Sub-saharan Africa recorded $100.6 billion price of crypto transactions on-chain between July 2021 and June 2022, in accordance with a Chainalysis report.

Whereas it represented a development of 16% year-over-year, it accounted for less than 2% of world crypto transactions — the bottom on this planet.

Nonetheless, the newest Chainalysis report signifies that the area has a few of the most well-developed crypto markets, with:

“Deep penetration and integration of cryptocurrency into on a regular basis monetary exercise.”

Chief in small retail crypto transactions

In Sub-saharan Africa, retail crypto transfers account for 95% of all crypto-related transactions within the area, in accordance with the report.

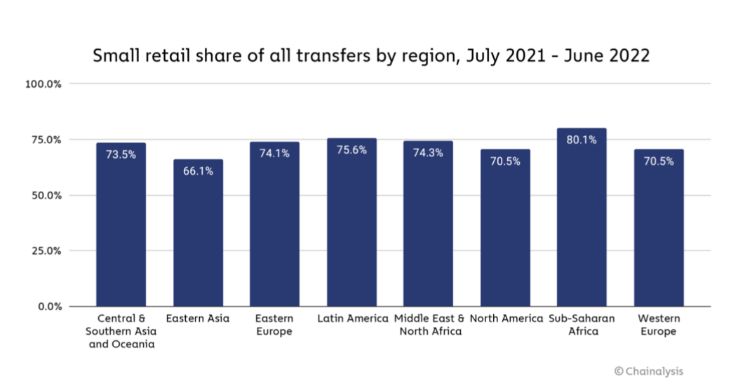

Small retail transfers of lower than $1,000 made up for 80% of crypto transactions between July 2021 and June 2022, greater than every other area on this planet. Comparatively, the share of small retail crypto transfers in North America stood at 70.5% throughout the identical interval.

Nigerian blockchain consultancy and product studio Convexity founder Adedeji Owonibi instructed Chainalysis that Sub-saharan Africa doesn’t have institutional crypto buyers. As a substitute, the area’s crypto market is pushed by retail utilization, the place day by day merchants attempt to earn a dwelling amid excessive unemployment charges. He added:

“It [crypto] is a solution to feed their household and resolve their day by day monetary wants.”

Subsequently, the adoption of cryptocurrencies is being pushed by necessity in Sub-saharan Africa. This is the reason the variety of small retail transactions within the area grew when the bear market began in Could 2022, in accordance with Chainalysis information.

The report additional acknowledged that the fluctuating worth of fiat currencies of some nations within the area — comparable to Kenya and Nigeria — present additional incentive to commerce cryptocurrencies, particularly stablecoins. Many buyers within the area have turned to stablecoins to keep up their financial savings amid the volatility of native currencies.

Peer-to-peer buying and selling is the important thing

Based on the Chainalysis report, P2P exchanges account for six% of all crypto transactions within the area.

Anti-crypto rules, like Nigeria banning banks from interacting with crypto companies in 2021, have brought about increasingly more folks to show to P2P trades.

Moreover, P2P buying and selling just isn’t solely restricted to P2P exchanges within the area like Paxful, whose clients grew 55% year-over-year in Nigeria.

Based on the report, crypto merchants within the area additionally perform non-public trades through teams on social media platforms like WhatsApp and Telegram.

Crypto for remittances and worldwide enterprise funds

The Sub-saharan area has hundreds of cost techniques with no interoperability or communication with one another.

Sending a cost to a rustic within the area may be extraordinarily costly in comparison with crypto.

Companies within the area with worldwide suppliers additionally use crypto to make funds.