Crypto analytics agency Santiment is digging into the charts to see what brought about Bitcoin (BTC) to surge dramatically in latest days.

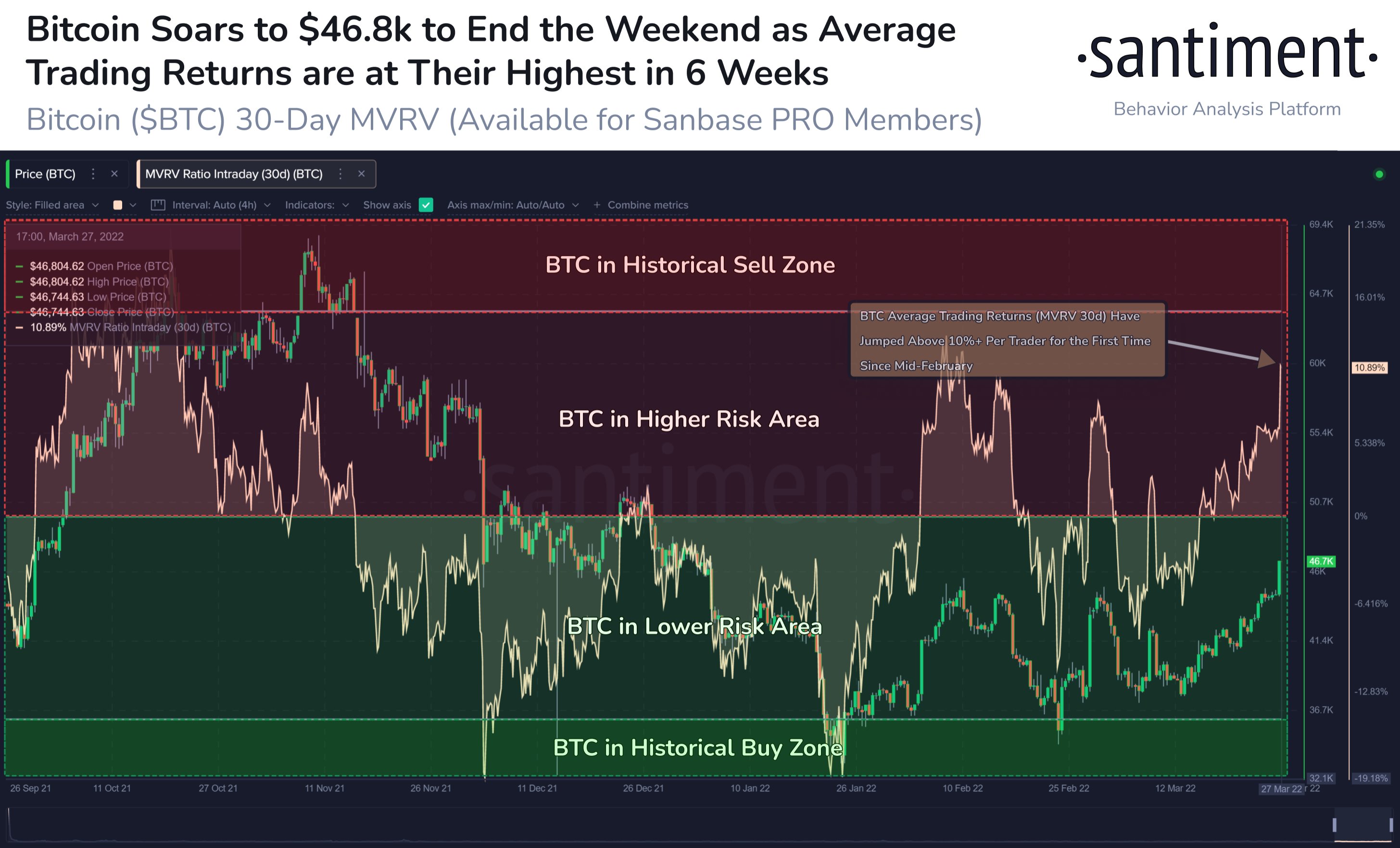

The market insights company says that the lessening considerations about macroeconomic information and geopolitical occasions are serving to Bitcoin traders obtain positive factors of greater than 10% when calculating market worth to realized worth (MVRV).

“Bitcoin has now returned all the way in which again to $46,800 for the primary time since January 4th.

The 11-week excessive comes as inflation, struggle, and Covid-19 fears have all eased considerably, giving BTC merchants a median mid-term buying and selling return of over 10%.”

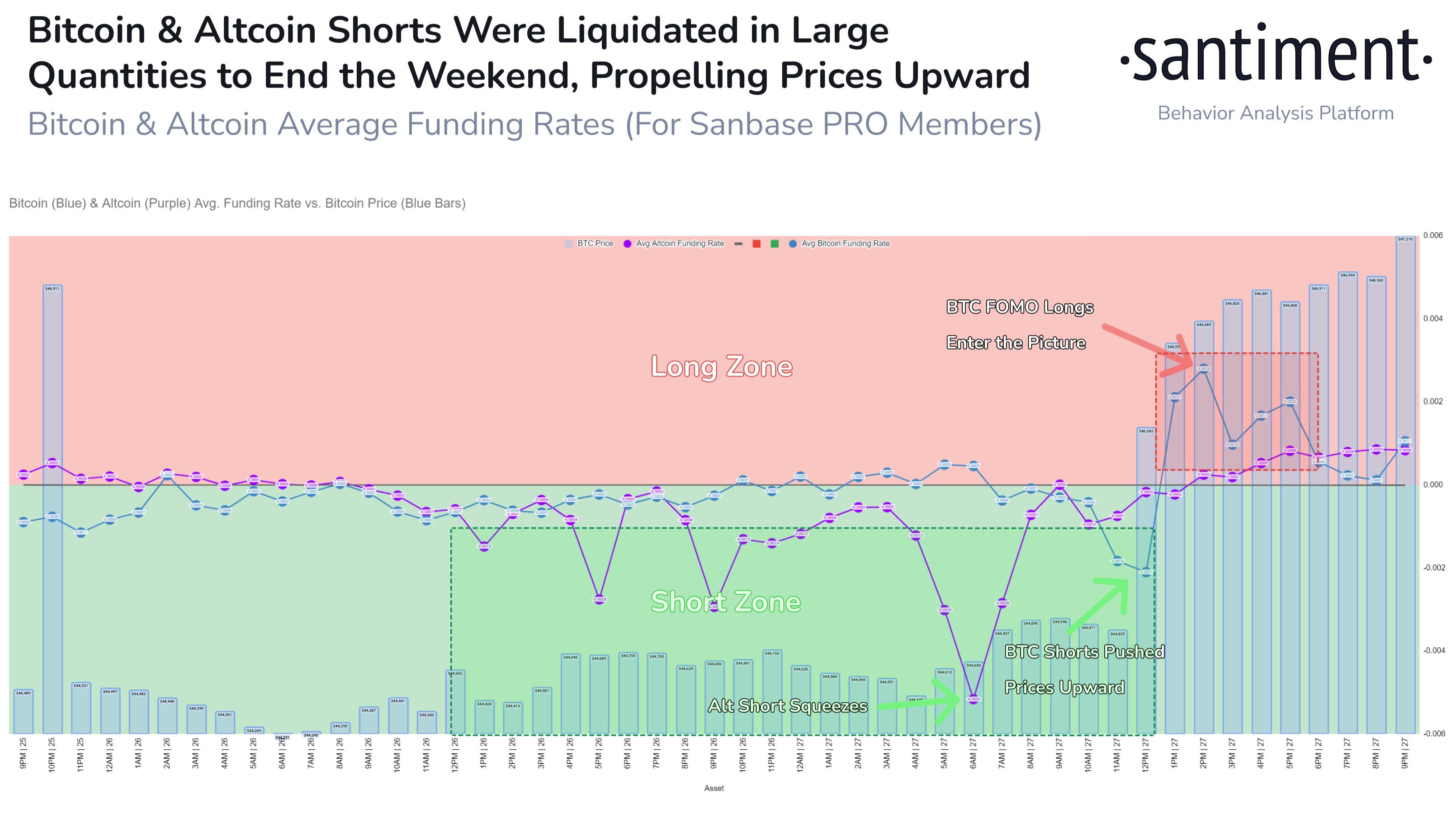

The info agency provides a three-day chart of Bitcoin whereas discussing how quick liquidations accounted for a lot of BTC’s leap to the upside.

“Bitcoin launched to $47,200, its highest worth since January third. The huge quantity of shorts that had been rising on exchanges is the first offender for this leap.

Altcoins actually noticed an enormous quick ratio at 1pm UTC, adopted by BTC at 6pm UTC, spiking all of crypto.”

Brief liquidations occur when merchants who’re betting on Bitcoin’s worth to go down are compelled to purchase BTC because the market strikes towards their bias.

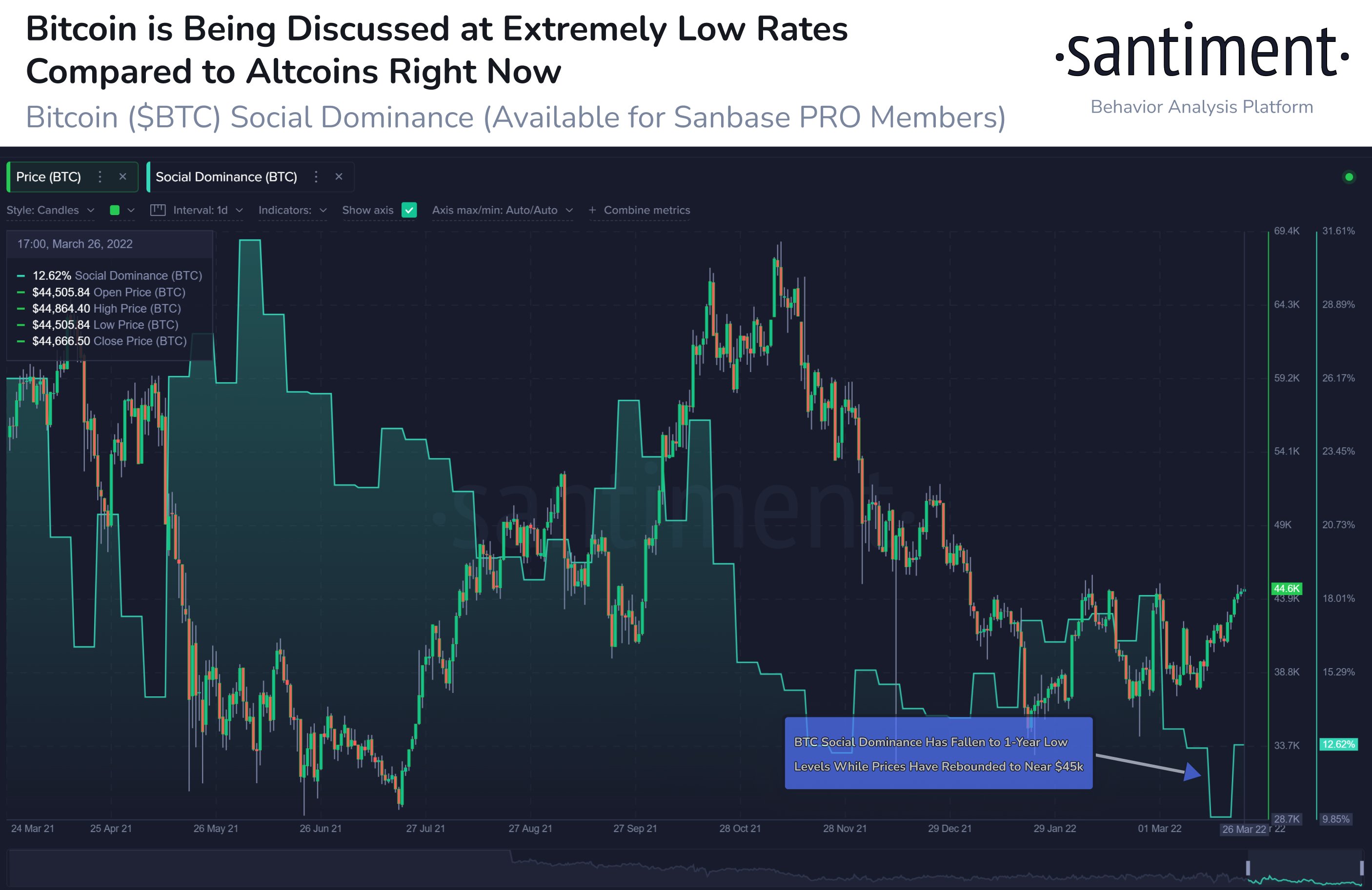

Santiment can also be looking at Bitcoin’s social dominance on the one-year timeline, the place BTC has fallen to a yearly low. Though the agency expects renewed curiosity within the main crypto asset by market cap, what stays to be seen is whether or not Bitcoin continues to rise or retraces after seeing a 25% worth enhance in latest weeks.

“The speed of dialogue towards Bitcoin in comparison with different altcoins is at one-year low ranges, as Cardano and different prime property have been getting extra of the highlight.

Search for crowd deal with BTC to return as both a bull run or capitulation happens.”

At time of writing, Bitcoin is up practically 2% and is valued at $47,221.

Regardless of crashing to under $33,000 again on January twenty fourth, BTC has now virtually fully returned to its New Yr’s Day beginning worth of $47,292.

Examine Worth Motion

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/fran_kie