As bitcoin (BTC) soars to $42,000 and past, buying and selling above $43,000 at press time, the premier cryptocurrency by market cap noticed greater than 15,000 BTC in outflows from exchanges earlier this week. It’s the most important outflow from exchanges because the twenty ninth of January, in keeping with data from crypto analysts IntoTheBlock.

This constitutes a constructive signal for the value motion of bitcoin, since property taken off exchanges, and sure transferred to chilly storage, are much less prone to be bought within the short- to medium time period. The final time BTC skilled a big outflow, it was adopted by a big rise in worth.

Largest quantity of ether withdrawn from Exchanges in 2022

Not solely is bitcoin transferred out of exchanges in massive troves, ether, the second-largest cryptocurrency by market cap, noticed one other main outflow from exchanges on Wednesday. In response to InteTheBlock, this was the most important quantity of ether withdrawn from Exchanges in 2022, as over 180,000 ETH was withdrawn from centralized exchanges inside a single day. ETH reserves on centralized exchanges have been reducing quickly in 2022, including as much as over 1.08 million.

In response to crypto on-chain analysts Santiment, ether enjoyed one other leg up on Wednesday, leaping above $3,000 after yesterday’s first breach above this resistance degree in three weeks. Merchants shorting ether have been piling up following the breakout above $3,000, resulting in loads of ether liquidations as an instantaneous consequence.

Typically, this previous week has been a sea of inexperienced for crypto after the U.S. Federal Open Market Committee (FOMC) introduced a price hike of the U.S. Federal Reserve rate of interest everybody anticipated. The non-surprising enhance of the rate of interest by 25 foundation factors has had most markets commerce within the inexperienced. Crypto market costs are nonetheless transferring in tandem with equities, however there are indicators of much less correlation, in keeping with Santiment.

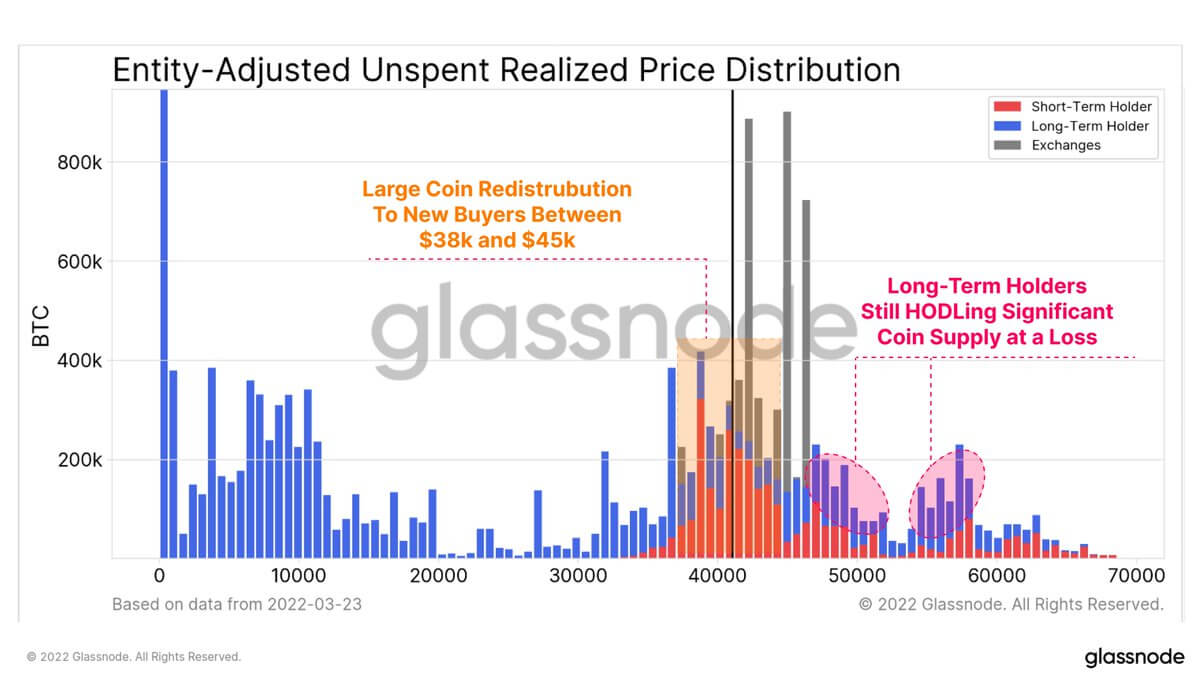

Bitcoin costs have now consolidated between $38,000 and $45,000 for over two months, and a big quantity of BTC has modified palms throughout this era, as per data from on-chain analysts Glassnode. Newer patrons (short-term holders) have accrued closely on this vary whereas many long-term holders are holding cash at a loss. This implies each classes have an incentive to proceed holding.

Bitcoin’s breaking out of the gloomy pattern

On the time of writing, bitcoin (BTC) is buying and selling at $43,200, up 2% the previous 24 hours, and up 4.8% on the week. Since its all-time excessive at $60,044 set on the tenth of November, bitcoin remains to be down 37.7%. Nonetheless, the premier cryptocurrency has seen an upward pattern the previous month and the value has elevated by 16.4% up to now 30 days, breaking out of the gloomy pattern seen because the starting of the 12 months.

Ethereum has seen a giant surge in social discourse over the previous weeks, particularly concerning The Merge which is prone to happen in June. It’s arduous to inform, although, whether or not the occasion is priced in. Some skeptics as as to if the proof-of-stake transition will work nonetheless stay. In response to Ethereum core builders, nevertheless, all main hurdles are cleared and the merge is nice to go after a interval of ultimate testing of the Kiln testnet.

At press time, ether (ETH) is buying and selling at $3,050, up 1.9% the previous day, and up 10.1% on the week. Zooming out, ether has gained 19.3% in a month and 83.5% in a 12 months. For the reason that all-time excessive at $4,878 set on the tenth of November final 12 months, ether remains to be down 37.3%.