The full cryptocurrency market capitalization recovered from the day gone by and stood at $978.77 billion at 06:00 UTC on Sept 8 — up by 4.29% over the previous 24 hours.

Bitcoin’s market cap grew roughly 2.5% — $10 billion — over the day to $369.61 billion. Ethereum’s market cap, then again, elevated 8% to $199.87 billion from round $185 billion on Sept 7.

After a day within the purple, the highest ten cryptocurrencies adopted the restoration of Bitcoin (BTC) and Ethereum (ETH), with Binance Coin (BNB) posting the second highest beneficial properties of 6.35% after Ethereum, in response to CryptoSlate knowledge.

Tether (USDT) and USD Coin (USDC) market caps remained flat over the day, at $67.55 billion and $ 51.69 billion, respectively. BinanceUSD (BUSD) market cap additionally remained flat and stood at $19.70 billion as of press time.

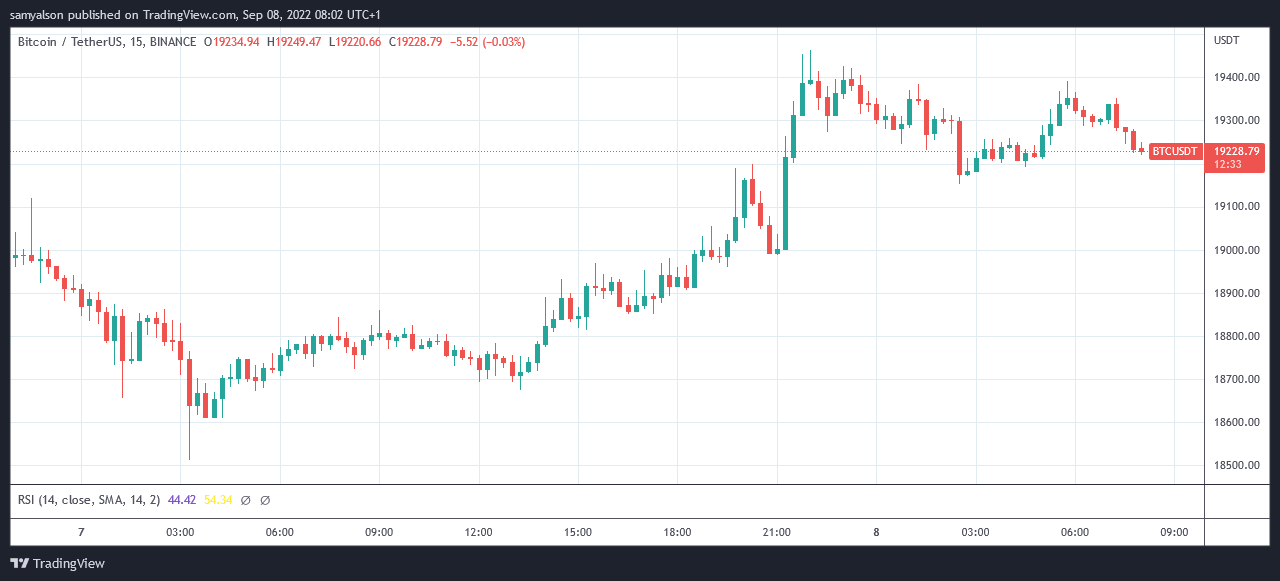

Bitcoin

After the value drop on Sept 6, BTC recovered barely over the previous 24 hours and was buying and selling at round $19,306 at 06:00 UTC — up 2.91% throughout the day. Nevertheless, regardless of the value restoration, BTC’s market dominance dropped additional to 37.8% as of press time, in comparison with 38.3% on the day gone by. The market dominance of BTC is slipping decrease on daily basis, with the present ranges final seen over 4 years in the past.

The restoration of the most important cryptocurrency lacked momentum, and the market sentiment stays primarily bearish. The Bitcoin worry and greed index factors to excessive worry.

Over the previous 24 hours, BTC traded between $18,800 and $19,400. At round 20:00 UTC on Sept 7, BTC bagged its most vital beneficial properties for the day when the value jumped from round $19,000 to above $19,350.

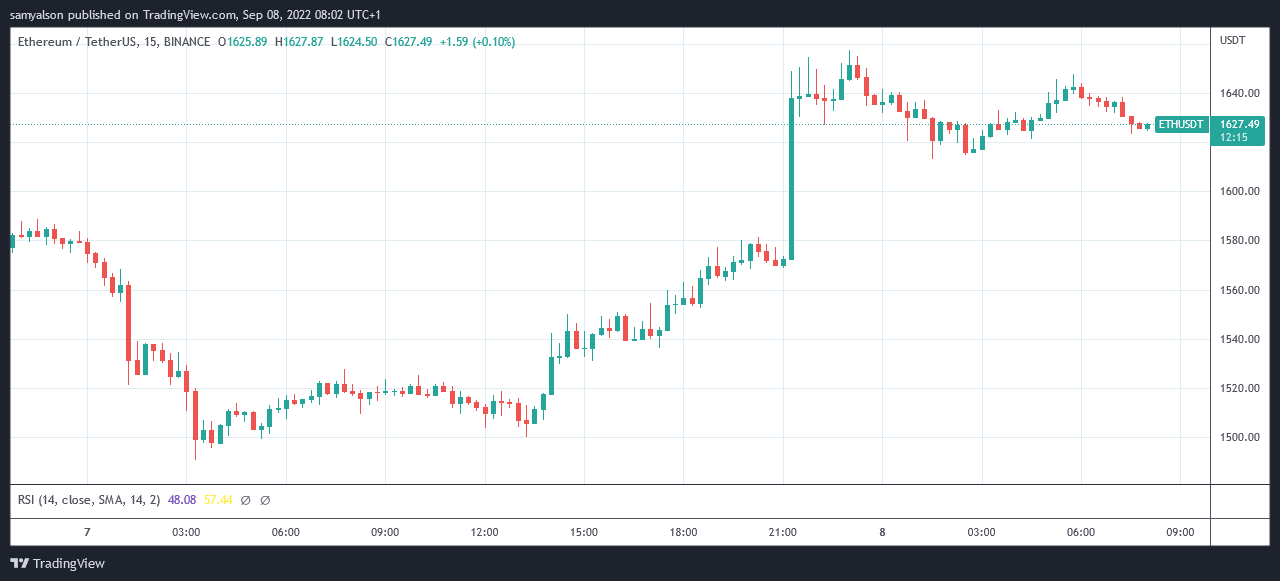

Ethereum

ETH worth rose 7.82% over the previous 24 hours to commerce at round $1,634 at press time, recouping all its losses from the day gone by. Anticipation across the Merge — scheduled for thirteenth – fifteenth Sept — has been the important thing driver of ETH worth development over the previous few weeks.

ETH worth recovered quicker than BTC, protecting with the persistently higher efficiency over the previous month because the Merge strikes nearer. Complete ETH staked within the ETH 2.0 contract remained secure at 14.27 million, in response to Ethereum Basis knowledge.

From round $1,500 the day gone by, ETH continued to climb to round $1,570 by 19:00 UTC. The momentum helped the token break the $1,600 mark and went as excessive as $1,650.

High 5 gainers

Terra Basic

LUNC posted essentially the most important beneficial properties of the day, rising 44.35% and buying and selling at $0.00053 on the time of publishing. The community’s V22 improve, which enabled token staking late final month, supplied a lift to the neighborhood. The token is up 128.44% over the previous week.

Helium

HNT worth noticed excessive volatility over the previous 24 hours, rising 35.08% to commerce at $5.22 at press time. Between 01:00 am and 03:00 am UTC, the token worth plunged from $5.28 to $3.59 and again as much as round $5.18. The token is down 38.37% over the previous 30 days. Ever because the builders recommended shifting the mission to the Solana community, the neighborhood has been plunged into doubts.

Synapse

SYN worth grew 22.71% over the previous 24 hours to commerce at $1.59 at press time. The token recovered all its losses from the day gone by and is up 31.68% over the previous week. The fluctuations within the token’s worth might be attributed to volatility.

EOS

The value of EOS grew 22.54% over the previous 24 hours, and on the time of publishing, the token was buying and selling at $1.70. The token is up 43.22% over the previous 30 days.

iExec RLC

RLC recouped most of its month-to-month losses after rising 18.98% over the previous 24 hours to commerce at $1.22 as of press time. From simply above $1, the token worth went as excessive as $1.26 throughout the day.

High 5 losers

Netvrk

NTVRK fell 5.47% over the previous 24 hours and was buying and selling at $0.22 on the time of publishing. The token skilled excessive volatility all through the day.

Chain

XCN posted losses of 4.49% over the previous 24 hours. The token was buying and selling at $0.06 as of press time, widening its weekly losses to 14.24%. The token has been persistently buying and selling downwards since Aug 22.

Request Community

REQ was buying and selling at $0.12 as of press time, down 1.95% over the previous 24 hours. Throughout the day, the token worth spiked to $0.13 however fell again quickly after.

DeFiChain

DFI continued to lose steam, slumping by 1.66% over the previous 24 hours and buying and selling at $1.01 as of press time. The token has undergone a correction, eliminating all losses from earlier this month.

OKB

The native token of crypto alternate OKX is down 1.49% over the previous 24 hours, buying and selling at $13.91 on the time of publishing. At round 14:30 UTC, the token worth fell sharply from round $14.35 to $13. 40, however has recovered barely since then.