Ethereum is without doubt one of the most widely-adopted cryptocurrency tasks worldwide. But, it’s hated worldwide for its sky-high fuel (transaction) charges. Customers globally continuously complain in regards to the coin’s terribly-high transaction costs on varied social media platforms.

Shockingly, Santiment, an on-chain and metrics platform, revealed on Twitter a report exhibiting Ethereum’s transaction costs plummeting to their lowest.

The Ethereum Platform

Ethereum is a distributed, permissionless, and open-source blockchain that gives customers entry to a sensible contract. It’s the second-largest blockchain by market capitalization, following crypto large Bitcoin.

Associated Studying | Bitcoin Dominance Stays Excessive As Market Promote-Offs Settle

Remarkably, Ethereum presents a p2p (peer-to-peer) community that verifies and executes codes inside the platform, often known as Sensible Contracts.

Ethereum GAS Value

On the Ethereum community, customers are charged some quantities to carry out any transaction, shopping for, promoting, swapping, minting, and so forth. Ethereum previously had a ridiculous file for having very excessive fuel charges for its transactions.

Lately, the crypto large started providing meager transactional prices to its customers, as recorded by Santiment. Santiment is a monetary market content material and knowledge platform for blockchains and cryptocurrencies.

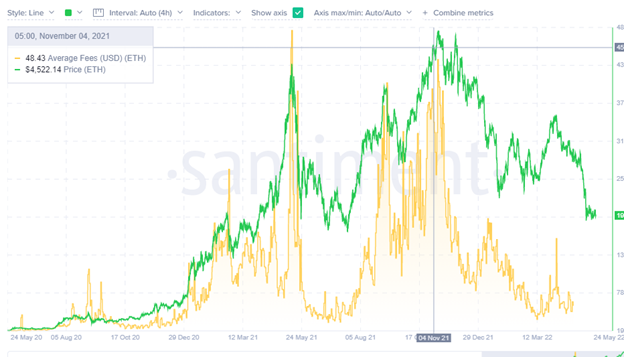

The metric platform took to Twitter the information of Ethereum’s meager transaction costs. As of Tuesday, 24th Might, the second-largest blockchain had a transaction value of $2.54 a transaction.

What’s Subsequent For Ethereum

In response to Santiment, that is the bottom the transaction charges have been since final July. Due to this fact, it might be distinctive for ETH costs. Traditionally, ETH coin costs normally leap as soon as the typical transactions drop beneath $5. Ethereum’s common fuel charges have plummeted, breaking its 10-months low.

However, merchants nonetheless should be cautious whereas buying and selling and transacting with the crypto as a result of the market is presently deprived. Thus, a substantial leap won’t happen given the present international bearish market.

Numerous crypto pundits and monetary analysts venture that Bitcoin is about to dip massively, predicting an additional dip. Mike Novogratz was among the many “prophets of doom” for the world’s main blockchain and crypto.

Novogratz, a monetary investor, took to Twitter, stating that additional dips await Ethereum and Bitcoin and all the DeFi market. In his tweet, he emphasised that 2022 is not going to be so favorable for buyers and merchants.

Associated Studying | Perp Merchants Stay Quiet As Bitcoin Struggles To Maintain $30,000

Noting that Bitcoin controls the worth of all the DeFi market, if Bitcoin dips, being essentially the most important blockchain, the entire market dips. This contains the Ethereum blockchain.

Featured picture from Pexels, chart from TradingView.com