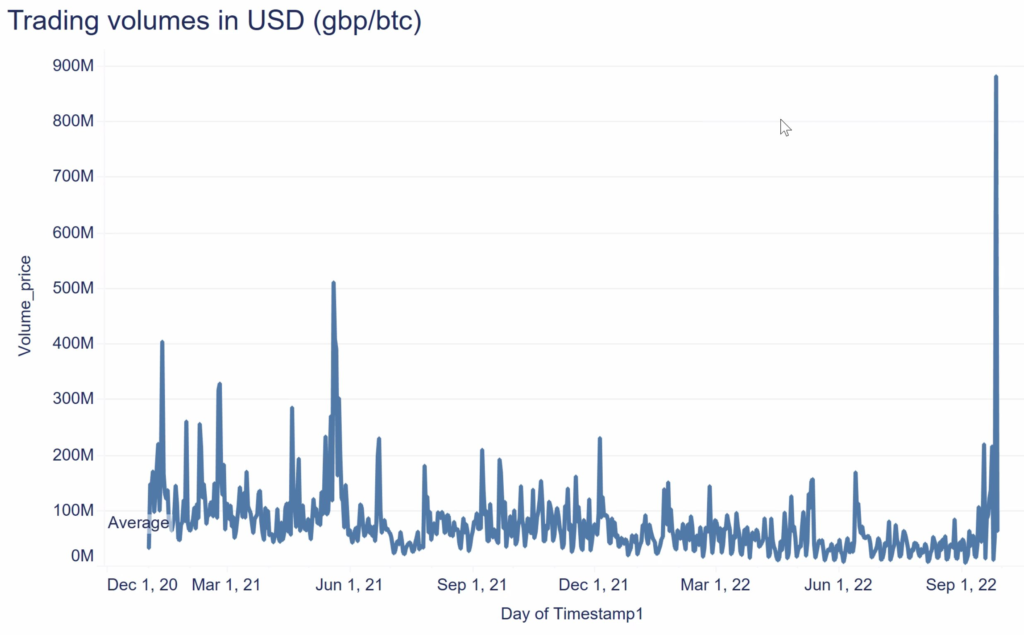

- Bitcoin buying and selling volumes recorded an all-time excessive towards GBP at present on Sep twenty eighth, as GBP fiat forex confirmed weak spot.

- In keeping with the Technique adviser of funding big VanEck, BTC ought to see elevated curiosity from the G20 international locations as a hedge towards their very own insurance policies.

- Over the previous 12 months, GBP has collapsed by -22% towards USDT.

Bitcoin buying and selling volumes just lately recorded a speedy improve towards GBP as fiat forex is threatened, and GBP recorded lows towards the greenback. In keeping with Gabor Gurbacks, the Technique Adviser of Funding Large Vaneck, the UK will quickly be “orange-pilled” in investing in BTC, given GBP volatility. VanEck continued to state that if not the UK, different G20 international locations might begin taking some small Bitcoin positions to hedge towards their insurance policies.

The UK will get orange-pilled in a short time given GBP volatility. Provided that the UK is now outdoors of the EU bureaucratic equipment, it is going to get one other probability to change into a #Bitcoin hub. I believe UK leaders will use this chance moderately effectively.

Gabor Gurbacks, VanEck

The latest pound selloff sparked a commerce of $BTC towards different devaluing currencies. GBP’s disintegration hit the bottom file this week at practically $1.03.

The UK will get orange-pilled in a short time, given GBP volatility, stated Gurbacks. Provided that the UK is now outdoors of the EU bureaucratic equipment, it is going to get one other probability to change into a Bitcoin hub. I believe UK leaders will use this chance moderately effectively.

Bitcoin could possibly be a hedge towards their very own insurance policies, which is price a small % allocation and assist. Some are beginning to perceive this, continued to say Gurback.

In keeping with knowledge from Coinshare’s Head of analysis, Bitcoin volumes have been up $881M yesterday towards GBP.

Bitcoin buying and selling quantity additionally made a file of 878.11% improve up to now 30 days.

MicroStrategy Founder Micheal Saylor additionally stated that when central banks intervene to prop up their bonds, they cripple the capital markets and collapse their currencies. In keeping with Saylor, Bitcoin gives a sound financial & moral various.

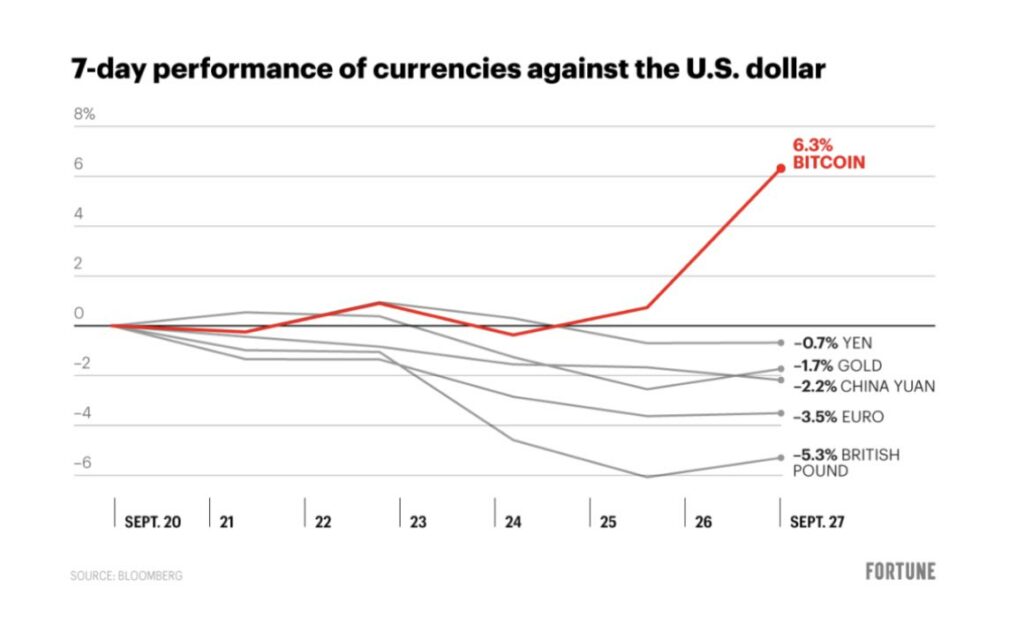

Bitcoin has been more and more outperforming main currencies up to now week by 6.3%, as currencies resembling Yen, Gold, China Yuan, and British Pound file falls in worth.

Traders seem to not solely be working away from the inflation subject within the EU and UK and shifting their cash to US authorities bonds but in addition contemplating Bitcoin as a possible secure haven towards fiat devaluation. This check might put Bitcoin on the forefront as a forex devaluation hedge.