A preferred analyst is digging into the charts to replace his worth targets for a handful of main crypto property.

Michaël van de Poppe first tells his 622,600 Twitter followers that he’s protecting a detailed eye on assist ranges for scalability and interoperability ecosystem Cosmos (ATOM), which lately gave up positive factors from the most recent leg of an prolonged rally courting again to mid-June.

“At huge ranges of assist right here, which is cheap for lengthy entries.

If this one is misplaced, I’m $8 subsequent.

Holding right here = potential set off in direction of $18-20 within the coming month.”

At time of writing, Cosmos is down 8.59% over the previous 24 hours and priced at $10.83.

Transferring on to crypto lending and borrowing protocol Aave (AAVE), the crypto strategist says that in mild of the latest marketwide corrective, he sees the altcoin as a candidate for vary buying and selling with assist at $80 and resistance at $103.

“This one is trending down as all the market is correcting.

Pretend-out above resistance and drop beneath $103 triggered an acceleration of the correction.

Taking a look at $80-82 for assist. Taking a look at $103 for essential resistance. Vary-bound performs.”

Aave has been sliding into the pink all week, presently down practically 15% on the day and buying and selling for $84.31.

Additionally on Van de Poppe’s watchlist is enterprise-grade blockchain platform Elrond (EGLD), which has been steadily dropping since August tenth. The analyst is setting two ranges of assist: one at $50 after which $44 if the primary capitulates.

“An vital stage of assist and confluence on a number of timeframes.

Hole has been crammed, which was virtually the final one. Arguments for a backside across the markets could possibly be there.

Resistance at $57. Break there = new highs. Assist: $50 and $44.”

Elrond is down 8.79% and altering fingers for $52.37. The altcoin was buying and selling above $69 only a week in the past.

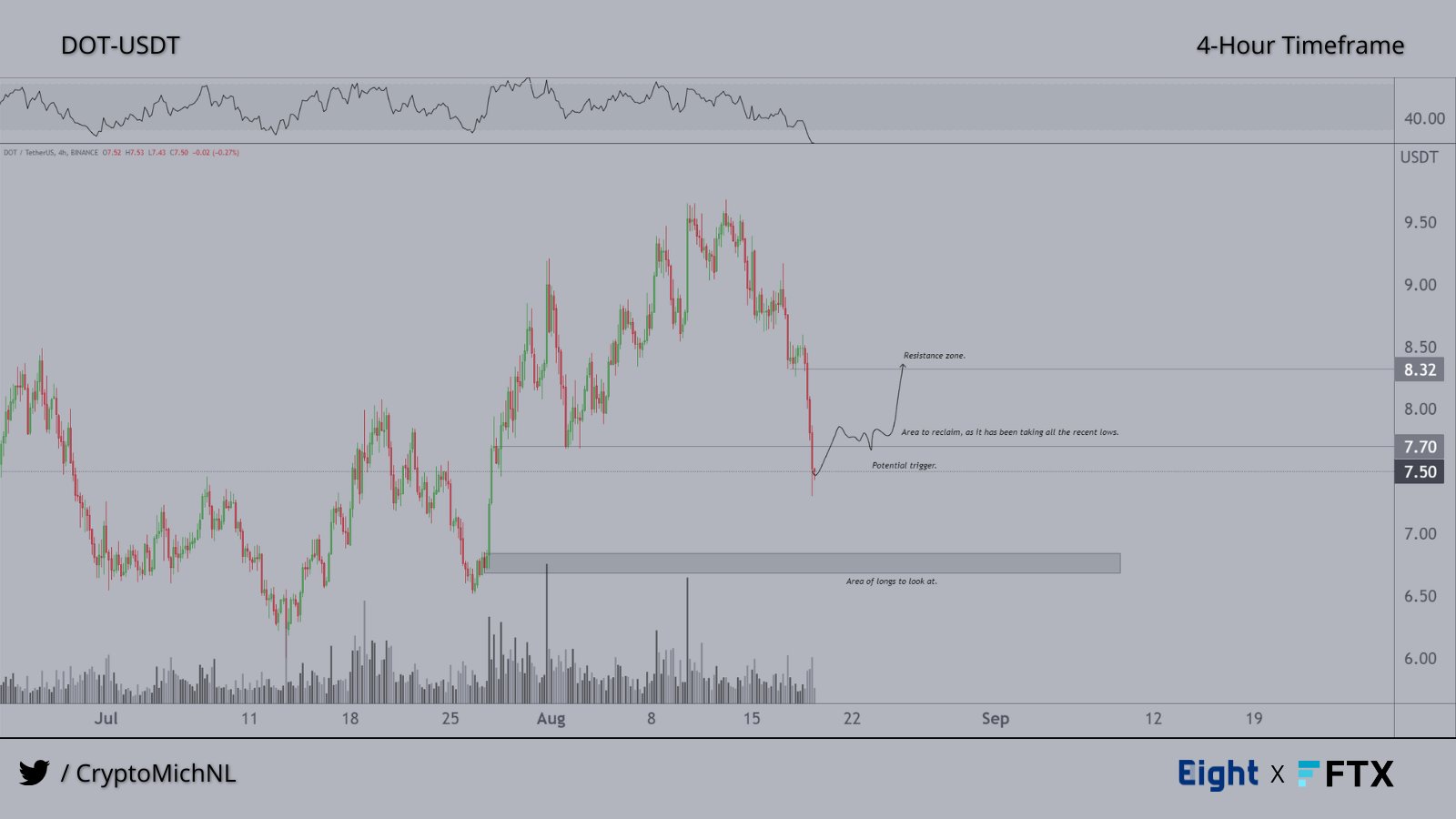

Relating to cross-chain interoperability protocol Polkadot (DOT), the crypto analyst thinks {that a} rally to $8.40 is feasible if $7.70 is recaptured. Nevertheless, Van de Poppe cautions concerning the potential for DOT to lose assist at $7.

“On the lookout for a set off on this one if we reclaim $7.70, as then a retest at $8.40 is probably going.

In any other case, the endurance sport occurs, and also you’ll must see whether or not sub-$7 is a set off for longs.”

Polkadot’s worth mirrors the general crypto market hunch to finish the week, with DOT presently within the pink by practically 12.5% and valued at $7.35.

Final on Van de Poppe’s radar is EOS (EOS), an open-source and decentralized platform whose sensible contract capabilities make it a direct competitor to Ethereum (ETH).

In response to the altcoin’s mid-week rally in defiance of broader market tendencies which was quickly adopted by a pointy corrective transfer, the dealer advises his followers to not go working after cash which are already pumping.

“Trying on the construction, it’s best to study a lesson from this latest transfer of EOS. Keep away from chasing pumps!

On this case, I’d be affirmation if we dip to $1.18 and reclaim $1.30 afterward for longs. The identical goes for reclaiming the $1.40 space.”

Again on Tuesday, EOS leaped by 27.9% from $1.29 to $1.65, however has since labored its manner again down. At time of writing, EOS is down 16.24% and altering fingers for $1.27.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: StableDiffusion