Ethereum, the second-largest cryptocurrency on the planet, witnessed loads of volatility in its costs after the merge. Nonetheless, during the last seven days, Ethereum’s worth appears to be forming a plateau. In reality, it seems that the whales might cease supporting Ethereum.

Right here’s AMBCrypto’s Value Prediction for Ethereum for 2022-2023

Taking a more in-depth look

One of many causes for the expansion in Ethereum’s costs may very well be massive buyers. In response to analytics provider CryptoQuant’s replace, a spike in costs with low buying and selling quantity may point out that the value motion is on the mercy of whales.

Curiously, at press time, it appeared that the whales started to lose curiosity in ETH.

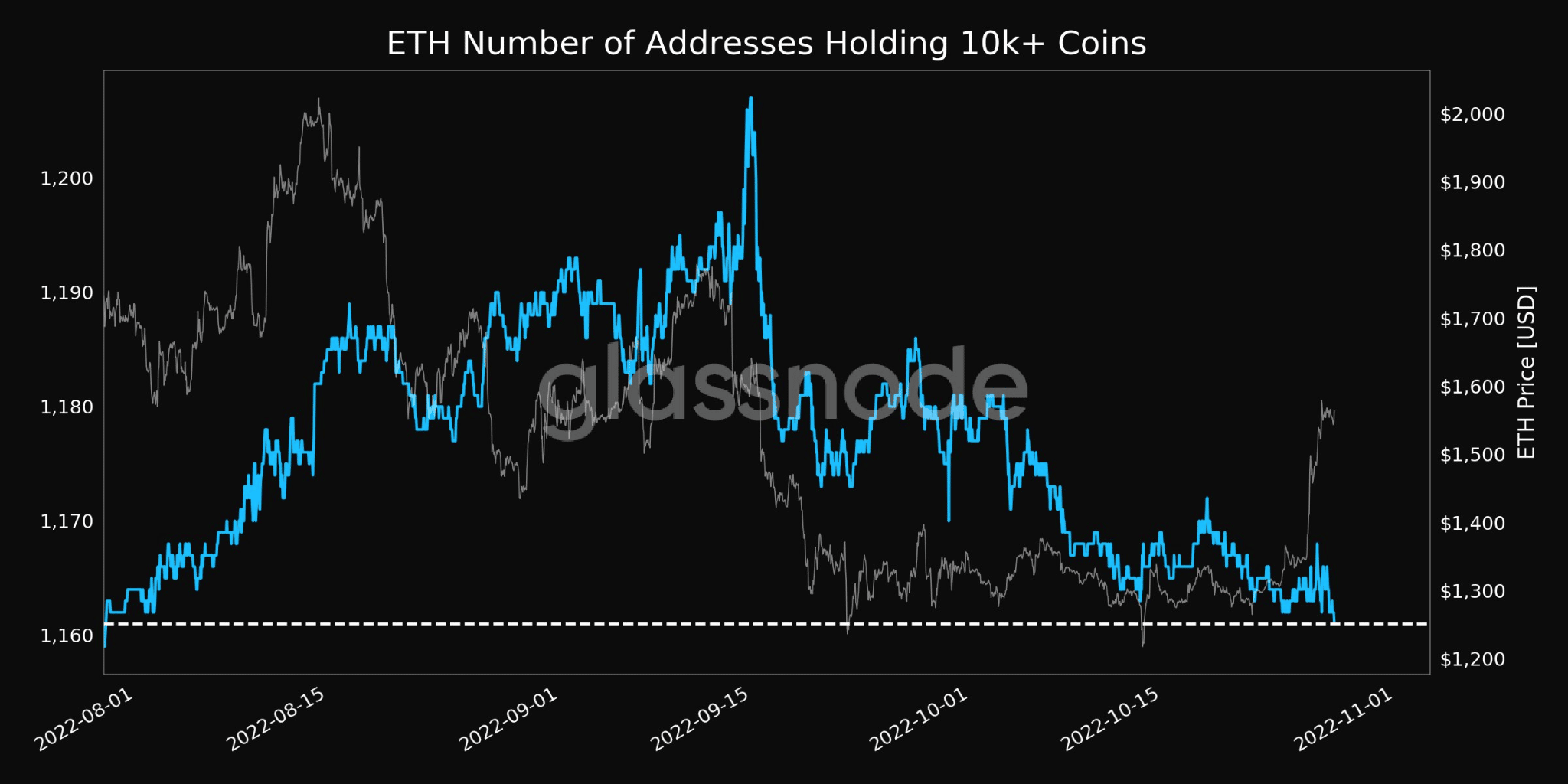

A tweet posted by analytics firm glassnode, indicated that the variety of addresses holding greater than 10 thousand cash had decreased to succeed in a 1-month low.

Supply: glassnode

Together with the decline in addresses holding large quantities of ETH, the variety of energetic addresses additionally witnessed a decline. In response to glassnode’s data, the variety of energetic addresses on the Ethereum community decreased and reached a 3-month low on 27 October.

Regardless of the decline in exercise, there have been different areas the place Ethereum confirmed positive factors.

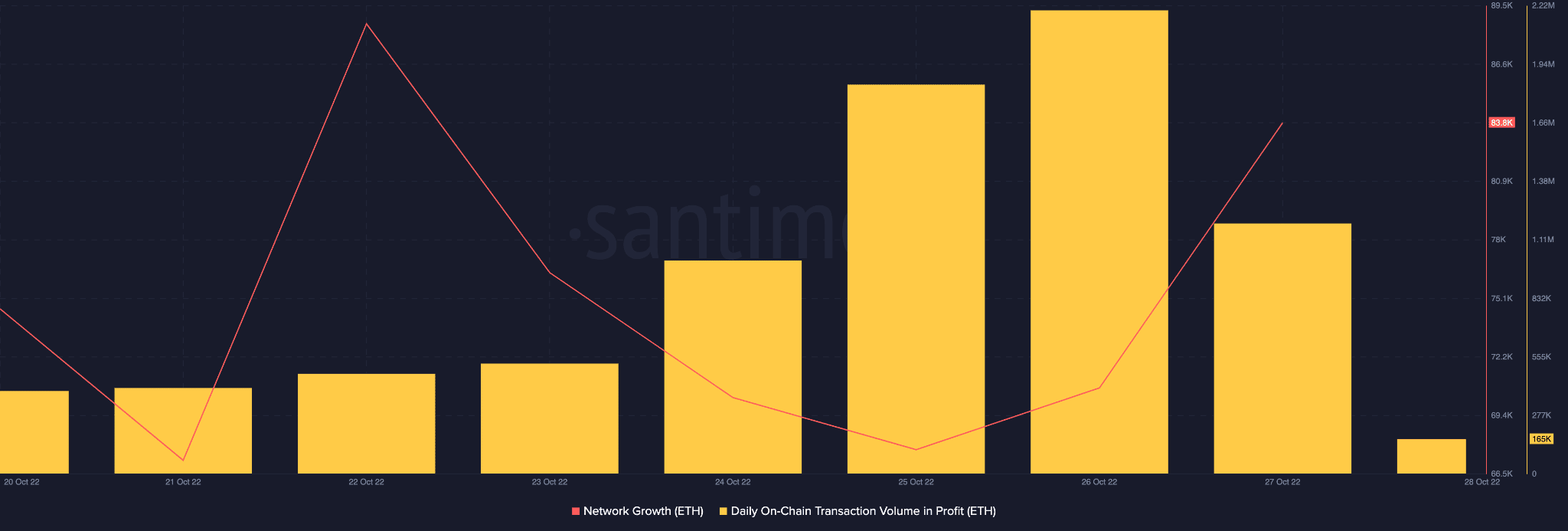

Ethereum’s community progress elevated over the previous few days. Thus, indicating that the variety of new addresses that transferred Ethereum for the primary time elevated.

Moreover, the quantity of transactions in revenue additionally elevated throughout the identical time interval.

Supply: Santiment

Regardless of the volatility of Ethereum’s present state, main companies continued to indicate their religion within the altcoin.

For example, Google, in a weblog put up posted on 28 October, introduced that they are going to be launching a Blockchain node engine, which is able to assist prospects monitor their Blockchain nodes.

At press time the service was solely obtainable for the Ethereum community, Google will ultimately plan on offering this service to extra networks later. Nonetheless, there’s a chance that Ethereum may benefit from the first-mover benefit on this state of affairs.

It stays to be seen what path ETH will take sooner or later.

On the time of writing, Ethereum was buying and selling at $1,500 and had depreciated by 3.06% during the last 24 hours. Ethereum’s quantity additionally decreased by 14.98% throughout the identical time interval.