- FTX customers might get half of their deposits again

- They may should be affected person as a result of chapter proceedings can take too lengthy to finish

Sam Bankman-Fried (SBF) formally filed for Chapter 11 chapter for FTX, FTX US, and Alameda Analysis on Friday, 11 November 2022. In response to stories, FTX collectors might attain a million. Including FTX customers, or about a million, that whole quantity raises doubts about whether or not everybody might be coated and compensated.

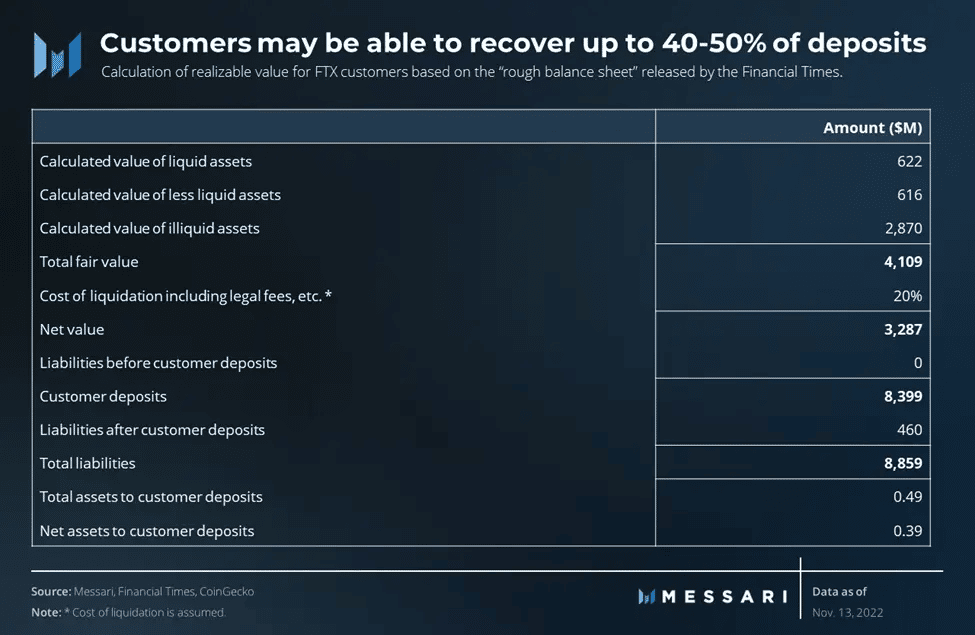

In response to Messari, FTX customers can shortly recuperate 40-50% of their deposits if they’re sorted out first. Utilizing a preliminary FTX steadiness sheet printed by the Monetary Instances, Messari famous that FTX clients’ deposits whole $8.4 billion.

In comparison with the $4 billion in realizable FTX property, promoting these property, which embody stablecoins and BTC holdings, can assist clients recuperate about 50% of their deposits.

Supply: Messari

The above evaluation by Messari makes three assumptions to succeed in its conclusion. It assumes that some FTX-linked property, akin to serum (SRM) and FTT, will probably be zero. It additionally assumes that FTX customers (“clients”) will probably be paid first and that the preliminary steadiness sheet used is error-free.

The primary assumption that FTT and SRM will probably be zero is believable, given the present FUD. Though we can not substantiate the integrity of the preliminary steadiness sheet, FTX customers will definitely not be paid out first.

Chapter proceedings might complicate issues for FTX customers

Any financially distressed firm can select the kind of chapter process that fits its wants. FTX has opted for the Chapter 11 process.

The chosen process offers excessive precedence to secured collectors. In second place are unsecured collectors, i.e., people or corporations that mortgage cash with out acquiring collateral for his or her line of credit score. Lastly, the shareholders can obtain their claims as soon as the primary two collectors have been happy.

These rely upon the chapter courtroom and the way it categorizes every group. For comparability, Voyager account holders have been categorized as “general unsecured creditors.” This implies they’ll solely be served as soon as the higher-priority collectors are sorted.

Celsius and FTX customers might fall into the identical class below the Chapter 11 chapter course of. Subsequently, it’s probably that FTX customers would be the final, if not the second, to be included within the claims course of.

As well as, chapter proceedings take a very long time to finish. For instance, the chapter proceedings of Mt. Gox, a former Bitcoin trade based mostly in Japan, are ongoing and had been began in 2014. It was in October 2022, eight years later, that the courtroom started paying out claims.

As well as, the blocked property of customers are valued otherwise over time. Customers can solely get what they’re given when the day of reckoning comes. In brief, the present worth of realizable property, which Messari’s evaluation suggests might cowl buyer deposits, might fall or rise over time.

FTX’s chapter submitting offers collectors, buyers, and customers of the FTX platform an opportunity to recuperate their investments and crypto property. However the course of will not be simple and will take longer.

If something, Voyager’s chapter provided crypto buyers an unforgettable chapter regulation 101. Typically, you may be the final in line for compensation with none ensures. That’s why you will need to do not forget that “not your keys, not your crypto.”