Key Takeaways

- Lido is a well-liked liquid staking answer for Ethereum and different blockchains.

- Lido accounts for the overwhelming majority of liquid staking derivatives within the Ethereum ecosystem. Because it’s seen parabolic development, there are rising considerations that it may affect Ethereum’s decentralization.

- Whereas the considerations are warranted, Ethereum staking ought to change into extra decentralized because the community grows and extra options like Lido enter the market.

Share this text

Lido is a liquid staking answer that helps Ethereum and different blockchains. The protocol has seen parabolic development and dominates the liquid staking market with a considerable amount of staked ETH. However some onlookers have considerations that Lido’s success may affect Ethereum’s decentralization.

What Does Lido Do?

Lido is crypto’s prime liquid staking protocol.

Launched in December 2020, the protocol helps a number of of the ecosystem’s prime Layer 1 networks, but it surely’s greatest identified for its Ethereum staking providing. Lido has created an simple manner for Ethereum customers to stake their ETH to earn a variable APR of round 4%. When staking ETH by means of Lido, customers obtain an equal quantity of an auto-compounding token referred to as stETH in return. stETH can be utilized in DeFi protocols or to offer liquidity on automated market makers whereas producing staking yield. Lido’s primary worth proposition is that it lets those that wish to stake their ETH preserve it liquid by receiving stETH tokens in return for staking.

Staking swimming pools like Lido supply another for customers who don’t wish to arrange their very own validator node. Those that wish to run a node should lock up a minimal of 32 ETH, the equal of over $90,000 at at the moment’s costs. Moreover, working a node requires some technical understanding of the Ethereum blockchain, {hardware} able to working a node, and a dependable Web connection. It additionally exposes stakers to the danger of slashing if their validator goes offline, doubtlessly costing them a portion of their staked ETH.

When staking by means of Lido, customers are protected against slashing. The protocol fees a ten% payment on staked ETH rewards and allocates a portion of it to an insurance coverage fund for such instances. As a result of Lido points stETH, which is appropriate with different DeFi protocols, there’s a financial incentive for staking ETH with Lido as an alternative of working a validator. stETH might be paired with different tokens to offer liquidity and earn swap charges or be used as collateral on lending and borrowing protocols akin to Aave. Meaning customers can earn a 4% staking yield, put stETH to work elsewhere in DeFi, and earn extra yield.

Lido’s Monopoly

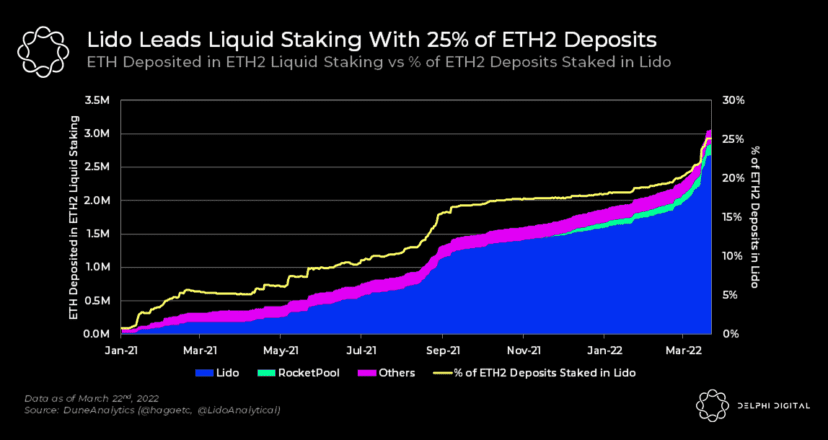

Lido was the primary liquid staking answer to launch after the Ethereum Beacon Chain went reside, and it has gone on to dominate the market. Information compiled by Delphi Digital exhibits Lido’s % of Ethereum staking deposits has grown exponentially in comparison with its opponents.

In accordance with knowledge from Dune Analytics, Lido at the moment accounts for over 90% of all liquid staking derivatives in circulation. Whereas different liquid staking choices akin to Rocket Pool and StakeWise exist, they’ve did not put a significant dent in Lido’s market share.

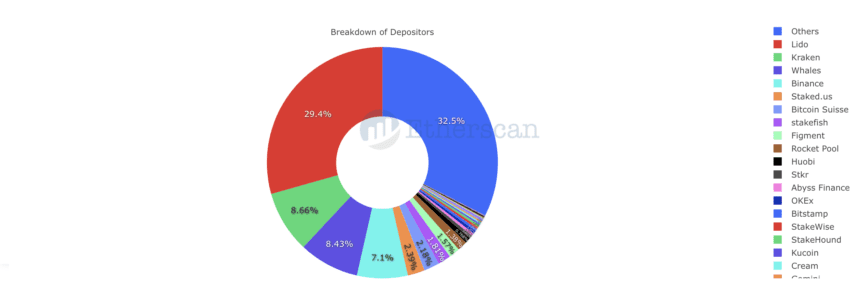

Exterior of the liquid staking area, Etherscan data exhibits that Lido accounts for 29.4% of all ETH deposited to the Beacon Chain, greater than triple that of crypto alternate Kraken, the following single largest depositor at 8.66%. The Beacon Chain at the moment comprises roughly 12 million ETH, with about 3.5 million coming from Lido.

Nonetheless, by way of validators, the protocol controls solely 8.23% of the Beacon Chain nodes, coming in simply behind Kraken’s 8.95%.

Whereas Lido’s present numbers don’t point out an unhealthy quantity of management over the Beacon Chain but, critics argue that Lido’s parabolic development has set it on an unstoppable path to controlling a disproportionate quantity of the community. SureSats author Dap not too long ago penned a blog post arguing that the protocol has achieved a monopoly because of the explosion of stETH use in DeFi protocols akin to Curve, Aave, and MakerDAO. This utilization of stETH in DeFi produces a flywheel impact that incentivizes ETH stakers to make use of Lido sooner or later, Dap argued. He wrote:

“The extra liquid stETH is on these platforms, the decrease the chance price of staking, which results in extra ETH being staked with Lido which then will increase the stETH liquidity. This deep liquidity in stETH incentivizes the person to stake with the market chief.”

As noticed in different DeFi protocols akin to Curve, deep liquidity is efficacious to protocols and will also be a robust market-moving pressure. Lido has established stETH because the de facto liquid staking asset by being first to market and eradicating boundaries to entry. In accordance with critics like Dap, these seeking to stake their ETH sooner or later will see the yield producing alternatives and deep liquidity of stETH and select to stake with Lido over its opponents.

Presently, Lido’s looming dominance remains to be theoretical. At current, the Ethereum Beacon Chain validates principally empty blocks except for ETH deposits to the staking contract. Nonetheless, after Ethereum merges its Proof-of-Work chain with the Beacon Chain, anticipated to happen later this yr, it should start validating all Ethereum transactions below its new Proof-of-Stake consensus mechanism.

The argument from detractors follows that if Lido’s dominance retains rising from its community results, it stands to achieve management over nearly all of all staked ETH. This might enable Lido to censor Ethereum transactions or perpetrate a 51% assault towards the community.

An extra issue weighing on Lido is its governance token distribution. For the reason that protocol operates as a DAO, if Lido may appeal to nearly all of staked ETH, the protocol’s LDO token holders would achieve energy over the Ethereum community.

In accordance with the official Lido blog, over 63% of Lido’s 1 billion LDO tokens are managed by the founding group, early buyers, builders, and enterprise capital funds. Excluding the Lido treasury, the highest 16 addresses maintain sufficient tokens to affect the end result of protocol votes. No matter Lido’s management over Ethereum, the protocol is extremely centralized and susceptible to an oligarchy forming round its governance.

Is Lido a Menace to Ethereum?

Whereas there are some real considerations with Lido’s market dominance and governance, it’s important to place these considerations into context. Ethereum’s present Proof-of-Work validation additionally suffers from factors of centralization that might negatively affect the community. For instance, the three largest mining swimming pools, Ethermine, F2Pool, and Hiveon, collectively control greater than half of Ethereum’s hashrate. Whether or not or not this present distribution is sufficiently decentralized is determined by who you ask. Nonetheless, the latest figures displaying the quantity of ETH deposited to the Beacon Chain counsel that the community’s change to Proof-of-Stake ought to enhance the variety of events that would wish to conspire to assault it, thus growing the community’s safety regardless of Lido’s present dominance.

Moreover, Lido’s development is in the end tied to the event of decentralized finance. Those that already maintain their ETH in a Web3 pockets and work together with DeFi protocols are seemingly to make use of liquid staking protocols akin to Lido. Nonetheless, extra informal retail buyers will seemingly choose to stake their ETH on crypto exchanges akin to Kraken and Binance for the added comfort as an alternative of looking for out extra capital-efficient choices akin to Lido. As extra new buyers purchase ETH, the availability ought to change into extra distributed and taper the quantity of ETH deposited into the Ethereum staking contract by means of Lido.

Moreover, because the Ethereum community switches to Proof-of-Stake, demand for ETH amongst institutional buyers can be more likely to enhance. As establishments should adjust to tighter rules, they’re much less seemingly to make use of Lido to stake ETH. As a substitute, institutional buyers seeking to enter the Ethereum ecosystem will extra seemingly purchase and stake ETH by means of skilled custodial options supplied by corporations akin to ConsenSys, Staked, and Fireblocks.

Lengthy-term Ethereum advocate DCinvestor has additionally commented on Lido’s perceived dominance over liquid Ethereum staking. In a five-part tweet storm, he argued that the present fears over Lido are overstated. “There isn’t one steady coin, and I don’t suppose there shall be one staked ETH token,” he asserted whereas additionally calling for unbiased staking to be made simpler and extra accessible to assist decentralize Ethereum.

long-term, i feel the market demand for staked ETH tokens will broaden past the present state the place just one supplier (Lido) has many of the market share

Lido was simply first to market with an excellent, low friction product

others ought to observe & study from their success

— DCinvestor.eth ⌐◨-◨ (@iamDCinvestor) April 20, 2022

It’s onerous to disclaim that Lido’s exponential development may pose an actual menace to the steadiness and decentralization of Ethereum. Lido’s token allocation additionally raises considerations in regards to the small variety of addresses which are in a position to management the protocol. Nonetheless, regardless of Lido’s parabolic development, it’s unclear whether or not its community results will be capable of preserve the trajectory it has loved up till now.

Lido itself says its raison d’etre is making certain a single centralized entity doesn’t take management over the Ethereum community. With this in thoughts, there’s hope for Ethereum that the protocol’s token holders additionally share this imaginative and prescient and perceive that decentralization is likely one of the community’s key worth propositions. Whereas Lido’s dominance could possibly be a trigger for concern sooner or later, if the Ethereum Merge occurred tomorrow, Lido would solely management about as a lot of the community as Ethermine does at the moment.

For these with considerations, one easy answer is to keep away from utilizing Lido. Different liquid staking options exist, and whereas they could be much less handy for now, the extra adoption they get, the extra decentralized and safe the Ethereum community will change into.

Disclosure: On the time of scripting this characteristic, the creator owned ETH and a number of other different cryptocurrencies.