- CRO didn’t see a worth rise regardless of a constructive response to its proof-of-reserve report

- Regardless of this, the coin’s 24-hour tackle rely and seven-day circulation elevated

Crypto.com joined different exchanges in following CZ’s suggestion that such corporations be open with their belongings whereas following the proof-of-reserves mannequin. The Binance CEO had known as for open scrutiny after the now-bankrupt alternate, FTX, allegedly engaged in shady offers with customers’ funds.

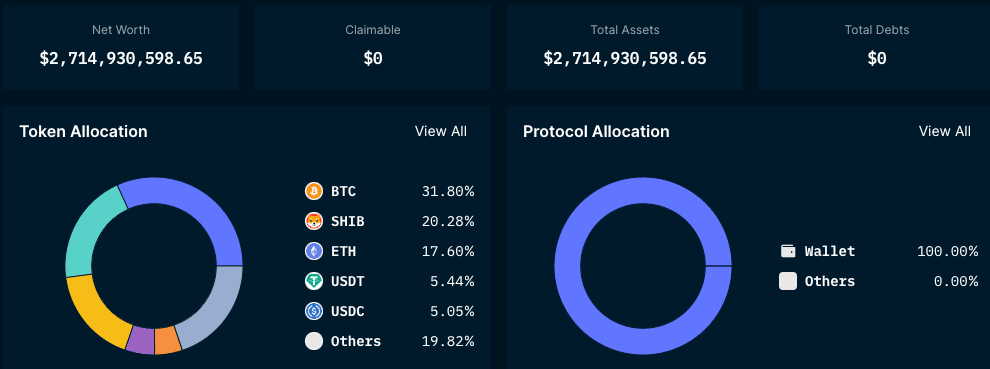

In response to Nansen, Crypto.com’s holdings have been cumulatively $2.94 billion and had no money owed. Particulars from the crypto perception platform additionally confirmed that Bitcoin [BTC] topped the opposite belongings because it fashioned 31.80% of the whole.

Supply: Nansen

Learn AMBCrypto’s Value Prediction for Cronos 2023-2024

The alternate’s CEO, Kris Marszalek, famous that the belongings publicly displayed have been solely partial. In his tweet, Marszalek communicated that the complete audit can be out, and shared with Nansen. Nevertheless, regardless of the disclosure, Crypto.com’s alternate token, Cronos [CRO], couldn’t capitalize on the constructive response it garnered.

Whereas the Proof of Reserves audit preparation is underway, we’re sharing our chilly pockets addresses for among the prime belongings on our platform.

This represents solely a portion of our reserves: about 53,024 BTC, 391,564 ETH, and mixed with different belongings for a complete of ~US$ 3.0b

— Kris | Crypto.com (@kris) November 11, 2022

CRO, what’s the journey on-chain?

Contemplating its worth, CRO misplaced 13.39% within the final 24 hours. In response to CoinMarketCap, the Cronos chain native token had additionally decreased in quantity inside the similar interval, with a 35.40% loss. This implied that the amassed variety of tokens engaged in transactions over yesterday was modest. Curiously, there was extra to see on-chain than the worth or quantity revealed.

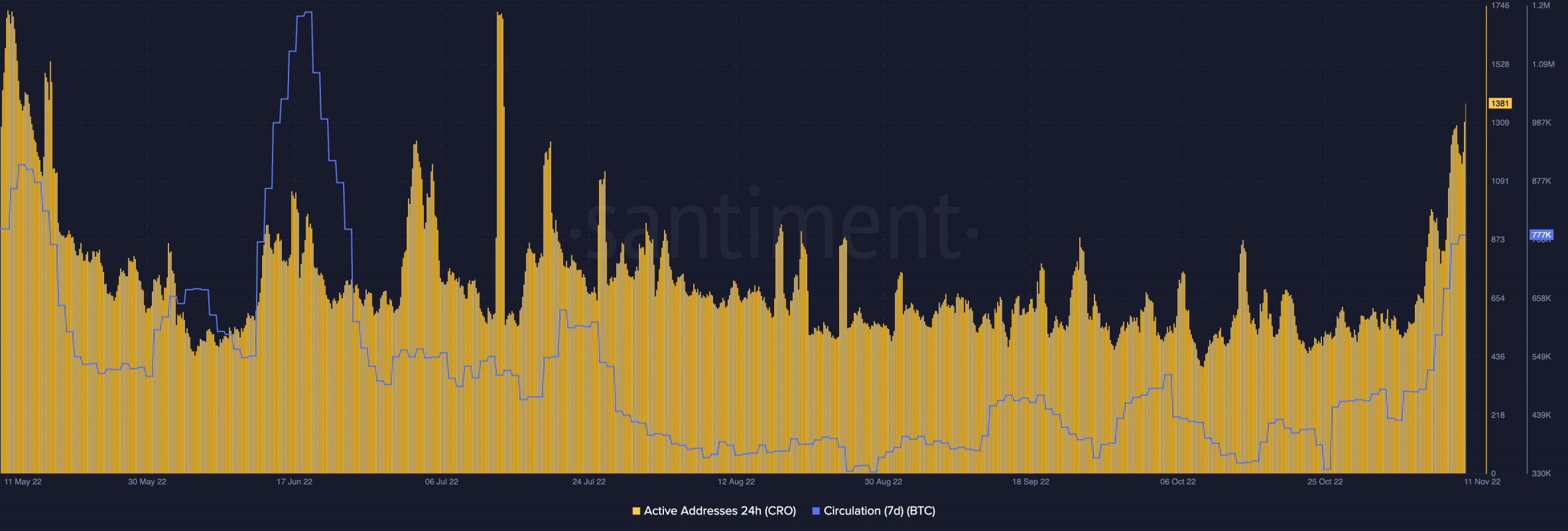

In response to Santiment, it appeared that Crypto.com’s openness earned it some belief. This was as a result of the 24-hour energetic addresses surged regardless of being at a a lot decrease spot on 8 November. At press time, the energetic addresses had elevated to 1,381. This state implied that distinctive deposits on the Cronos chain had improved and crowd interplay was at a powerful stage.

CRO’s seven-day circulation additionally elevated, rising to 777,000. This implied {that a} excessive variety of CRO tokens had been used for transactions. Due to this fact, CRO may start to draw extra traders within the crypto ecosystem quickly.

Supply: Santiment

Involvement is down nonetheless

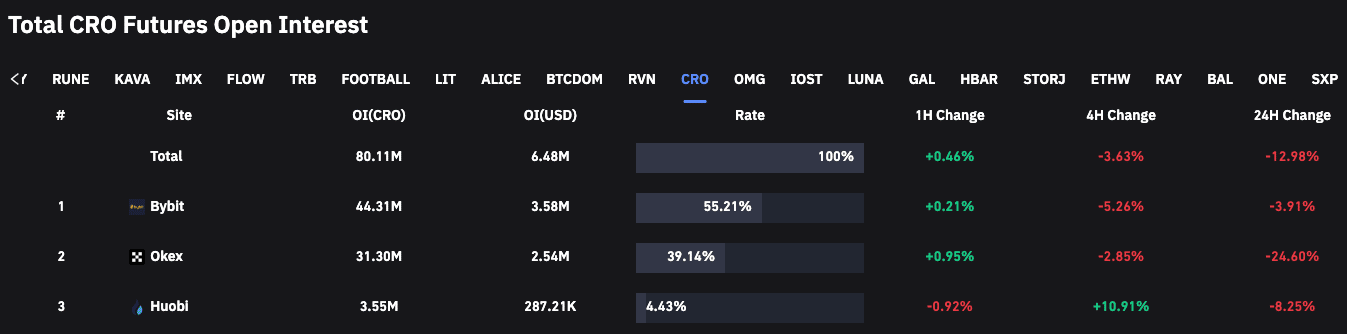

Regardless of the resurgence in some elements, it didn’t translate to elevated curiosity for CRO within the derivatives market. In response to Coinglass, the futures open curiosity had taken a single and double-digit downturn on most exchanges inside the final 24 hours. This meant that merchants have been nonetheless cautious of the market volatility regardless of the alternate actions. Nevertheless, rising information from the derivatives data portal confirmed curiosity had picked up.

Supply: Coinglass

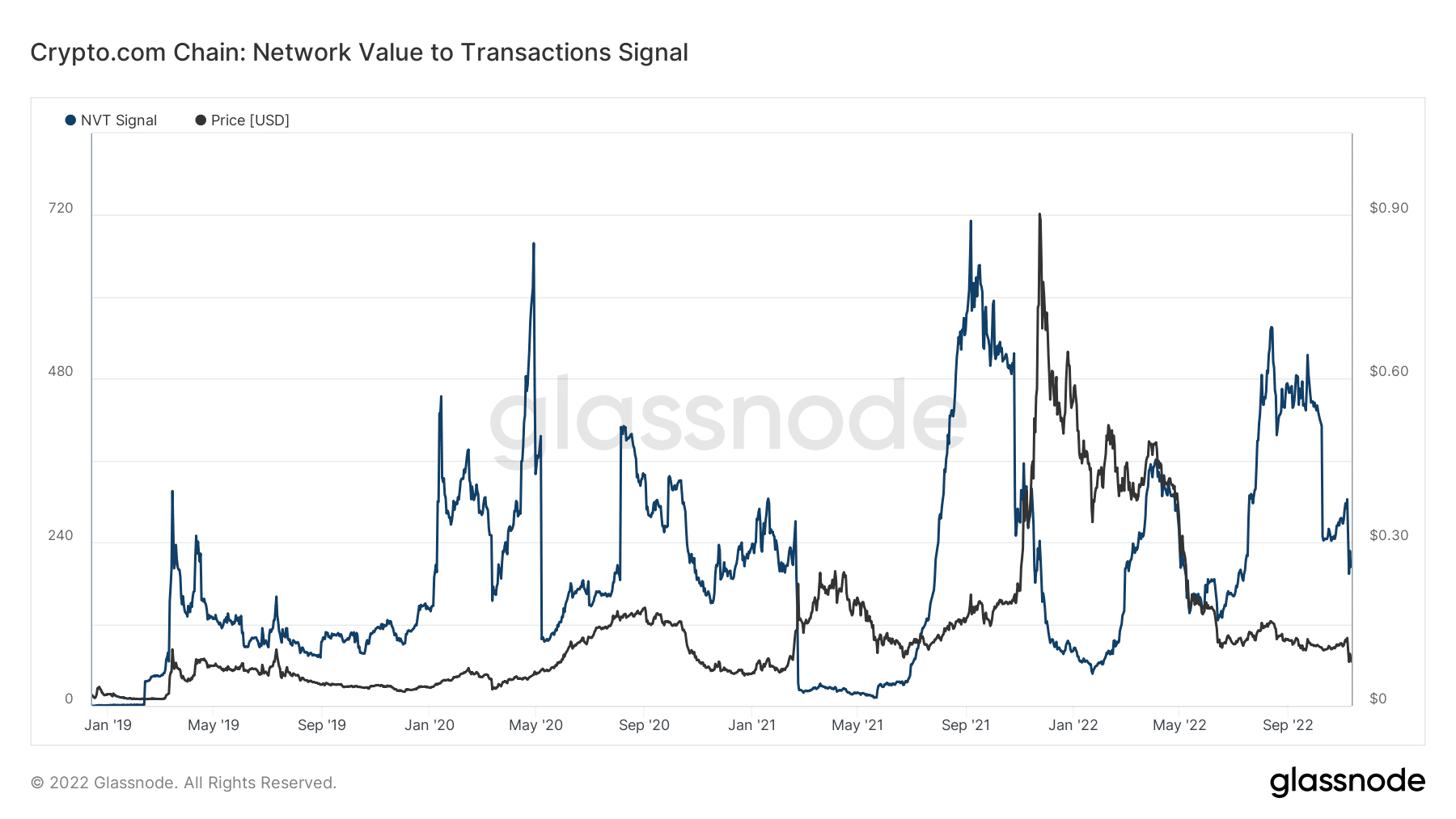

Moreover, CRO’s involvement amongst its friends per transferring common had stumbled from its try to go larger on 3 November. As of this writing, Glassnode information confirmed that the NVT sign was 193.76. At this level, it meant that transaction quantity was outrunning the community worth. In instances like this, the token was signaling a bullish motion. Consequently, CRO’s reversal to the greens was certainly a chance.

Supply: Glassnode