- BNB Chain was fairly heated because of a number of constructive developments

- BNB’s stochastic was oversold, however the remainder of the metrics have been damaging

BNB’s efficiency final week was not what buyers anticipated. Its worth went down significantly, like most different cryptos available in the market. The credit score for this worth decline goes to the present market, which favors the sellers.

In response to CoinMarketCap, BNB registered a 19% decline within the final week. At press time, it was buying and selling at $284.02, with a market capitalization of $45.49 billion.

Learn BNB Chain’s [BNB] worth prediction 2023-2024

Regardless of this, BNB, in a latest tweet, acknowledged,

“It doesn’t matter what occurs, one factor you possibly can depend on is our October Stars persevering with to make stable progress.”

It doesn’t matter what occurs, one factor you possibly can depend on is our October Stars persevering with to make stable progress ? @Quest3_xyz, @bobanetwork, @xdaoapp and @PythNetwork continued reaching new milestones this week.

Get the main points ⤵️ pic.twitter.com/XARdZ3O2H2

— BNB Chain (@BNBCHAIN) November 12, 2022

As per the tweet, a number of constructive developments occurred on the BNB chain that appeared fairly promising for the blockchain. For example, Boba Community was nominated for the AIBC summit blockchain of the yr 2022 award, whereas Pyth Community was set to launch a CAKE/USD worth feed. Moreover, Quest3 had over 18,000 weekly lively customers on the BNB chain.

BNB was additionally among the many checklist of probably the most voted cash on CoinGecko on 12 November, which was constructive information for the coin.

⚡️Most Voted Cash by @CoinGecko

12 November 2022#Bitcoin #BTC $BTC #Ethereum #ETH $ETH #BNBChain #BNB $BNB #TRON #TRX $TRX #Cardano $ADA $DOGE #Litecoin $LTC #Chainlink $LINK #Monero $XMR #Stellar $XLM #XLM pic.twitter.com/pJfZSJk3C5— ?? CryptoDep #StandWithUkraine ?? (@Crypto_Dep) November 12, 2022

That is value contemplating

Earlier than speculating that these updates would possibly positively influence BNB’s worth, let’s take a look at BNB’s metrics to raised perceive the state of affairs. On the time of writing, BNB had registered an uptick as its worth went up over 3% within the final 24 hours. Nonetheless, the on-chain metrics have been nonetheless didn’t favor buyers.

BNB’s day by day transactions in revenue went down sharply after a spike on 8 November. The rate additionally took the identical path and declined up to now few days, which was one more bearish sign. Moreover, BNB’s Market Worth to Realized Worth (MVRV) ratio additionally registered a downtick, additional growing the probabilities of a worth decline.

Supply: Santiment

Nonetheless, CryptoQuant’s data gave a slight ray of hope to buyers because it revealed a serious bullish sign. BNB’s stochastic was in an oversold place, thus acknowledging the potential of a northbound breakout quickly.

Market indicators in assist of BNB?

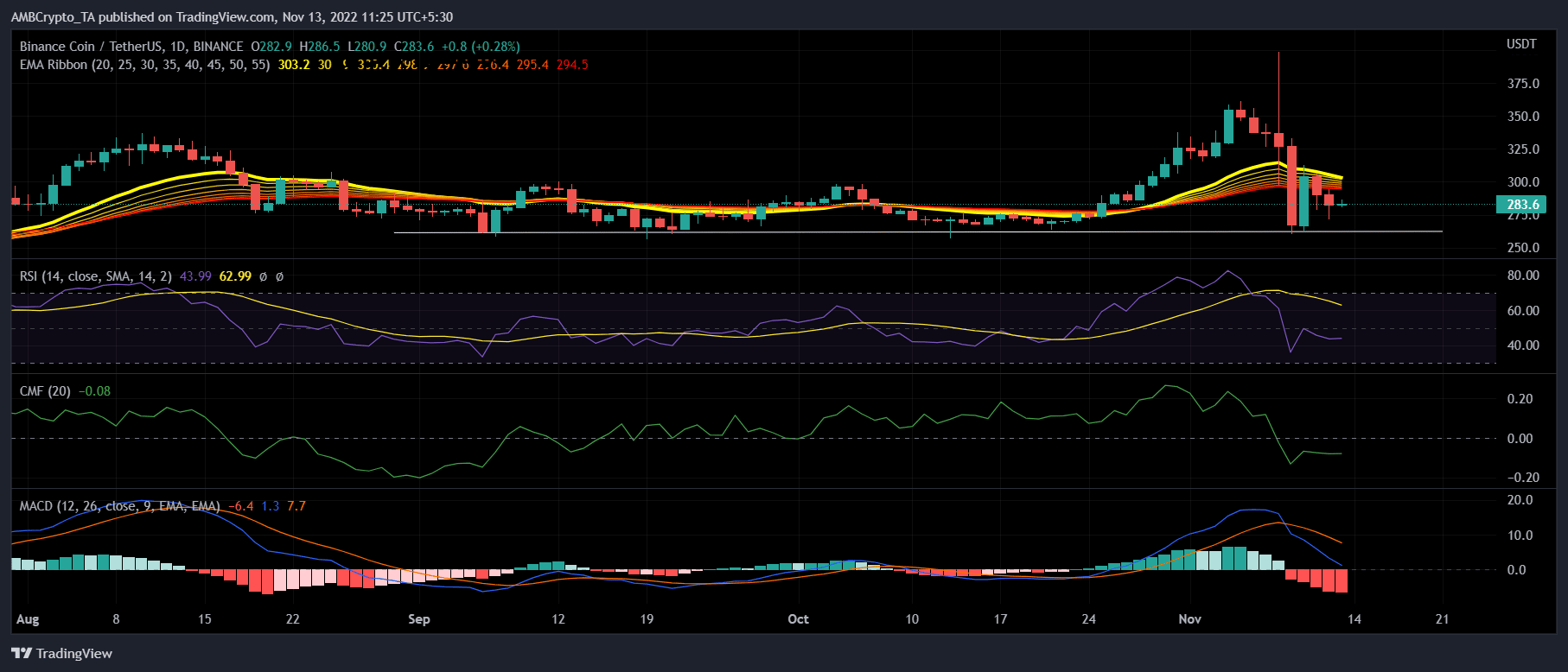

Market indicators for BNB painted a bearish image, as they supported the sellers. BNB’s Relative Power Index (RSI) and Chaikin Cash Circulation (CMF) have been each resting beneath the impartial place, a damaging sign for the blockchain. The Shifting Common Convergence Divergence (MACD) additionally displayed a bearish crossover, growing the probabilities of a worth plummet.

The Exponential Shifting Common (EMA) Ribbon was within the bulls’ favor, because the 20-day EMA was above the 55-day EMA. Nonetheless, the space between them stored reducing, which could trigger a bearish crossover quickly.

Supply: TradingView