- Ethereum whales accumulate AAVE because it breaks into the highest ten tokens bought by giant buyers

- The on-chain efficiency of AAVE has not been splendid, with solely its growth exercise recording a rise

Aave [AAVE], the open-source liquidity protocol, grabbed the eye of Ethereum [ETH] whales because it broke into the highest ten tokens purchased by crypto sharks. Based on a tweet by WhaleStats, an ETH-focused whale monitoring platform, AAVE was the topic of curiosity for the highest 5000 whales, even because the deflationary token slid to $57.69 within the final 24 hours.

JUST IN: $AAVE @AaveAave now on prime 10 bought tokens amongst 5000 largest #ETH whales within the final 24hrs ?

Peep the highest 100 whales right here: https://t.co/kOhHps8XBB

(and hodl $BBW to see information for the highest 5000!)#AAVE #whalestats #babywhale #BBW pic.twitter.com/PRRpEi1Ecr

— WhaleStats (monitoring crypto whales) (@WhaleStats) November 25, 2022

Learn AAVE’s Worth Prediction for 2023-2024

In the identical vein, involvement in buying and selling AAVE had additionally declined as its quantity shredded 37.24% inside the similar interval. Nevertheless, quantity was not the one issue that noticed declining curiosity from whales.

Much less love, no ego for AAVE

A have a look at DeFiLlama confirmed that AAVE couldn’t seize a great efficiency per its Whole Worth Locked (TVL). Based on the DeFi TVL aggregator, AAVE’s sensible contract protocol had not skilled vital will increase within the final 24 hours.

With a 5.80% lower, spreading as much as a 31.69% fall within the final thirty days, it appeared that there had been fewer deposits into the swimming pools underneath the AAVE chain.

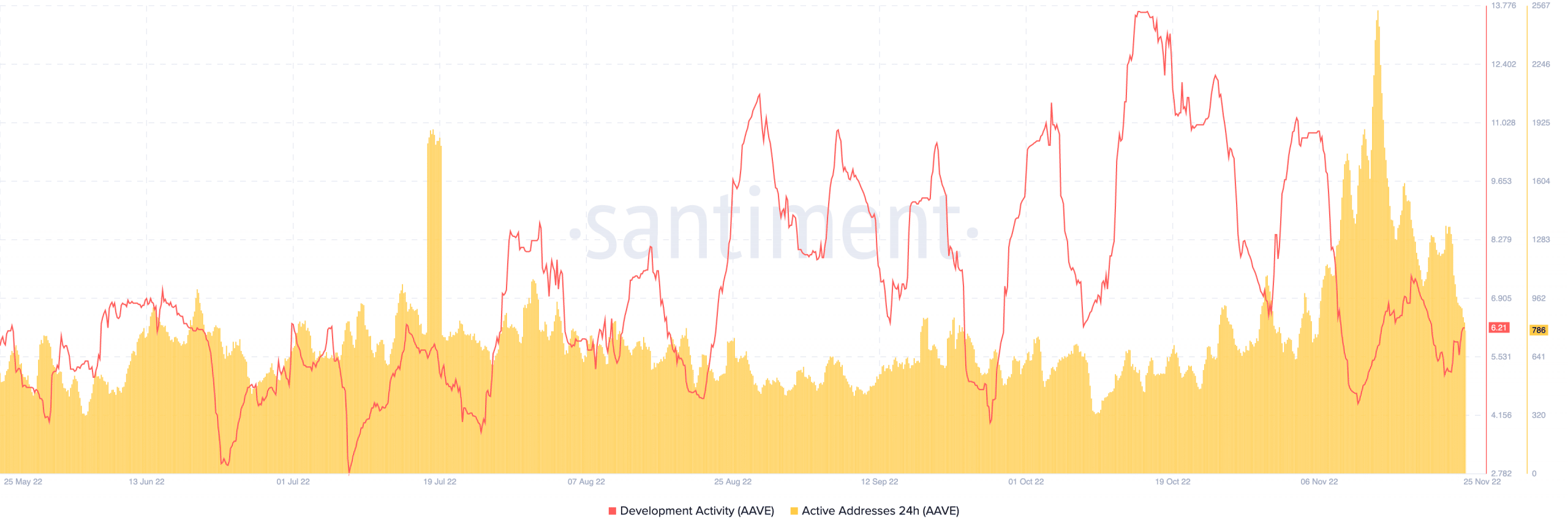

AAVE suffered an exploit not too long ago. Nevertheless, the workforce appeared unfazed by the entire situation, as the event exercise, as seen on Santiment, showed that extra upgrades had been ongoing on the community.

Regardless of the rise, distinctive deposits on the chain fell from its elevation on 23 November. This was as a result of lower registered by the lively addresses. At press time, Santiment confirmed that the each day lively addresses on AAVE had been 786.

Supply: Santiment

Buddy-buddy on the drop

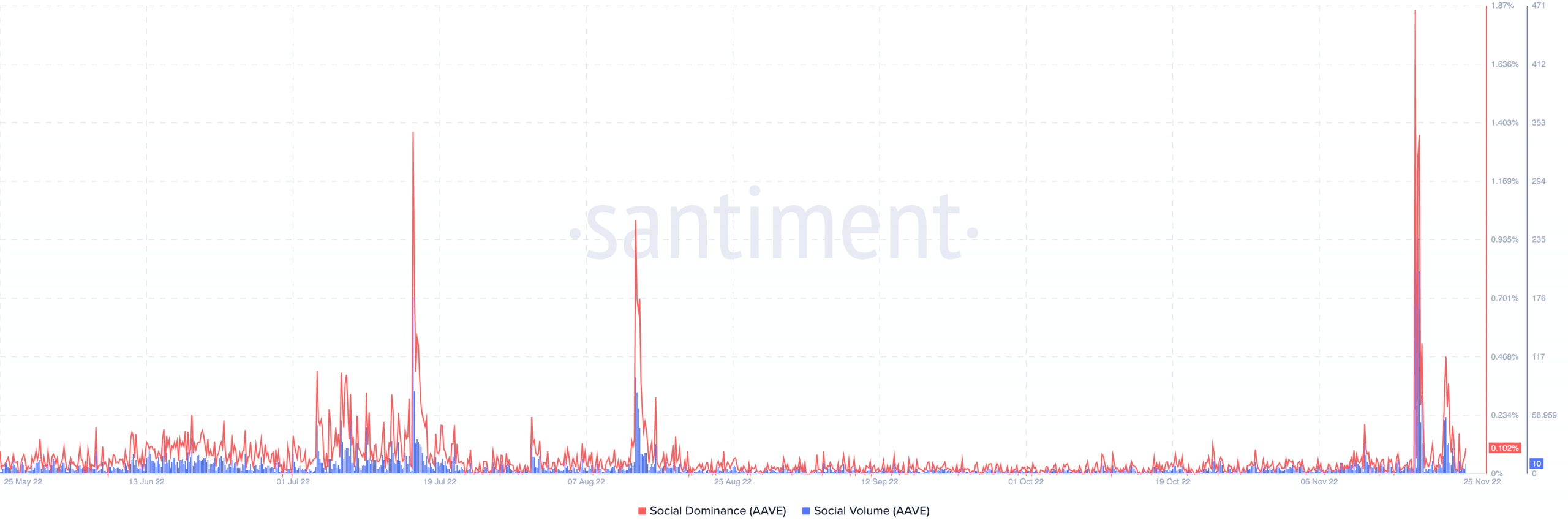

As for its social quantity and dominance, the seek for AAVE and discussions concerning the token had significantly dropped. As of this writing, AAVE’s social quantity was at a worth of 10. This worth indicated that there had been a lot much less seek for the token.

With social dominance at 0.112%, the asset was removed from hitting any hype. Therefore, there was a really low chance of an AAVE uplift as a result of social metrics impression.

Supply: Santiment

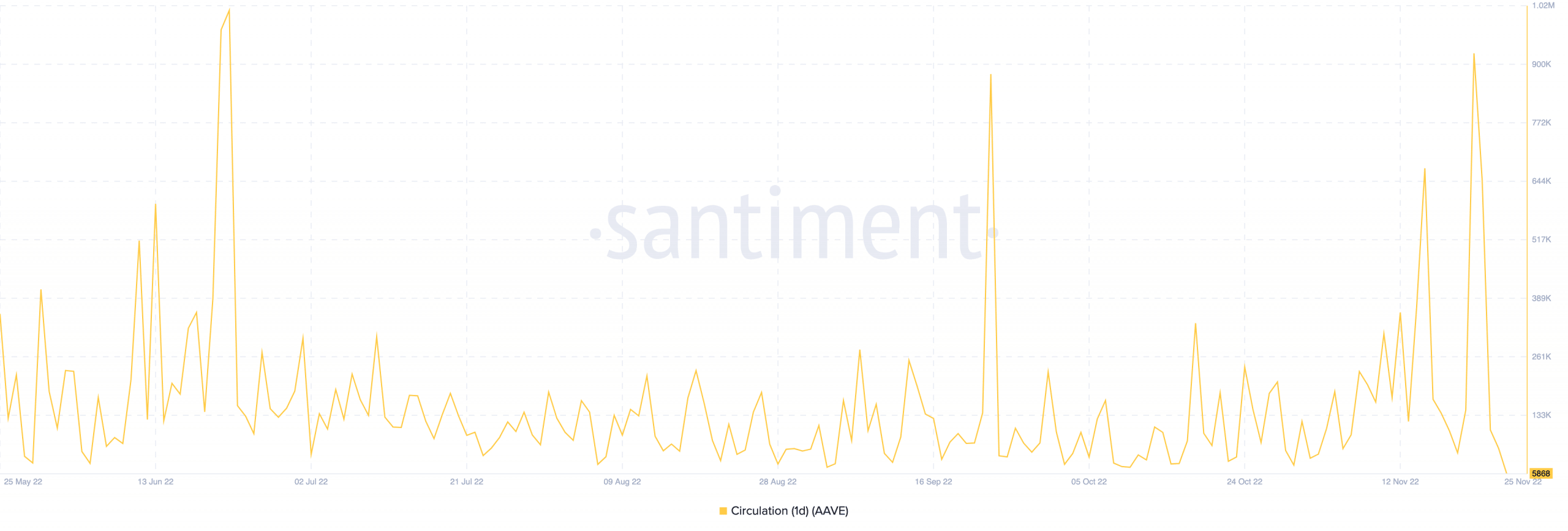

Past this, circulation has not been monumental. Based on Santiment, the one-day circulation had declined from a excessive of 921,000 to 5868. Such a jaw-dropping lower meant that there had been only a few AAVE tokens concerned in transactions over the past 24 hours.

All issues thought of, the AAVE community was in horrible form and it would require a significant market restoration for its on-chain standing to get higher.

Supply: Santiment