Key Takeaways

- Twister Money is decentralized, non-custodial protocol that helps crypto customers keep non-public on public blockchains.

- It makes use of a sensible contract that lets customers ship deposits from one deal with after which withdraw the funds from to a different utterly new deal with, thus breaking the on-chain hyperlink between the funds.

- The most recent model of the undertaking helps arbitrary quantity swimming pools and shielded transactions, permitting customers to leverage the protocol as a chosen non-public pockets.

Share this text

Twister Money is a decentralized, non-custodial privateness answer for Ethereum and different good contract-enabled blockchains primarily based on ZK-SNARK expertise. It lets customers break the hyperlinks of their on-chain exercise to enhance their privateness.

Understanding Blockchain Privateness

Twister Money is a non-custodial protocol that lets customers ship ETH and different cryptocurrencies to a sensible contract on Ethereum utilizing one deal with after which withdraw the tokens utilizing a unique deal with, thus breaking the hyperlink between the deposited and the withdrawn funds.

To know Twister Money’s worth proposition, it’s first important to dispel the parable of personal cryptocurrency transactions. On-chain privateness on public blockchains like Ethereum is basically non-existent, as anybody can monitor the blockchain’s public ledger to examine all the transaction historical past of any pockets. Actually, blockchain analytics companies like Nansen are within the enterprise of doing simply that. Nansen analyzes the Ethereum blockchain, flags particular wallets and good contract addresses, interprets the insights into human-understandable kind, after which sells this tooling to crypto buyers trying to make better-informed buying and selling choices primarily based on the on-chain knowledge. Different blockchain analytics companies like Chainalysis scrutinize public blockchains and work with governments to flag, monitor, and de-anonymize sure transactions and accounts related to illicit actions.

Whereas public blockchain addresses don’t reveal customers’ identities, with some effort, particular person wallets might be de-anonymized and analyzed to extract all types of details about the person. On-chain transparency can have profound safety implications. To make an analogy with the normal world, if bank card funds labored like Ethereum transactions, all customers would have their account balances and monetary histories open for anybody to see. This might reveal delicate info resembling their salaries and spending habits, make them a goal for criminals, and far more.

In a collection of Telegram messages, Crypto Briefing spoke to representatives from Twister Money* to debate the significance of monetary privateness. They defined that the general public nature of blockchains makes it that rather more vital for customers to care about their monetary privateness and have a extra thoughtful method. They mentioned:

“A sizeable variety of people fall sufferer to scams and blackmailers because of the lack of privateness within the blockchain atmosphere. Except for people, companies are protecting of their privateness as properly, particularly relating to the ins and outs of their monetary operations (usually for a similar causes as people—vulnerability to assaults). When assessing the affect in its entirety, it’s exhausting to think about extra vital causes to prioritize monetary privateness.”

Twister Money Defined

Twister Money makes use of good contracts to just accept token deposits from one deal with. It allows withdrawals from a unique deal with, thus breaking the on-chain hyperlink between the deposited and withdrawn funds. The legacy model of the protocol is operational on Ethereum, BNB Chain, Polygon, Gnosis Chain, Avalanche, Optimism, and Arbitrum. Presently, it helps solely mounted quantity swimming pools for six tokens: ETH, DAI, cDAI, USDC, USDT, and wBTC.

To assist customers protect their privateness, Twister Money leverages a expertise pioneered by the privacy-focused blockchain undertaking Zcash known as ZK-SNARKs—in any other case often known as zero-knowledge succinct non-interactive arguments of data. Zero-knowledge proofs enable one celebration (the prover) to show to a different celebration (the verifier) {that a} explicit assertion is true with out disclosing any info other than the truth that the assertion is certainly true.

In different phrases, zero-knowledge proofs are an encryption expertise that lets one celebration show to a different celebration that they know a secret with out revealing the key. To know why Twister Money wants these proofs within the first place, it’s price exploring an instance of a typical transaction.

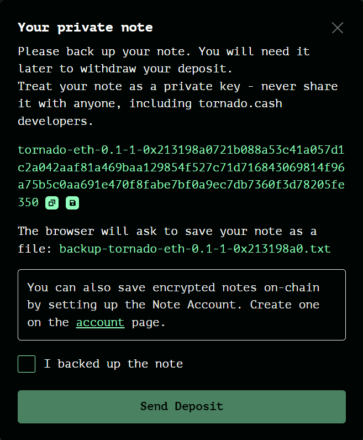

To make a Twister Money deposit, a person should first generate two cryptographically linked random numbers, known as a “secret” and a “nullifier,” after which ship the tokens alongside a hash generated from each numbers known as a “dedication” to the good contract. A “hash” is the output of a hashing algorithm, a one-way perform that generates a deterministic, fixed-length outcome from a given enter. Hashing algorithms are primary however extremely safe encryption instruments used extensively in fashionable cryptography for something from digital signature era to password verification.

Twister Money then shops the dedication to report the person’s deposit. Later, when the person needs to withdraw their funds utilizing a very totally different deal with, they have to show that they’ve a sound declare in opposition to a particular unspent deposit held within the contract with out revealing any piece of doubtless figuring out info. To do this, they arrive to Twister Money with a brand new withdrawal deal with and two zero-knowledge proofs. One proves they know a secret and nullifier whose hash matches some dedication recorded within the good contract (with out pointing to a particular dedication as to not break privateness). On the similar time, the opposite is the nullifier that hyperlinks them to a specific deposit.

As a result of Twister Money doesn’t know who’s withdrawing, it wants the second zero-knowledge proof to ensure that the identical person can’t withdraw the quantity they deposited a number of occasions. It ensures that by storing a hash of the nullifier contained in the contract after which checking whether or not the proof supplied by the person matches in opposition to it. If it doesn’t, the person can’t withdraw their funds. If it does, the nullifier hash is marked as spent, which means the person can’t use the identical nullifier to withdraw funds sooner or later.

As a result of one-way nature of hashing, it’s unattainable to hyperlink a particular dedication or deposit to a specific nullifier however attainable to generate a zero-knowledge proof confirming a particular deposit. Utilizing this encryption expertise, customers can deposit funds to Twister Money utilizing one deal with after which withdraw them to a wholly new deal with, successfully breaking the on-chain hyperlink between the 2 transactions.

Twister Money additionally must care for the transaction charges to make sure full privateness. Like all blockchain transactions, withdrawing funds from Twister Money requires paying transaction charges, which must be unattainable when one is withdrawing to a wholly new deal with. Twister Money makes use of a community of so-called “relayers” that handle all the withdrawal to unravel this. They pay for the transaction charges by deducting them immediately from the withdrawal and charging a further service price.

“If Twister Money is used accurately and all directions and ideas had been adopted diligently, it’s not attainable [even theoretically] to deanonymize transactions,” the nameless supply mentioned. And whereas there have been cases of comparable privacy-ensuring protocols or coin mixers being deanonymized up to now, resembling when Chainalysis reportedly demixed a collection of CoinJoin transactions, they defined that each one privateness protocols—together with Twister Money—are liable to person errors. They mentioned:

“Within the occasion of Chainalysis, it’s possible that the CoinJoin service wasn’t used accurately. A service like this, similar to every other (together with Twister Money), might be liable to person error—therefore the compromised privateness. For instance, even with all different privateness practices in place, a person who makes 18 deposits of 100 ETH and later withdraws those self same 18 deposits runs a excessive danger of breaking anonymity.”

That being mentioned, Twister Money makes a number of recommendations to maximise customers’ privateness when utilizing the protocol. One is to make use of the TOR browser or a VPN with a “no-log coverage” to forestall third events from studying that they’re interacting with the protocol. The opposite suggestions embrace ready a minimum of a day between deposits and withdrawals, deleting browser knowledge and cookies after every deposit, and reinstalling the pockets software or browser extension with every transaction. “Bear in mind to save lots of your notes in a safe place, clear your cookies, be affected person (the longer you wait, the upper your anonymity), and multiply withdrawal addresses,” the representatives added.

Twister Money Nova

The legacy, time-proven Twister Money protocol solely helps fixed-amount deposits, which means customers may solely deposit predefined quantities of tokens into the swimming pools. Customers would sometimes select between depositing 1 ETH, 10 ETH, or 100 ETH after which withdrawing the identical quantity later. Nevertheless, the undertaking just lately launched a brand new, upgraded model of the protocol known as Twister Money Nova that helps arbitrary quantity swimming pools and so-called shielded transactions.

Arbitrary quantity transactions enable for deposits and withdrawals of utterly personalized quantities of ETH, whereas shielded transactions let customers switch the custody of their tokens with out ever leaving the swimming pools. Shielded transfers enhance transactional privateness as a result of the transferred quantities are hid from public view. Furthermore, they considerably enhance person expertise, permitting the protocol for use like a devoted privateness pockets.

“Nova affords yet one more enhancement to privateness as a result of now, fairly than storing balances with separate notes for particular quantities, a person can start using Nova very like a crypto pockets,” the representatives mentioned. “Balances can merely be saved within the dApp for so long as wanted, minimizing pointless manipulations and thus maximizing privateness by default.”

Nova is a groundbreaking expertise as a result of, fairly than merely breaking the on-chain hyperlink between two wallets, it lets customers privately transfer funds from one pockets to a different and use the protocol as a shielded pockets to remain completely non-public whereas working inside decentralized finance.

Criticism and Scrutiny

As a result of nature of Twister Money’s product, it has confronted criticism and occasional scrutiny from the cryptocurrency group and mainstream world alike. That’s as a result of it’s popularly utilized by criminals after they steal funds on the blockchain. Hacks and scams are an everyday incidence in crypto, with tens of millions of {dollars} misplaced in DeFi rug pulls and different assaults regularly. In January, hackers stole $34 million from the crypto change Crypto.com then tried to launder a bit of the funds by means of Twister Money. DeFi hackers continuously goal good contract vulnerabilities to empty liquidity swimming pools then flip to Twister Money to maneuver the stolen funds with out leaving a paper path behind.

As multi-million greenback hacks have more and more attracted the curiosity of authorities and mainstream information publications, Twister Money has additionally discovered itself beneath the highlight. Earlier this month, Bloomberg ran a misleading article titled “Crypto Mixer Twister Money Doesn’t Plan to Comply With Sanctions” in reference to the West’s current financial sanctions in opposition to Russia. Twister Money’s Roman Semenov described the piece as “an instance of dishonest journalism” in a tweet; the headline was later amended.

Crypto Briefing requested the nameless supply whether or not the Twister Money staff had ever been contacted by regulation enforcement businesses however didn’t obtain a transparent reply. As an alternative, they mentioned that they didn’t know.

Closing Ideas

Twister Money is certainly one of only a few protocols that has grow to be an Ethereum staple in slightly over two years since launching. Up to now, the legacy protocol has welcomed over 12,000 distinctive customers and acquired over $5.9 billion in deposits. A big a part of its success might be attributed to its excellent product-market match. Twister Money has constructed a privacy-ensuring product in a really clear atmosphere.

Twister Money is a working, well-designed, well-thought-out product. Simply as importantly, in lots of respects, it’s unstoppable. It’s totally decentralized with governance dealt with by a DAO, the code is open-source, and the good contracts making up the product’s core are totally autonomous and deployed by the group. Now that they’re deployed on the blockchain, there isn’t any approach of shutting them down—no matter how authorities might really feel concerning the undertaking. The group additionally hosts the person interface on the InterPlanetary File System, a peer-to-peer protocol for storing and sharing knowledge in a distributed file system, which minimizes the chance of censorship.

On the subject of shifting cash on public blockchains, privateness is sort of synonymous with operational safety, making Twister Money one of many premier security-enhancing protocols within the trade.

Disclosure: On the time of writing, the creator of this function owned ETH and a number of other different cryptocurrencies.

*The quotes from our dialog had been initially attributed to the Twister Money core staff. The nameless supply we spoke to later mentioned that the quotes got here from members of the Twister Money DAO.