constant code or migrate dApps between layers 1 and a pair of. Total, the usual zk-Rollup is sort of complicated to implement and has sure sensible restrictions.

Due to the unification of programming methods in zkEVM, the composability in layer 2 will probably be better, making it simpler for Ethereum-based dApps to transition to the zk-Rollup chain with little alteration to the supply code.

Roadmap

At present, the challenge has reached the Alpha mainnet part of Period. It’s anticipated that the staff will concentrate on decentralization and anti-censorship. That’s, zkSync will goal to be a decentralized and censorship-free challenge by fully eradicating the management of Matter Labs. As a substitute, these rights will probably be given to the group.

Core staff

- Marco Cora: Head of Enterprise Improvement at Matter Labs.

- Alex Gluchowski: Founding father of Matter Labs.

Traders & Companions

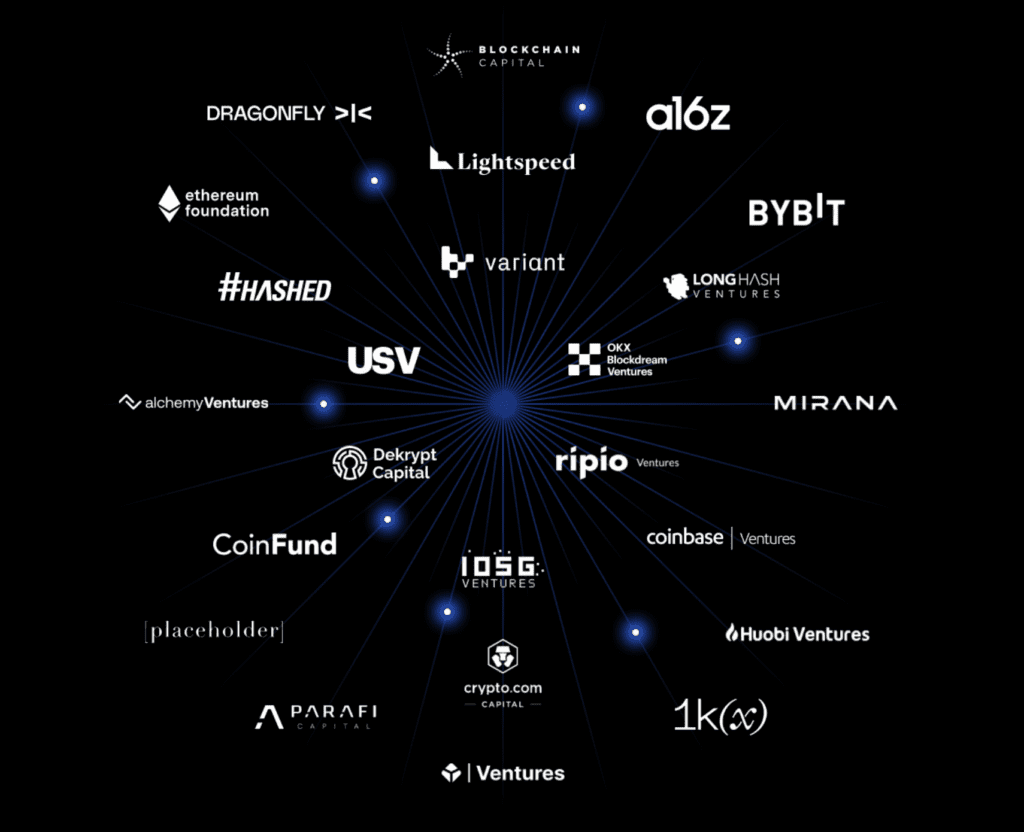

Traders

zkSync is invested by many respected funds within the blockchain business akin to Binance, Cb Ventures, Balancer, Curve. In November 2021 in a sequence B funding spherical, zkSync acquired $50 million in funding from Horowitz, Placeholder, Crypto.com, and extra.

In January 2022, Matter Labs was permitted for a $200 million funding from BitDAO to construct the zkSync ecosystem.

The corporate additionally efficiently raised a $200 million fund led by Blockchain Capital and Dragonfly, together with different traders akin to Mild Pace Enterprise Companions, Variant, and a16z… in November 2022.

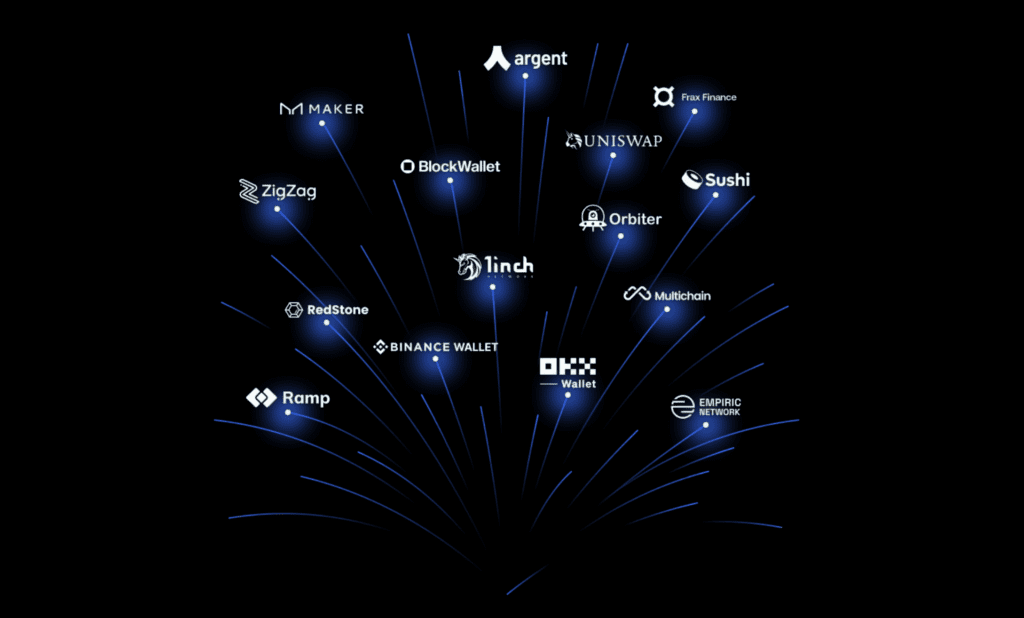

Companions

Conclusion

It may be seen that, amongst many Layer 2 tasks on Ethereum, zkSync is proving itself to the group that it’s a good candidate. Sooner or later, with many enhancements and token launches (only a prediction), this can most certainly be the brand new bomb of the crypto market after Arbitrum and Optimism.

DISCLAIMER: The Info on this web site is supplied as common market commentary and doesn’t represent funding recommendation. We encourage you to do your personal analysis earlier than investing.