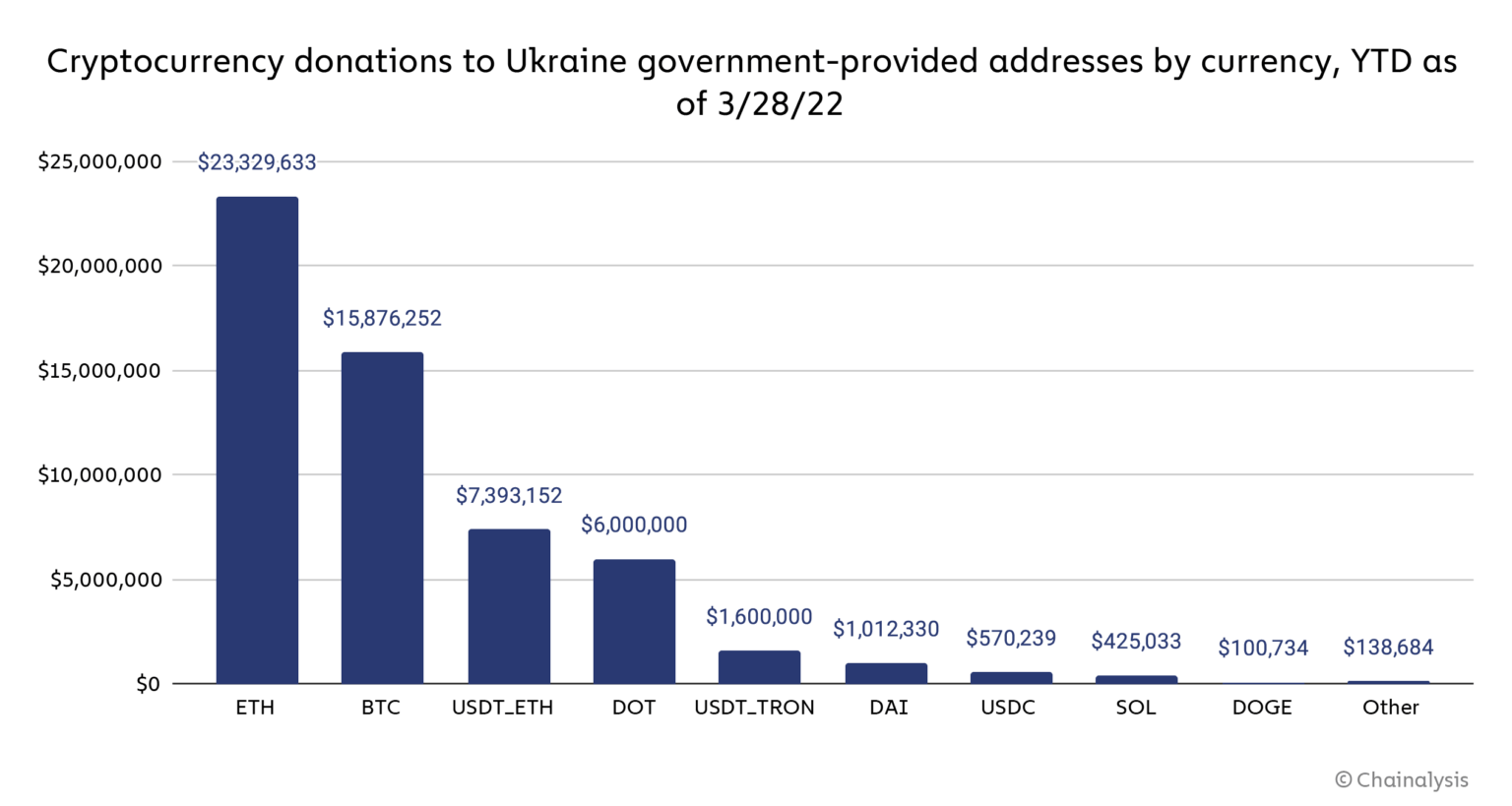

As Russia’s struggle in Ukraine continues, cryptocurrencies are taking up an vital function within the battle, however not within the capability of evading sanctions on Russian entities or oligarchs. Quite the opposite, crypto has confirmed itself to be very helpful in supporting Ukraine as customers world wide have donated over $56 million in cryptocurrency to addresses supplied by the Ukrainian authorities alone.

That is “showcasing not simply the crypto group’s generosity but additionally digital belongings’ distinctive utility for cross-border funds,” Chainalysis report on the matter reads.

As most readers know, america and plenty of of its allies within the EU and elsewhere have taken unprecedented actions towards Russia, together with including Russian oligarchs, their members of the family, and their companies, in addition to all main state-owned banks and plenty of vitality exporters, to the Workplace of International Property Management’s (OFAC) Specifically Designated Nationals And Blocked Individuals Record (SDN).

Western powers have additionally eliminated choose Russian banks from the SWIFT system, basically slicing them off from the worldwide monetary system, and sanctioned Russia’s central financial institution, stopping it from utilizing its $650 billion in reserves to mitigate the influence of the sanctions.

There’s no proof sanctions evasion is occurring

Many are actually questioning how Russia’s enterprise and political elites might use cryptocurrency, similar to bitcoin (BTC) or ether (ETH), to evade sanctions. “Whereas there’s no direct proof that is taking place, It’s an affordable concern as Russia accounts for a disproportionate share of a number of classes of cryptocurrency-based crime, and is house to many cryptocurrency companies which have been implicated in cash laundering exercise,” the report reads.

As Chainalysis co-founder Jonathan Levin defined whereas testifying earlier than the U.S. Senate, if cryptocurrency-based sanctions evasion is occurring, it could most likely look extra like typical cash laundering exercise, through which comparatively small quantities of cryptocurrency are moved progressively to disparate cashout factors, slightly than in enormous transactions.

Chainalysis’ report goes on to checklist the alternative ways sanctions could possibly be evaded and dismisses all of them.

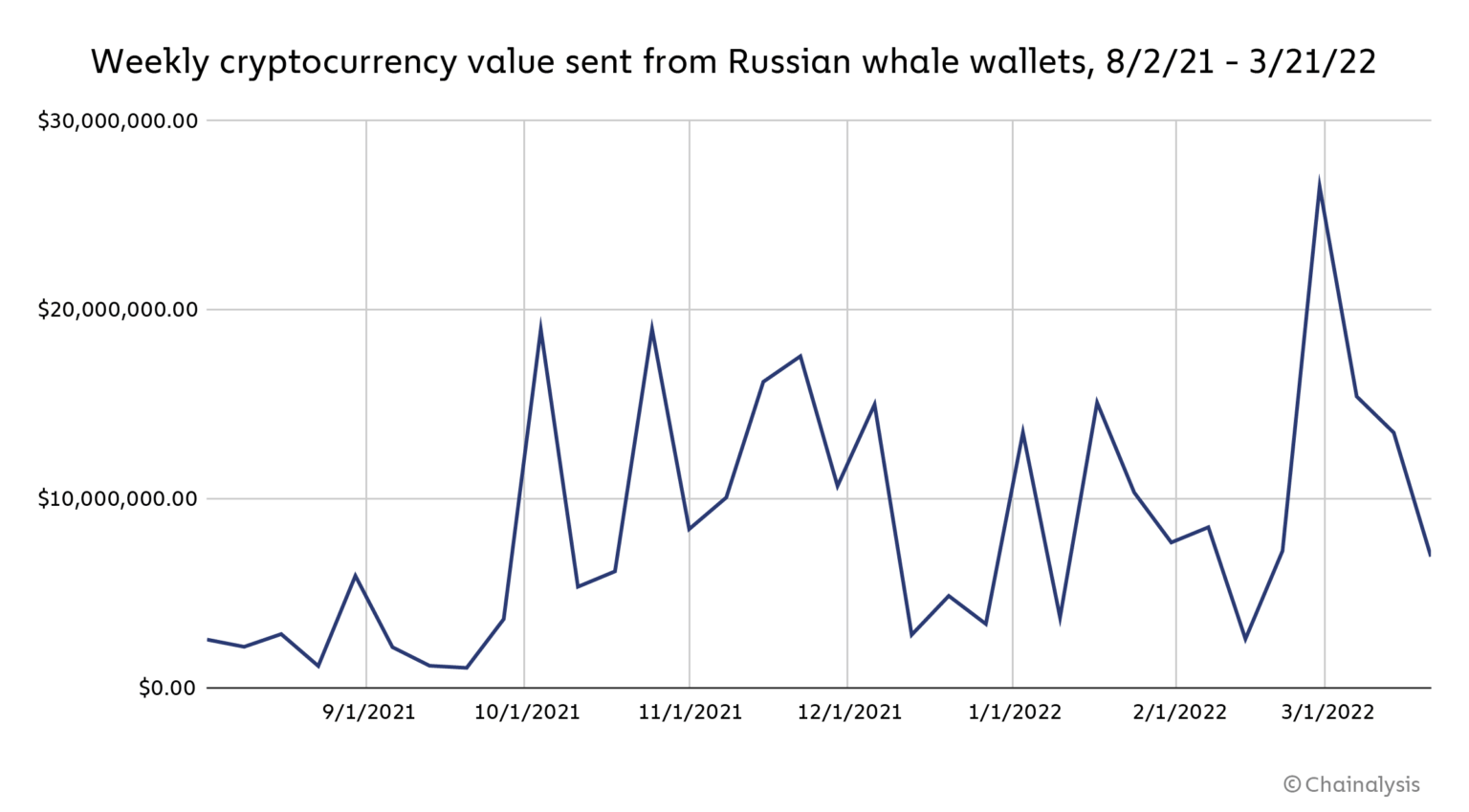

First, if Russian crypto whales – wallets with greater than $1 million price of crypto – would attempt to transfer these funds, it could present. Between the beginning of the invasion and the twenty first of March, Chainalysis tracked simply over $62 million price of cryptocurrency despatched from Russia-based whales to different addresses, lots of that are related to OTC desks and exchanges, a few of them high-risk.

“Whereas spikes on this exercise are widespread, Russian whale sending hit its highest ranges in roughly eight months throughout the week of February 28 quickly after the invasion, reaching $26.5 million. On-chain exercise alone can’t inform us if these transfers represent sanctions evasion, as we don’t know if the whale wallets are managed by sanctioned people and entities,” the report reads.

Sbercoin to zero

Chainalysis additionally regarded into the newly created cryptocurrency issued by Russia’s greatest financial institution Sberbank, which was placed on the sanctions checklist at first of the struggle. The Sbercoin, as it’s named, had beforehand been introduced in late 2020.

In accordance with CoinMarketCap, Sbercoin has seen roughly $4.5 million in complete transaction quantity, all on one common decentralized trade. Sbercoin’s worth has dropped over 90% since its launch and at present sits at $0.00003329 as of March 28, 2022, with a market cap of $113,089. Sbercoin is thus clearly not used for sanctions evasion.

Chainalysis additionally checked out different cryptocurrency companies and utilization typologies that would point out sanctions evasion by Russian entities, however to this point, on-chain indicators for these don’t present a lot out of the unusual.

Russia has a big ecosystem of companies, and it’s cheap to count on that sanctioned Russian entities might attempt to use these companies to evade sanctions by shifting their wealth via them.

No exchanges have proven any uncommon exercise

Moreover, Chainalysis analyzed high-risk exchanges, those who are likely to have lax compliance necessities, like Garantex and Bitzlato, that are outstanding in Russia, but additionally Twister, an Ethereum mixer. To this point, none of those companies have proven spikes in inflows or outflows, or some other uncommon exercise. Chainalysis additionally checked out Hydra, by far the world’s largest darknet market, with the identical outcome.

“We’re persevering with to watch Hydra, however to this point, its transaction quantity reveals nothing out of the unusual, and actually has fallen within the time following the Ukraine invasion,” the report says.

Some sanctioned international locations, like Iran, have turned to crypto mining to achieve entry to capital and make up for sanctions-related losses. It’s attainable that Russia might do the identical. As of August 2021, Russia ranked third worldwide within the share of world hashrate for Bitcoin. Whereas there was a rise in electrical energy consumption by cryptocurrency miners in some components of Russia after the invasion, it’s since not possible to inform if any of that may be attributed to a sanctioned entity.

It might even be unlikely, Chanalysis writes, for a sanctioned entity to have arrange a major mining operation within the weeks which have handed since new sanctions had been handed down.

Ruble buying and selling pairs grew over 900%

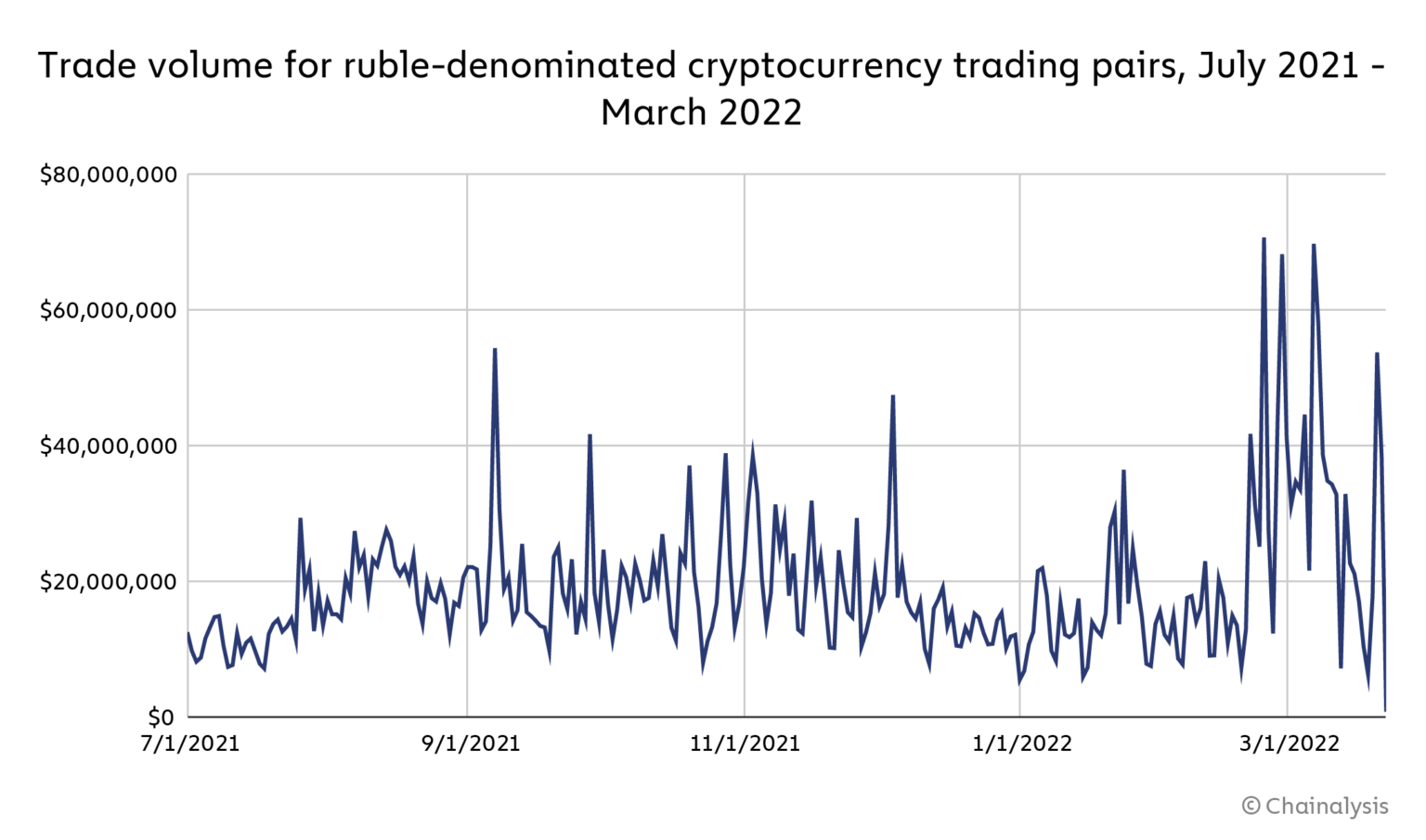

Moreover, Chainalysis, utilizing trade order e book knowledge supplied by Kaiko, additionally watched for modifications in commerce quantity for buying and selling pairs that embody the Russian ruble. Commerce quantity involving ruble commerce pairs elevated instantly following the invasion, rising over 900% to over $70 million between February 19 and 24, the very best buying and selling quantity since Could 2021.

Since then, ruble buying and selling volumes have continued to be risky, although they’ve but to interrupt above $70 million once more. As Chainalysis previously stated, they consider this exercise is unlikely to mirror large-scale sanctions evasion.

“Our present speculation is that the chief drivers of ruble pair volumes are volatility and non-sanctioned Russian cryptocurrency customers making an attempt to guard their financial savings because the ruble’s worth plummets,” the report reads.

Lastly, Chainalysis additionally monitored exercise by Russian cybercriminals, particularly gangs partaking in ransomware assaults. Considered one of these gangs, Conti, probably the most energetic ransomware group of 2021, in accordance with Chainalysis, declared its loyalty to the Russian authorities shortly after the invasion, promising to launch cyberattacks towards Russia’s enemies.

Quickly after, an unknown celebration retaliated by leaking delicate info on Conti, together with the group’s inside chat logs, supply code, and extra. To conclude, Chainalysis has discovered no signal of elevated exercise by these gangs, nor any actions that would point out sanctions evasion.

$56 million price of cryptocurrency to Ukraine

In abstract, Chainalysis can’t discover any vital indicators of sanctions evasion. The function of cryptocurrencies within the struggle in Ukraine should as a substitute be that of a car for assist of the Ukrainian struggle effort and the nation’s folks.

“As of March 28, crypto fans world wide have donated over $56 million price of cryptocurrency to addresses supplied by the Ukrainian authorities, to not point out tons of of NFTs and donations to different charitable organizations accepting cryptocurrency,” the report reads.

“These donations stand not simply for example of the group’s generosity, but additionally of cryptocurrency’s utility as a cross-border worth switch mechanism in a time of emergency,” Chainalysis concludes.