Key Takeaways

- Ethereum has developed a descending triangle on its four-hour chart.

- If the $1,720 help stage continues to carry, Ethereum might respect by as a lot as 25%.

- Conversely, if Ethereum breaks its help, a downswing to $1,300 seems possible.

Share this text

Ethereum stays stagnant in a no-trade zone that’s getting narrower over time. Persistence is suggested till ETH can escape of this tight worth pocket.

Ethereum at a Crossroads

Merchants look like rising impatient as Ethereum continues to consolidate inside a decent worth vary.

Information from Coinglass has revealed that roughly $1.5 billion value of lengthy and brief ETH positions have been liquidated throughout the board over the previous three weeks. Within the meantime, Ethereum has been locked in a no-trade zone that’s getting narrower over time. The token’s worth motion has outlined two crucial worth factors that may possible decide the place costs are heading subsequent.

Ethereum has developed a descending triangle on its four-hour chart. This technical formation prevails {that a} break under the X-axis or above the hypotenuse might lead to a 25% worth motion in both course. A sustained shut under $1,700 or above $1,900 will possible resolve the paradox that ETH presently presents.

Dipping under help might lead to a downsizing towards $1,300, whereas overcoming resistance would possibly encourage sidelined buyers to re-enter the market and push Ethereum as much as $2,270.

Regardless of the ambiguous technical outlook, on-chain knowledge exhibits that many giant Ethereum whales are exiting their positions, indicating fears of an extra decline.

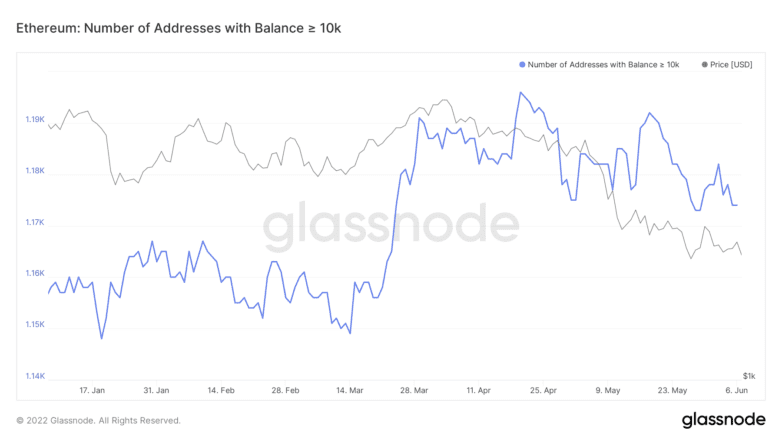

Information from Glassnode reveals that the variety of addresses with a stability better than 10,000 ETH has declined by 1.51% prior to now three weeks. Roughly 18 whales have both left the community or redistributed their holdings. Though this sum could seem insignificant at first look, it’s value noting that every of those addresses held not less than $20 million value of ETH.

This rise in promoting stress from whales could possibly be tampering with Ethereum’s skill to rebound. Nonetheless, a decisive four-hour candlestick shut exterior of the $1,700-$1,900 no-trade zone might assist decide which course ETH will transfer over the approaching weeks.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.

For extra key market tendencies, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.