Axie Infinity turned its sport right into a billion-dollar financial system that helped hundreds of gamers within the Philippines and different low-income nations to climate the fallout from pandemic mitigation measures. The principle ingredient for fulfillment: sturdy property rights.

Gamers can take in-game materials out of the sport and commerce on third-party marketplaces like OpenSea. The liberty to set costs and to simply commerce unlocked a veritable tsunami of financial exercise in and outdoors of the sport.

The 30-page report from Cointelegraph Analysis analyzes the highest 5 titles and what modified because the days of Second Life and is produced in partnership with Galaxy Struggle Membership, The Sandbox, Planetarium, Immutable x, SolaDefy, Decentral Video games, X World Video games and Animoca manufacturers.

The making of a brand new financial system

The report dives deep into the variations between digital economies of the previous, like Second Life or World of Warcraft, and trendy blockchain-powered video games comparable to Axie Infinity or DeFi Kingdom.

Creating a well-functioning market full with an in-game foreign money and open requirements for sport materials was merely past the scope of any growth studio up to now. However, blockchains provide financial constructing blocks to sport builders. The expertise permits builders to launch a token inside an hour or to outline sport supplies as nonfungible tokens (NFTs). This offers customers sturdy property rights and the power to take their characters and objects outdoors of the video games onto third-party marketplaces and even different video games at little further growth value.

Obtain the total report right here – totally free.

With the addition of decentralized finance (DeFi) expertise, gamers have monetary alternatives they by no means had earlier than, which led to the lightning-fast adoption of those video games.

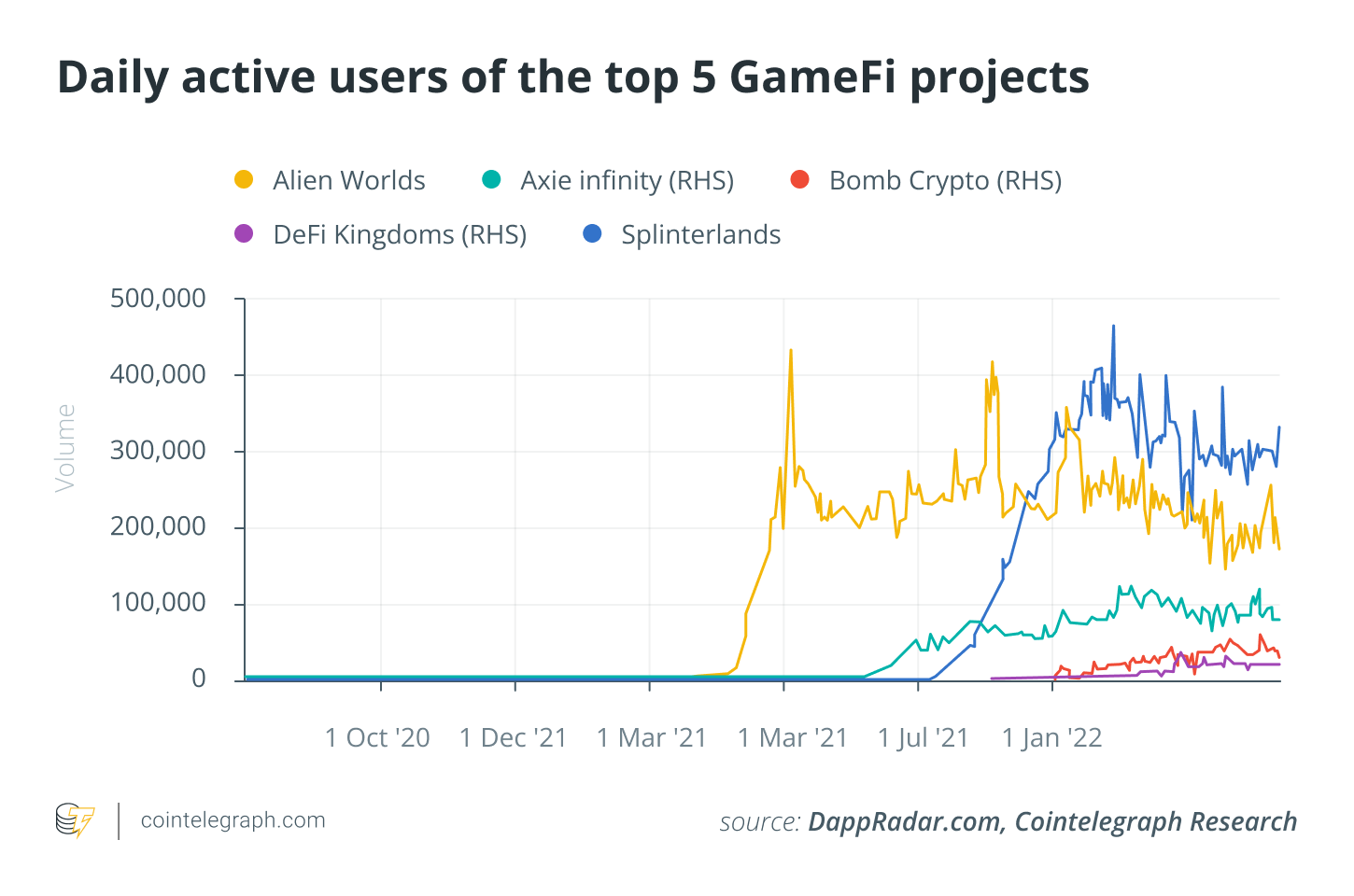

The report then compares the highest 5 blockchain sport titles Alien Worlds, Axie Infinity, Bomb Crypto, DeFi Kingdom and Splinterlands. Every of those video games has totally different gameplay and affords totally different incentives to gamers. Day by day lively customers, transaction quantity, deposited balances and gameplay — in addition to tokenomics which can be the financial incentives for the in-game foreign money — are every put into comparability.

However, no report could be full with out masking the darkish aspect of blockchain gaming. Environmental considerations, a pointy divide between the haves and the have-nots, the legality and tax implications are all legitimate considerations round these new economies. That is particularly vital because the sheer success makes these video games more and more engaging to gamers and sport builders.

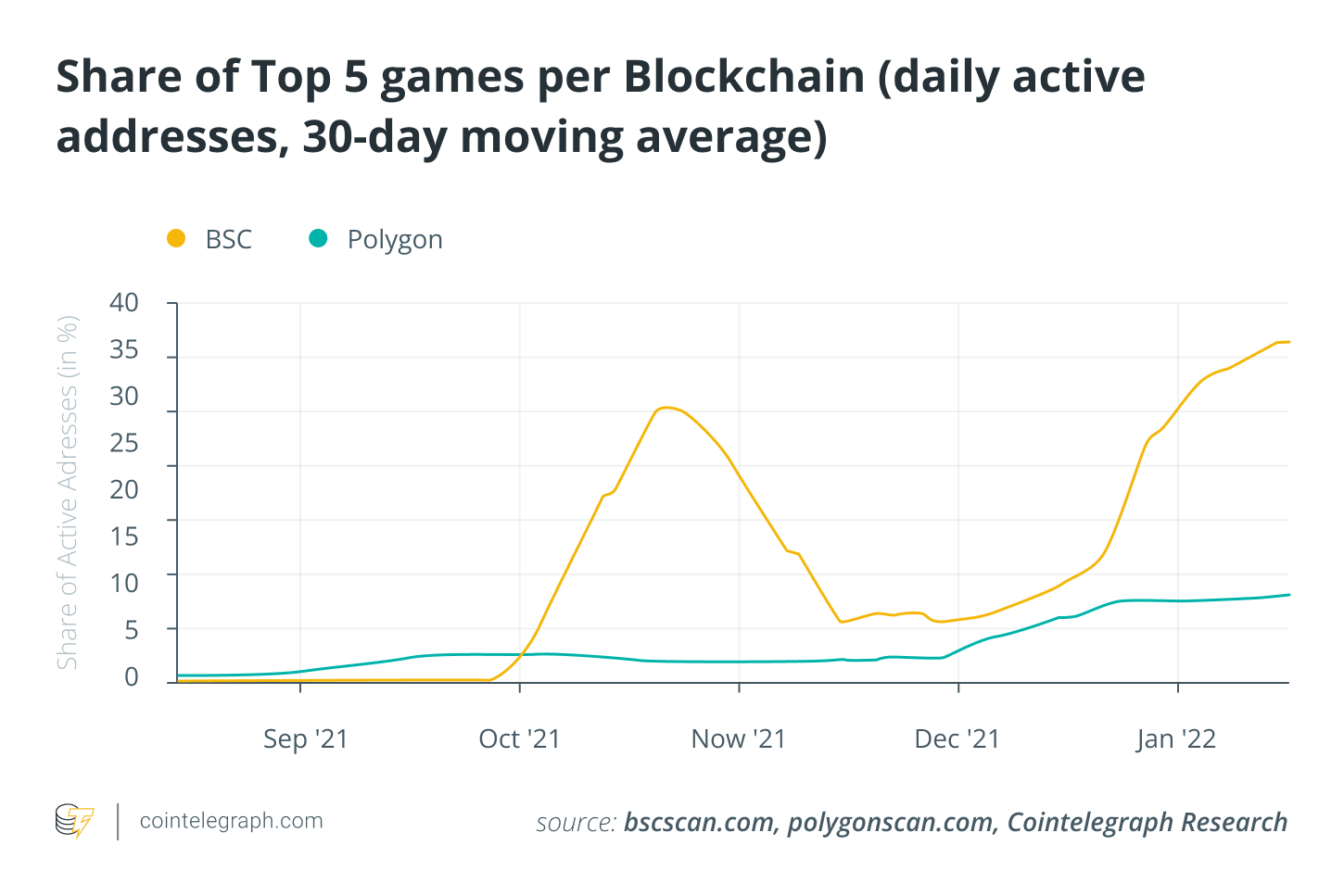

GameFi titles have been accountable for greater than 35% of all Polygon transactions throughout peaks in 2021 and early 2022. However, with out addressing the potential points, the long-term viability of the entire blockchain sport area is compromised, as critics and regulators will use these arguments to hinder growth or make it tougher for gamers to take part.

Prepare, struggle!

The report has an optimistic conclusion about the way forward for blockchain gaming and the potential unlocked by financial freedom. Decrease transaction prices, stronger property rights and open requirements all work collectively to interrupt open the deliberate economies of prior sport markets.

Blockchain expertise opens a world of latest alternatives for builders and gamers. If environmental and regulatory considerations could be addressed, 2022 would be the greatest yr for GameFi but.

This text is for data functions solely and represents neither funding recommendation nor an funding evaluation or an invite to purchase or promote monetary devices. Particularly, the doc doesn’t function an alternative choice to particular person funding or different recommendation.