Key Takeaways

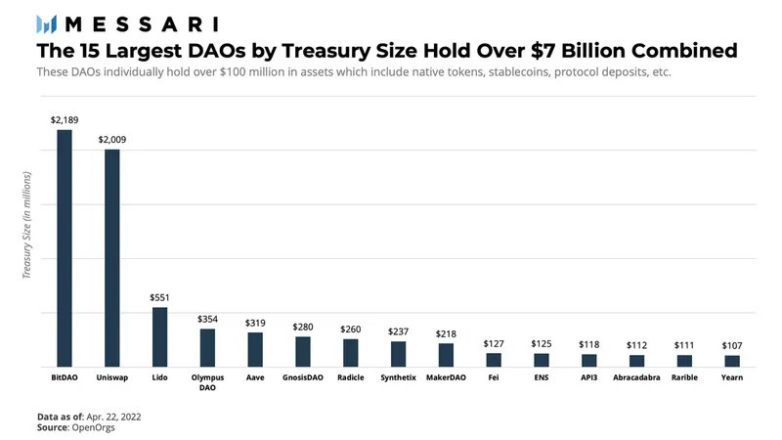

- Information from Messari exhibits that DAOs held $11 billion by the top of 2021, with $7 billion held by the 15 largest DAOs.

- The grand complete ($11 billion) represents a forty-fold enhance in DAO treasury holdings over the course of 2021.

- Messari warned that the composition of a treasury can have an effect on the soundness of the DAO as token costs change.

Share this text

New information from Messari means that decentralized autonomous organizations (DAO) holdings grew considerably throughout 2021.

DAO Treasuries Attain $11 Billion

DAO treasuries cumulatively held greater than $11 billion in cryptocurrency on the finish of 2021, Messari reported Tuesday.

Although that worth is scattered amongst 1000’s of DAOs, the 15 largest DAOs held $7 billion of the whole worth.

Simply two treasuries—these belonging to BitDAO and Uniswap—accounted for $4.2 billion of the whole, with every holding roughly $2 billion. Different giant DAOs embody these of standard DeFi platforms akin to Aave, Synthetix, Maker, Yearn, and varied others.

The collective worth held by DAOs on the finish of 2021 was 40 occasions bigger than it was at the start of that 12 months. At the moment, treasuries would have held roughly $275 million.

Funding Breakdown Impacts Stability

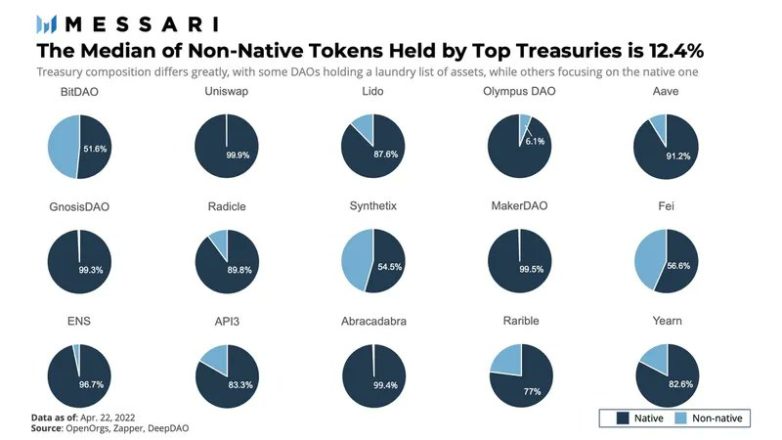

Messari broke DAO treasuries down into three classes of property: native tokens, deposits in different protocols, and different crypto property.

This breakdown of holdings impacted venture economics. “Holding giant sums of the native token implies that worth modifications can have an effect on the treasury worth massively,” Mesari famous.

It noticed that Uniswap has a treasury made up virtually solely of native tokens. As such, it warned that Uniswap is in a “precarious place” if its native UNI token crashes.

Different treasuries which can be made up of greater than 99% native property embody these of Gnosis, Maker, and Abracadabra.

Messari additionally discovered that small treasuries containing lower than $125 million have a tendency to carry stablecoins. The treasuries of Aave, Maker, APi3, Abracadabra, and Yearn every consisted of 95% stablecoins after omitting the protocol’s native asset.

In a separate article, Messari stated that DAOs have “a case for buying and selling for stablecoins or staking in different initiatives” so as to keep away from the dangers that include filling a treasury with native tokens.

The Rise of DAOs

Decentralized autonomous organizations have existed since 2016. Although the primary DAO was a failure as a result of it was hacked, the mannequin has change into a key a part of the Ethereum ecosystem.

Typically, DAOs act as governance protocols: they permit token holders to vote on the path of a blockchain venture’s improvement or vote on treasury spending.

A number of DAOs in current months have been used for fundraising functions. Examples embody fundraisers for Ukraine, Wikileaks founder Julian Assange, and Silk Street founder Ross Ulbricht. Websites like Juicebox have enabled people to simply create such fundraisers.

Nonetheless, the biggest DAOs are nonetheless primarily used to control blockchain initiatives, as seen in Messari’s information above.

Disclosure: On the time of writing, the creator of this piece owned BTC, ETH, and different cryptocurrencies.