Macro strategist Lyn Alden believes that Terra’s (LUNA) latest Bitcoin shopping for spree could possibly be the catalyst that triggers a capitulation occasion for BTC and the remainder of the crypto markets.

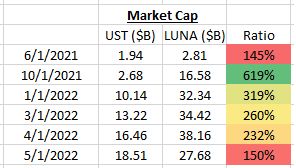

Over the previous couple of months, the Luna Basis Guard (LFG), the non-profit group constructed to help Terra, has been aggressively accumulating BTC to the tune of $1.63 billion.

In accordance with Terra founder Do Kwon, the huge Bitcoin buys are designed to again Terra’s native dollar-pegged stablecoin TerraUSD (UST).

Now, the macro strategist tells their 410,700 Twitter followers {that a} sharp decline in LUNA’s valuation would possibly power the LFG to faucet into its Bitcoin reserves to maintain UST secure.

“If Luna has an analogous worth decline to Fantom (FTM) or a few of these different hard-hit cryptos, the UST peg can be in danger. If the UST peg turns into in danger, the LFG can be promoting Bitcoin reserves into an already comfortable market. That sort of occasion may mark a cycle capitulation.”

Alden additionally points out one other danger the place bearish market circumstances power UST holders to convert the stablecoin into LUNA or BTC in an effort to money out.

“Not like a crypto-collateralized stablecoin, there isn’t any particular threshold the place UST breaks. Nonetheless, if LUNA will get small relative to UST, the chance of an algorithmic financial institution run will increase… A lot of them would liquidate their BTC for money since their positioning on the time was meant to be a stablecoin.”

The macro analyst additionally highlights one other danger involving the Anchor Protocol (ANC), a financial savings and lending borrowing platform constructed on the Terra blockchain that enables customers to earn as a lot as 19.5% in annual proportion yield (APY).

In accordance with Alden, Anchor Protocol’s excessive APY is a double-edged sword because it serves as each a requirement creator for UST and a ticking time bomb that might go off.

“Then there’s the unsustainable Anchor yield timebomb. The time bomb isn’t about how well-managed the yield decline might be. It’s about what occurs to UST demand structurally, when the first demand driver (artificially excessive Anchor yields) now not exists.”

Test Worth Motion

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses it’s possible you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/jamesteohart