newbie

Cryptocurrency continues to be an extremely new and younger discipline. In consequence, many individuals don’t actually know easy methods to strategy it, which may result in losses. There nonetheless aren’t that many established methods that may let you know precisely easy methods to make most revenue with crypto. Buyers and crypto merchants should be fast on their ft and provide you with new approaches on a regular basis.

Nonetheless, that doesn’t imply there are not any “guidelines” in the case of earning money with cryptocurrencies. There are some widespread errors individuals typically make that may trigger them to lose their cash. Let’s check out a few of them – and the way they are often prevented!

Please observe that this text doesn’t represent funding recommendation.

Going All-In

Some of the important errors individuals make once they first start crypto investing goes all in. There are two sides to this: placing all of your eggs in a single basket and investing all of your out there sources immediately.

The primary mistake – investing all of your cash in a single coin or token – is written down in all Funding 101 rulebooks. Diversification is the muse of any profitable portfolio, and that is very true for industries like crypto, the place costs can crash inside hours, if not minutes.

TIP: Studying extra concerning the crypto market is an effective way to diversify your funding portfolio. In the event you don’t need to trudge by means of hundreds of thousands of crypto cash, think about following influencers that spotlight attention-grabbing tasks or signing up for an e mail subscription service.

One other mistake individuals make goes all in with their funds. Keep in mind that funding and buying and selling are additionally a ability – and studying easy methods to do them effectively can take time. Cash isn’t going wherever, so don’t be afraid to take it straightforward at first and begin your journey with small quantities and demo accounts.

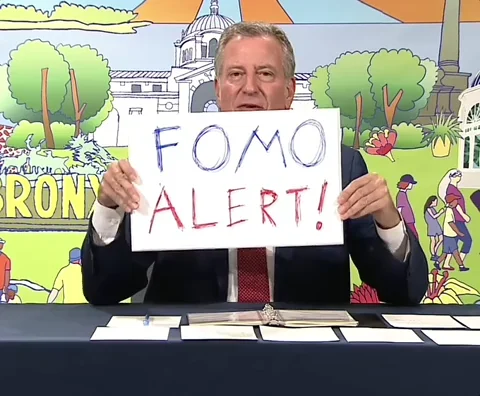

Shedding To FOMO

FOMO is principally one of many 4 horsemen of the cryptocurrency market. Everybody is aware of about it, has heard one million instances that they want to pay attention to it, and but… When the time comes, it may be so onerous to withstand it, particularly should you like cryptocurrency just for the revenue it might offer you.

Now, there’s no disgrace in eager to earn extra. Nonetheless, you must all the time do not forget that there’s no such factor as free cash. When the hype for the coin is excessive, or when it’s dying down and the costs are declining, the remainder of the market sees it, too – and might react accordingly.

One of many greatest threats FOMO poses is that it typically forces us to make rash selections… which within the crypto world can result in falling prey to scammers. Think about if all of your on-line associates and communities are raving concerning the newest trending coin, and you then all of the sudden get a DM from a seemingly acquainted face a few technique to get that coin quick with out having to pay excessive charges or coping with unstable charges on exchanges.

Though laid out like this a message like that clearly screams “rip-off alert”, within the spur of the second, FOMO could make you click on on the hyperlink in it, resulting in you shedding entry to your funds.

You’ll be able to be taught extra about FOMO and the methods to combat it on this article.

Neglecting Your Feelings

This error ties into the earlier one. Some individuals make investments with their coronary heart, not their mind. It’s tremendous should you’re solely having enjoyable with smaller quantities and are able to lose your funds, however it may be detrimental to your checking account should you let your feelings rule over you when approaching crypto significantly, with an intention of earning money.

Studying easy methods to handle your temper and feelings effectively is a ability that can be helpful even past your crypto funding journey. Controlling your self will enable you to to make knowledgeable selections and keep away from pointless losses.

For instance, let’s think about Eric, a newbie crypto dealer and investor. He began off by shopping for Ethereum when it boomed in 2017. Then, he bought it in 2019 after shedding his religion within the crypto market. Afterwards, he purchased in once more when crypto boomed in the beginning of the pandemic, and – you guessed it – bought his ETH when the market slowed down a month or so later. Eric was caught in a typical crypto limbo as he stored letting his feelings make his trades for him.

TIP: Whereas fast reactions could be actually vital within the crypto world, attempt to keep away from making spur-of-the-moment selections. Give your self a while to suppose your trades over.

Not Studying From One’s Errors

An vital a part of studying any ability is trying again at what you have got executed beforehand and studying out of your errors. Nonetheless, many individuals neglect this rule in the case of crypto.

We expect it stems from some individuals probably not taking cryptocurrency significantly. Actually, many new crypto traders in all probability see it as one thing akin to playing. And whereas crypto’s volatility can generally be as unpredictable as a slot machine, there’s nonetheless a technique to cryptocurrency funding and buying and selling.

A great way to interrupt out of this behavior is maintaining monitor of your outcomes. First, write down all transactions you make. Though there are apps that present your buying and selling historical past, it’s good to have all that info in a single simply accessible place. Analyze these outcomes, and attempt to see if there are any patterns you’ll find, particularly ones that often result in losses.

Going In With out A Plan

A mistake individuals typically make in the case of working with crypto isn’t having any plan. To begin with, you must set up what your targets are. Do you need to be taught extra concerning the market or make a revenue? What return do you need to see? And “as a lot as potential” isn’t actually an excellent reply – you must purpose to maintain your targets real looking. You also needs to determine how a lot cash you may afford to lose – and by no means spend greater than that.

Earlier than you begin investing or buying and selling crypto, you also needs to get a dependable pockets. In the event you plan on holding giant quantities of cash, it’ll be value it to get a {hardware} pockets. Bear in mind to by no means share your non-public key with anybody.

As soon as that’s executed, you can begin researching the other ways you need to use crypto to make cash. And there’s loads of them! Though the cryptocurrency business is comparatively younger, there’s loads of innovation surrounding it. Formulate your funding technique, but additionally be prepared that it might have to vary if it doesn’t work in addition to meant. In the event you’re attempting one thing new, attempt to check the waters first and use stop-loss orders if potential.

Don’t be afraid to go for methods you’ve by no means heard of earlier than. For instance, do you know that some individuals make cash with crypto by taking part in video games? There are some NFT platforms that provide you with tokens for finishing duties along with your digital avatar, or PvP-ing to your coronary heart’s content material.

TIP: To be taught extra about new methods of incomes revenue with digital currencies, be part of crypto communities on Discord and different social media platforms. Customers there are sometimes blissful to offer recommendation and share recommendations on revolutionary makes use of of blockchain expertise!

Underestimating Margin Buying and selling Dangers

Margin buying and selling is a sophisticated buying and selling technique, however this error is sadly all too widespread within the crypto world. Whereas there are not any research that may conclusively inform us why it occurs so typically, we predict it has one thing to do with the excessive threat, excessive reward nature of the cryptocurrency market. Margin buying and selling raises the stakes even greater than normal crypto buying and selling, which attracts risk-takers.

So as to add to that, many crypto exchanges are… very loosely regulated, to say the least. In consequence, you might get entry to margin buying and selling lengthy earlier than you’re prepared for it – and it might even be out there as a fundamental function, in-built in the usual buying and selling terminal and never even locked behind two-factor authentication.

Keep away from utilizing leverage until you actually know what you’re doing, and don’t neglect about options like cease losses. In the event you do determine to commerce with leverage, put together your self mentally that you could be obtain a margin name and take into consideration methods to offset your threat.

Ultimate Ideas

There are various crypto errors that we haven’t even touched on on this article. Nonetheless, most losses could be averted should you comply with the fundamental funding guidelines: diversify, do your personal analysis, and be taught out of your errors.

There are numerous the explanation why you might lose your cash within the crypto market: a few of them could be prevented, whereas others occur as a result of unhealthy luck. In the event you’re sad along with your fee charges or charges, you may all the time contact the help group of the alternate you’re utilizing. And don’t hesitate to step again should you ever really feel like your crypto journey is turning into a adverse expertise – cryptocurrency isn’t going wherever!