Analysts have predicted that the crypto mining market will develop at an 11.4% compound annual development charge (CAGR) from 2023 to 2032. However what can drive that development?

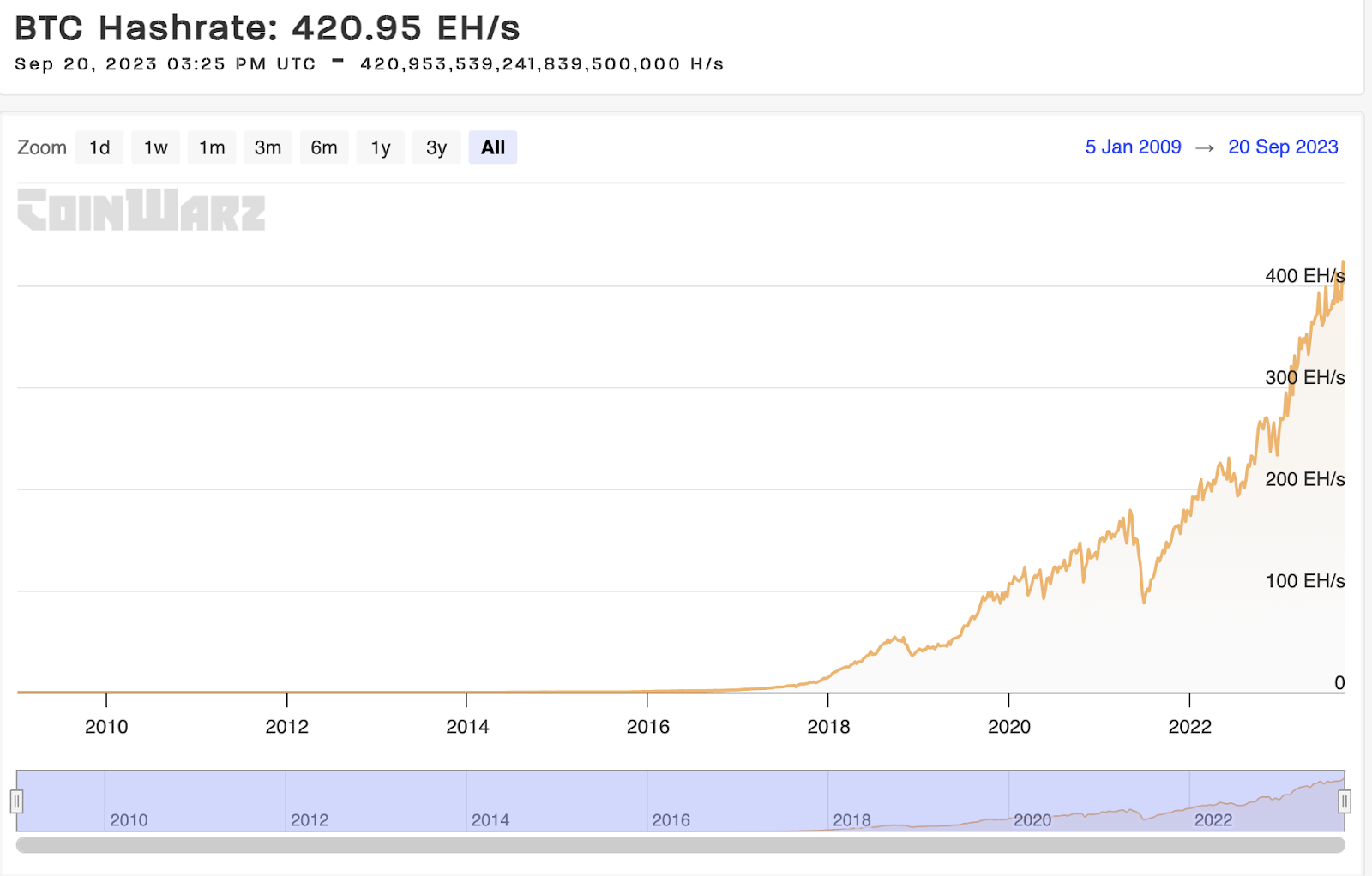

After the collapse of FTX final 12 months, many mining firms needed to wrap up their operations. Whereas mining shares have recorded staggering development this 12 months, the businesses are dealing with points with profitability as a result of rising hash charges and mining difficulties.

Prime Impacting Elements for Crypto Mining Market Progress

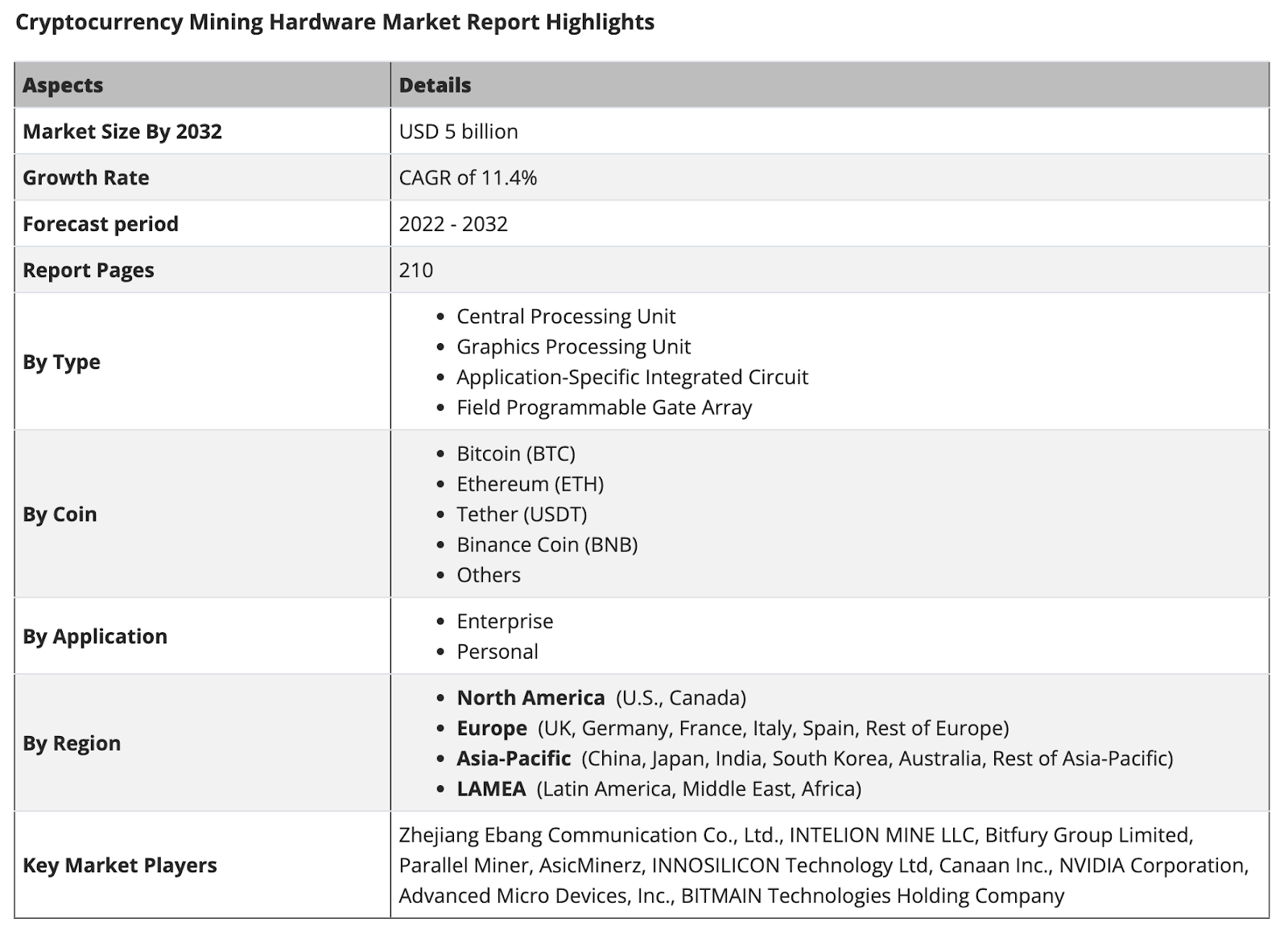

In response to a report from Allied Market Analysis, the crypto mining market will attain a valuation of $5 billion by 2032. The report mentions that the market’s present valuation stands at $1.8 billion.

The analysts listed the next causes as the highest impacting elements for the expansion of the crypto mining market:

- Improve in adoption of the digital forex.

- Improve in the usage of digital transformation expertise.

The report additionally lists the “enhance in web penetration charge and elevated launch of superior cryptocurrency mining processors” as a chance for the crypto mining business. Conversely, the excessive value of crypto mining {hardware} is difficult for the sector’s development.

Click on right here to learn our evaluation of the cloud mining platform BitFuFu.

Crypto mining market report highlights. Supply: Allied Market Analysis

Earlier this month, BeInCrypto reported that the profitability of the Bitcoin miners is being impacted because the hash charge and mining issue consistently hit new all-time highs. After all, a rise in these metrics makes the Bitcoin community safer, however on the flip aspect, it additionally will increase the miners’ prices.

Certainly, one of many key market gamers, Canaan, recorded $22.5 million greater losses in Q2 2023 in comparison with Q1.

Click on right here to learn to construct a mining rig

Bitcoin hashrate hovers round all-time highs. Supply: CoinWarz