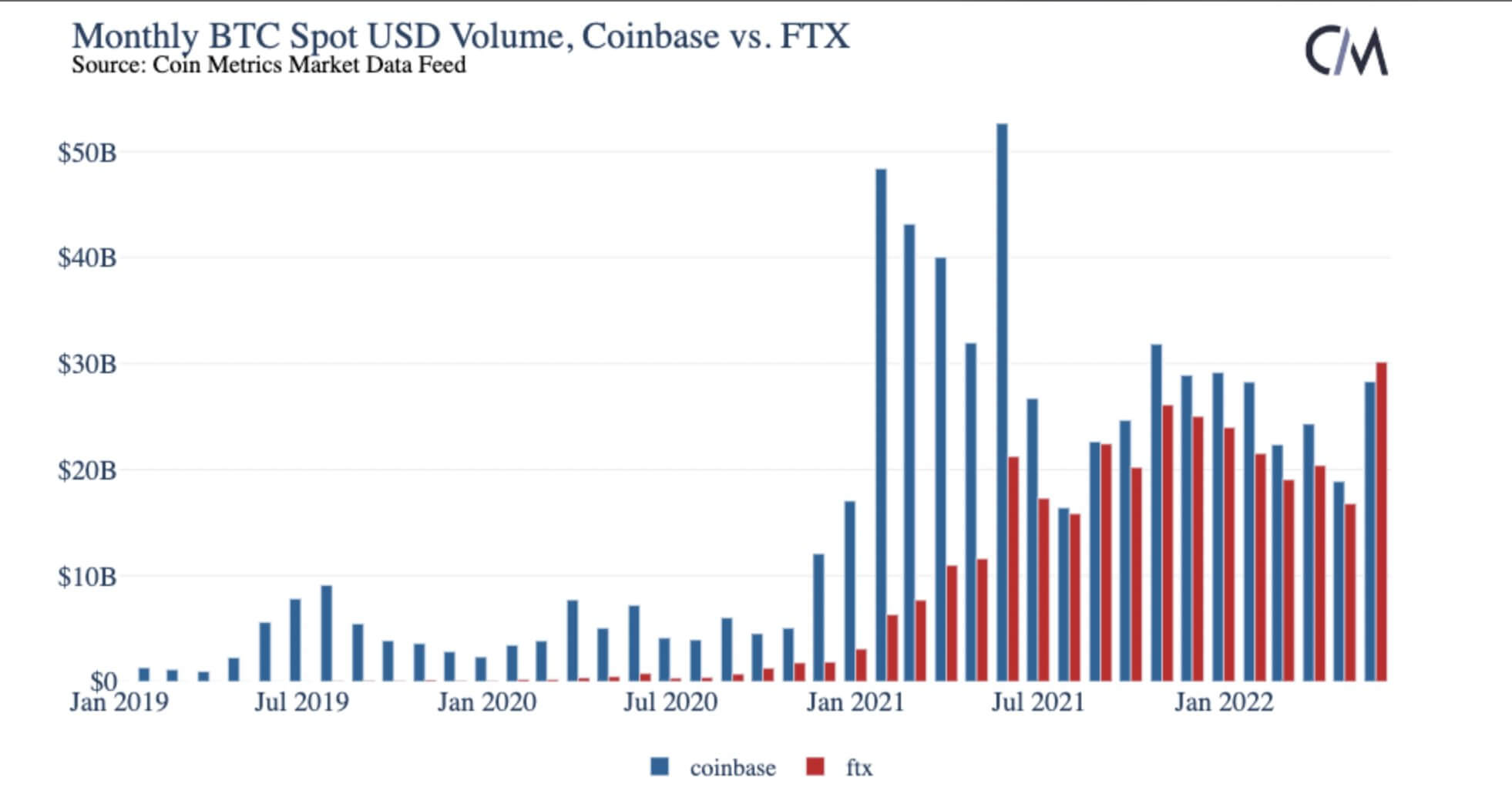

The spot Bitcoin buying and selling quantity on FTX has surpassed Coinbase for the primary time, hitting $30 billion in a single month.

Tushar Jain, Co-Founding father of Multicoin Capital (homeowners of FTX), shared the under chart highlighting the second FTX handed Coinbase in buying and selling quantity.

Coinbase struggling

Coinbase is having a tough time in 2022 as they not too long ago introduced they might be stopping new hires and rescinding job presents to new starters. The corporate has additionally seen its share worth drop from highs of $342 per share down to simply $69, a decline of 79%.

Modifications to its phrases and situations additionally sparked issues because the wording round potential ‘chapter‘ was up to date in Might. Even with the announcement of recent choices similar to its NFT market, Coinbase struggles to take care of momentum throughout this bear market.

FTX thriving

FTX is now the second-largest centralized trade by buying and selling quantity, in line with Coinmarketcap. Binance nonetheless tops the chart with a large $17 billion per day, however FTX now trades over $2 billion per day in second place.

Additional, the FTX token, FTT, is in fourth place amongst centralized trade tokens in line with the chart in CyptoSlate’s asset listing. The FTT token is up 5% weekly, with solely Bitfinex’s LEO outperforming it at place 2 with an 8% achieve within the final seven days.

Apparently, a volume monitoring instrument on the FTX web site means that OKX has the second-highest spot quantity at $5 billion per day. Nevertheless, Coin Gecko lists FTX within the quantity two spot amongst exchanges with a ten/10 belief rating. Different exchanges similar to WhiteBIT, LBank, and XT.com report increased spot buying and selling volumes, however these exchanges at present have a 9/10 belief rating by Coin Gecko. It’s unknown why FTX says OKX buying and selling quantity is a lot increased than different sources.

FTX IPO

FTX elevated has greater than doubled its userbase throughout the closing quarter of 2021, in line with a tweet by its president. Conversely, Coinbase reported a $430 million loss amid a decline in utilization.

The US trade, FTX, has yet to go public with an IPO because the board fears launching right into a bear market. The corporate was valued at round $32 billion at the beginning of the 12 months, so a future IPO may begin at a good increased valuation, given its latest success.