Glassnode has identified a weird consistency between the present and former Bitcoin cycles when it comes to a metric, right here’s what.

Bitcoin Breaks Above 200-Day Easy Shifting Common Line

A “easy transferring common” (SMA) is an analytical device that produces a median of any given amount over a selected time period. As its title already implies, it strikes together with the amount and modifications its worth accordingly.

SMAs might be fairly helpful for finding out long-term traits, as they clean out the curve and filter out any short-term fluctuations within the related amount that haven’t any bearing on the longer traits in any case. As is often the case with instruments like these, an SMA might be taken for any size of time, however a couple of durations like 7 days and 30 days typically discover essentially the most use.

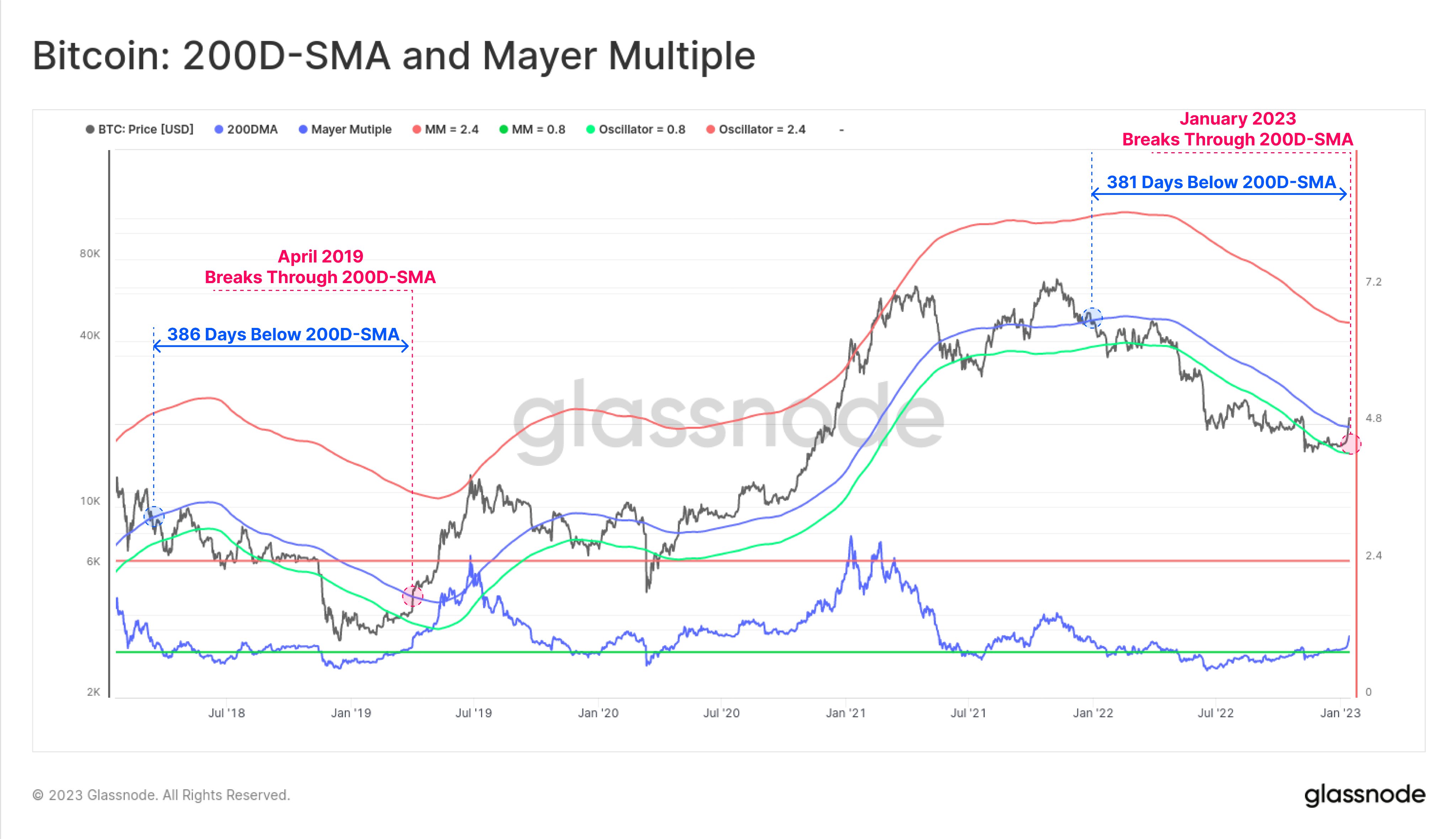

In line with information from the on-chain analytics agency Glassnode, BTC has spent 381 days underneath its 200-day SMA curve on this cycle. The 200-day SMA is a vital line for BTC as each the bear-to-bull and vice versa transitions have traditionally taken place with breaks above or under this stage.

Here’s a chart that exhibits the pattern within the 200-day SMA for Bitcoin over the previous couple of years:

The worth of the crypto appears to have damaged above the 200-day SMA in latest days | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin value had dipped under the 200-day SMA across the begin of the bear market and had stayed there till very lately. In complete, the crypto had spent 381 days under this stage, earlier than the newest rally got here alongside and helped the coin lastly escape above this line.

Within the chart, Glassnode has additionally highlighted the pattern for the metric throughout the earlier bear market. It seems to be like in that cycle as effectively, the crypto’s value had declined under the 200-day SMA because the bear started to take maintain. Additionally, the eventual break above the extent results in the tip of the bear marketplace for the coin again then.

Nevertheless, essentially the most fascinating of all is the period that Bitcoin stayed under this stage in that cycle: 386 days. Amazingly, that is very almost the identical variety of days (381) that BTC took to interrupt above the road within the present cycle.

If this weird consistency is something to go by, then the newest push above the 200-day SMA may imply the present bear market is likely to be executed as effectively.

The chart additionally exhibits information for an indicator referred to as the “Mayer A number of” (MM) which gauges the present distance between the worth of Bitcoin and the 200-day SMA. Its worth is just calculated by dividing the worth of the crypto by the 200-day SMA. Bottoms within the crypto have often taken place under the 0.8 MM stage, which BTC is now firmly above.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $20,800, up 21% within the final week.

BTC consolidates slightly below $21,000 | Supply: BTCUSD On TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Glassnode.com