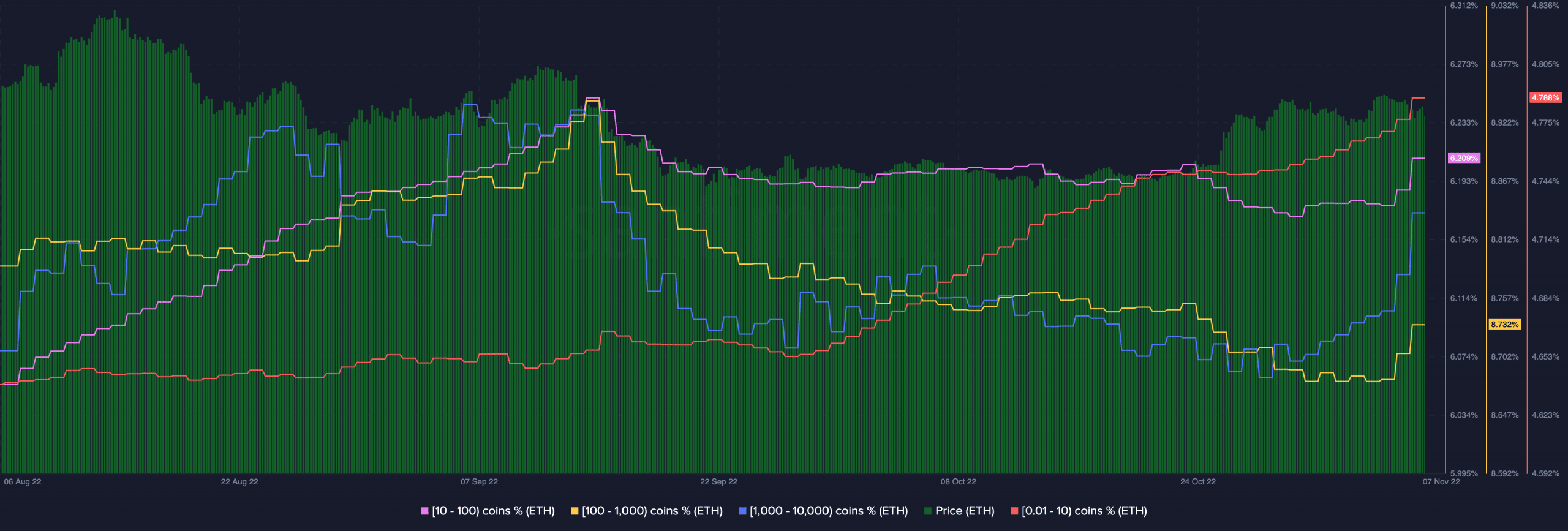

Because the finish of October, all classes of Ethereum [ETH] holders launched into a buy-the-dip spree, information from Santiment revealed. In response to the on-chain analytics platform, the main altcoin witnessed a surge in coin accumulation by small, medium, and enormous merchants since late October.

Right here’s AMBCrypto’s worth prediction for Ethereum [ETH] for 2022-2023

Aside from founders’ addresses holding over 10 million ETH cash, all different cohorts of ETH buyers elevated their proportion holdings of ETH’s complete provide.

Supply: Santiment

In response to Santiment, the expansion in dip accumulation could possibly be attributed to the final rally within the altcoins market up to now few weeks. This led buyers to take “income from altcoins” and “transfer again to blue chips.” A ensuing impression of this was that it “might most likely imply the tip of the rally (for altcoins) for a while,” Santiment famous.

Commenting on the place worth may go subsequent, Santiment took a cue from historical past books and opined,

“Traditionally talking, we’ve seen an identical sample in again September, they simply purchased the dip, and we dumped.”

What else will we see on-chain?

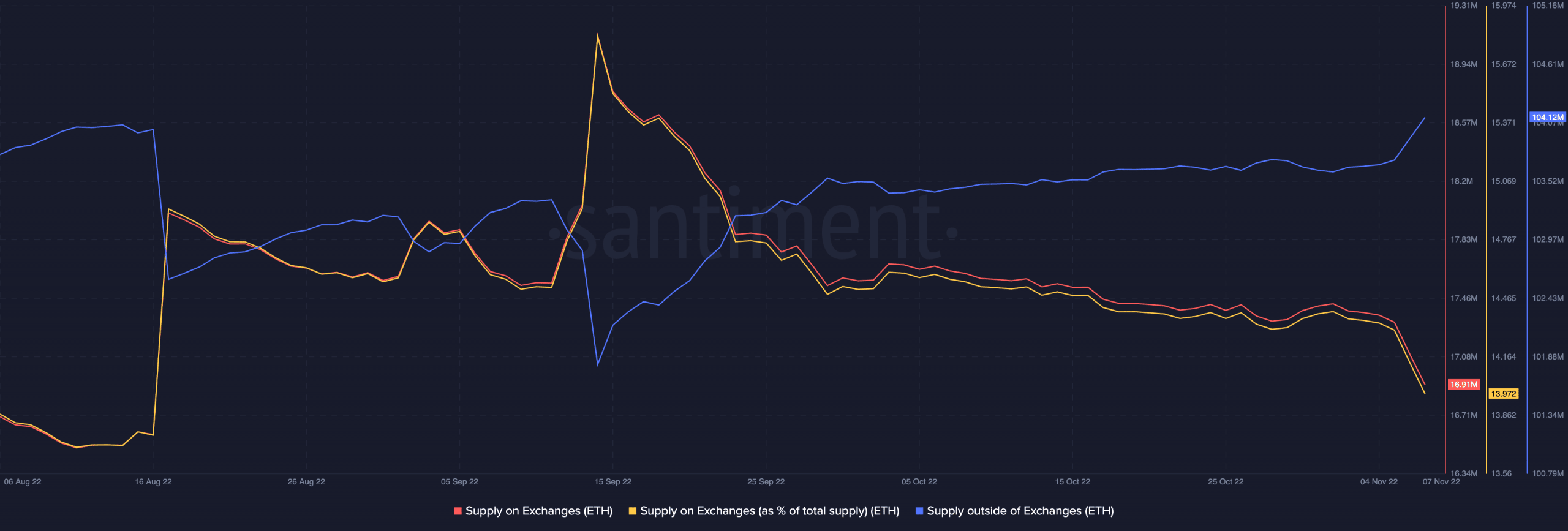

Regardless of the constant and painful decline within the alt’s worth since 15 September, on-chain information revealed that promoting stress dropped considerably. Whereas many harbored doubts concerning the success of the Ethereum Merge earlier than and after the occasion, HODLers’ conviction remained fervent as fewer ETH cash acquired despatched into exchanges because the Merge.

In response to information from Santiment, ETH’s provide on exchanges has since dropped by 12%. This revealed that the proportion of ETH’s complete provide on exchanges dropped from 15.82% to 13.97% inside the interval beneath overview.

Conversely, the alt’s provide outdoors of exchanges has since rallied. Per Santiment, because the Merge, this quantity grew by 3%.

Supply: Santiment

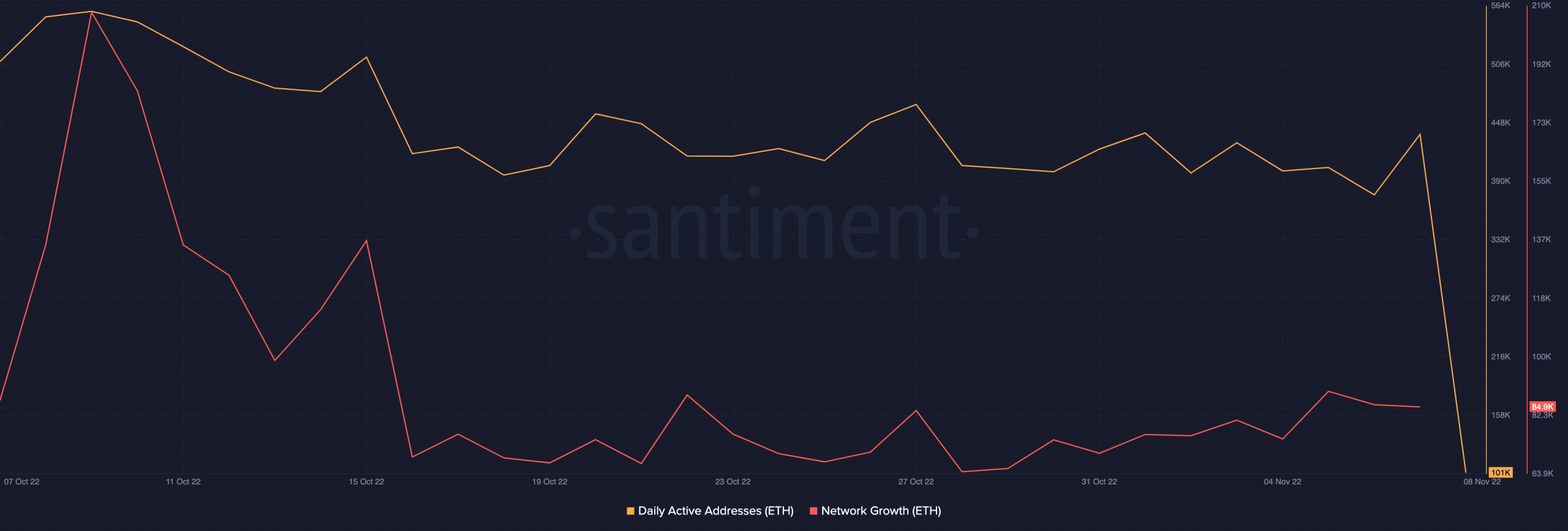

The rely of distinctive addresses that traded ETH additionally witnessed a drop in October. Per Santiment, this dropped by 80%. Notably, within the final 24 hours, this decline was unusually steep because the rely of every day energetic addresses on the ETH community fell from 436,000 to 101,000.

This coincided with an 8% decline within the alt’s worth inside the final 24 hours. In response to CoinMarketCap, buying and selling quantity was up by 55% inside the similar interval displaying that sellers ravaged the ETH market. Thus, explaining the steep decline in every day energetic addresses.

As well as, the every day rely of latest addresses on ETH community additionally dropped by 60%, information from Santiment confirmed.

Supply: Santiment

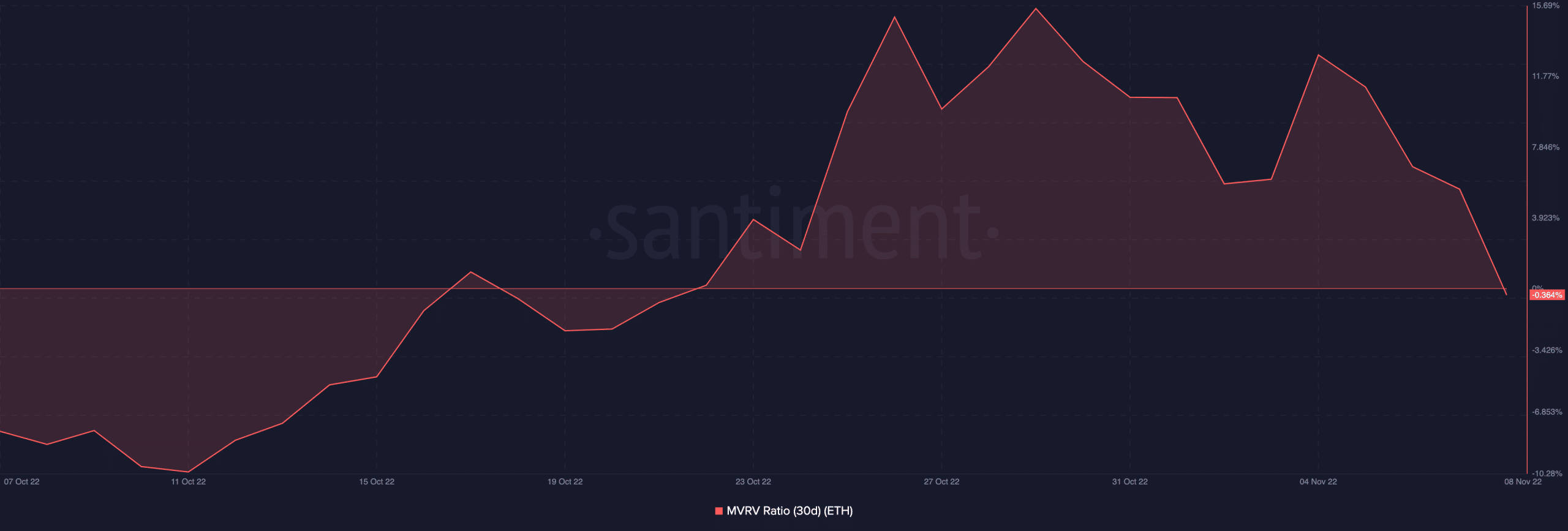

Relating to ETH’s profitability on a 30-day transferring common, most holders at present held the altcoin at a loss. Its 30-day Market Worth to Realized Worth (MVRV) ratio posted a detrimental -0.364%.

Therefore, buyers shopping for the deep must HODL for a short time longer earlier than they will flip any income on their investments.

Supply: Santiment