Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation

- A rising wedge sample was noticed for Polkadot

- Bearish order block heightened the probability of a pullback

Polkadot [DOT] has seen a robust restoration from the $5.8 zone over the previous week. Technical indicators revealed a very good quantity of shopping for strain behind this rally as effectively.

Right here’s AMBCrypto’s Worth Prediction for Polkadot [DOT] in 2022-23

A current article highlighted a fall within the weighted sentiment behind Polkadot this previous week. Regardless of this discovering, nevertheless, the value has been capable of preserve a optimistic run on the charts.

Polkadot types a bearish sample proper beneath a resistance zone

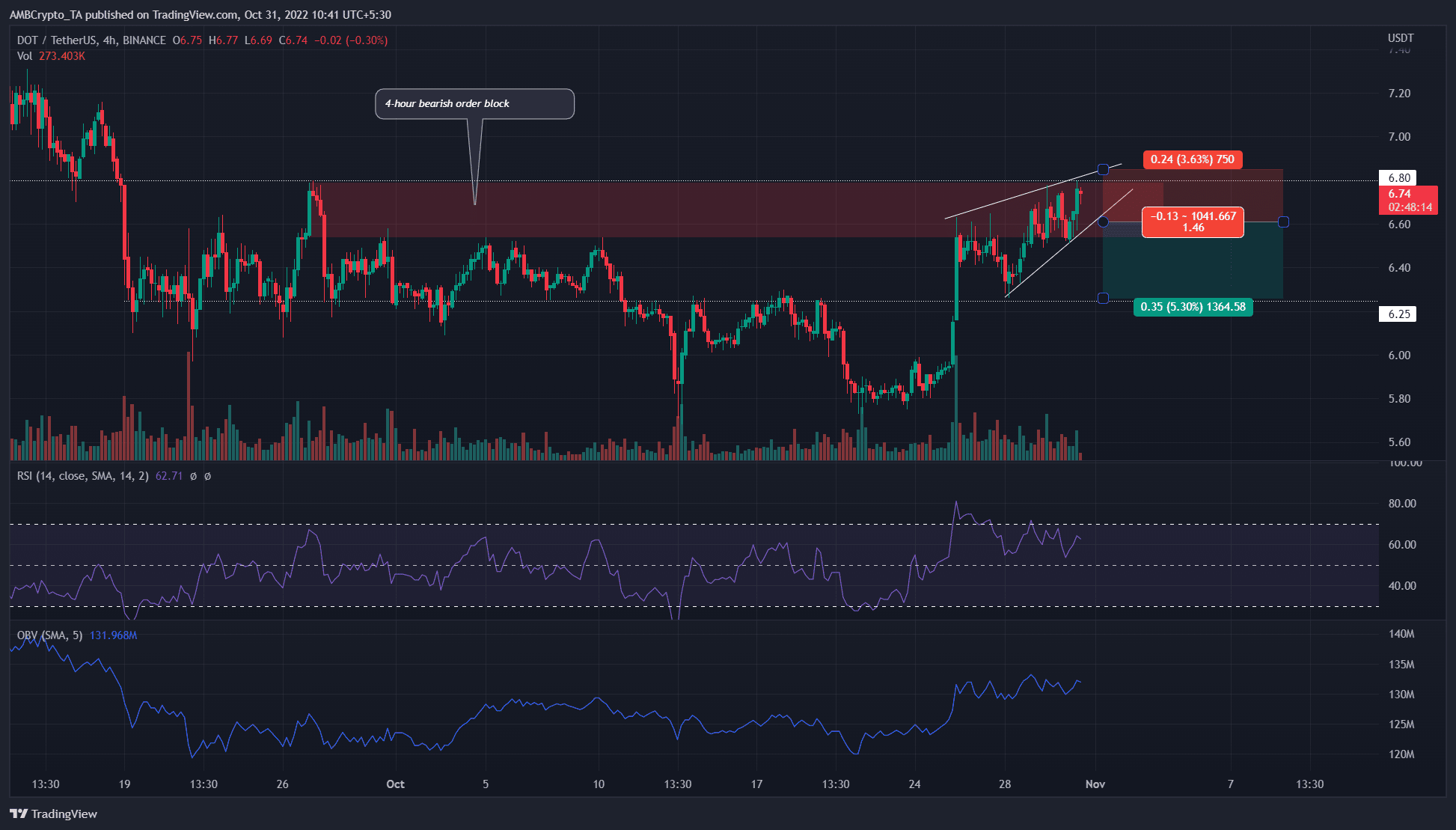

Supply: DOT/USDT on TradingView

On the 4-hour chart, a bearish order block was recognized within the $6.65-area. It was marked in pink and signified a belt of short-term resistance. Over the previous few days, the market construction has been bullish on the decrease timeframes.

The each day timeframe additionally noticed a shift in construction from bearish to bullish. This improvement highlighted that risk-averse merchants seeking to commerce with the pattern can search for shopping for alternatives.

In the meantime, DOT fashioned a rising wedge sample over the past three days. With the confluence from the resistance zone, it’s seemingly that DOT might see a short-term pullback. The 4-hour RSI fashioned a bearish divergence with the value over the past two days. This bolstered the probability of a dip. The OBV didn’t present heightened promoting not too long ago because it remained flat.

This pullback might see DOT fall to the $6.15-$6.25 help zone. Not solely was this a big belt of help over the previous two weeks, nevertheless it was additionally near the bottom of the wedge sample.

Slight rise in Open Curiosity, however longs have dropped over the past 24 hours

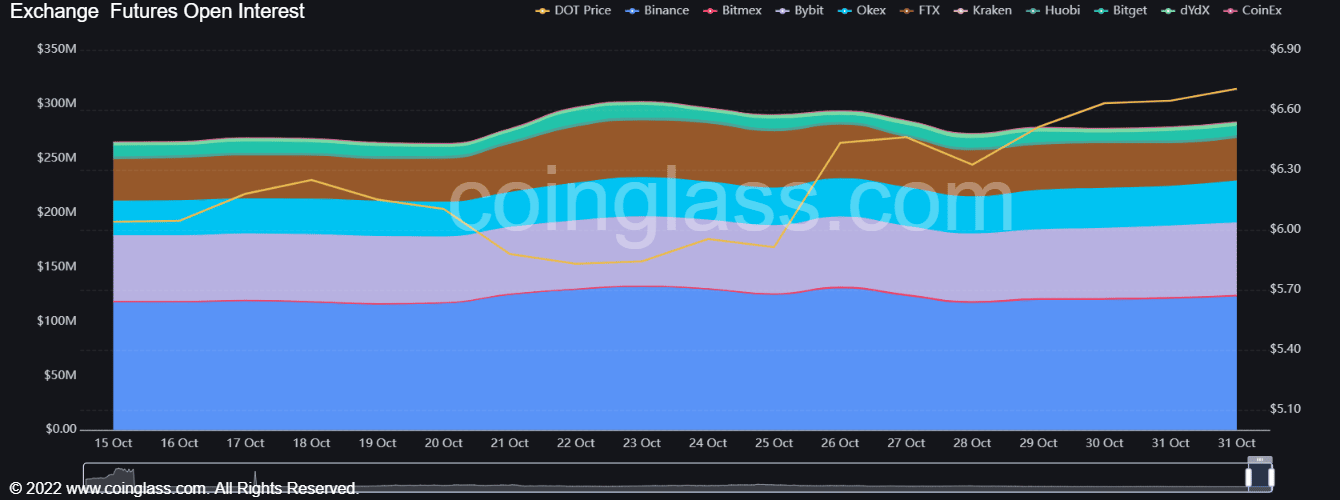

Supply: Coinglass

Over the previous two days, the Open Curiosity behind DOT went up by a really slight margin. It measured near $2 million, however this uptick got here at a time when DOT gained by almost 7%.

The Long/Short ratio was not favorable to the bulls both. The final 24 hours noticed quick positions register a minor victory. At press time, the ratio stood at 50.19% shorts. The funding rate was optimistic for DOT on Binance. This prompt that speculators have maintained a bullish outlook for DOT.

A revisit to the $6.15-$6.25 zone will seemingly supply a very good shopping for alternative. A transfer above $6.75 will invalidate the bearish concept based mostly on the confluence of the rising wedge sample and the bearish order block.