- CoinShares noticed a weekly influx of $193 million into its crypto funding merchandise.

- Europe dominated the inflows with $147 million, whereas the Americas recorded $45 million.

- Solana additionally noticed its highest weekly influx, with $45 million.

CoinShares has revealed its weekly report on digital belongings fund flows, and it holds some optimistic indicators for the market. The report highlights that inflows into crypto investments merchandise totaled $193 million, the very best since December 2021.

The spike in inflows is an indication that the market’s sentiment is altering. The influx was largely dominated by entities in Europe, with the continent accounting for $147 million, whereas the Americas made up the rest at $45 million.

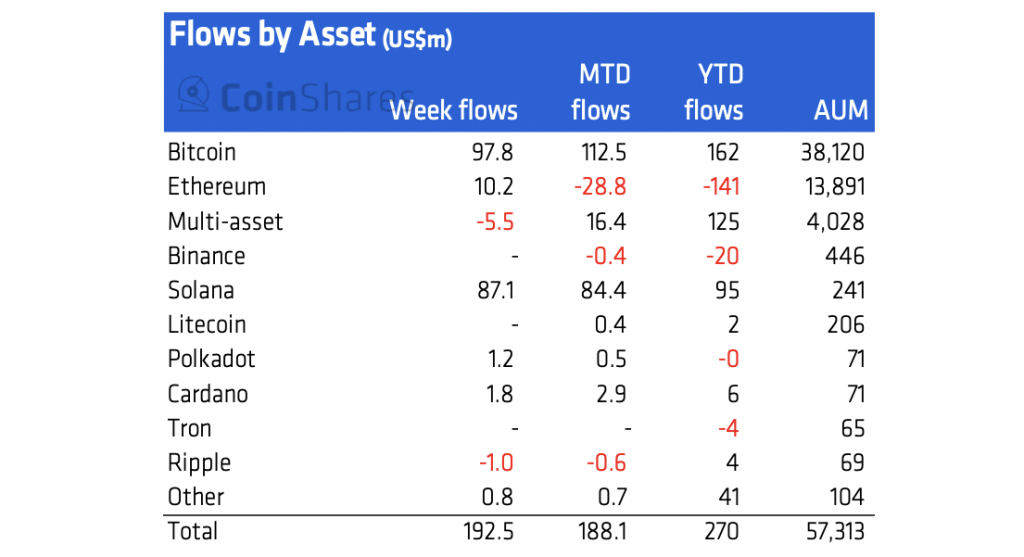

It wasn’t simply bitcoin and ethereum that noticed elevated funding, as solana recorded its largest single week of inflows, with a complete of $87 million. That represents 36% of CoinShares’s belongings below administration. The full AUM of Solana is $241 million, making it CoinShares fifth-largest funding product.

Bitcoin noticed a complete influx of $98 million and ethereum $10.2 million. Bitcoin’s year-to-date influx now stands at $162 million. Different belongings additionally typically noticed funding, although not on the dimensions of the aforementioned belongings.

The market has been having a powerful week on almost all accounts — most notably the value of belongings and the general market cap surging by double digits over the previous week. All of those developments have introduced some long-needed optimism for the market, which took a success earlier this yr.

The following few weeks shall be essential in setting practical targets for bitcoin and different belongings. Analysts have put $51,000 as a long-term resistance goal, and technical indicators are bullish.

A Bull Run in Sight?

Traders shall be protecting a detailed eye in the marketplace because it seems on the verge of a bull run. Up over 16% previously days, bitcoin appears prefer it might be breaking out of the stagnation of the $40,000–$50,000 vary. Ethereum has accomplished even higher on the again of many optimistic developments in its ecosystem.

A number of developments recommend {that a} bull run could certainly be across the nook. Small holders of bitcoin and ethereum are growing, with the variety of addresses with greater than 0.1 BTC and ETH each up this yr.

Readability in regulation, particularly in america through President Biden’s govt order, additionally tentatively suggests higher costs. On the very least, buyers have perked up concerning the market and see greener days forward.