FTX has misplaced a number of potential rescuers after shady particulars of the interior workings proceed to emerge. The most important setback was Binance pulling out of the deal.

However in keeping with the crypto large’s CEO, the cope with FTX didn’t make sense.

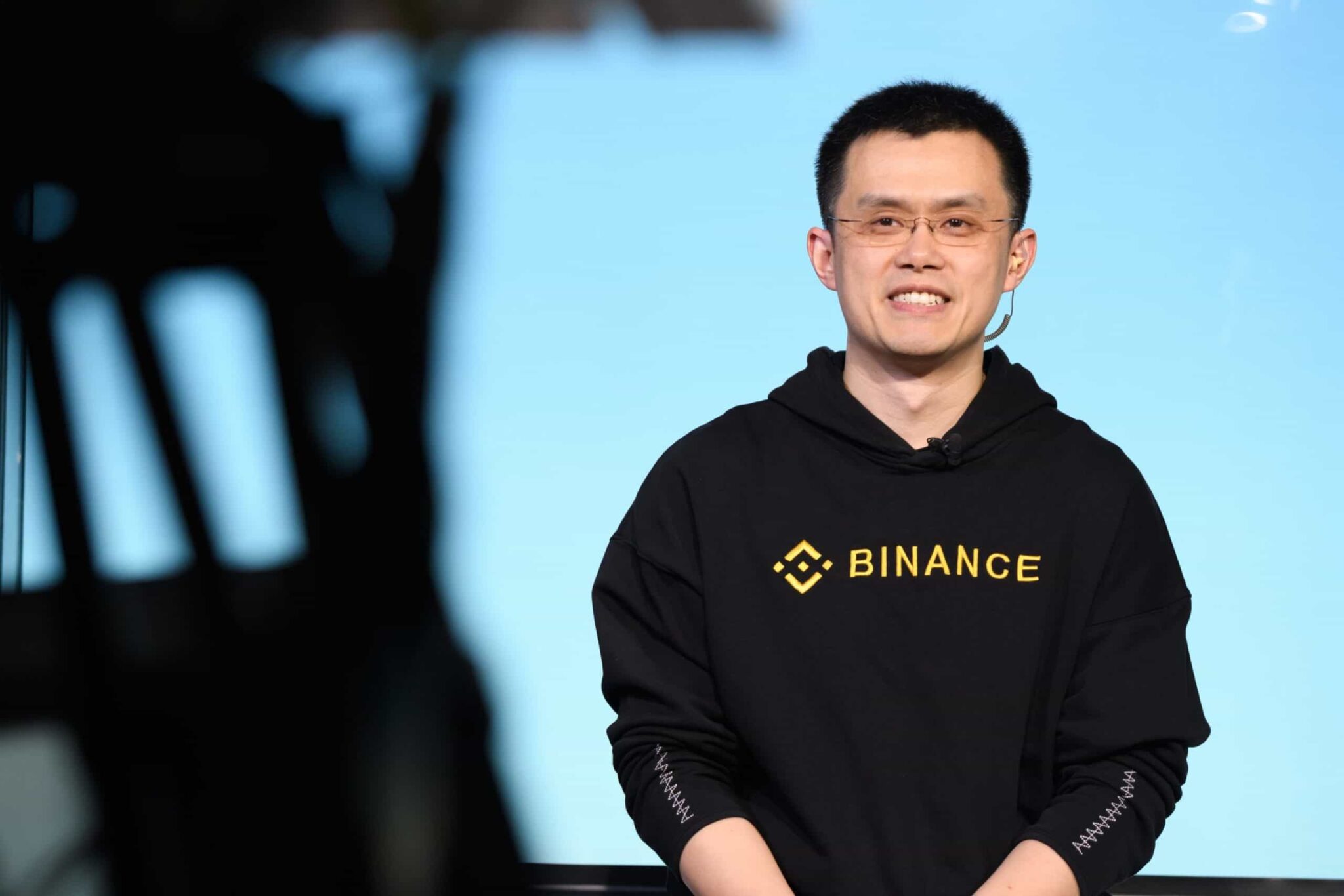

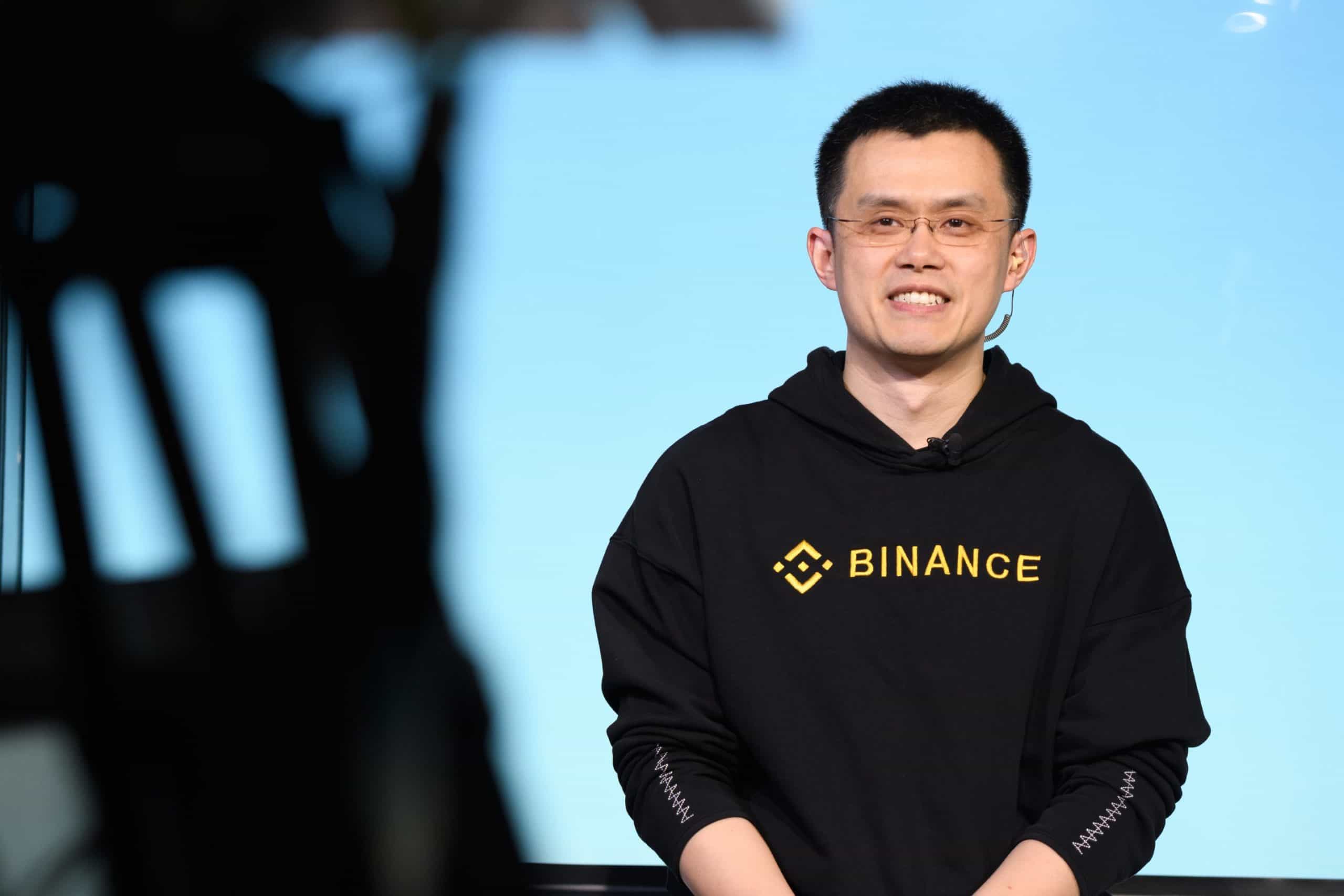

- Whereas talking on the Indonesia Fintech Summit, Changpeng “CZ” Zhao weighed on the takeover that by no means materialized and the rationale behind it.

“From a monetary perspective, there’s a huge gap. From new customers, we’ve got very excessive overlaps. We cowl all of the areas they cowl they usually have a lot much less customers than us. From a know-how or product perspective, I believe we’ve got a superior product. They don’t have something we don’t have.”

- In line with CZ, the unique intention was to “defend” the customers. Nonetheless, the stories of misappropriating consumer funds in addition to probes from US regulatory companies prompted Binance to name off the takeover.

- The exec additionally stated that there will likely be shift in regulatory perspective.

- Earlier, watchdogs have been extra involved about KYC/AML compliances. However with FTX happening, the main focus will likely be on alternate operations, enterprise fashions, and proof-of-reserves.

- Bankman-Fried had reportedly approached stablecoin issuer Tether, crypto alternate and Kraken OKX in addition to enterprise capital agency Sequoia Capital for $1 billion or extra from every of the platforms.

- Tether CTO Paolo Ardoino confirmed that having no plans to take a position or lend cash to FTX or its sister buying and selling firm, Alameda, which is on the heart of the debacle.

Binance Free $100 (Unique): Use this hyperlink to register and obtain $100 free and 10% off charges on Binance Futures first month (phrases).

PrimeXBT Particular Supply: Use this hyperlink to register & enter POTATO50 code to obtain as much as $7,000 in your deposits.