Key Takeaways

- sudoswap is a decentralized NFT market constructed on Ethereum.

- It adopts an automatic market mannequin just like Uniswap, internet hosting liquidity swimming pools for NFTs slightly than standalone listings.

- sudoswap’s design affords a number of benefits for NFT buying and selling over different venues like OpenSea, which explains why its reputation has soared in latest weeks.

Share this text

Discover ways to purchase and promote NFTs on crypto’s first NFT automated market maker.

What Is sudoswap?

sudoswap is making NFT buying and selling even simpler.

Launched in Might 2022, sudoswap is crypto’s first NFT automated market maker. The Ethereum-based platform capabilities equally to Uniswap, letting customers trustlessly commerce property by way of user-funded liquidity swimming pools. Nonetheless, as an alternative of buying and selling between two fungible tokens, sudoswap customers can commerce between NFTs and ETH.

At first look, it is likely to be onerous to see what benefits sudoswap affords the common consumer over typical NFT buying and selling platforms like OpenSea, the world’s largest NFT market with buying and selling volumes that far surpass all of its rivals. Not like OpenSea, sudoswap’s swimming pools are utterly decentralized and funded by its customers. Nonetheless, this doesn’t imply that buying and selling is free—the creator of the buying and selling pool units a swap payment of some per cent paid to them from each profitable NFT buy or sale.

The charges generated when property are traded by way of the platform’s swimming pools return to these offering the NFT and ETH liquidity. This additionally signifies that sudoswap bypasses current royalty charges positioned on collections by their creators. Moreover, the decrease the swap charges are on a particular pool, the extra incentive customers should commerce by way of it. This incentivizes a “race to the underside” for pool creators to supply the bottom charges, leading to higher costs for finish customers.

A last advantage of sudoswap is that it lets NFT house owners promote their property immediately with out having to attend for a purchaser, in flip enhancing liquidity and effectivity within the NFT market.

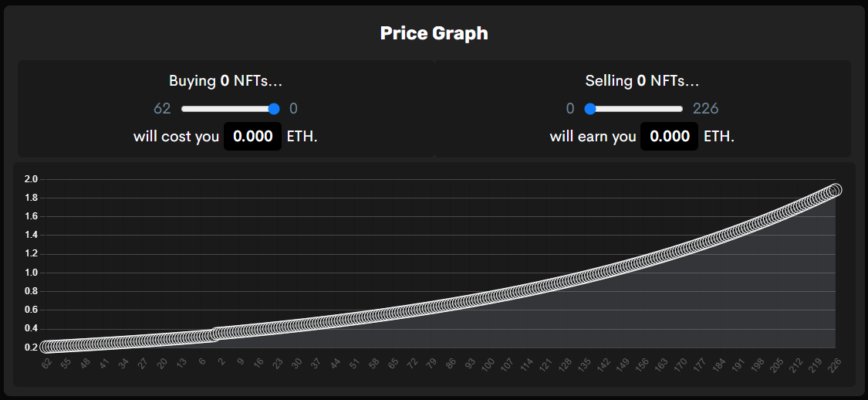

Nonetheless, arguably essentially the most progressive a part of sudoswap is the way it manages the worth of the NFTs traded by way of its swimming pools. The platform makes use of bonding curves to routinely improve and reduce the bid and ask on every assortment relying on what number of NFTs are purchased or offered. For instance, when a consumer sells an NFT right into a pool, growing the availability, the purchase worth barely declines. Relying on the delta worth chosen by the pool’s creator, the extra NFTs offered, the decrease the worth per NFT turns into till market forces discover its honest worth. Then again, shopping for an NFT from a pool incrementally will increase the price of subsequent purchases, conserving the asset’s worth according to demand.

Over the previous few weeks, the quantity of customers interacting with sudoswap has exploded. In keeping with Dune data compiled by 0xRob, the protocol had a mean of 36 customers a day in July. One month later, sudoswap has registered virtually 2,000 each day customers and a complete buying and selling quantity of over $18 million.

Getting Began With sudoswap

Buying and selling NFTs on sudoswap is not any tougher than interacting with different automated buying and selling platforms. As with interacting with any blockchain protocol, ensure you’re on the correct site and join your Web3 pockets utilizing the on-screen prompts.

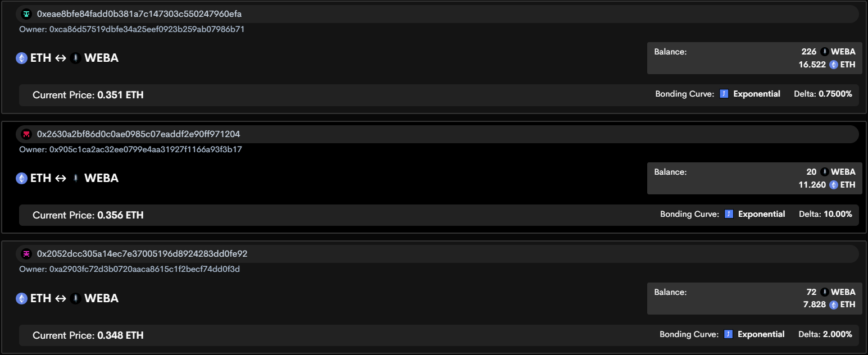

As soon as related, navigate over to the collections web page to see which NFT collections customers have created liquidity swimming pools for. The most important and most energetic swimming pools are for widespread, well-established, and incessantly traded collections—don’t look forward to finding swimming pools for smaller and extra obscure initiatives. After discovering a group to commerce, click on on it, then navigate to the “swimming pools” tab. This can present the user-created swimming pools providing NFTs from the gathering, how a lot liquidity there’s for every one, the kind of bonding curve used, and the Delta worth (how a lot gross sales and purchases have an effect on the worth of NFTs within the pool). We’ll use the Webaverse Genesis Cross assortment for this demonstration.

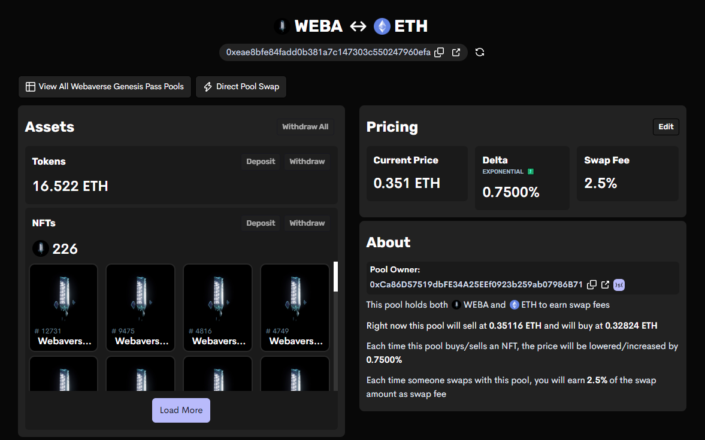

Most collections have one primary pool the place most of their liquidity is concentrated. Nonetheless, it’s value checking if there are different swimming pools obtainable providing decrease swap charges—particularly in case you’re seeking to purchase NFTs from greater worth collections like Bored Ape Yacht Membership or 0xmons. For Webaverse Genesis Passes, we’ll have a look at the principle pool with the liquidity of 226 NFTs and 16.522 ETH.

Right here we will see the present worth the pool sells an NFT for, the Delta (the quantity NFT gross sales and purchases transfer the ask worth), and the general swap payment charged by the pool’s creator. Scrolling down, we will additionally see a graph that offers a visible illustration of the pool’s bonding curve. Shifting the sliders on the purchase and promote sides can simulate how shopping for or promoting a number of NFTs from the pool will improve or lower the worth and the way a lot doing so would price.

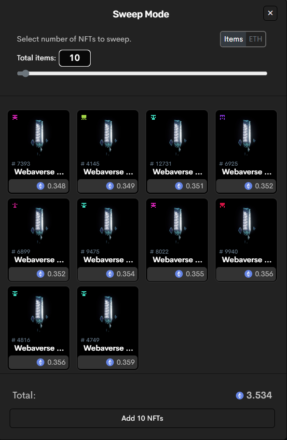

As swimming pools improve the worth of NFTs as they promote them, it’s typically higher to make use of a number of swimming pools when shopping for a number of NFTs. sudoswap’s built-in “Sweep Mode” can be utilized to seek out the very best mixture of purchases. For instance, if we wished to purchase 10 Webaverse Genesis Passes, the most cost effective possibility could be chosen for the primary buy. Nonetheless, this may improve the worth of different NFTs within the corresponding pool, which means it may very well be cheaper to purchase from different swimming pools earlier than returning to the primary pool.

The identical rules for getting a number of NFTs applies when promoting them. If we wanted to promote a number of NFTs from a group rapidly, we might probably get a greater total worth by promoting single NFTs to particular person swimming pools slightly than promoting all of them to the identical one.

It’s additionally value noting that customers can choose the precise NFT they obtain when shopping for NFTs from sudoswap swimming pools. Whereas this isn’t notably vital for collections like Webaverse Genesis Cross the place every NFT is identical, it has an impression on collections with variable rarity. It is because it affords consumers an opportunity to purchase NFTs with uncommon traits near the gathering’s ground worth. NFT holders seeking to promote rarer items, in the meantime, could discover they will get a greater worth for his or her grails on different marketplaces akin to OpenSea.

Whereas sudoswap remains to be in its infancy, it might doubtlessly revolutionize NFT buying and selling. Members of the NFT group have already began experimenting with different uses for the protocol starting from raffle techniques to GameFi marketplaces. On the similar time, speculators are hoping to capitalize on the hype with spinoff initiatives like Sudo Loot and Sudo Inu. Whereas it’s unclear whether or not sudoswap will host extra substantial collections sooner or later, which may not matter. It’s already pushed NFT buying and selling ahead and appears set for a brilliant future.

Disclosure: On the time of scripting this piece, the writer owned ETH and a number of other different fungible and non-fungible cryptocurrencies.