Investors celebrating a meteoric rise in stock prices this year may want to pause and consider an ominous concept: the “bezzle.” Coined by economist John Kenneth Galbraith, the term refers to the amount of illusory wealth in an economy, often stemming from fraud or psychological distortions that inflate asset values far beyond their intrinsic worth.

“The bezzle often arises from deliberate fraud,” Galbraith explained. However, the term has evolved to include phenomena such as speculative bubbles and market exuberance. Charlie Munger, the late billionaire investor and vice-chairman of Berkshire Hathaway, expanded the definition, highlighting psychological factors that mislead investors and drive unsustainable valuations.

“When an embezzlement is committed, victims mistakenly feel they are rich during the time it remains undiscovered,” Galbraith famously noted. Investors today may find themselves blinded by a similar dynamic.

Signs of a Growing Bezzle

The current market environment shows troubling signs of elevated bezzle levels. Bitcoin, for instance, surged by 40% last month, driven largely by speculative excitement over Donald Trump’s potential influence on cryptocurrency markets. “It’s a case of an asset with no dividends and no earnings soaring in value simply because people figure other people are going to get excited about it,” the report noted.

A stark reminder of how quickly inflated valuations can collapse came with the bankruptcy of Swedish battery-maker Northvolt AB. Once a darling of the green-energy sector, Northvolt’s implosion forced Goldman Sachs to write off its $900 million stake. “Nearly a billion dollars can vanish like that,” the report pointed out, emphasizing the risks of hazy projections driving valuation bubbles.

Similarly, the U.S. stock market is brimming with optimism over artificial intelligence (AI), driving tech valuations to unprecedented heights. Even stalwart firms like Walmart and Home Depot are trading at multiples traditionally reserved for high-growth startups.

Market Warnings and Strategic Responses

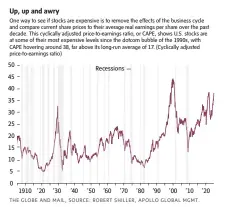

Wall Street analysts acknowledge the frothy state of the market. Citigroup’s Levkovitch Index has identified a “euphoria” stage in economic indicators for months. The CAPE ratio, comparing stock prices to long-term earnings, is nearing levels last seen during the dot-com bubble.

Despite these warnings, many strategists, including those at BlackRock, suggest staying invested in U.S. stocks, predicting even greater market exuberance. Factors fueling this optimism include persistent fiscal deficits under the new U.S. administration, sustained enthusiasm for AI, and limited international investment alternatives.

For cautious investors, experts recommend classic strategies such as a balanced 60-40 portfolio—60% stocks and 40% bonds. Options like Vanguard Canada’s VBAL-T or RBC iShares’ XBAL-T exchange-traded funds offer diversified exposure while reducing risk.

“When the bezzle is as high as it now appears to be, reducing risk is more important than seeking maximum returns,” the report concludes.

Investors, it seems, face a delicate balancing act: riding the wave of exuberance while preparing for the moment when reality asserts itself and the bezzle shrinks.