Blockchain

Ethereum could also be far youthful than the standard funds giants, comparable to Visa, however it has proven (but once more) that blockchain, in a single decade, developed right into a drive to be reckoned with.

As a fee know-how, blockchain has grown as a lot as to rival established gamers. Latest knowledge from Coingraph has proven that Ethereum, for instance, processed $3.01 trillion in transactions, versus Visa, which processed $3.08 trillion.

It’s a testomony to the expansion in mainstream adoption of the nascent know-how, which is commonly perceived – typically practically completely – as a vessel for scammers, drug sellers, and cybercriminals.

Ethereum is the second-largest community: its present market capitalization, in keeping with CoinGecko, is $227.8 billion, in comparison with the 1st-placed Bitcoin’s $538.96 billion and the Third-placed Tether’s $82.8 billion.

Notably, because the world’s second-biggest blockchain, Ethereum powers quite a few monetary know-how options that want to disrupt the worldwide, conventional finance market. These options embrace decentralized finance (DeFI), staking, lending, and flash loans, amongst many others.

It has grown to change into a wealthy and versatile atmosphere, with loads of room for additional improvement – which is one other benefit it has over conventional monetary layers.

Final 12 months, it was reported that Ethereum processed 4.5 occasions extra transactions than Visa in 2021.

Additionally, a report by Ethereum Basis‘s Josh Stark claimed that Ethereum surpassed Visa in buying and selling quantity in 2021. “Ethereum moved roughly $11.6 trillion USD. That’s greater than Visa [$10.4 trillion], and greater than double Bitcoin,” the report stated.

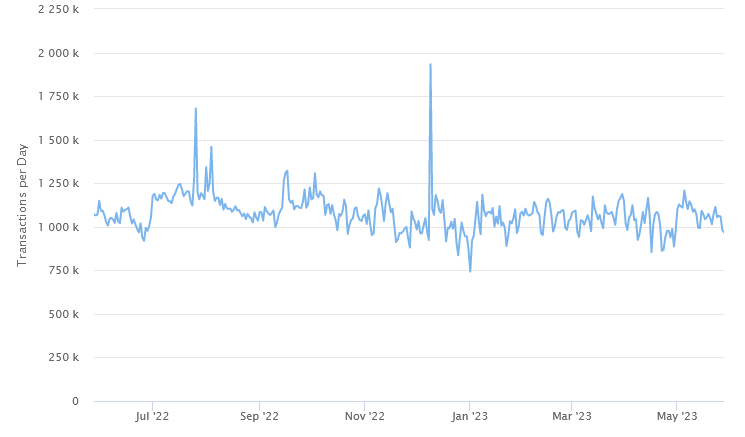

Trying on the newest Ethereum every day transactions, etherscan reveals 968,996 on Could 28, with the all-time excessive being 1,932,711 transactions on December 9, 2022.

Ethereum 1-year every day transactions chart:

Supply: etherscan.io

Ethereum Already Entered TradFi

The favored blockchain is already the community of selection for a lot of established gamers seeking to make the most of the novel know-how – and amongst them, Visa.

Moreover simply writing about Ethereum’s economics, as reported in mid-Could, Visa used Ethereum’s Goerli testnet to check out transaction-free funds with the assistance of account abstraction.

It used a wise contract known as Paymaster, permitting the corporate to benefit from account abstraction to carry out complicated duties on behalf of accounts and handle transaction prices.

“Excited to see Visa deploy our first paymaster sensible contract on testnet as we proceed to analysis and experiment with account abstraction and ERC-4337,” Cuy Sheffield, Head of Crypto at Visa, stated on the time.

ERC-4337 is an Ethereum normal that achieves account abstraction and not using a consensus-layer change, permitting customers to bundle and automate transactions on the community.

“ERC-4337 lays down fascinating future potentialities for enhancing on-chain consumer funds expertise by means of a self-custodial sensible contract pockets, which may in flip remodel the best way customers interact with digital currencies and digital belongings,” Visa stated.

Visa first launched a proposal that may enable Ethereum customers to make automated programmable funds with out the involvement of any third celebration in December final 12 months.

The corporate additionally reiterated its dedication to crypto in March this 12 months, refuting studies that it deliberate to pause its crypto push attributable to unsure market circumstances.

“We proceed to accomplice with crypto corporations to enhance fiat on and off ramps in addition to progress on our product roadmap to construct new merchandise that may facilitate stablecoin funds in a safe, compliant, and handy means,” Sheffield stated.

He added that the earlier crypto meltdown didn’t change their view of digital belongings and that “[now] is the time to construct!”

On the time of writing (Monday midday UTC), ETH was buying and selling at $1,898, up 3% in a day and 4.5% in every week.

ETH 7-day worth chart:

Supply: coingecko.com