The provision dynamics of Bitcoin (BTC) might want to change as a way to decouple from equities, in line with in style on-chain analyst Will Clemente.

In a brand new Blockware Intelligence E-newsletter, Clemente notes that BTC has demonstrated an “extraordinarily excessive” correlation to the Nasdaq 100 not too long ago.

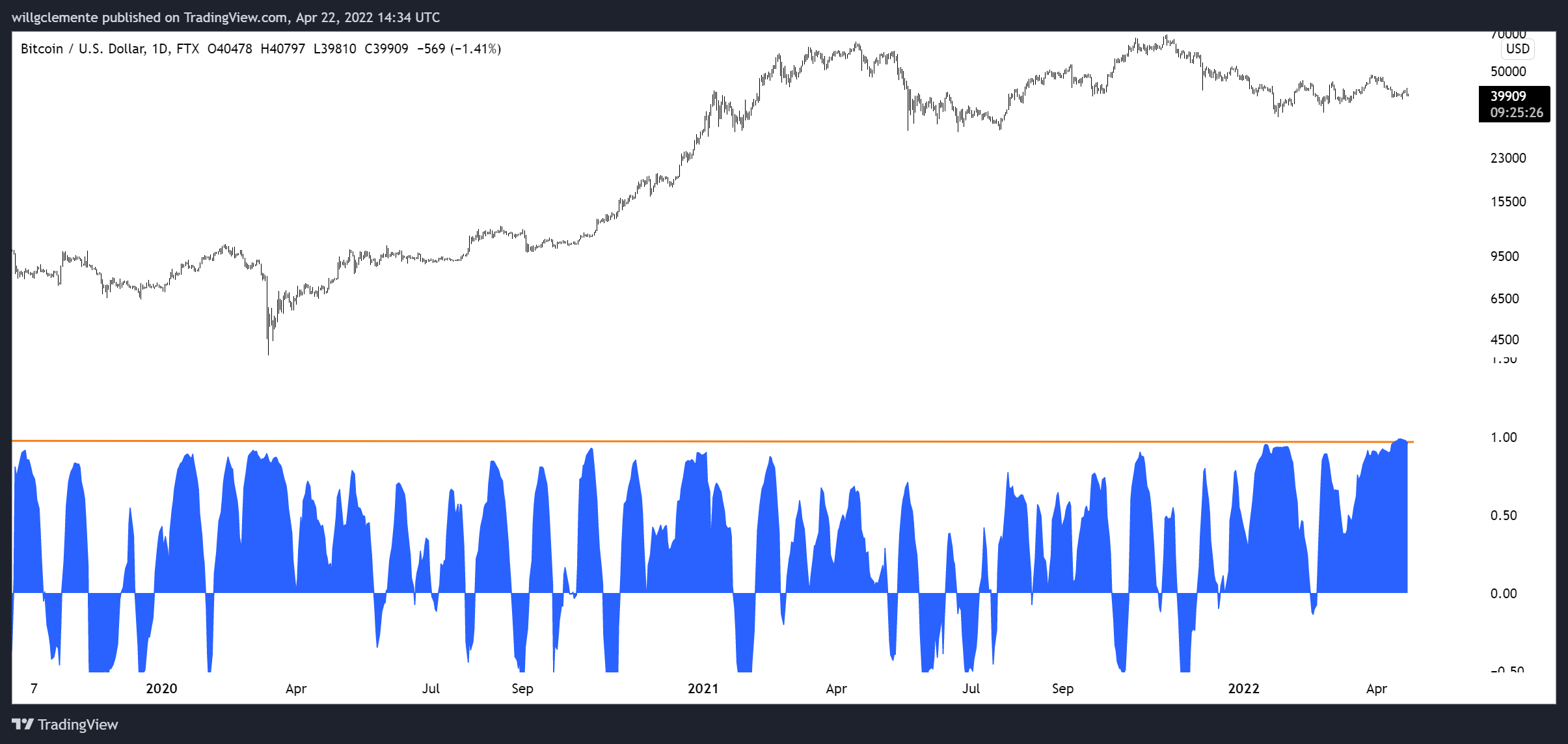

“Under you possibly can see the 1D correlation of BTC to [Nasdaq] reaching as excessive as 0.98. Whether or not Bitcoiners view BTC this manner or not, the actual fact is that the broader market has been viewing [BTC] as a excessive beta asset, basketing it in with tech.”

For Bitcoin to maneuver up in value, Clemente says it both wants tech to rebound or it must decouple from equities.

Based on the analyst, a brand new breed of patrons is accumulating BTC at present costs, which he predicts will result in the decoupling of Bitcoin and the inventory market.

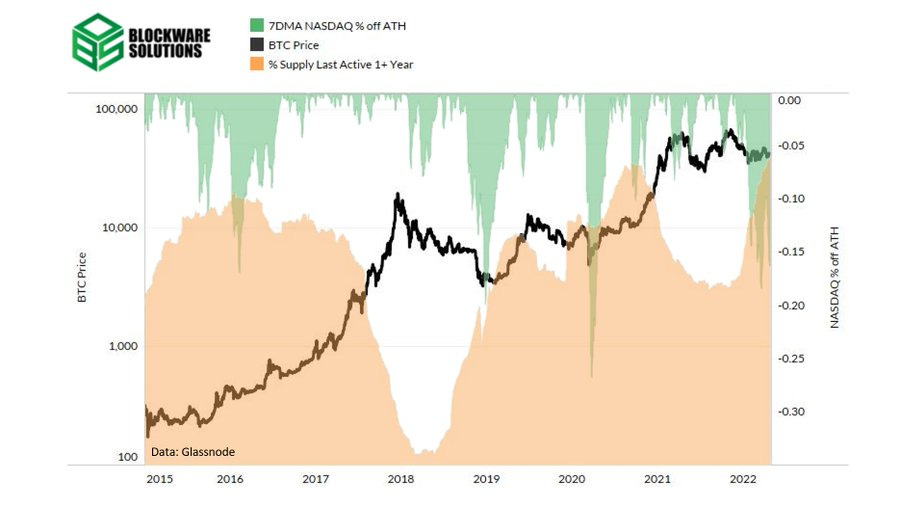

As proof, Clemente compares a chart displaying the share of Bitcoin that hasn’t moved in a yr with a chart monitoring how far the Nasdaq is off its all-time excessive.

“What we see is that, regardless of the Nasdaq being down about 20%, an all-time excessive ~64% of Bitcoin’s circulating provide has not moved. To me, this illustrates the actual fact that there’s a convicted base of long-term Bitcoin believers/HODLers on the market using BTC as a retailer of worth regardless of unprecedented uncertainty in world markets.”

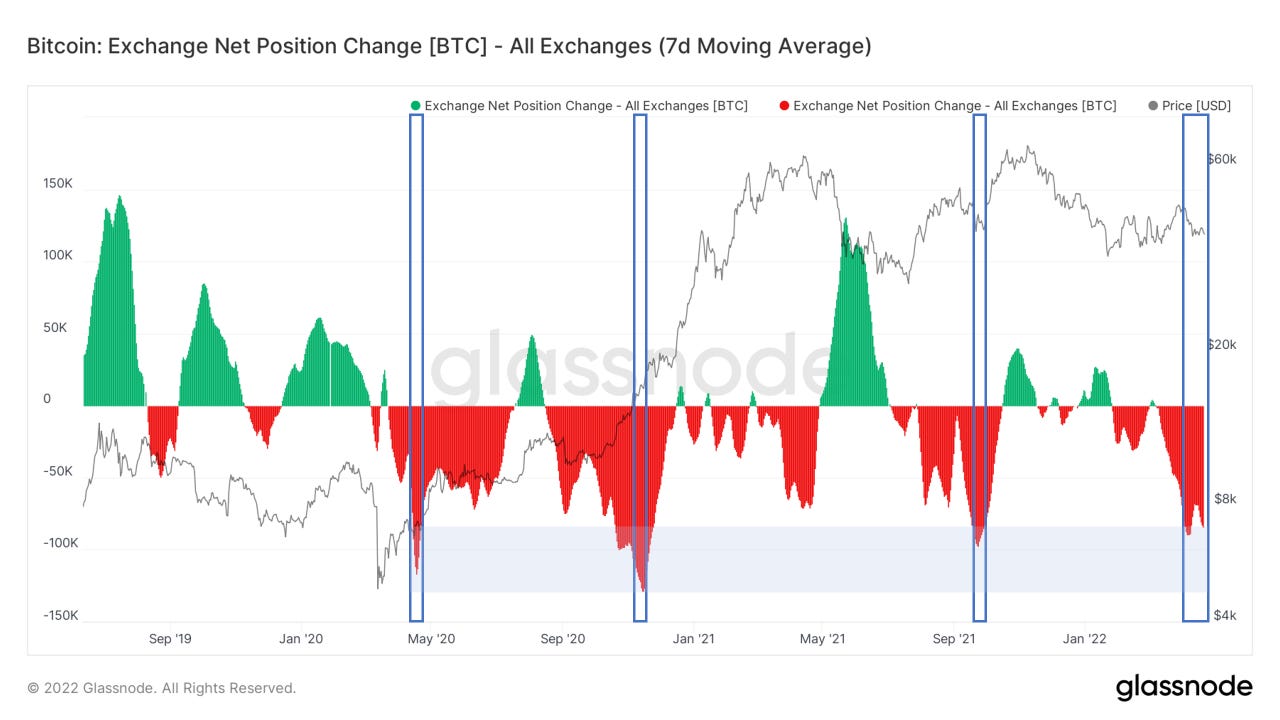

Clemente additionally notes that Bitcoin trade outflows are surging. Moreover, whales have been accumulating BTC for a month, in line with the analyst.

“I believe the story of this bear market is the switch of provide from correlation buying and selling conventional finance entities to long-term convicted crypto natives, [high-net-worth] people, and forward-looking establishments. As soon as this provide switch is full, I think we will see a chronic multi-week decorrelation at a minimal.”

Bitcoin is buying and selling at $38,343.77 at time of writing, down 5.57% previously 24 hours.

Test Worth Motion

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in online marketing.

Featured Picture: Shuttersock/Vadim Sadovski