Yesterday, very like the inventory markets, cryptocurrencies had tough occasions. Ethereum misplaced about 9% of its worth, and the bears pushed the worth towards the help at $2,800.

Technical Evaluation

By Grizzly

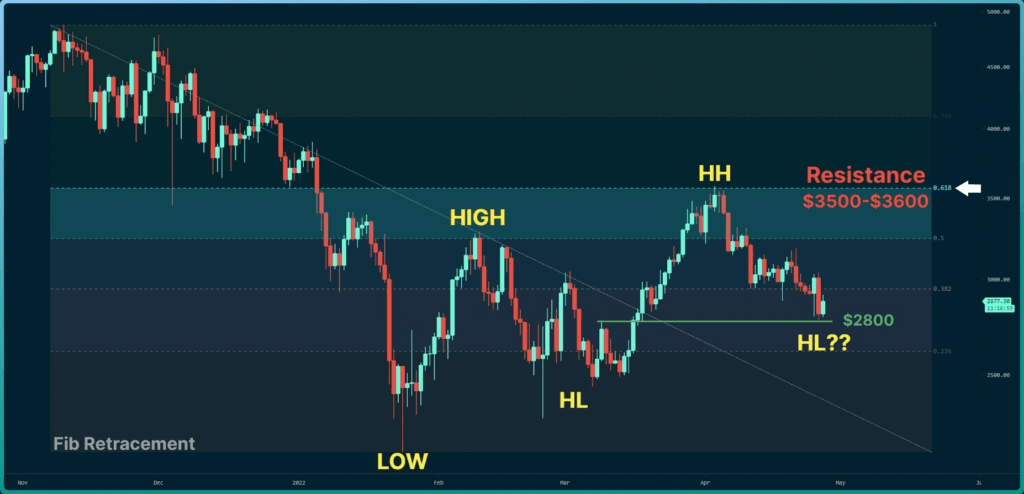

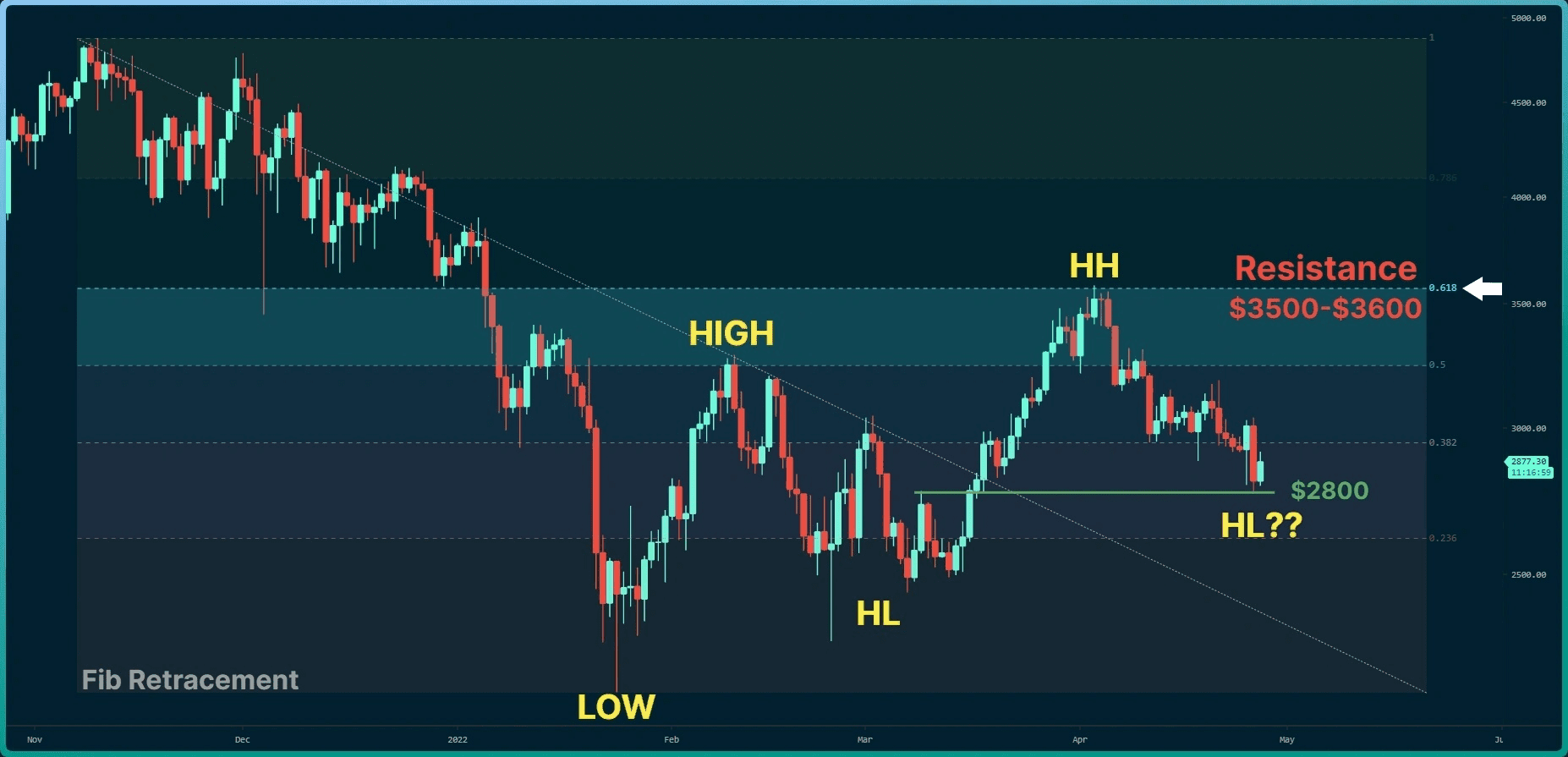

The Day by day Chart

On the each day timeframe, Ethereum entered a correction part after failing to interrupt the barrier of Fibonacci Retracement at 0.618. It’s presently forming a bullish sample with the formation of upper highs and lows. Nonetheless, the principle query is whether or not the bears would enable the help at $2800 to be thought of a better low?

If this occurs, a retest of the horizontal resistance within the vary of $3500-$3600 can be barely extra possible. Breaking it and forming one other increased excessive may push the worth to $4000. The downtrend momentum appears to have considerably eased, and sellers are step by step shedding energy though nonetheless holding the higher hand.

Assist Key Ranges: $2500 & $2300

Resistance Key Ranges: $3300 & $3600

Transferring Averages:

MA20: $3030

MA50: $3036

MA100: $2907

MA200: $3470

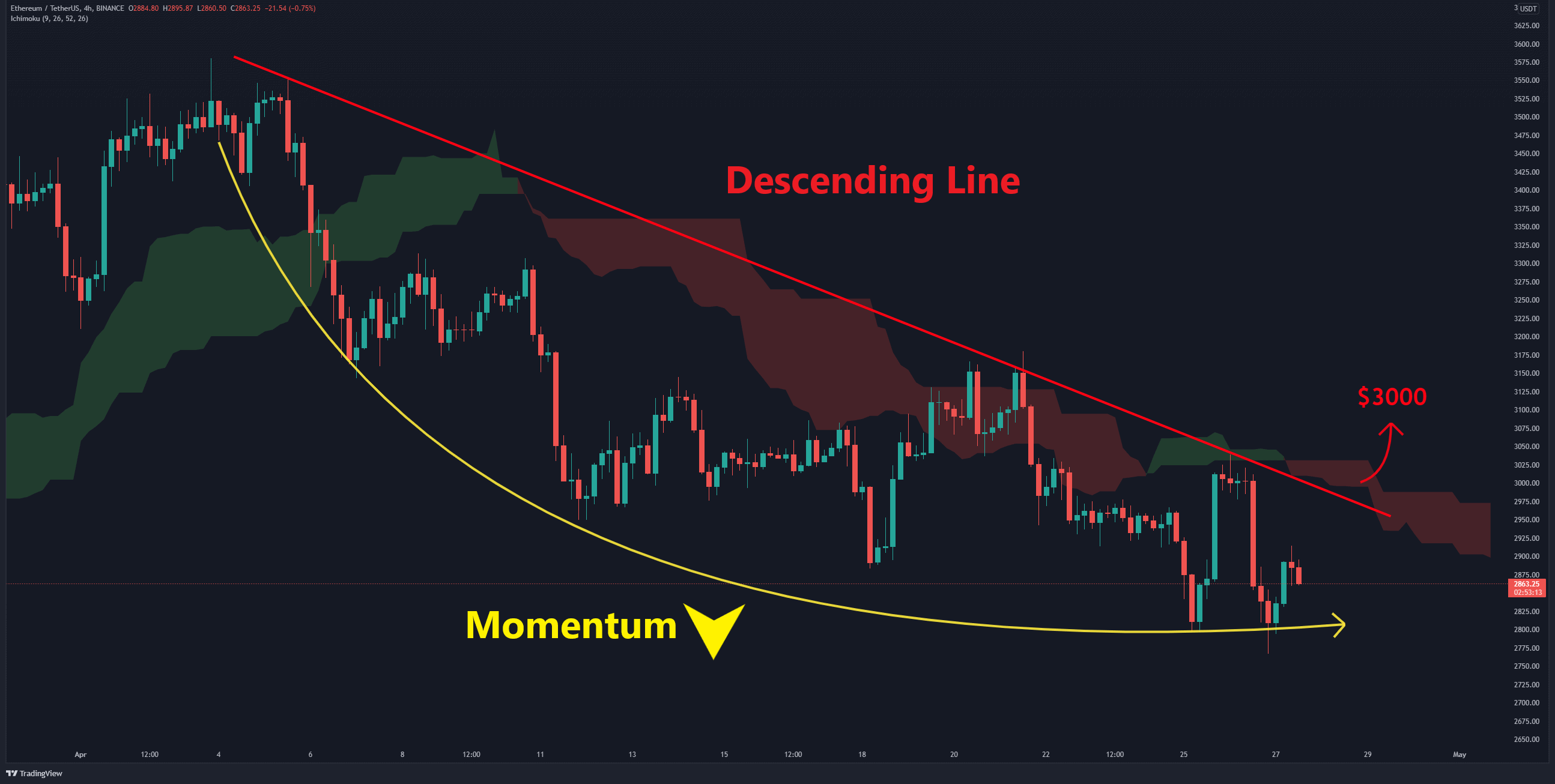

The 4-Hour Chart

On the 4-hour timeframe, ETH is buying and selling under the descending line (marked crimson) and the Ichimoku Cloud, which acts as a resistance. What’s exceptional is that the downward momentum on this timeframe step by step decreases. If ETH can maintain help at $2800 and construct a better excessive on this zone, one can anticipate the bulls to retest the resistance at $3000, which is the principle barrier within the decrease timeframe.

On-chain- evaluation

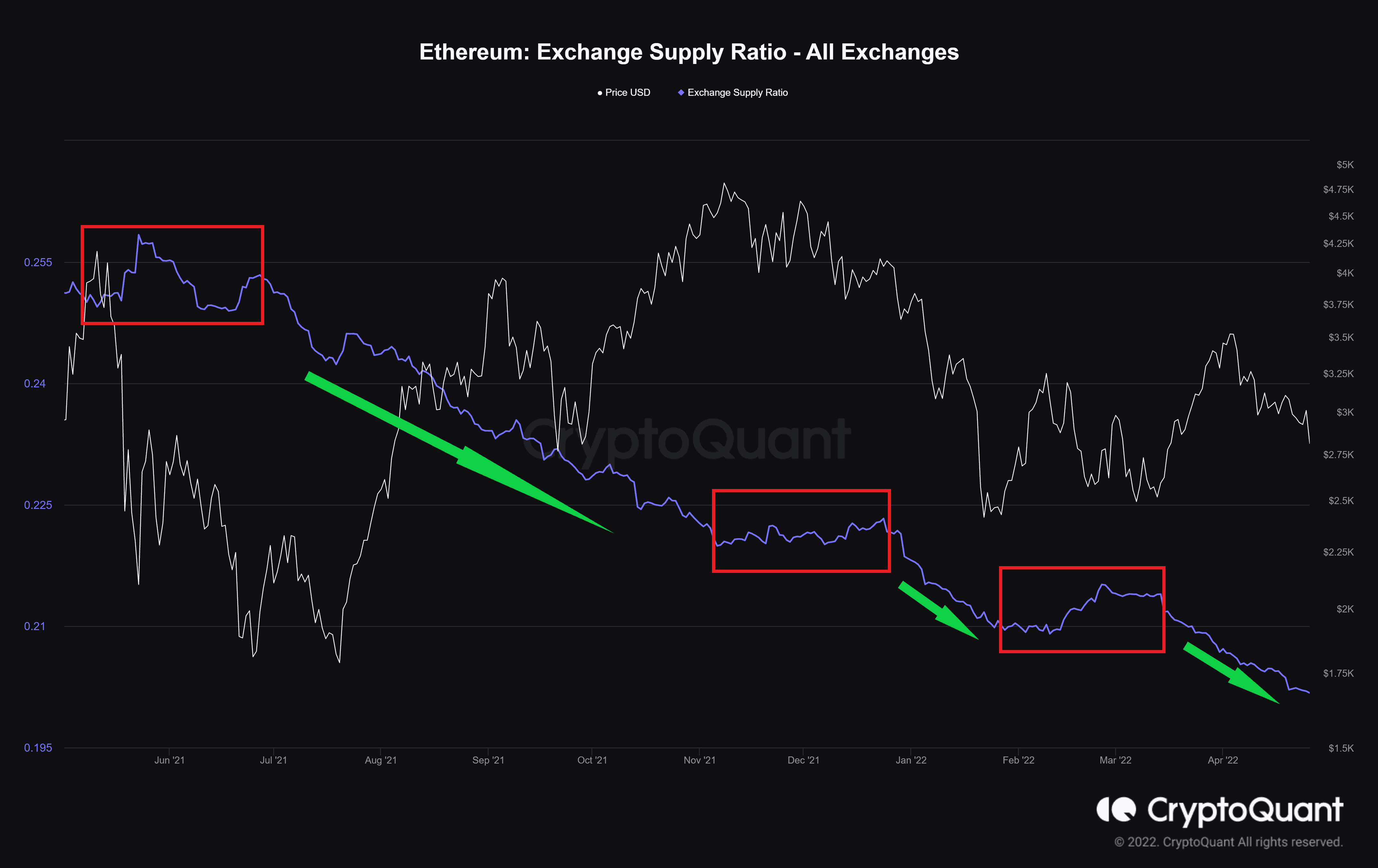

Change Provide Ratio

Change Provide Ratio is calculated because the alternate reserve divided by the overall provide for a particular asset equivalent to bitcoin.

As it’s proven within the chart, regardless of the worth decreases, this metric continues the downward development, which we’ve already seen prior to now uptrends. There’s presently no signal of buyers’ willingness to deposit their tokens into exchanges.