Disclaimer: The findings of the next evaluation are the only real opinions of the author and shouldn’t be thought of funding recommendation

- Monero (XMR) was bearish on the each day chart

- The elevated optimistic sentiment over the weekend has flattened out

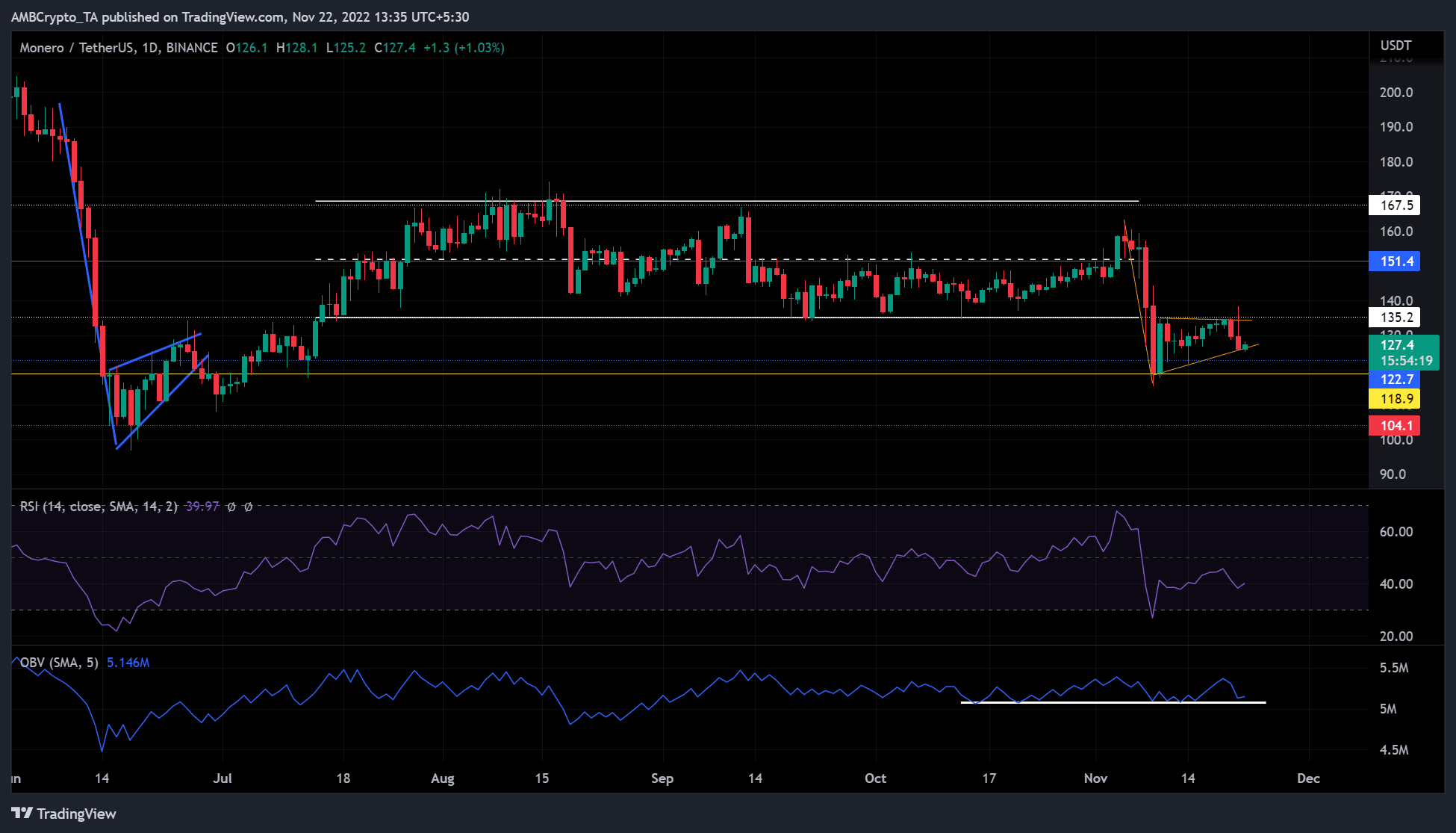

Monero (XMR) bulls have been minimize to measurement over the weekend as bears threw a large get together. This was evidenced by the bearish engulfing sample (A tiny inexperienced candle adopted by a bigger pink candle) on the charts. It signifies that the bears will decrease the costs quickly.

Learn Monero’s [XMR] Worth Prediction 2023-24

The bulls tried to regain management on Monday, pushing XMR’s value above $135.2. Nonetheless, the bears furiously neutralized their efforts and pushed the worth decrease, as proven by the Taking pictures Star (pink candlestick with an extended tail).

The current value motion has shaped a bearish pennant sample. Ought to a bearish breakout happen, XMR might see a deep plunge in the direction of $104.1.

XMR falls under its 3-month buying and selling vary

Supply: XMR/USDT, TradingView

After a false bearish breakout from a bearish pennant sample in June, XMR posted a rally resulting in the ATH of $174.2 in August. Since mid-July, XMR has been confined to a spread of $135.2 to $167.5, with $154.1 because the midpoint.

On 9 November, XMR fell under this vary and shifted to a bearish market construction. The Relative Energy Index (RSI) was at 39, under the impartial degree of fifty and the On Stability Quantity (OBV) has been regular for a couple of month. These indicators, thus, help the bearish market construction.

Subsequently, a breakout to the draw back might transpire, dropping the altcoin to $104.1 in the long run.

Nonetheless, the bearish pennant is just like the road shaped in June (blue strains). So, if historical past repeats itself, XMR might see a false bearish breakout earlier than rallying to the mid-range at $151.4 in the long run. This is able to invalidate the bearish bias.

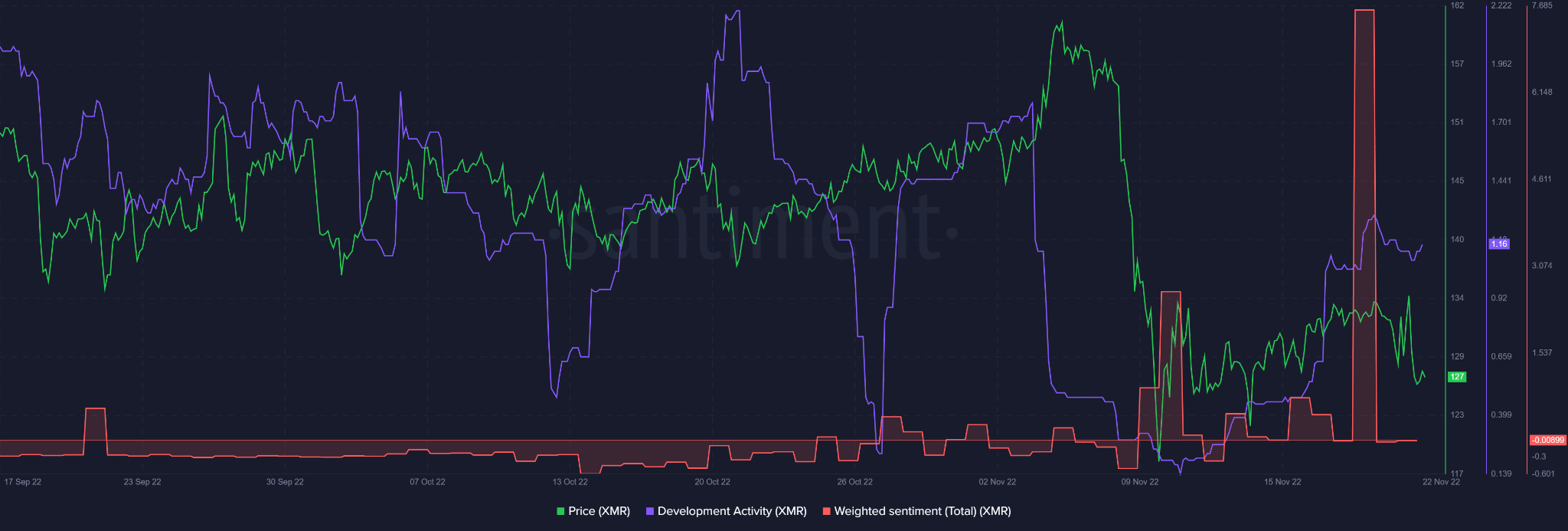

Impartial sentiment might undermine upside value motion as improvement exercise rebounds

Supply: Santiment

In keeping with Santiment, the elevated weighted optimistic sentiment seen over the weekend has levelled off. The elevated sentiment corresponded with a rise in improvement exercise on the Monero community.

A decline in improvement exercise was later mirrored in a discount in optimistic sentiment. There was a slight enhance in improvement exercise at press time, regardless of the impartial sentiment. Apparently, there was additionally a slight enhance in value motion.

Lengthy-term traders ought to subsequently monitor the community’s improvement exercise to evaluate its viability and skill to draw different long-term gamers.