Key Takeaways

- Ethereum has retraced by greater than 18% over the previous two weeks.

- The losses prolonged after the Ethereum Basis’s Tim Beiko hinted that “the Merge” could possibly be months away.

- Ethereum should maintain above $3,000 to keep away from a brutal correction.

Share this text

Ethereum followers suffered a setback this week after the Ethereum Basis’s Tim Beiko hinted that the Proof-of-Stake transition wouldn’t happen in June 2022. The replace got here as Ethereum has been looking for secure worth help.

Ethereum Sits on Shaky Floor

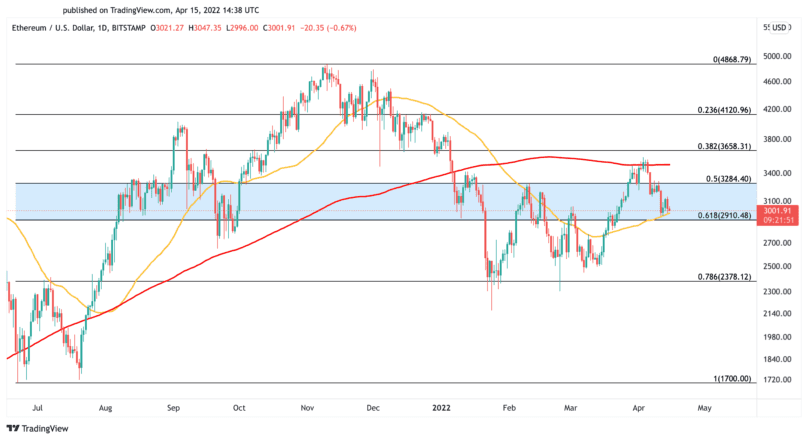

Ethereum seems to be buying and selling above essentially the most important help degree on its development.

The second-largest cryptocurrency by market cap has seen its worth dive by practically 18% over the previous two weeks. The losses have been prolonged this week after the Ethereum Basis’s Tim Beiko hinted at a delay to the long-awaited “Merge” to Proof-of-Stake. “It gained’t be June, however possible within the few months after,” he tweeted Tuesday. Notably, the Merge doesn’t but have a set date, however June 2022 has been mentioned locally as a tough goal date for a while.

It will not be June, however possible within the few months after. No agency date but, however we’re undoubtedly within the closing chapter of PoW on Ethereum

— Tim Beiko | timbeiko.eth ?? (@TimBeiko) April 12, 2022

The quantity two blockchain has developed a fame for its sluggish growth occasions; “the Merge” to Proof-of-Stake has been in planning for a number of years, with Vitalik Buterin initially suggesting that it could be prepared method again in 2016. Any additional delays might impression Ethereum’s buying and selling worth.

Ethereum has been testing the 50-day transferring common as help for the previous 5 days. Though this demand zone has managed to carry Ethereum to this point, any spike in promoting strain across the present worth ranges might have brutal penalties for the bulls. Breaching the $3,000 help degree might push ETH all the way down to $2,400.

Regardless of the bearish outlook {that a} break of the $3,000 help poses, the asset has a number of robust fundamentals supporting the bullish thesis. Greater than 11.5 million Ethereum have been deposited within the Eth2.0 deposit contract, over 2.1 million Ethereum have been burned by way of EIP-1559, and the stability on exchanges is at a four-year low of 20.6 million Ethereum.

Such market conduct hints at a major discount of promoting strain and a possible provide shock. If Ethereum prints a every day candlestick shut above its 200-day transferring common at $3,500, it might advance additional. In that state of affairs, the primary bullish goal can be at $4,120.

Disclosure: On the time of writing, the writer of this piece owned ETH and BTC.