Seems to be like Deutsche Telekom’s (DTEGY) loss is Finoa’s achieve.

Six months after departing the European telecoms big, Andreas Dittrich and Daniel Schrader – two of Deutsche Telekom’s former blockchain staff – have helped create a unit at cryptocurrency custody supplier Finoa for constructing infrastructure to help proof-of-stake (PoS) networks.

Finoa, regulated by Germany’s BaFin, will work with PoS specialist StakeWise, the businesses introduced Monday. The brand new Finoa Consensus Companies subsidiary will supply liquid staking.

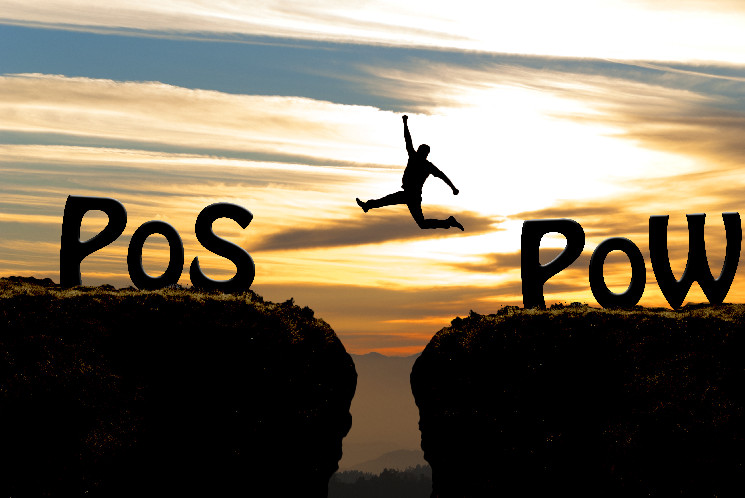

As Ethereum, the second-largest public blockchain, makes its transition from proof-of-work (PoW) mining to PoS, individuals operating transaction validator nodes are required to lock up ether (ETH) tokens on the community, for which staking yield will be earned over time. Providing individuals a option to have their cake and eat it, liquid staking platforms present customers with IOU tokens representing property certain to a community for staking and validation functions, unlocking the power to make use of these liquid tokens in decentralized finance (DeFi) protocols, for example.

Finoa has supplied in-custody staking for a number of years. It’ll run validators on the Ethereum community and turn out to be a StakeWise operator for each Gnosis and Ethereum, defined Dittrich, managing director of the brand new division.

“In our opinion, liquid staking can be on each single PoS community on the market inside a yr or two,” Dittrich mentioned in an interview. “Proper now, this could be a brand new factor, however it will likely be considerable and really regular sooner or later. You possibly can’t do with out liquid staking.”

There’s a well-trodden path that leads innovators away from bureaucratic enterprises to nimble startups, a gradual stream that flows from banks and blue-chip firms to crypto native companies.

“It was nice working for Deutsche Telekom, with this superior energy behind you and with the ability to steer it from time to time,” Dittrich mentioned. “However actually, the velocity at which you’ll be able to transfer stuff in an organization like Finoa is gigantic and it’s absolutely crypto native. One thing that had all the time been fairly exhausting at Deutsche Telekom was having to persuade individuals, ‘can we need to do this blockchain factor?’”

Nonetheless, the current collapse of the Terra UST stablecoin and its associated LUNA, would possibly affect regulators’ and the general public’s perceptions of complicated mechanisms used to earn yield from subsequent technology blockchains.

“We anticipate regulation will come to this house. Perhaps the pure infrastructure a part of staking would possibly stay like a technical or IT service. However if you’re speaking liquid staking that’s fairly near changing into a monetary service. We should be prepared for our institutional purchasers who need to actively help proof of stake networks but in addition need to do extra with their property. So we’re getting ready the crypto house for future regulation.”