The speed of sensible contract and dApp growth on Ethereum dropped in the previous few months. That is unsurprising due to the bearish market situation that prevailed throughout the identical interval.

Right here’s AMBCrypto’s value prediction for Ethereum (ETH)

Builders are conscious that their dApps are much less prone to get traction throughout a bear market. Given these observations, the most recent spike in Ethereum sensible contracts signifies that builders have gotten extra optimistic.

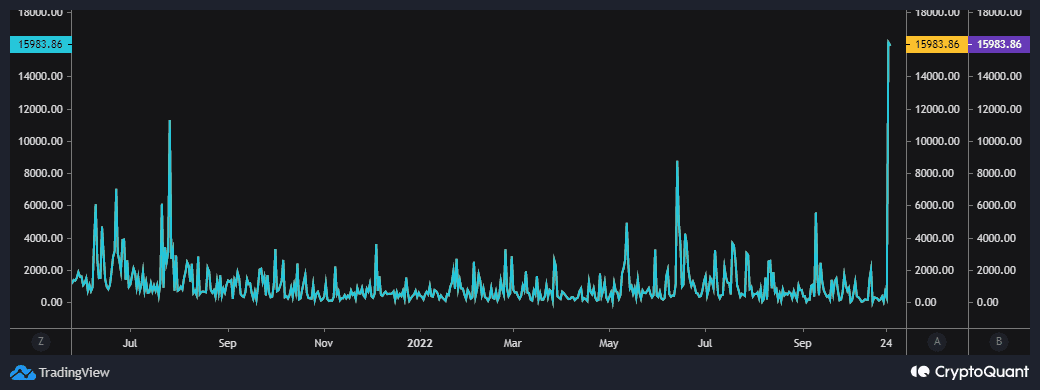

To place it into perspective, the variety of new sensible contracts on Ethereum surged to the very best 2022 ranges within the final three days.

Supply: CryptoQuant

Ethereum builders have traditionally opted to roll out sensible contracts throughout bullish occasions. It’s because they’re prone to seize extra utility when there may be quite a lot of exercise available in the market and that’s typically throughout a bull run.

It’s thus no shock that the most recent sensible contract spike occurred throughout a bullish rally. A rise in sensible contracts, coupled with wholesome utilization of stated contract ought to end in extra transactions.

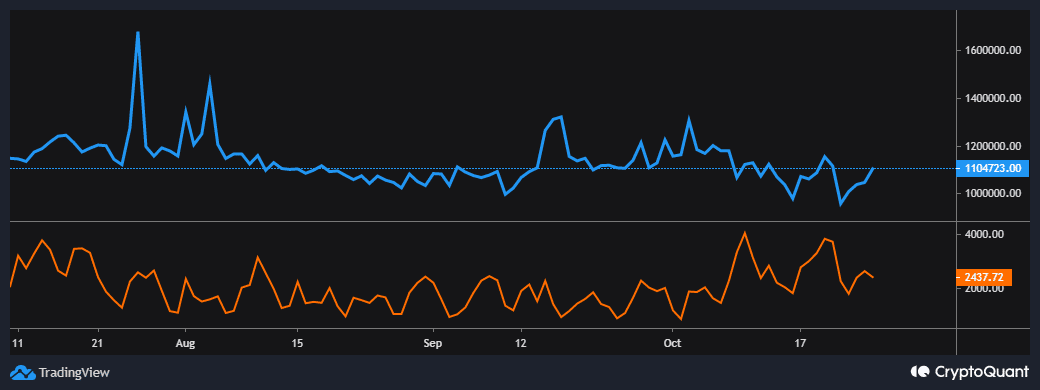

As anticipated, Ethereum’s transaction depend additionally registered an uptick since 22 October.

Supply: CryptoQuant

Community charges had been up marginally and never proportional to the sensible contract spike. This is perhaps as a result of the brand new sensible contract utilization continues to be low, therefore they haven’t captured a lot worth to date.

Ethereum’s present stage of readiness

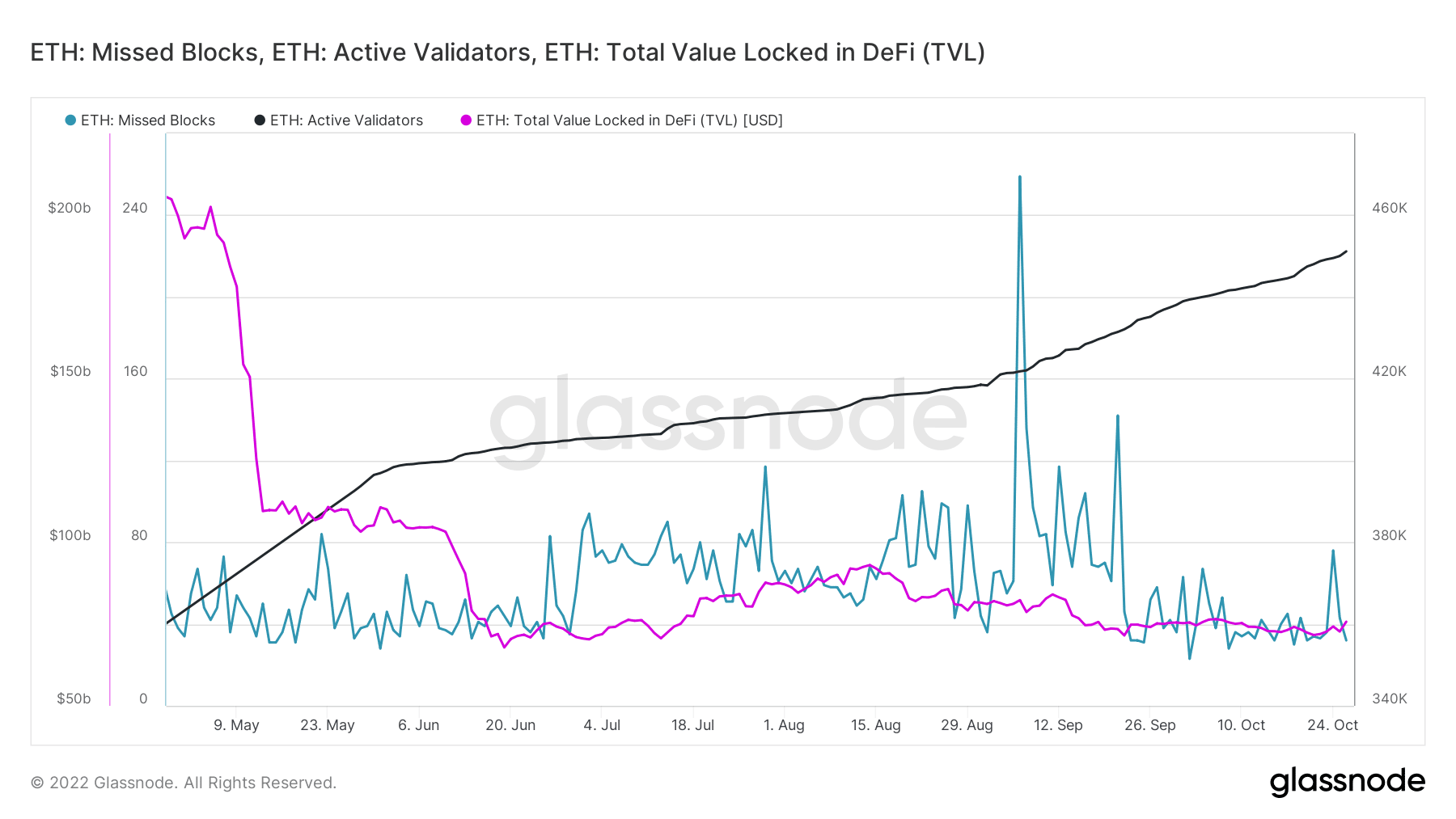

A possible cause for the low stage of charges regardless of the return of the bulls could possibly be the comparatively decrease worth locked in DeFi. The bearish circumstances within the final six months noticed a lot of outflows from the community as traders panicked. Nevertheless, the whole worth locked in DeFi elevated barely from its October lows this week.

Supply: Glassnode

The surge in sensible contracts on Ethereum is already an indication that builders are able to reap the benefits of potential worth in the course of the bull run.

Different community contributors are additionally in place. For instance, the variety of energetic validators is at present at a 6-month excessive. In the meantime, the variety of missed blocks did spike earlier within the week.

We will conclude from the above info that Ethereum is properly ready to deal with a surge in community demand. The bullish motion we noticed this week means that ETH might proceed to expertise revitalized demand.

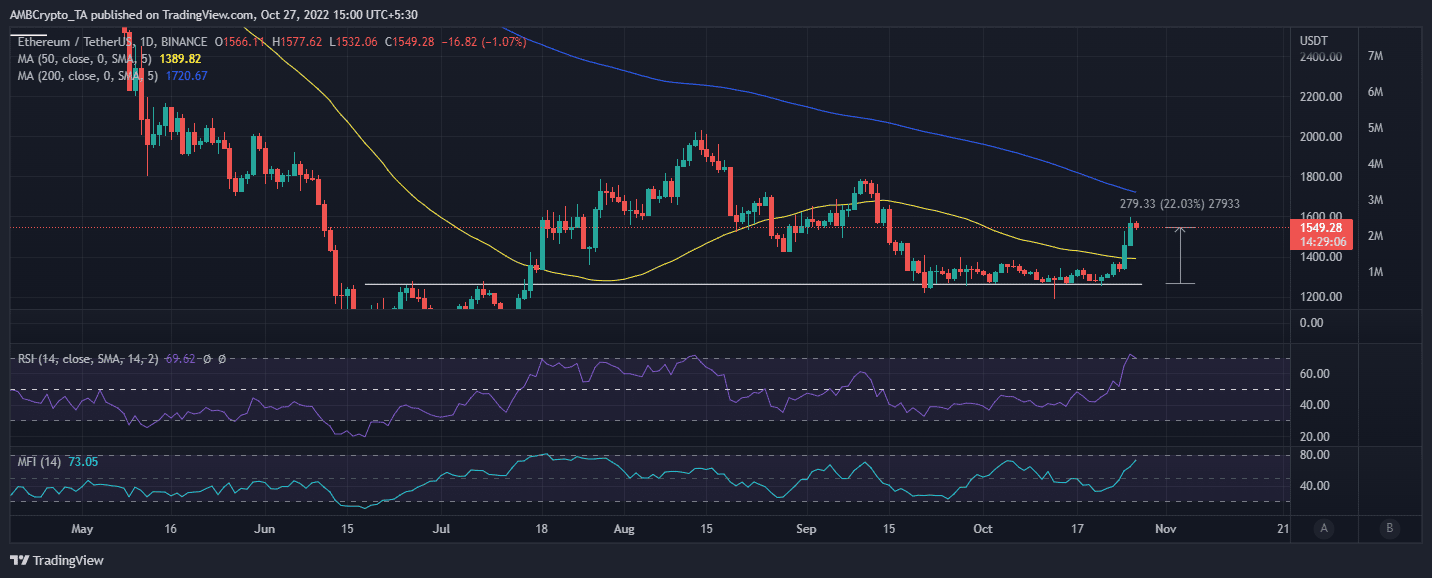

It managed to reclaim the $1,500 value stage and traded at $1,547 on the time of writing. This was after a 22% upside within the final seven days.

Supply: TradingView

ETH traders ought to nevertheless be aware that the demand has slowed down within the final 24 hours. That is possible because of the truth that ETH is now overbought in line with the RSI. It nonetheless stays to be seen whether or not the cryptocurrency will handle to exit its decrease vary.