One other DeFi platform took a serious hit at the moment, because the decentralized, credit-based stablecoin Beanstalk (with it’s stablecoin $BEAN) has damaged it’s peg following a roughly $80M hack.

Hypothesis has been left, proper and heart and quite a lot of sleuths have been monitoring the motion of funds and learning the exploit that has seemingly left Beanstalk Farms within the mud.

Let’s have a look at what we all know from the early hours because the hack.

Beanstalk Farms’ Hack: What Went Down

The transaction on Etherscan exhibits that the hacker used what’s generally generally known as a ‘flash mortgage assault,’ one which has been seen on DeFi protocols beforehand. A flash mortgage in crypto permits a consumer to borrow and repay a mortgage in a single transaction, which minimizes threat for lenders and might streamline processes for debtors.

Within the Beanstalk Farms hack, the hacker borrowed practically a 3rd of the BEAN provide, roughly 32 million tokens and utilized Curve Finance’s $3Crv tokens to generate a novel tokens ‘BEAN3CRV-f’ and ‘BEAN3LUSD-f.’

The attacker utilized these two new tokens to deceive Beanstalk’s governance mannequin and gave the hacker an enormous majority holding of ‘seeds,’ the platform’s governance token. With such a bigger holding of seeds, the hacker had the contractual functionality to execute an ’emergency governance motion,’ siphoning large quantities of funds from the Beanstalk contract.

The hacker even included a $250K donation to the Ukrainian donation deal with as a part of the hack, and arrange the governance proposals over 24 hours previous to precise execution of the flash mortgage assault.

Lossless (LSS) has reached out to Beanstalk; the venture is an increasingly-utilized instrument to fight towards potential hacks. | Supply: LSS-USDT on TradingView.com

Associated Studying | Bitcoin Clings To $40K On Easter Sunday As Crypto Seen To Head Decrease In The Quick Time period

Can The Protocol Get well?

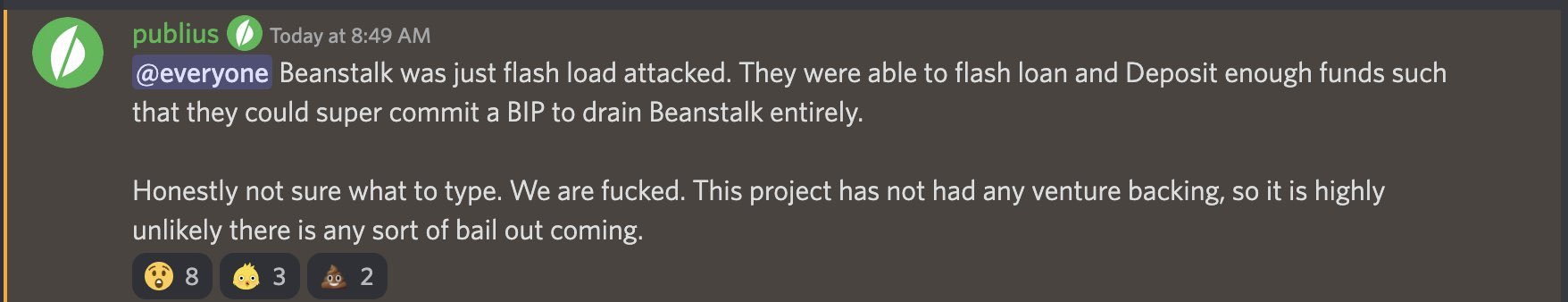

Simply days in the past, Beanstalk was celebrating over $150M in TVL, over $130M in liquidity, and a quickly approaching market cap of $100M that was impending. The protocol has needed to pump the brakes, and it’s future is now unclear – with a stark Discord screenshot from admins:

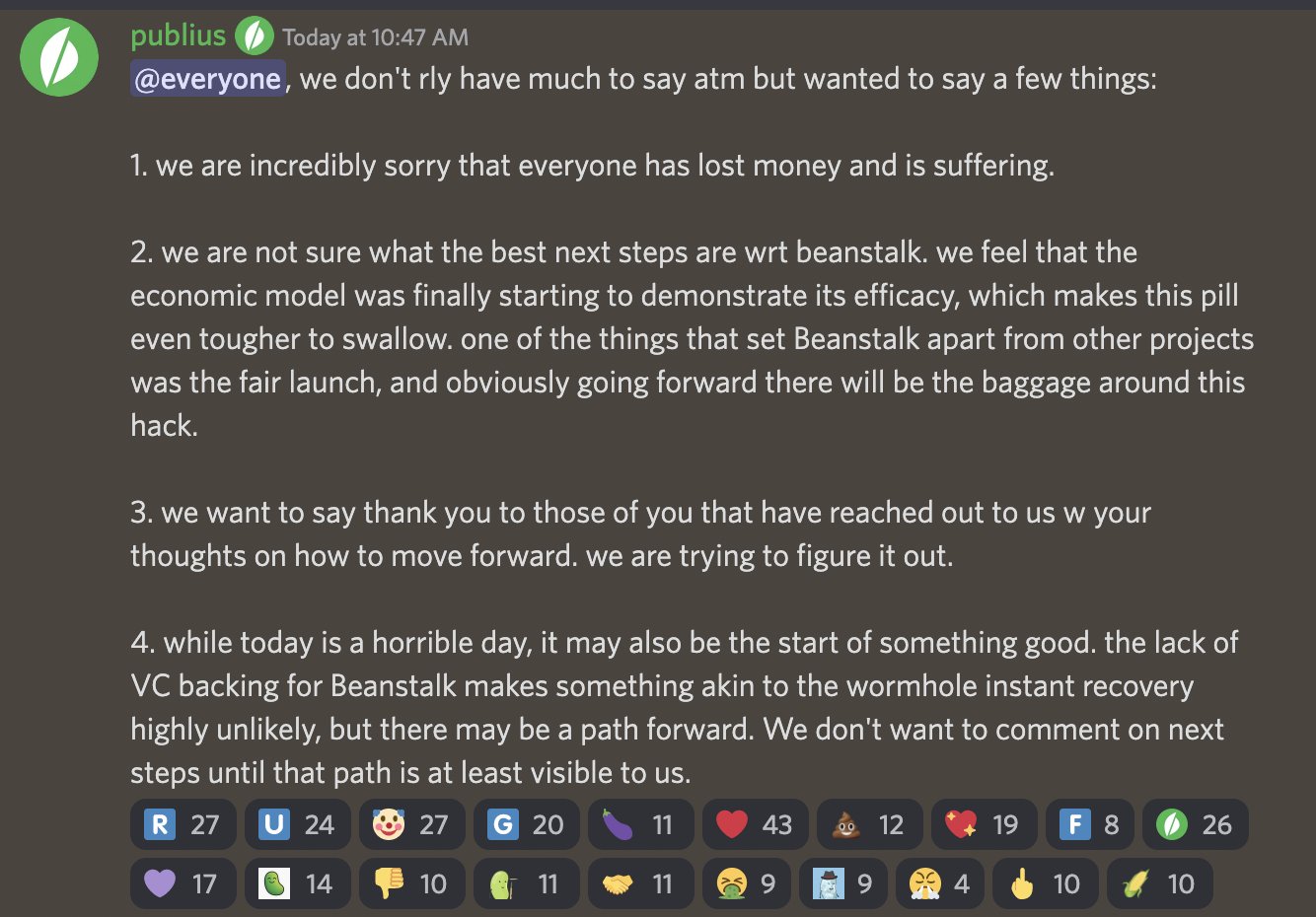

How the protocol recovers from right here can be tough to foretell. Further Discord screenshots present that the venture shouldn’t be shutting down instantly, however can be not committing in the direction of an eventual re-build:

Crypto hack mitigators Lossless have reached out and Beanstalk will seemingly want robust companions to recuperate from this. Commentors on Beanstalk’s Twitter account have speculated that it was an ‘inside job’ carried out by Beanstalk to go away retail as exit liquidity. Nevertheless, till extra particulars come to gentle, it’s all hypothesis.

We’re participating all efforts to attempt to transfer ahead. As a decentralized venture, we’re asking the DeFi group and consultants in chain analytics to assist us restrict the exploiter’s capability to withdraw funds by way of CEXes. If the exploiter is open to a dialogue, we’re as effectively. https://t.co/fwceVz6hbi

— Beanstalk Farms (@BeanstalkFarms) April 17, 2022

Associated Studying | ADA To Rebound With Integration Of USDT And USDC On Cardano

Featured picture from Pixabay, Charts from TradingView.com The author of this content material shouldn't be related or affiliated with any of the events talked about on this article. This isn't monetary recommendation.