The crypto market has witnessed a easy rally since mid-July, with Bitcoin and Ethereum rising 29% and 72%. The upside momentum will persist for a while, however possible be short-lived as it’s a bear market rally.

Furthermore, cryptocurrencies held by high trade addresses are rising, and the market is reaching an inflection level that can determine the upcoming value momentum.

Crypto Market Might Witnessed a Brief-Time period Rally

The crypto market is having fun with an upside rally regardless of the FUD surrounding the Fed price hike and recession. U.S. Home Speaker Nancy Pelosi’s go to to Taiwan spurred some fears, but it surely’s now over. The crypto market is witnessing a market-wide rally in the present day.

In line with crypto analyst CryptoBirb, the crypto market rally can be short-lived. As of now, solely 7% of cryptocurrencies are above the 200-day shifting common, whereas 80% are above the 50-day shifting common. It signifies a bear market rally — the bear market interval throughout which costs rally.

He believes the market will rally for a while, however will possible be adopted by a correction. At present, the crypto costs are rising for many cryptocurrencies, with Bitcoin and Ethereum costs rising 3% and 6% to $23,559 and $1676, respectively.

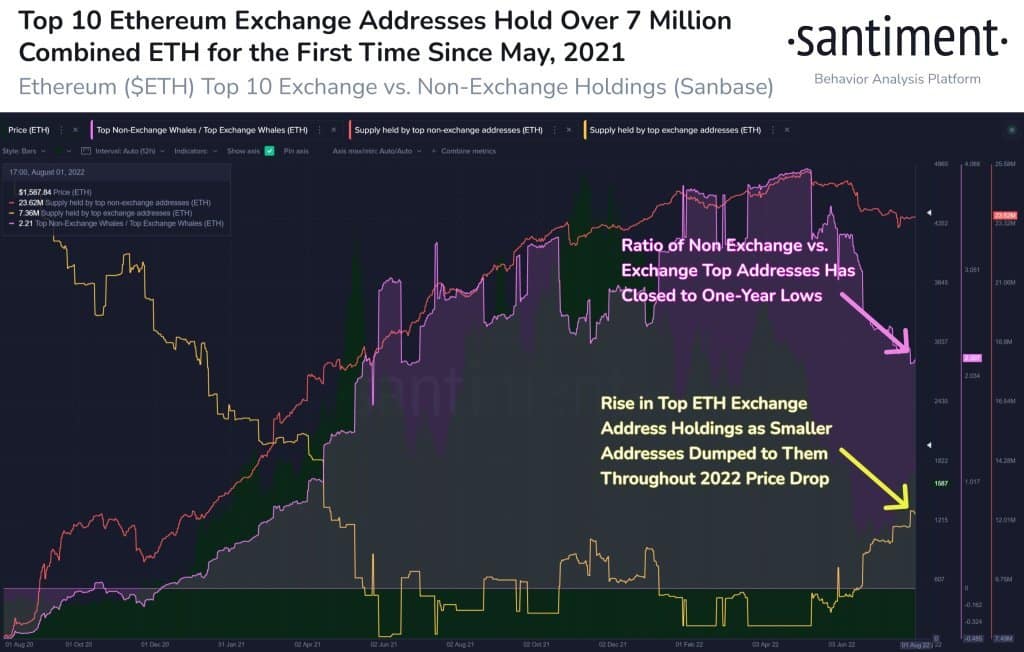

In line with the on-chain platform Santiment, the Ethereum Prime Trade vs Non-Trade Holdings knowledge reveals the Ethereum provide held by high exchanges is rising as merchants dump their holdings. For the reason that begin of 2022, merchants have dumped vital holdings to the highest exchanges.

At current, the highest 10 trade addresses maintain greater than 7 million Ethereum, for the primary time since Might 2021. A decline in high ETH trade holdings can be a bullish sign for the Ethereum value.

“Ethereum has seen its provide held by high trade addresses rise, which is smart with merchants dumping their holdings on to massive exchanges through the 2022 slide. Look ahead to a decline in high ETH trade deal with holdings as a bullish sign.”

Bitcoin (BTC) Spot vs Derivatives Led Rally

Bitcoin (BTC) has witnessed two kinds of rallies over the past 4 years — Derivatives-led and Spot-led. Through the derivatives-led rally in 2019 and early 2020 quantity is targeting derivates exchanges than spot exchanges. Spot doesn’t play a major function and the rally is short-lived and smaller value will increase.

Throughout a spot-led rally in mid-2020 and 2021, the rally is longer and the worth elevated drastically attributable to lively spot shopping for by buyers. Due to this fact, buyers should search for the “spot influx index” to find out finest investing alternatives sooner or later.

The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.