Information from Coingecko, on the time of writing, information a slight restoration for Ethereum and huge cryptocurrencies. The second crypto by market cap has been trending to the draw back over the previous weeks and was seeing briefly breaking beneath $1,000 on sure venues.

Associated Studying | TA: Ethereum Might Resume Decline Beneath $1,100, Bears In Management

On the time of writing, Ethereum (ETH) trades at $1,180 with a 35% loss up to now 7-days. Based on economist Alex Krüger, ETH’s value information a 20% loss and 20% revenue throughout at present’s buying and selling session which might be a primary within the cryptocurrency’s historical past.

$ETH has put in a 20% intraday spherical tripper at present.

20% down, then 20% up.

Unsure if this has ever occurred earlier than.

— Alex Krüger (@krugermacro) June 15, 2022

Much like Bitcoin, Ethereum is reacting to the draw back of the macroeconomic state of affairs. Because the U.S. Federal Reserve (FED) introduced a 75 foundation factors enhance in rates of interest, preceded by a cascade of liquidations and adverse information for the crypto market, BTC and ETH have been capable of regain some bullish momentum.

Probably pushed by overextended promoting stress, and panic amongst crypto buyers, ETH’s value bounced again from round $1,000 to its present ranges. Krüger believes the present value motion is a part of a well-established market sample:

(…) since December. Hawkish market expectations => costs tank in anticipation => hawkish FOMC => belongings rally. Partially priced in one thing. Not a meme. This has been so constant it’s developed right into a sample. It received’t final ceaselessly.

The market may see extra volatility within the coming days. Krüger believes the market may proceed to positively react to the FED’s announcement because it was inside expectations. Thus, the bounce may see some continuation. He added:

Market favored hawkish Powell. Brief charges larger (in response to elevated hawkishness), lengthy charges decrease (in response to elevated credibility within the Fed’s capacity to reign in inflation). Hoping this sticks and we get continuation.

Ethereum Sees Brief-Time period Shopping for Stress

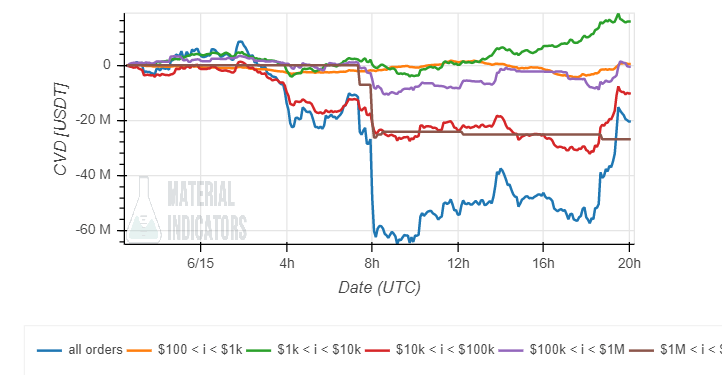

Information from Materials Indicators (MI) information a rise in shopping for stress for ETH on crypto alternate Binance. In decrease timeframes, nearly all invertors courses shifted from promoting to purchasing the present value motion.

Associated Studying | Tron Falls Sharply As Solar Scrambles To Save Stablecoin

This might contribute to ETH’s present momentum and probably push the cryptocurrency to earlier ranges. Nonetheless, ETH whales (in brown on the chart beneath) offered into at present’s value motion and will get in the way in which of any sustainable restoration.