A brand new report from CryptoCompare finds that top-tier digital asset exchanges equivalent to Coinbase, FTX, Gemini and Binance have continued to extend their market share over the past six months.

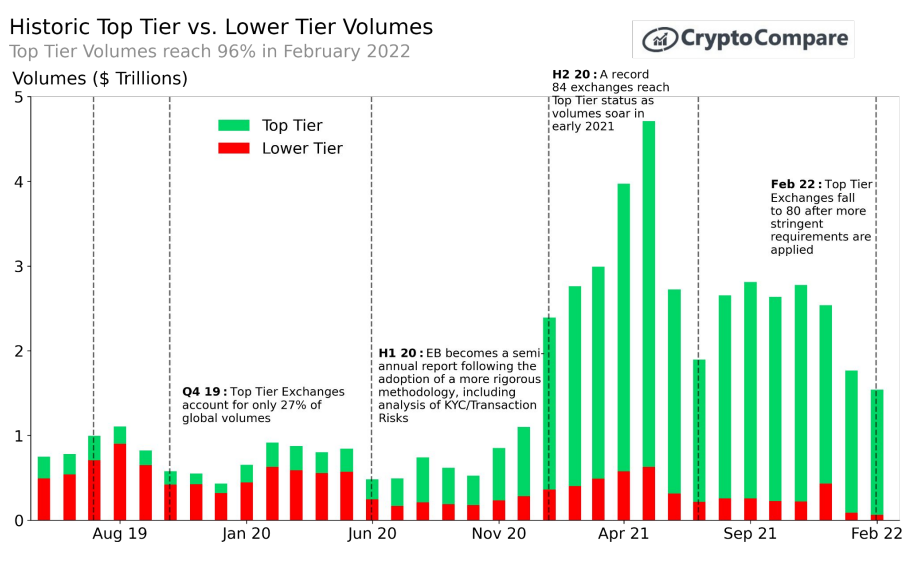

Within the newest Change Benchmark report, CryptoCompare finds that top-tier exchanges have gained an extra seven % market share since August 2021.

“Prime-Tier exchanges have elevated their market share from 89% in Aug 2021 (primarily based on Aug 2021 rankings) to 96% in February 2022 (primarily based on the newest Feb 2022 rankings) as each retail {and professional} merchants transfer to decrease threat exchanges.

When taking a mean over the past six months, Prime-Tier exchanges account for 88% of digital asset volumes.”

In line with the report, top-tier exchanges have undergone large market share consolidation within the final two years. Because the first Benchmark report was launched in 2019, 54 mid-to-low tier exchanges have shut down, unable to compete with rising top-tier buying and selling volumes.

The report additionally factors out how very important exchanges are to the well being of the general crypto business and its adoption. Nevertheless, the report mentions the rising tendency of merchants to maneuver belongings to self-custody, which might have an effect on crypto trade enterprise fashions because the business grows.

“Lastly, there’s a extensive inside motion inside crypto for customers to withdraw their crypto off exchanges in choice for self-custody. The mantra of ‘not your keys, not your cash’ is rising stronger amid the political strain acquired by exchanges, a motion that would hinder the enterprise mannequin of exchanges. That is additionally a key development to think about going ahead.”

Examine Value Motion

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Relight Movement