newbie

With Bitcoin hovering in reputation and worth for the reason that 2010s, many traders are asking themselves whether or not they have missed their probability to get a bit of this digital pie or not but. Now’s undoubtedly an thrilling time for these concerned with shopping for Bitcoin as its value continues to shed on a month-to-month foundation. And right here’s the excellent news: no, it’s not too late to spend money on Bitcoin! However this loud assertion must be clarified.

To resolve whether or not or not it’s a good suggestion for you personally to spend money on Bitcoin proper now, we propose you learn this text, the place we’ll bear in mind the historical past of Bitcoin’s efficiency, analyze its present market situation and assess its future potential.

Bitcoin Clarification in Brief

Bitcoin is a revolutionary and revolutionary cryptocurrency that makes use of blockchain expertise.

It was created in 2009 by an nameless particular person or a bunch. Bitcoin represents a decentralized digital forex that doesn’t require the oversight of any authorities or monetary establishment. Safe and nameless transactions are carried out through peer-to-peer networks, offering new alternatives for people to regulate their funds and to take a position their cash with out conventional banking constructions.

The Bitcoin community is enticing as a result of it may be used wherever throughout the globe, has low transaction charges, and offers near-instant transactions. All in all, Bitcoin affords customers a singular type of monetary independence.

Bitcoin Worth Historical past

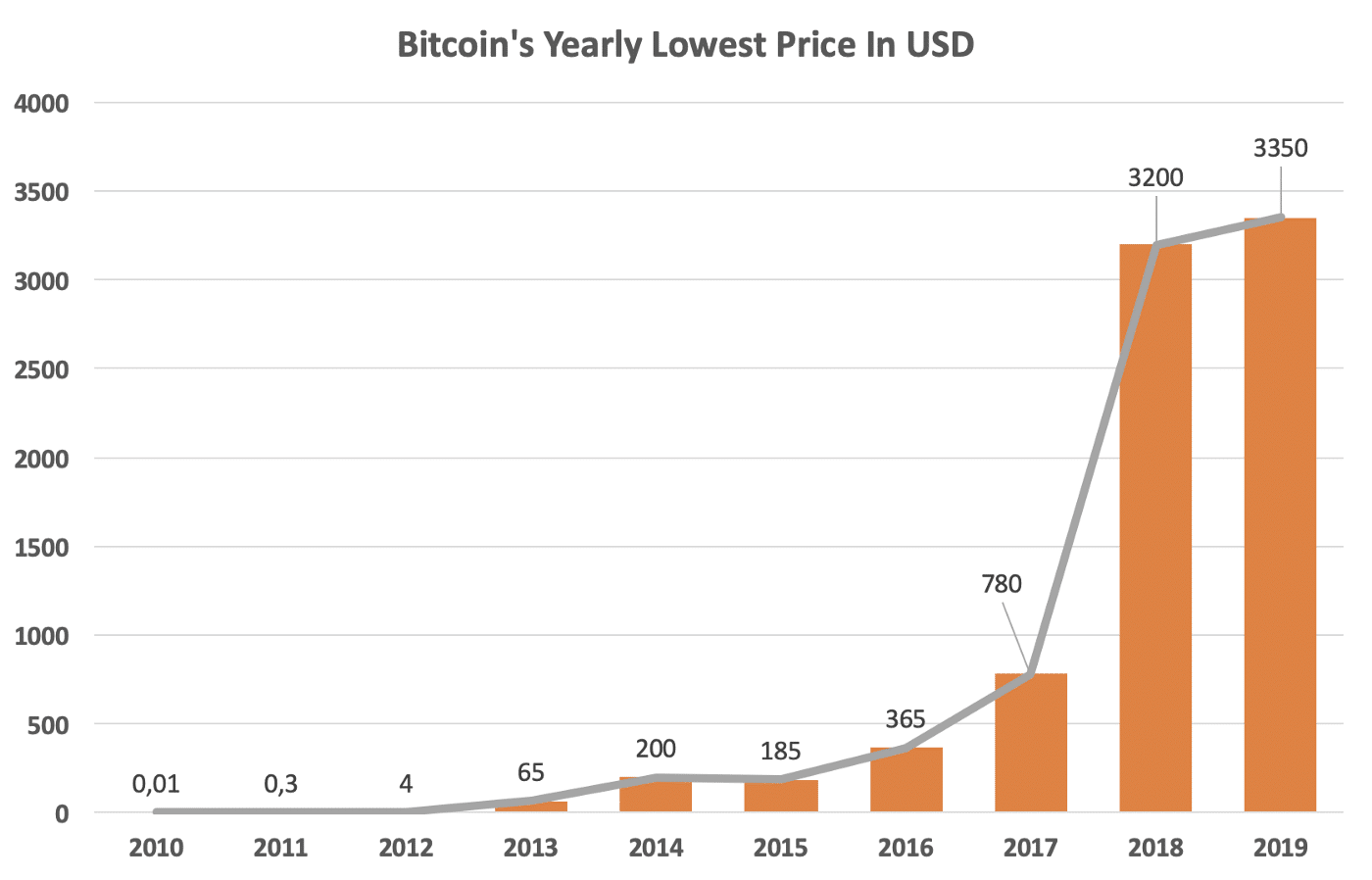

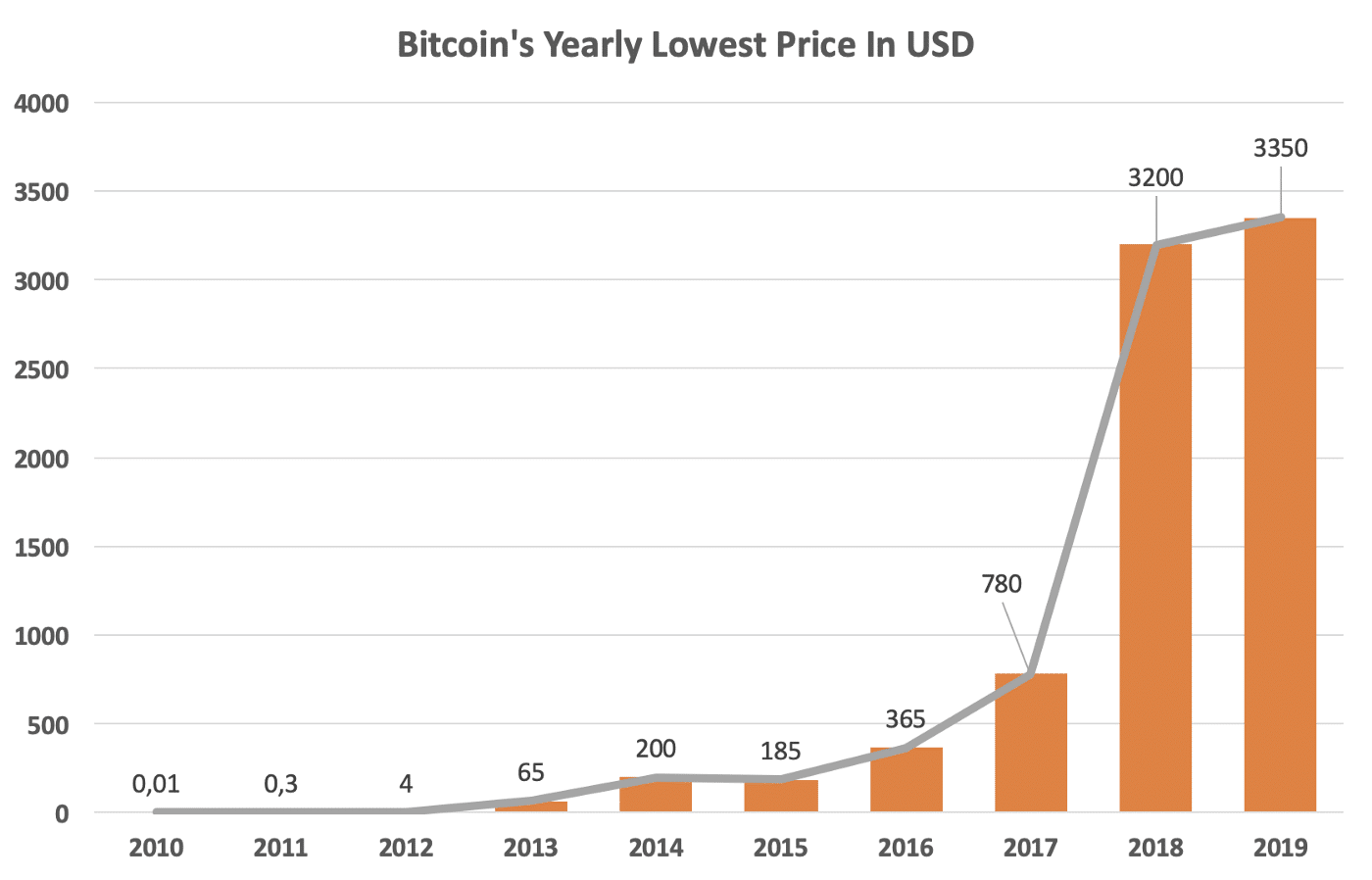

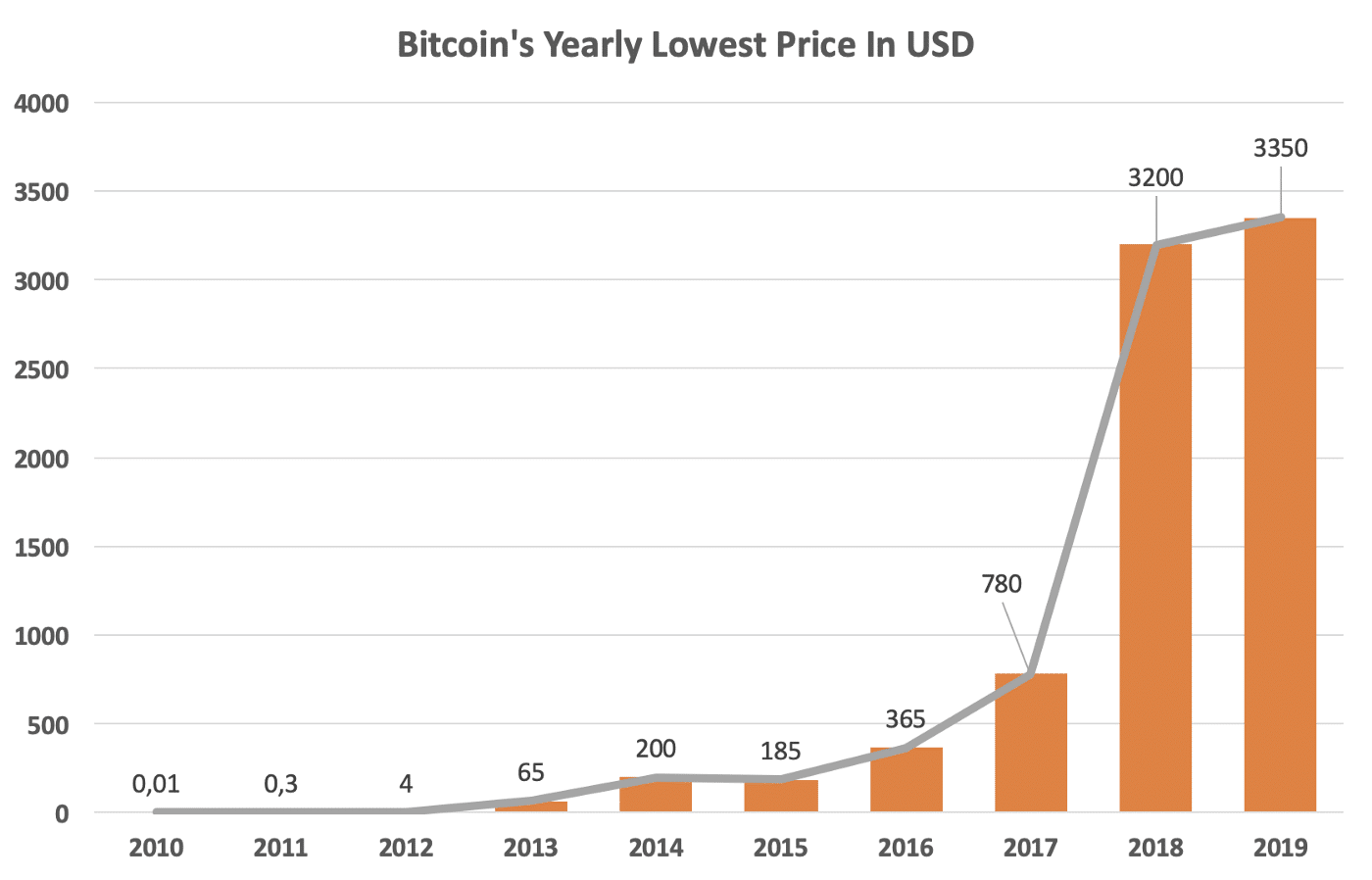

Individuals often marvel: Is Bitcoin nonetheless value investing in? However they ignore the coin’s value historical past, which might present perception into potential value actions sooner or later.

Bitcoin Worth – 2009 to 2017

The one locations the place Bitcoin noticed widespread use in its early years had been shady on-line marketplaces like Silk Highway.

The value of BTC began to rise within the early 2010s, and between 2013 and 2014, it elevated by greater than 5,600%. The event of lots of the prime cryptocurrency exchanges we see in the present day was prompted by the investing group starting to take discover at that time.

The value of the cryptocurrency was across the $1,000 mark at first of 2017. Bitcoin noticed a surprising rise from $975.70 on March 25 to $20,000 on December 17 after a small drop within the first two months.

Bitcoin Worth – 2018 to 2021

The BTC value ceased its rise in 2018. As an alternative, Bitcoin had returned to the $4,000 mark by the beginning of 2019. Within the first half of 2019, the worth of the cryptocurrency elevated by round 200%, reaching $12,000 by August. The value of Bitcoin stayed between $8,000 and $12,000 for the next six months.

Halfway by March 2020, the Covid-19 pandemic struck, sending your complete crypto market right into a tailspin. Bitcoin skilled a comparatively fast bear market, identical to different monetary property, shedding over 50% of its worth in lower than 48 hours to commerce under $5,000.

This decline, nonetheless, proved to be a quick setback. Bitcoin skilled explosive development after March 2020, reaching about $30,000 by yr’s finish — and this was solely the start. In January 2021, Bitcoin reached $40,000, and by March of that very same yr, its worth had risen to $60,000.

After a number of tumultuous months, Bitcoin ultimately reached an all-time excessive of virtually $69,000 in November 2021.

Having fun with this text? Subscribe to our weekly e-newsletter to remain up to date on the most recent crypto information!

Bitcoin Highs and Lows

The highs and lows of BTC from its conception to the current are summarized under:

- 2009 noticed the primary Bitcoin transaction, with the value per coin being $0.0009 again then.

- The value of Bitcoin first started to rise in 2013, when it went from about $100 to $1,150 in a single yr.

- The BTC value fell in 2014 and fluctuated in 2015 and 2016.

- December 2017 had a excessive of $19,735, representing a 933% rise in 5 months.

- December 2018 had a low of $3,270.

- June 2019 noticed a excessive of $13,910.

- March 2020 set a low of $3,881.

- The all-time excessive of $68,789 passed off in November 2021, surpassing the lows of March 2020 by 1,644%.

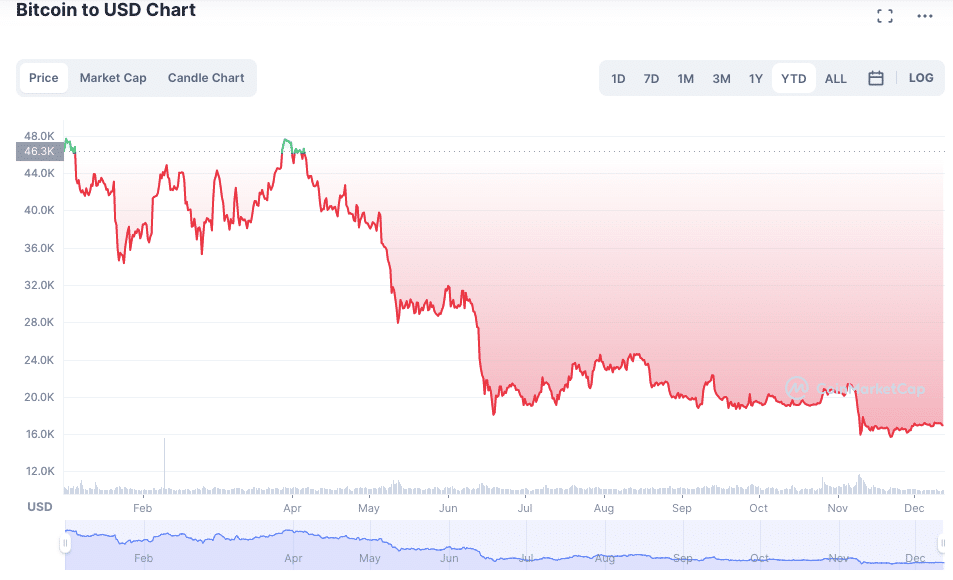

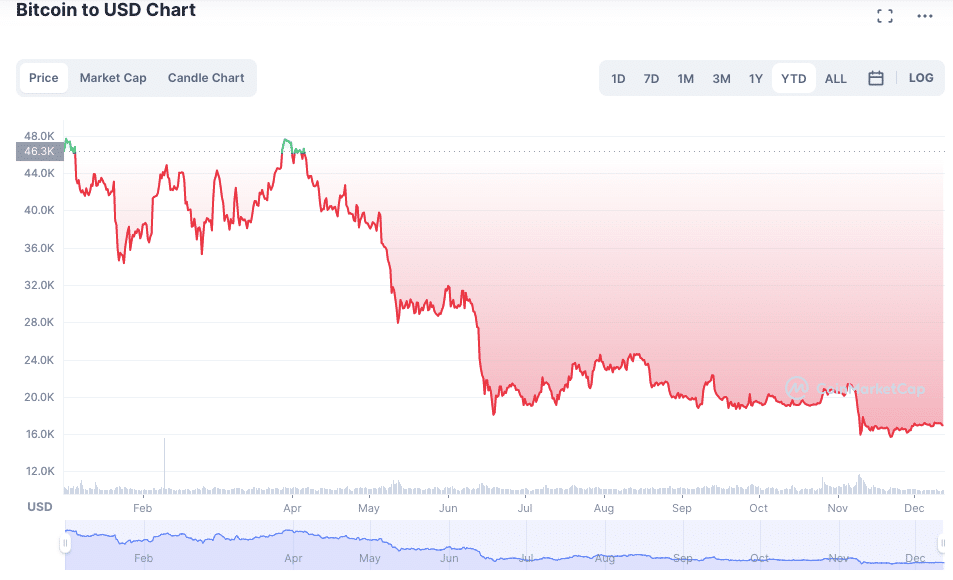

- November 2022 noticed a low of $15,757.

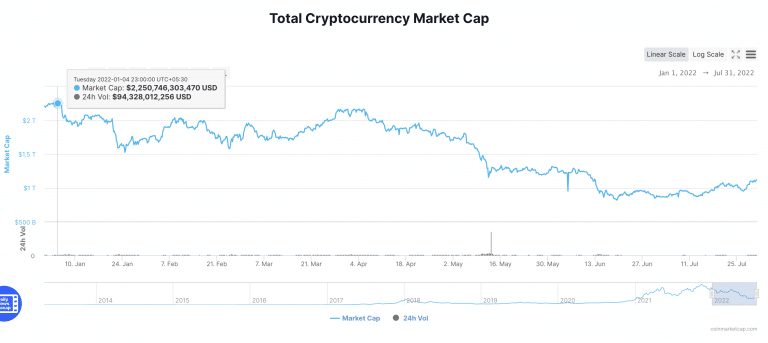

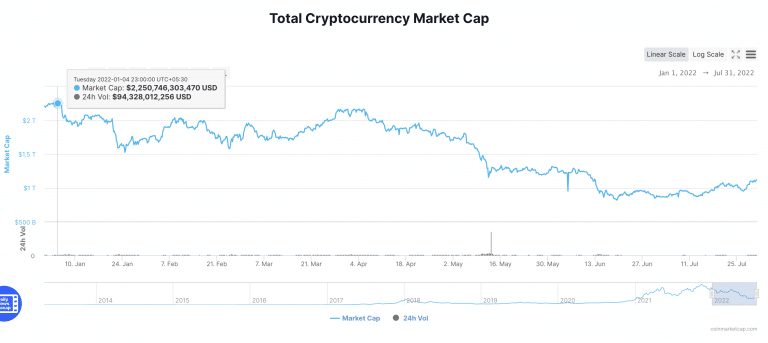

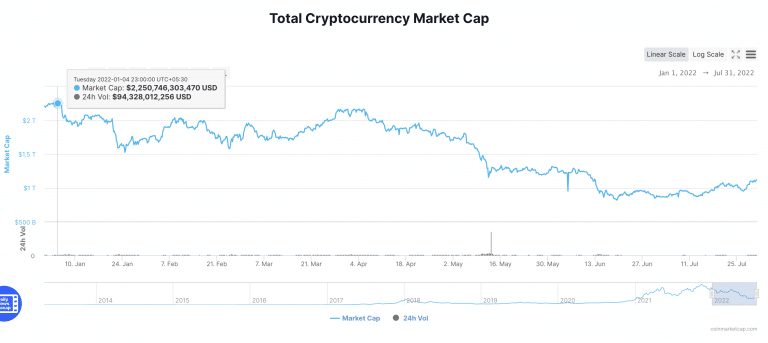

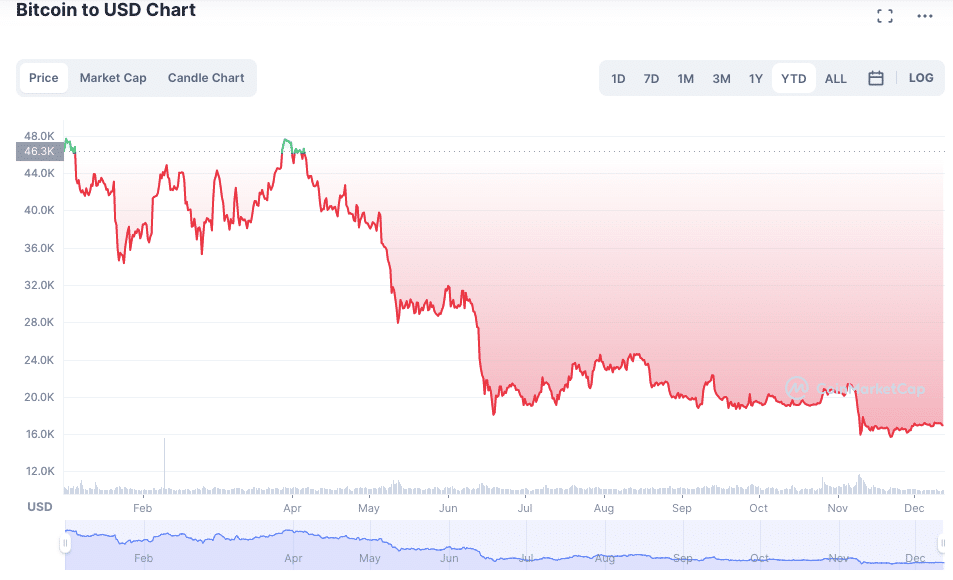

Bitcoin Efficiency in 2022

The yr 2022 has confirmed to be tough for the world markets: excessive ranges of inflation are presently affecting the worldwide economic system, and traders are nervous a few potential recession.

Moreover, rising rates of interest have introduced a normal decline in investments. These elements have triggered the crypto market, together with Bitcoin, to enter the bearish stage.

Bitcoin’s bearish momentum gained power as these looking for the cryptocurrency with the best potential for development began concentrating on different initiatives. Massive institutional traders like Tesla selected to unload sizable chunks of their Bitcoin holdings. All this stuff mixed created an unfavorable environment for Bitcoin and its proponents.

The FTX scandal served because the icing on the cake for BTC. Though this disaster had nothing to do with Bitcoin particularly, it impacted your complete cryptocurrency market. This sparked a widespread sell-off, which drove the value of BTC down.

Even when it has dropped by virtually 75% from its peak, Bitcoin stays one of many best investments of the last decade. Bitcoin proponents are hopeful that this “crypto winter” is only a transient drop and that, as historical past has usually demonstrated, the worth of BTC will rise as soon as extra.

Bitcoin Worth Prediction 2023 – 2030

In line with some analysts, Bitcoin’s days of exponential development are lengthy gone, so traders looking for fast income may be higher off elsewhere.

We expect that Bitcoin will nonetheless have the ability to generate income sooner or later, simply not on the identical charge because it did between 2020 and 2021. So, the following part offers BTC value forecasts for the upcoming years, based mostly on each technical and basic evaluation.

We estimate that BTC may have been value $23,000 by the top of 2023. The crypto market ought to recuperate within the coming years, creating a greater atmosphere for Bitcoin’s value to rise. If this occurs, we assume Bitcoin may have been value $35,000 by the top of 2024. If monetary establishments undertake Bitcoin extra extensively and there are extra use circumstances, Bitcoin will possible be the perfect long-term cryptocurrency. If so, BTC may have been value $60,000 by the top of 2025 and 90,000 by the top of 2030.

There are presently 18.5 million Bitcoins in existence, and this quantity consists of misplaced Bitcoins. There at the moment are lower than three million BTC left for distribution. Though you may nonetheless mine Bitcoin, solely 21 million cash could be mined. In intervals of rising prices and diminished buying energy, shortage can assist in sustaining worth.

For a extra detailed BTC value prediction, we propose you learn this text.

How Might Bitcoin Be Used within the Future?

Bitcoin has undoubtedly taken the world by storm since its launch in 2009. In consequence, quite a few traders have scrambled to get their palms on this digital forex on account of its potential to skyrocket in worth. Whereas Bitcoin continues to be risky and lacks authorities rules, consultants have recognized a number of catalysts that would drive the worth of Bitcoin within the coming years. All these key catalysts not solely excite traders but additionally signify that Bitcoin might nonetheless attain unimaginable heights within the close to future.

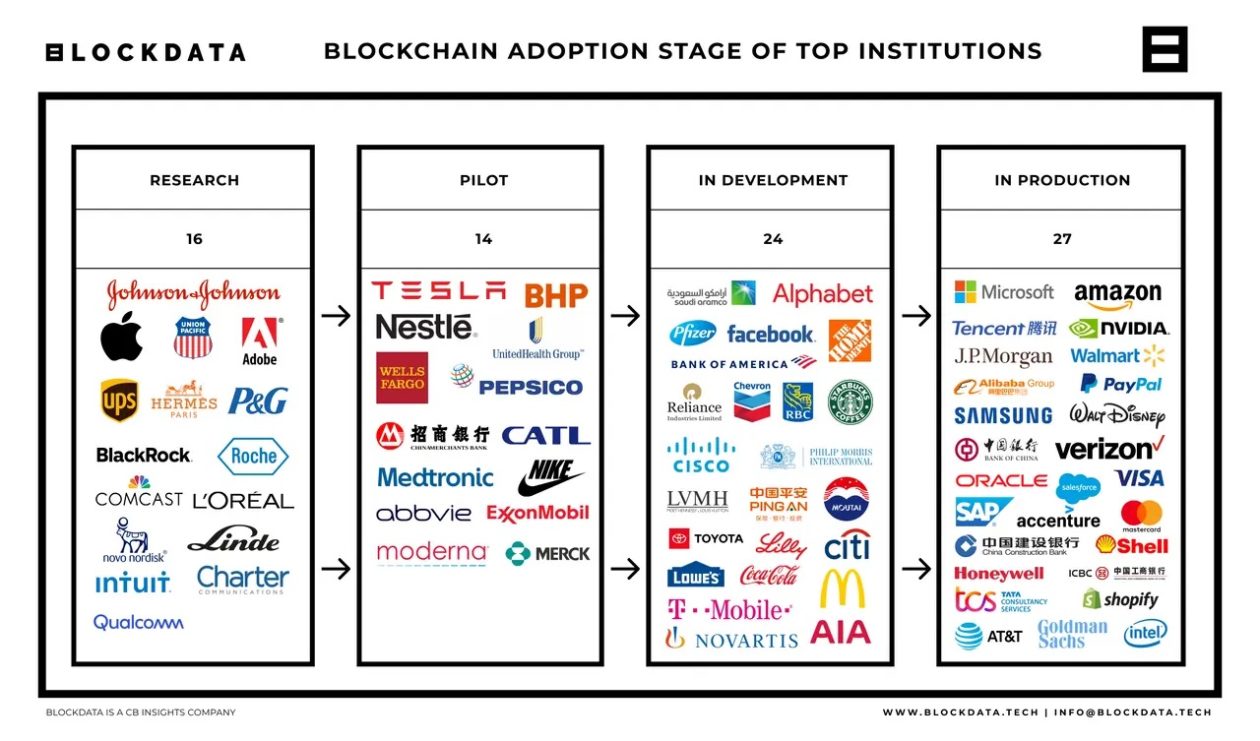

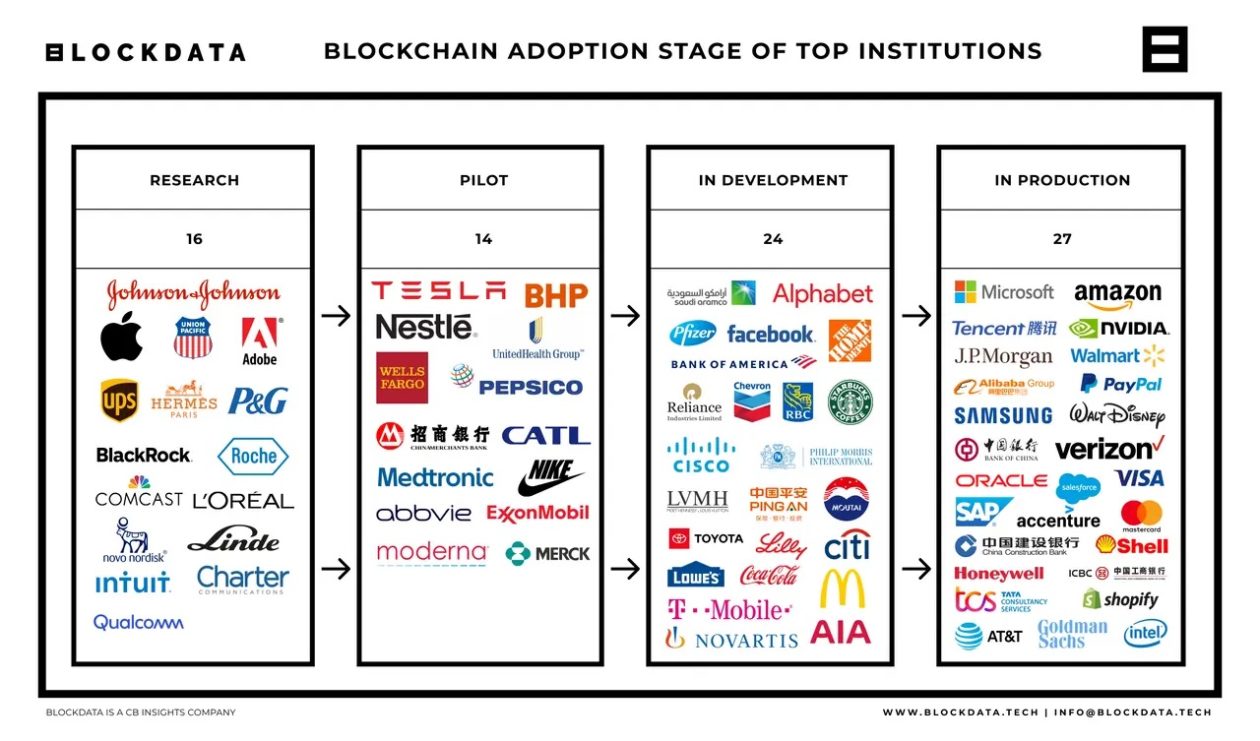

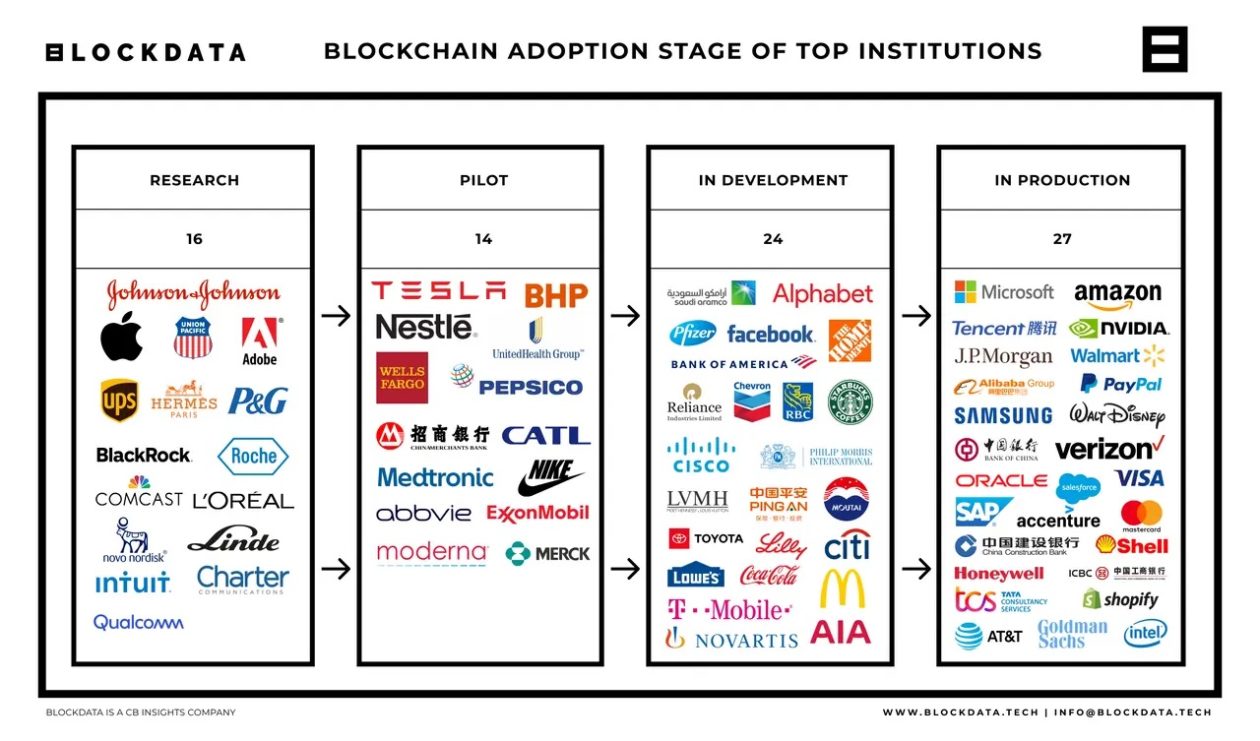

Rising Institutional Adoption

Bitcoin’s low correlation to different monetary property is considered one of its most alluring options.

With regard to market diversification, this unbiased stance offers Bitcoin a bonus. As an illustration, plenty of traders select to buy Bitcoin aiming to guard their portfolio from a attainable market hunch. Monetary establishments have created quite a few Bitcoin-focused securities in response to the demand for this digital forex. As an illustration, a lot of cryptocurrency ETFs present derivatives like futures along with direct and oblique publicity to Bitcoin.

You may additionally like: Can Bitcoin Turn out to be a Reserve Foreign money?

Actual World Transactions

Traders anticipate that cryptocurrencies will change into extra extensively accepted as a medium of trade each on nationwide and world ranges. Moreover, given the present monetary atmosphere, organizations acknowledge the potential of blockchain expertise increasingly, which may also help carry much-needed effectivity, transparency, and belief into many industries, from finance to healthcare.

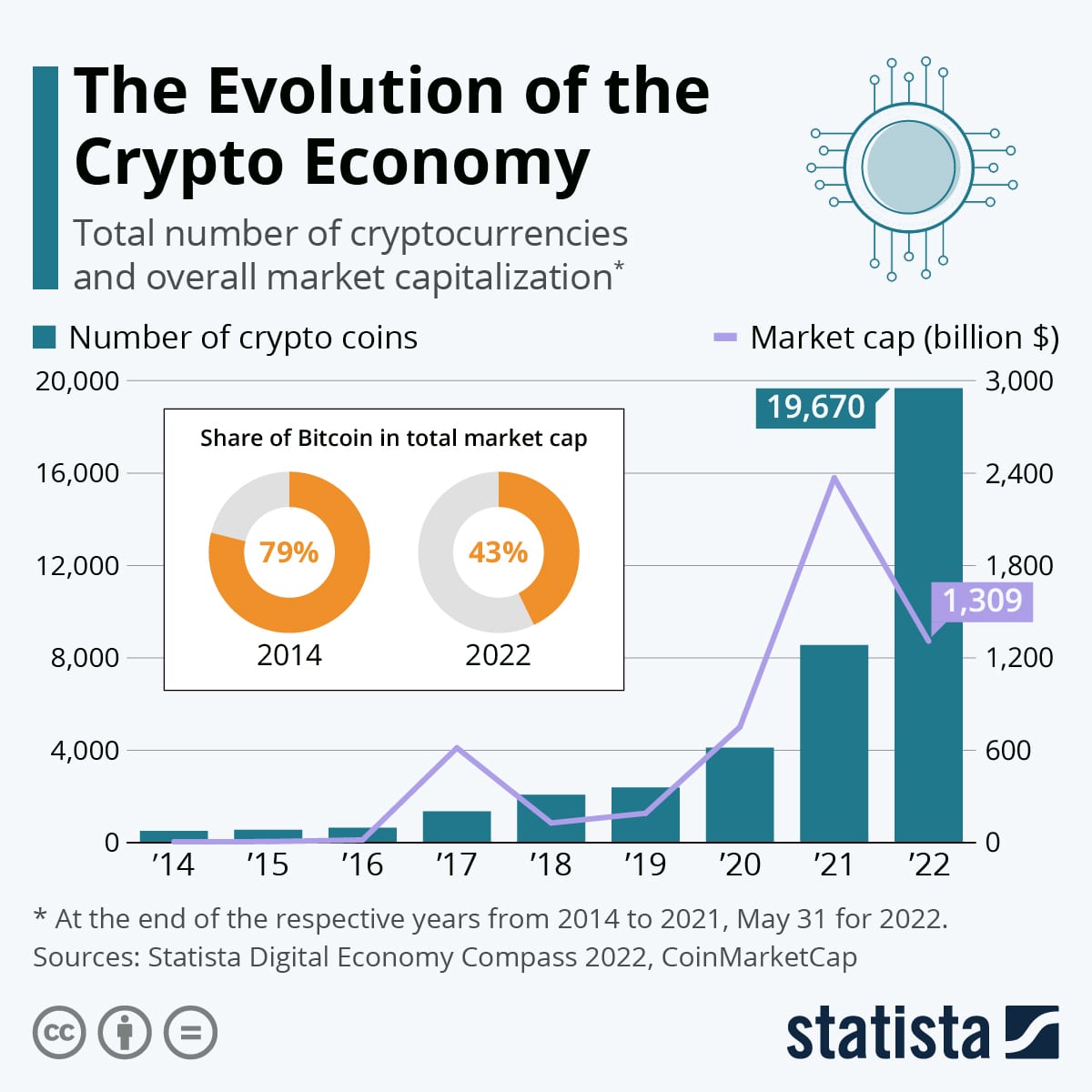

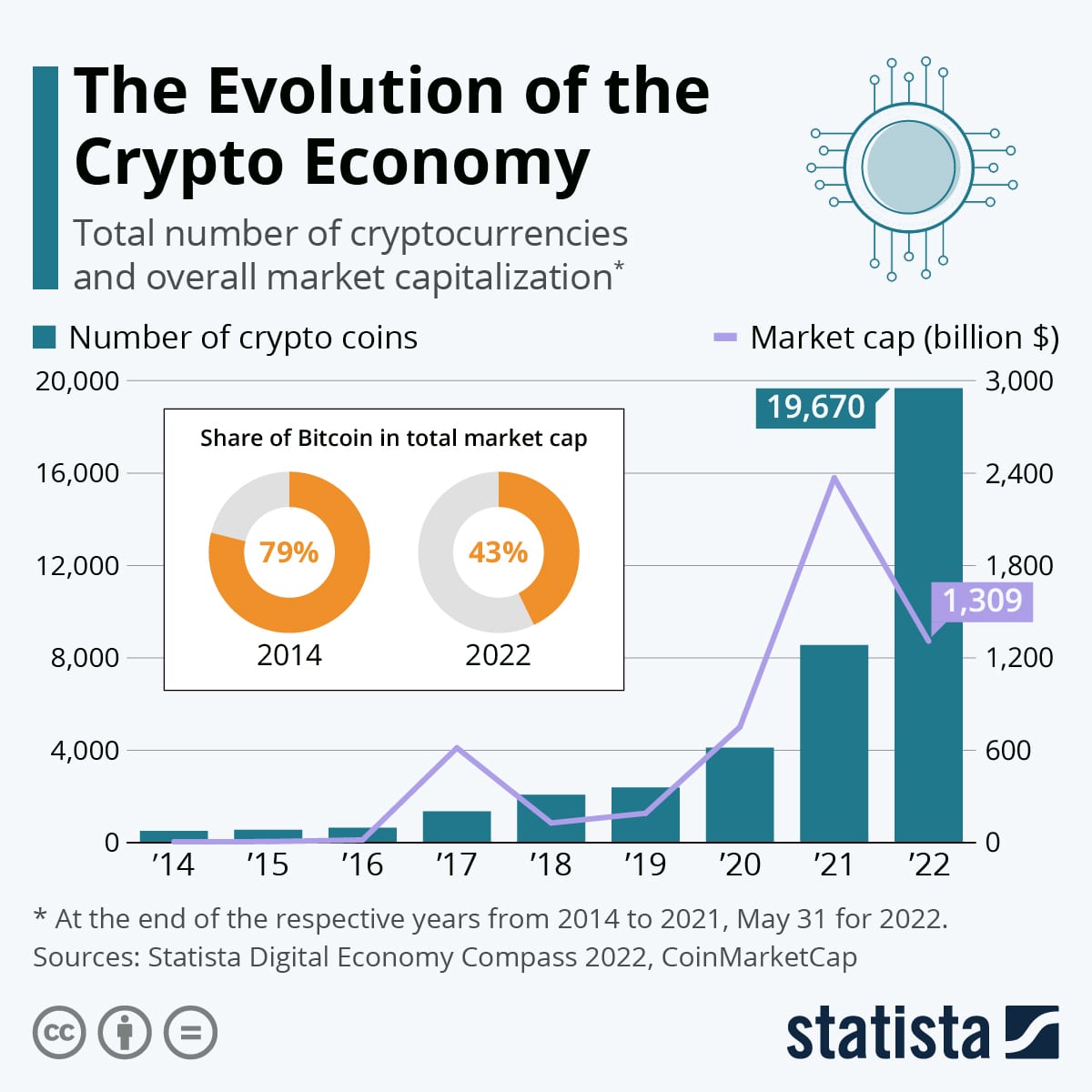

Rising Crypto Infrastructure

One other results of Bitcoin’s reputation is the rise of a totally new trade of infrastructure companies. A brand new crypto-based economic system is rising, and it’s led by Bitcoin. As an illustration, companies like Block, Robinhood, and PayPal have developed instruments to make buying and promoting Bitcoin easy. The information signifies that there’s nonetheless plenty of alternative for Bitcoin to develop, which is nice information for traders trying to find real-world purposes.

Knowledgeable Opinions: Is It Too Late to Purchase Bitcoin?

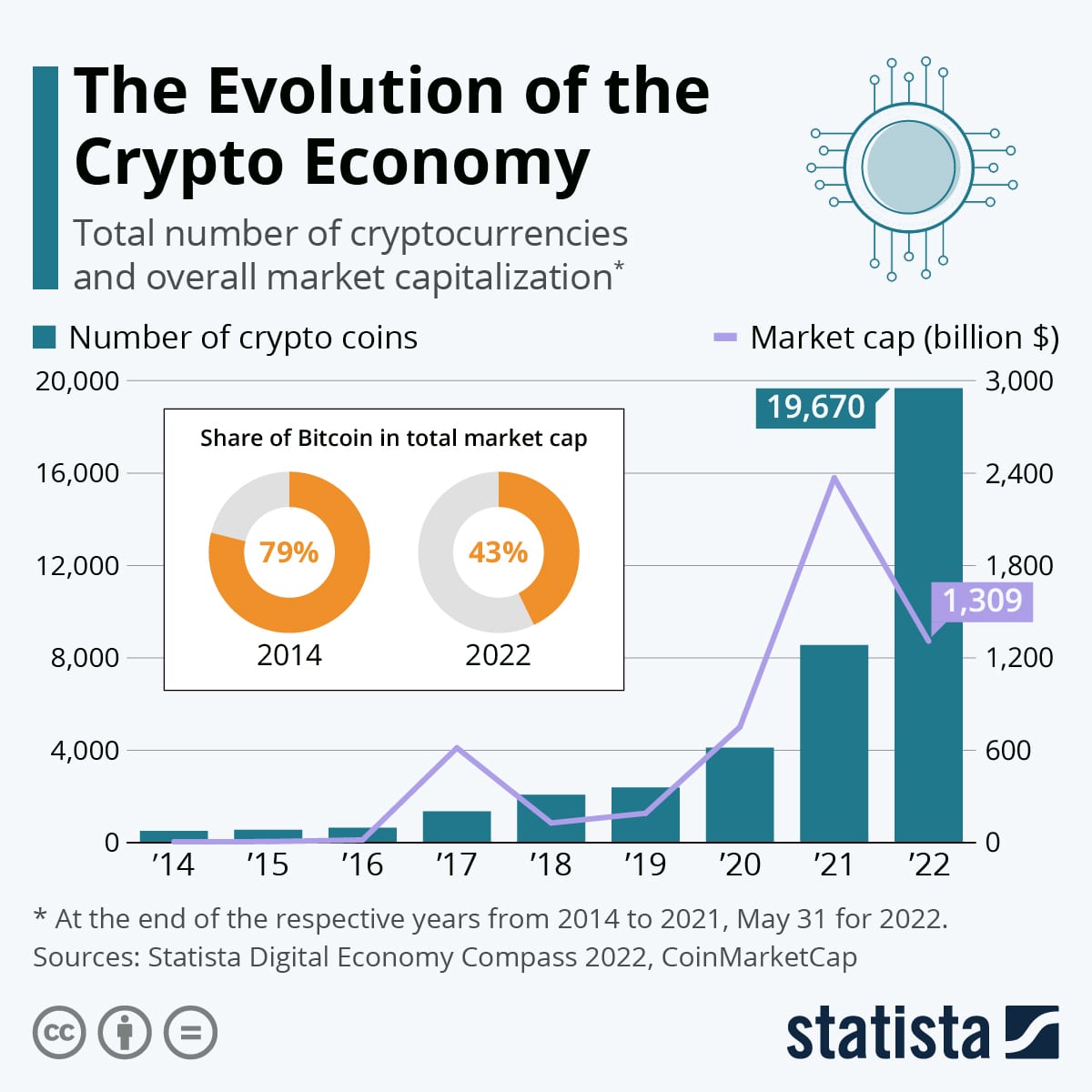

The controversy on whether or not it’s too late to purchase Bitcoin continues to spark sturdy opinions amongst monetary and cryptocurrency consultants. The vast majority of analysts agree that given its immense positive factors in recent times, shopping for Bitcoin now may not be the perfect funding resolution: the highlight is on new cryptocurrencies, and Bitcoin is progressively shedding market share. Nonetheless, many consultants are nonetheless intrigued by the potential of this forex.

Michael Novogratz

One of many largest traders within the discipline, Novogratz, acknowledged that it’s “uncertain” that Bitcoin will attain a value of $30,000 any time quickly in his current Bloomberg interview. Moreover, Novogratz identified that Bitcoin’s growth is being hampered by an absence of institutional capital getting into the market.

Cathie Wooden

Cathie Wooden, one of many well-known fund managers at Ark Make investments, continues to consider that Bitcoin will attain the $500,000 mark. Wooden has publicly acknowledged shopping for $100,000 value of Bitcoin, underscoring her upbeat outlook. Earlier this yr, an analyst at Ark Make investments acknowledged their opinion that BTC may be value greater than $1 million by 2030.

Jack Dorsey

Jack Dorsey, the co-founder of Twitter and Block, Inc., is a fervent proponent of cryptocurrencies and has often expressed his religion in Bitcoin.

In line with Dorsey, “Bitcoin modifications all the pieces,” and “The world will ultimately have a single forex, and I consider it will likely be Bitcoin.” Block, Inc. additionally permits for BTC commerce, underscoring Dorsey’s help for cryptocurrencies.

You may additionally like: Who Owns the Most Bitcoin within the World?

The place to Purchase Bitcoin

On the lookout for a platform to purchase Bitcoin on-line? Changelly is the perfect place to purchase and promote Bitcoin! We’re glad to give you the perfect trade charges within the trade, low charges, 24/7 buyer help, the best safety requirements, and extra!

Is It Too Late to Purchase Bitcoin? Our Conclusion

So, is it too late to purchase Bitcoin? Sure and no. There are stable arguments on each side. So, earlier than we ship a verdict, let’s take a more in-depth take a look at what individuals coming from these two positions say.

Crypto Is Approach Down From Its Current Highs

If you happen to consider that the cryptocurrency market is simply one other type of the inventory market, there will not be a greater time to purchase cryptos like Bitcoin as a result of they’re presently on sale. As Bitcoin’s historical past demonstrates, large dips like this will not be unusual in any respect, but the cryptocurrency has constantly managed to achieve new highs.

Crypto Is Going to $500,000 and Past

As we talked about earlier, the well-known monetary planner Cathie Wooden predicts that Bitcoin will really attain $500,000. In line with Greg Cipolaro and Dr. Ross Stevens, researchers at New York Digital Funding Group, who additionally help this assertion, “Growing basic demand mixed with a set provide and robotically declining provide development make a compelling case for Bitcoin instead funding for institutional traders.

Governments Are Toughening Up

One of many considerations about investing within the cryptocurrency market has at all times been that governments will ban the very creation and even acceptance of the cash. The second might have already arrived. Across the finish of Could 2021, China began to crack down severely on Bitcoin mining and commerce, which triggered the value of cryptocurrencies to spiral precipitously.

Extra these days, far-flung nations like Singapore, Estonia, and Iran have began their very own crackdowns. Demand and help for Bitcoin and different cryptocurrencies might collapse if different governments observe swimsuit.

As well as, there are fixed headlines within the media about the necessity to regulate the crypto market. The XRP vs SEC case illustrates this level.

Crypto Market Is Going to Zero

Skeptics suppose that cryptocurrencies are a category of property with no retailer of worth, an entry barrier, or any worth as a medium of trade. Due to this, detractors see cryptocurrencies as merely speculative investments that gained’t final as authentic asset courses in the long term. Jeff Schumacher, the founding father of BCG Digital Ventures, acknowledged this about Bitcoin in 2019: “I do consider it should go to zero. Though I believe it’s an excellent expertise, I don’t suppose it must be used as cash.”

Summing Up

In abstract, traders proceed to favor Bitcoin as considered one of their prime investments. Over the course of 13 years, Bitcoin has developed from a distinct segment fad to a extensively used funding automobile and can possible stay the biggest digital asset by market capitalization.

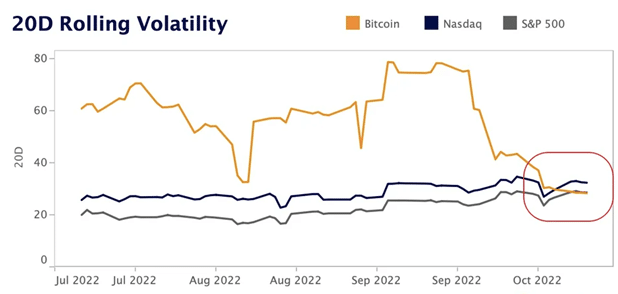

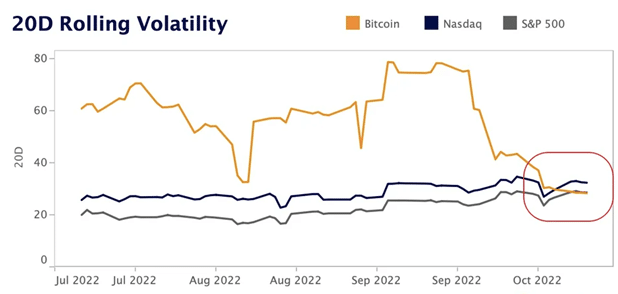

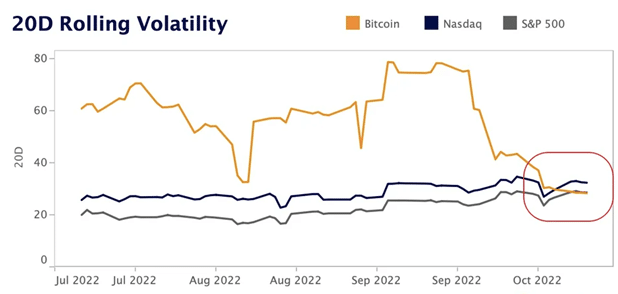

Bitcoin was much less risky than the S&P 500 and Nasdaq for the primary time since 2020. Supply: Kaiko

Certainly, Bitcoin is not a brand new cryptocurrency and is now even considered “previous” or “mature” within the context of the cryptocurrency market. This makes the coin’s value much less unpredictable on common, however this additionally makes episodes of exponential development unlikely. This is because of quite a lot of elements, together with the outdated, energy-intensive mining course of, lack of practicality, and, as stunning as it could sound, reputation. Though the acceptance by monetary establishments has some benefits, it additionally raises the chance that Bitcoin’s four-digit development is not attainable.

Given its mainstream reputation and promising future, Bitcoin could also be a sensible choice for retail traders who wish to enter the world of cryptocurrencies. Many analysts contend that Bitcoin is without doubt one of the most undervalued cryptocurrencies accessible in the meanwhile, with a value of round $17,000 as of this writing. Nonetheless, there are undoubtedly higher decisions if traders search cryptocurrencies with larger upside potential.

Cash to Think about Shopping for Alongside Bitcoin

Regardless of its great success instead asset, Bitcoin is just not with out its dangers, essentially the most notable of which being its risky value and gradual processing occasions. Happily, there are a selection of different digital or “alt” cash that provide probably larger returns and sooner transactions:

Whereas these choices could also be enticing to these concerned with investing in digital currencies, it is very important keep in mind that cryptocurrency markets can change shortly, and traders ought to conduct thorough analysis earlier than making any selections.

Cryptos to Think about Shopping for As an alternative of Bitcoin

If you happen to’re seeking to spend money on cryptocurrency, Bitcoin is just not your solely possibility. Earlier than buying Bitcoin, traders ought to contemplate different cryptocurrencies which have the potential to generate larger returns. Listed here are the perfect altcoins with essentially the most upside potential:

The volatility of those cash could cause crypto costs to fluctuate drastically in a single day, so it’s essential to do your analysis earlier than investing any vital sum of money. With the fitting method and information, various cryptocurrencies may very well be the important thing to larger returns for savvy traders.

The data on Changelly shouldn’t be considered funding recommendation, nor are we certified to supply it.

FAQ

Is it too late now to spend money on Bitcoin?

It relies on what you anticipate from such a funding.

Is it ever too late to get into crypto?

Because the crypto market turns into increasingly mainstream, the chance of unbelievable upsurges in value decreases. Amongst just a few the explanation why some day it may be too late to spend money on crypto, that is the primary one.

Is it the fitting time to purchase Bitcoin?

If you happen to consider in technical evaluation — sure, it’s. BTC has been at its lows in current months.

Is it too late to spend money on Bitcoin in 2022?

Some might argue that it’s by no means too late to spend money on BTC. We’ve mentioned what to anticipate from BTC investments above.

Disclaimer: Please observe that the contents of this text will not be monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.