Entrepreneurs are beginning to deploy their companies and types with authorities help or bootstrapping. Sadly, leaning on the federal government to again their invention is extremely inconvenient resulting from strict restrictions. This is because of an extended chain of command and a horrendous forms. However, a number of points might constrain a bootstrapped startup. Essentially the most important is a low price range and a smaller community of high-net-worth people. Regardless of their bumpy begin within the late 1900s, innovation and unicorn startups have had the help of enterprise capital firms for a number of years. They do that by bypassing the constraints that include asking the federal government for financing or attempting to bootstrap a enterprise. They may accomplish it by placing up quite a lot of capital in return for lots of fairness. However, Enterprise Capitalists (VCs) have their very own set of issues that Decentralized Autonomous Organizations (DAOs) would possibly have the ability to sort out.

The Challenges that Enterprise Capitalists Pose to Startups

One frequent drawback startup entrepreneurs face is an absence of religion of their concept as a result of it’s “too far on the market.” Many individuals are reluctant to spend money on a startup as a result of they imagine the cash can be wasted on overhead. That is very true for very creative startups that almost all VCs discover obscure. One other main problem enterprise buyers have with companies is discouraging them from taking dangers. They ceaselessly attempt to dissuade startups from attempting new issues. They do that by saying, “If it ain’t broke, do not repair it.” As a result of they anticipate a constant return on funding, they need entrepreneurs to play it secure. Sometimes, Enterprise Capitalists (VCs) require startups handy over a big chunk of their possession. This offers buyers with a substantial amount of energy. They will wield this energy to have an effect on the corporate’s operations and merchandise. It additionally permits enterprise financiers to entry the founders’ financial institution accounts. This means that earlier than they will spend any cash, they need to first ask the buyers. Final however not least, enterprise capitalists normally lack an intensive understanding of rising applied sciences. And whereas they will steer the corporate and management issues, they will not be the best people to make judgments. It’s because they could not totally perceive the imaginative and prescient or the results of their actions.

DAOs: A New Strategy To Fundraising

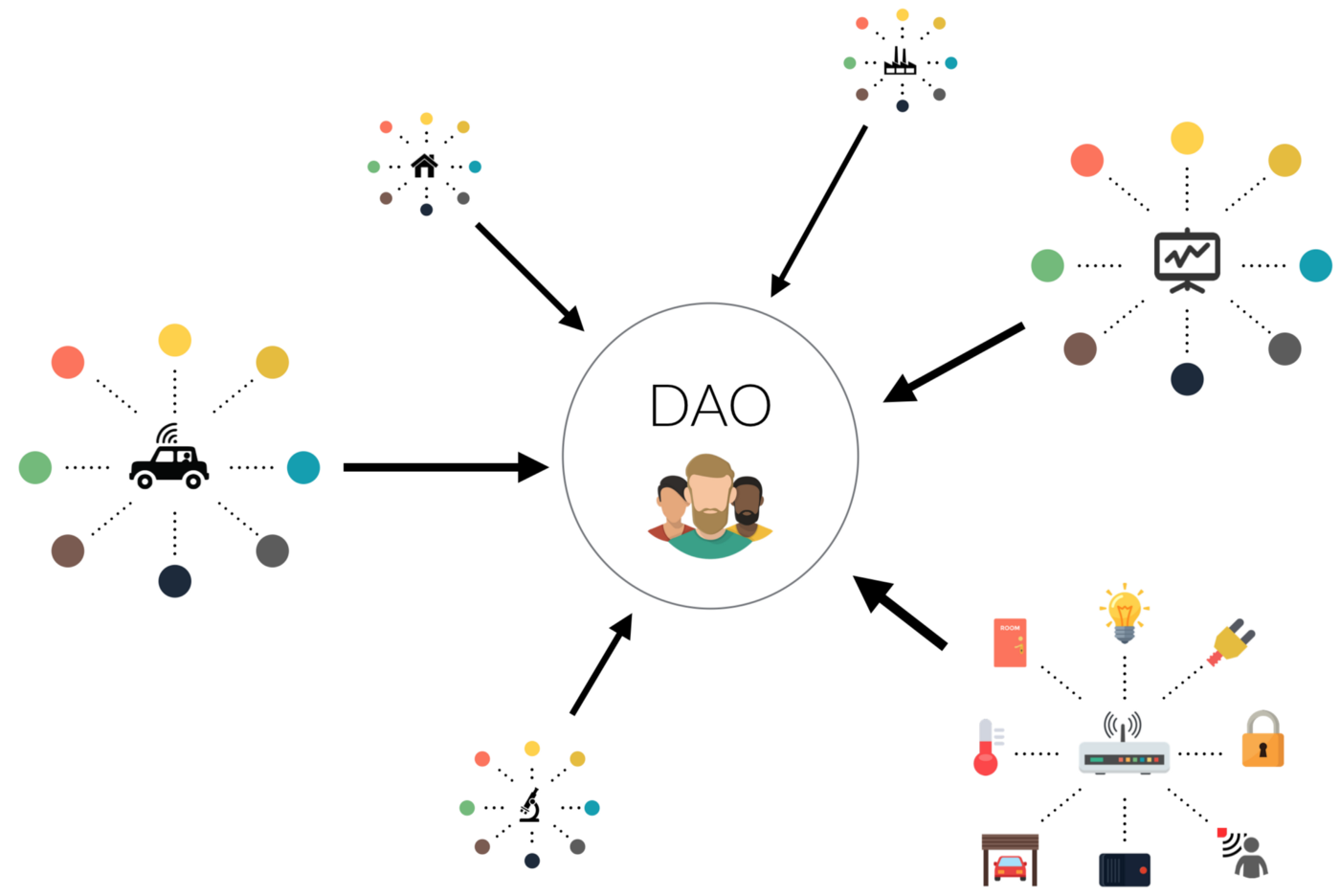

It is gaining popularity to make use of Decentralized Autonomous Organizations (DAOs) to fund startups and help inventors and innovators. The equal distribution of alternative is likely one of the most essential Distinctive Promoting Propositions (USPs) of DAOs. They help within the democratization of governance by decentralizing authority. As beforehand stated, conventional VCs have restricted information however a lot management over the mission’s future. Moreover, folks with decrease internet price are generally shut out of the sport due to the capital essential to spend money on startups. It does not matter in the event that they perceive the imaginative and prescient, mission, and technique higher than the VCs. DAOs intention to bridge these divides by connecting inventors and innovators with visionary buyers. Take, for instance, the scientific neighborhood. Many good scientists face important challenges in convincing buyers of the innovativeness of their merchandise or approving their initiatives. Politics, bigotry, and forms deter many excellent younger minds from chasing their passions and realizing their full potential. However, due to initiatives like DAOs, these geniuses can current their suggestions to a neighborhood that may relate to them.

Adapt To DAOs Or Change into Out of date?

In lots of respects, DAO fundraising is democratizing the VC trade. Regardless of investing over $600 billion in startups in 2021, the standard VC ecosystem is shutting down extra improvements than it helps. Founders of startups worldwide at the moment are expressing fear about how VCs funding is placing quite a lot of stress on them. Moreover, the excessive threat and capital necessities have stored strange buyers out of the VC sport for years. That is the place Decentralized Autonomous Organizations (DAOs) and blockchain might assist. Due to the DAOs initiative, tens of millions of buyers worldwide can pool their funds to help startups. The chance is unfold out amongst all contributors, and nobody particular person bears the complete burden. Moreover, DAO-funded startups might have a greater likelihood of succeeding. Crew members might get a way of how the market will obtain a services or products lengthy earlier than launch. Totally different governance-token holders oversee a DAO. Subsequently, the DAO might extrapolate its response to a mission to a wider market with the same psychographic and demographic viewers. As DAOs acquire recognition over conventional VCs, VC firms have to undertake blockchain and turn into extra democratic and fewer “shark-like.”