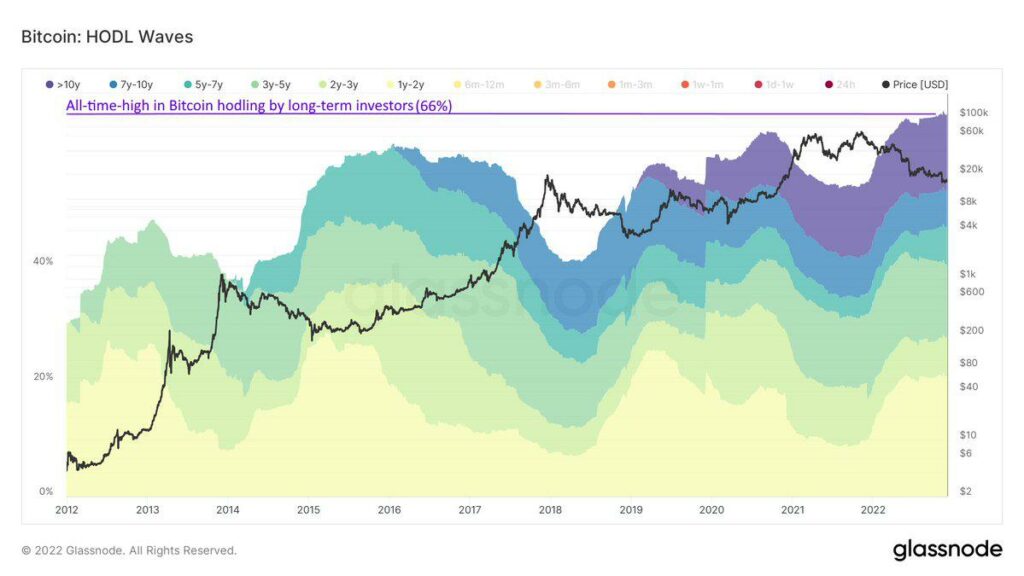

- BTC Conviction is at an all-time excessive as long-term traders preserve including to their BTC stack unfazed by the latest information and fallouts in line with information from Glassnode.

- Crypto has been declared useless fairly a couple of occasions as Worry and Uncertainty is at highs within the crypto trade.

- Though low conviction holders could have left, sellers should be right here attributable to miner capitulation, taxes or inflation fears.

We have now witnessed one of the intense months within the crypto trade, with FTX’s fallout and different key gamers that adopted, reminiscent of Genesis, Voyager, and BlockFi. Worry, uncertainty, and doubt are at excessive ranges inside media shops as Bitcoin is as soon as once more declared useless, and the BTC worth dropped to ranges as little as $15,700.

“Crypto is now useless: FTX, a cryptocurrency trade, collapsed final week, proving numerous cool guys horribly flawed,”. Tweets like this have been throughout social media when one of many largest crypto exchanges, FTX, collapsed, taking many distinguished gamers with them.

However amid all this uncertainty, long-term Bitcoin holders stay undeterred, and actually, the sample is as such that they’re at present rising their long-term Bitcoin holdings.

In keeping with the GlassNodes chart, Bitcoin Maintain Waves, this November marked an all-time excessive of BTC long-term holders, who at the moment are at 66% share on the chart. The long-term holders, 3yr to 10 yr, have been holding at a charge like by no means earlier than, as the proportion of their holdings retains rising.

FTX’s fallout didn’t transfer the BTC markets as a lot as anticipated, and this might be as a result of low-conviction holders already promoting and leaving the crypto trade. It’s but to be confirmed whether or not that is the underside of the markets; nevertheless, it seems that “unhealthy information” just isn’t essentially affecting BTC worth as dramatically as earlier than. This might be as a result of there are not any low-conviction sellers out there at present.

This isn’t to say that sellers gained’t be there in an additional fallout attributable to different elements reminiscent of miner capitulation, taxes and inflation.

Bitcoin Miners Due Capitulation?

In keeping with CryptoQuant analyst Kripto Mevsimi, an additional miner capitulation is because of reappear. Mevsimi posted his final capitulation evaluation on sixth of June 2022, when the worth of BTC was $31,500 and inside 1 to 2 days, the worth turned $18,000. In keeping with him, hte identical setup is now forming on the hash ribbon metric.

“So proper now bitcoin problem is absolutely excessive for miners so which means; prices are getting increased and doing enterprise in this sort of surroundings is getting tougher,”

“That’s why miners don’t work in full pressure. If they’ve efficient- new technology mining machines, they put them into work however that’s all. Inflation is excessive and other people feels impact of residing prices, bitcoin worth is declining, mining value and problem is getting increased. Robust surroundings for miners.” wrote Kripto Mevsimi in his most up-to-date weblog publish.

Kripto Mevsimi confirms {that a} change in mining problem might probably assist the state of affairs.

In keeping with information from BTC.com, mining problem is ready to drop at 7.08% on the time of writing.