One cryptocurrency alternate’s former CEO expects the second-largest asset by market cap to rally as soon as it completes a community improve.

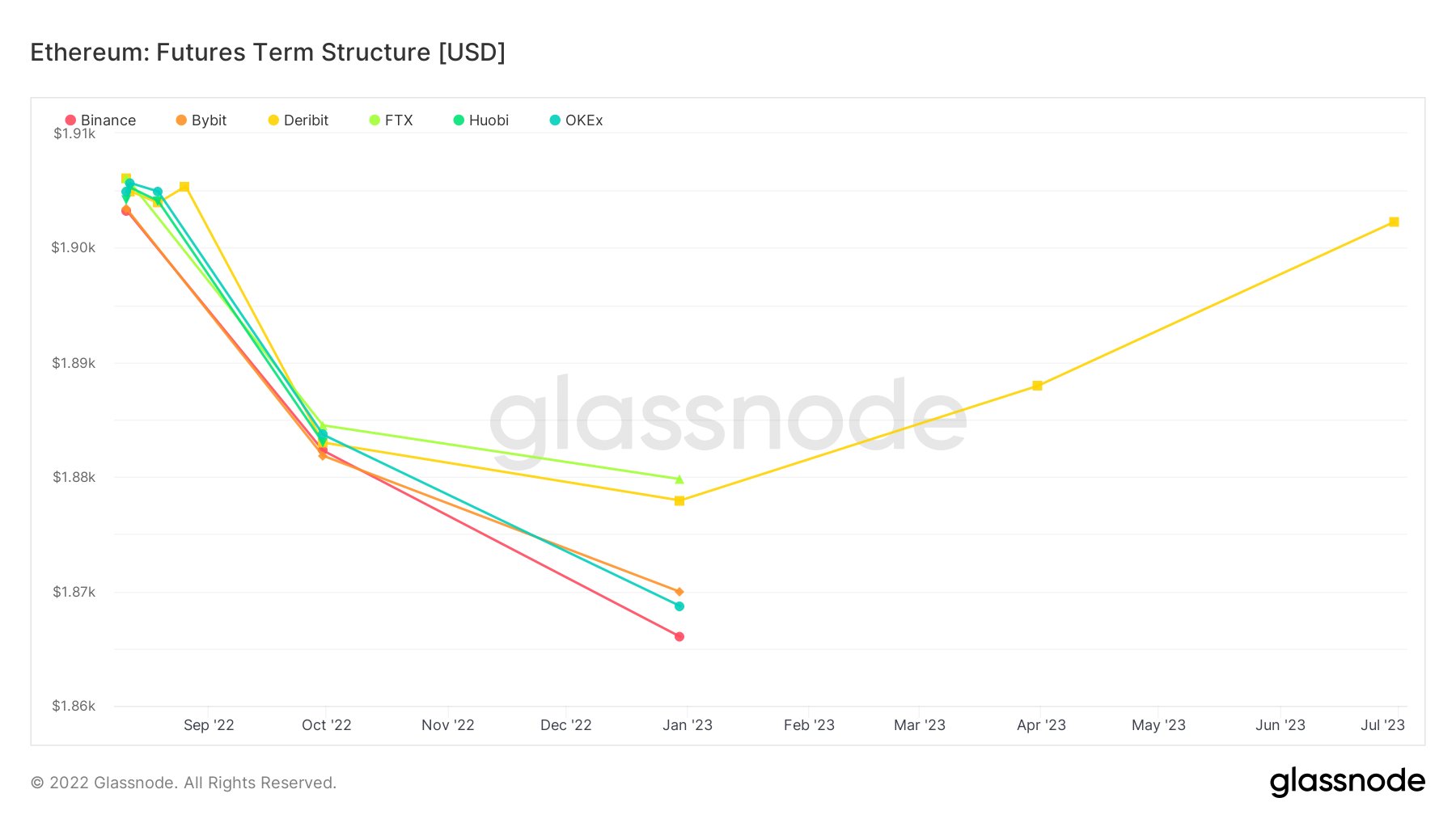

In a collection of tweets, BitMEX co-founder Arthur Hayes explains that Ethereum (ETH) finds itself in a curious scenario referred to as backwardation the place the asset’s spot worth is greater than what it’s buying and selling for within the futures market.

Hayes believes the discrepancy is because of merchants’ apprehension previous to ETH’s upcoming change to a proof-of-stake (PoS) consensus mechanism that’s scheduled for mid-September.

“The curve is in backwardation, that’s futures < spot, out till January 2023.

My guess is as a result of merchants are hedging out ETH publicity pre-merge simply in case.”

Hayes speculates on what may occur ought to the Ethereum improve fail by saying,

“If the marginal stress is on the promote aspect, then the market makers are lengthy futures, and should brief promote spot to hedge themselves. This provides downward worth stress to the money or spot market.”

Conversely, if the change to ETH 2.0 goes easily, Hayes says two prospects may play out.

“However what occurs if the merge is profitable, and hedgers cowl their shorts so they’re internet lengthy ETH once more? And what if speculators who imagine in a ‘triple-halving’ YOLO into leveraged lengthy positions?

Now the stress is on the purchase aspect, and market makers are brief futures and should go lengthy spot. A reversal of their positioning pre-merge.”

Hayes concludes by noting that the following “constructive suggestions loop” would reveal to Ethereum advocates that the mission is on an upswing.

“If you happen to imagine the merge goes to succeed, then that is yet one more constructive structural motive why ETH may hole greater into the top of the 12 months.”

Ethereum’s extremely anticipated replace will allow the mainnet to merge with its Beacon Chain, which already runs the PoS system. ETH 2.0 goals to deal with the community’s scalability points by setting the stage for future upgrades.

At time of writing, Ethereum continues its mid-week rally, having risen by 11.7% to $1,868 from a Tuesday low of $1,671.

Again in March, Hayes and fellow BitMEX govt Benjamin Delo pleaded responsible to violating the Financial institution Secrecy Act by willfully failing to ascertain anti-money laundering protocols. A decide later sentenced Hayes to 6 months of dwelling detention and two years of probation, and the previous CEO additionally agreed to pay a wonderful of $10 million.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: StableDiffusion