The crypto market has returned to the inexperienced with Ethereum (ETH) main the restoration. The second crypto by market cap has seen bullish momentum on the again of a possible full transition to a Proof-of-Stake (PoS) consensus. The date for this occasion was introduced two days in the past.

Associated Studying | TA: Ethereum Outpaces Bitcoin, Why ETH May Rise To $1,500

This course of can be accomplished with “The Merge”, an occasion set for September 19, 2022, with the target of mixing Ethereum’s execution layer with its consensus layer. ETH core builders have efficiently carried out this course of on the community’s important testnet.

As uncertainty round “The Merge” mitigates, crypto traders, develop more and more bullish. On the time of writing, Ethereum (ETH) trades at $1,480 with a ten% revenue within the final 24 hours and a 27% revenue previously week.

Within the crypto prime 10 by market cap, solely ETH’s value data such a rise. Bitcoin data a 7% revenue previously week, whereas XRP and Solana report a 12% and 15% revenue over the identical interval.

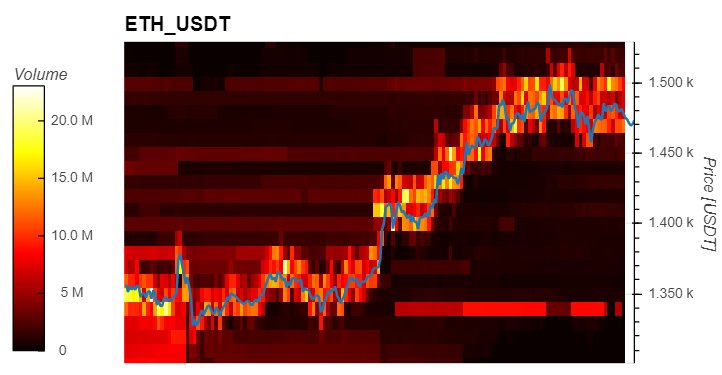

Information from Materials Indicators exhibits liquidity for the ETH/USDT buying and selling pair has been trending upwards with the value of the cryptocurrency. When ETH’s value broke above $1,350 it was in a position to shortly transfer into the $1,400 space.

This means that $1,300 has been flipped from resistance to assist making it a key stage in case of future draw back value motion. As seen under, bids have been transferring up with ETH’s value with over $7 million purchase orders at round $1,450 hinting at sustainable bullish value motion.

Analyst Ali Martinez believes ETH printed a bullish four-hour candlestick when it broke under $1,300. At the moment, the cryptocurrency broke from a multi-month consolidation gaining sufficient momentum to reclaim ranges above $1,650.

The analyst believes ETH’s value is heading in the direction of this space with the potential to hit $1,670. The following space to observe if ETH sees comply with via into this space is $1,700.

Why The $1,700 Are Essential For The Value Of Ethereum?

Extra data offered by JarvisLabs hints at an vital shift in Ethereum market dynamics. The cryptocurrency noticed a flipped in its 30-day returns, used to measure the short-term revenue and loss for crypto traders on this interval.

This metric has been trending in the direction of 0% after transferring in adverse territory for a number of months. Based on Jarvis Labs, a flip above 0% for Ethereum’s 30D returns may current traders with a promoting alternative.

Associated Studying | XRP Should Breach This Key Stage To Avert The Downturn

Previously, and through a bear market, at any time when ETH’s 30D returns skilled a interval of consolidation with a subsequent constructive flip within the metric, the cryptocurrency noticed extreme crashes. Under there’s a chart on what has occurred to ETH’s value when it sees the same efficiency, Jarvis Labs added:

If this fractal have been to replay itself all pumps as much as the $1700 stage will set off sell-offs for the subsequent 1 12 months. Conversely, a flip of 1700 from resistance again to assist can be equal to summer season 2020’s flip of ~$350 and will sign the beginning of a model new bull run.