- Shopping for stress is build up supported by ETH whales and retail accumulation

- ETH promote stress is steadily tapering out and will give strategy to a robust bullish bounce

ETH holders who purchased the dip final week could have loved some upside nevertheless it has been moderately restricted. It’s because final week’s crash left traders extra fearful and danger urge for food was suppressed.

Whereas not a lot has occurred when it comes to worth motion, traders ought to count on extra volatility and a bullish bounce forward as ETH accumulation will increase.

Learn Ethereum’s (ETH) worth prediction 2023-2024

In response to Glassnode researchers, the variety of ETH addresses holding greater than 0.1 ETH was at a three-month excessive. This meant that there was vital retail accumulation happening after the latest dip. Retail consumers have much less of an influence on the value than whales. Thankfully, the evaluation additionally revealed that whales had been additionally shopping for.

? #Ethereum $ETH Variety of Addresses Holding 100+ Cash simply reached a 20-month excessive of 46,579

Earlier 20-month excessive of 46,563 was noticed on 15 September 2022

View metric:https://t.co/FbjiMG3uFX pic.twitter.com/aKvYDvHqi5

— glassnode alerts (@glassnodealerts) November 14, 2022

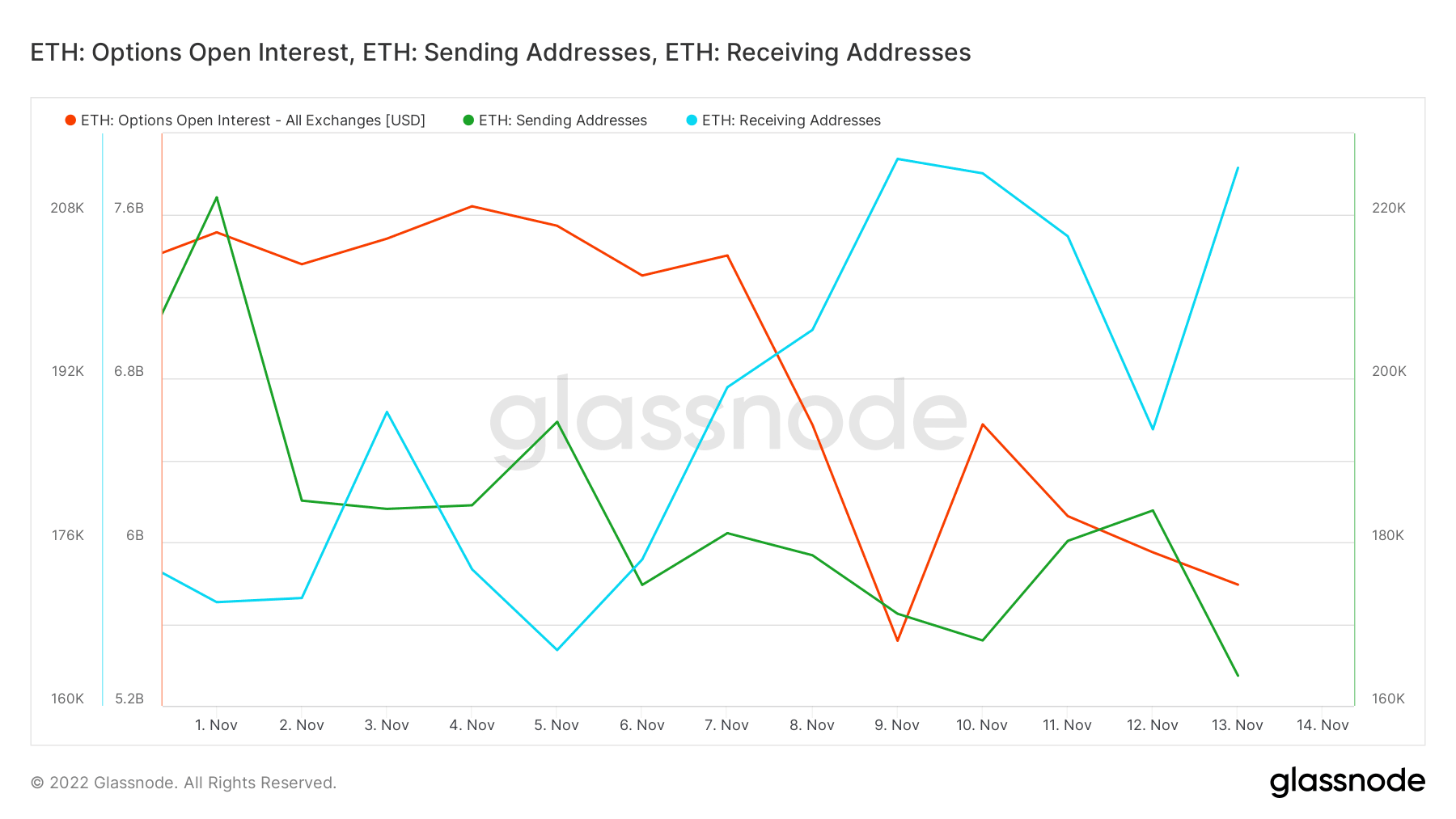

This meant that whales with over $100,000 value of ETH have been scooping up the cryptocurrency at discounted costs. However can this demand proceed or is that this one other case of accumulation at help ranges? A take a look at trade flows revealed that receiving addresses have elevated within the final two days. This confirmed the likelihood that traders had been shopping for ETH.

Supply: Glassnode

Sending addresses dropped within the final two days. This confirmed a drop in promote stress, which can pave the way in which for bullish stress. Additionally value noting was that open curiosity dropped again down barely within the final 4 days. This indicated that the derivatives market was but to get better.

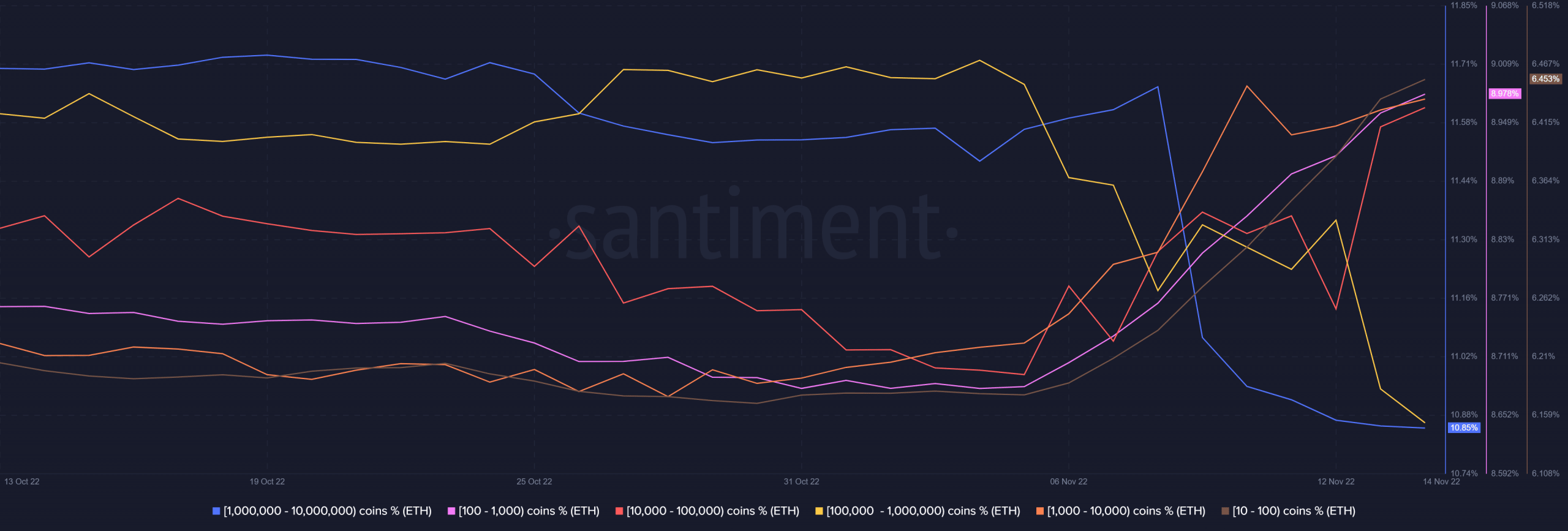

ETH’s provide distribution confirmed that promote stress witnessed a drop. The biggest whales holding over 1 million ETH lowered their balances within the final 5 days. Nonetheless, these outflows had been now truly fizzling out.

Supply: Santiment

Regardless of the above commentary, there was nonetheless a major quantity of promote stress. Largely from addresses holding between 100,000 and 1 million ETH. Word that addresses holding between 10,000 and 100,000 management the lion’s share of ETH in circulation. This whale class has been shopping for particularly within the final 2 days.

ETH worth motion

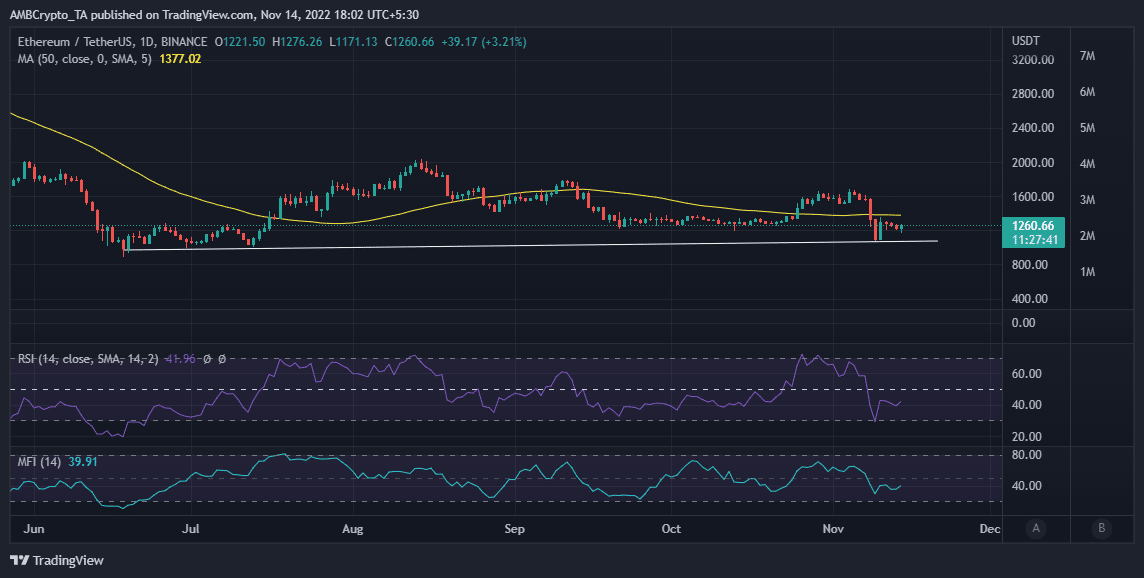

The above observations verify {that a} drop in ETH promote stress and a rise in shopping for stress. Nonetheless, any incoming purchase stress was restricted by the remaining promote stress. However, these observations steered an elevated chance of a restoration again above $1,300.

Supply: TradingView

ETH’s $1261 press time worth mirrored a 35 rally within the final 24 hours and a rise in relative power.

The return of bullish stress may very well be anticipated particularly after the value’s latest dip into oversold territory. However, this doesn’t essentially imply that the underside was in. It steered that purchasing stress was build up and will set off extra upside within the subsequent few days.