Welcome to Charts and Caffeine – our every day markets wrap that includes the perfect charts and reads from throughout Livewire’s group of knowledgeable editors. Let’s get you caught up on the in a single day session.

markets wrap

US MARKETS CLOSED FOR THE MEMORIAL DAY LONG WEEKEND

- FTSE 100 – 7,600 (+0.19%)

- STOXX 600 – 3,841 (+0.86%)

- USD INDEX – 101.34 (-0.33%)

- US 10YR – 2.74% (unch)

- GOLD – US$1,857.30/oz

- BRENT CRUDE – US$117.70 (+0.09%)

shares wrap

US shares had been closed for the Memorial Day lengthy weekend however the reopening of the Chinese language financial system (together with mild buying and selling volumes) allowed luxurious and tech names in Europe to guide the features.

the calendar

It is a pretty quiet day on the info docket domestically however for many who watch GDP as a lot as I do, there will probably be some key statistics (or as my good pal Annette Beacher would name it, puzzle items) for tomorrow’s print at 11:30 am.

There are additionally some minor inflation prints out of Europe – together with France, Italy, and certainly, the flash estimate for all the Eurozone.

In Germany, the inflation downside is already effectively entrenched. The Might flash print, launched final evening, confirmed an 8.7% month-on-month improve. The print is the very best since 1974 and got here in effectively forward of expectations. Speak about strain on the ECB!

Talking of the Eurozone, ANZ Chief Economist Richard Yetsenga had this to put in writing in his weekly be aware yesterday which caught my consideration.

Accelerating inflation suggests the European Central Financial institution is prone to start its price cycle in July and improve charges by 100bp by yr finish. There may be even upside threat on this.

Upside threat to a 100 foundation level tightening cycle? Speak about this time is completely different!

shares to observe

At the moment, I assumed we would take a deep dive into the retailers. Friday’s retail gross sales print in Australia showcased the energy (and resilience) of shopper pockets. However as you may see in our subsequent part, whereas the theme is international, not all corporations are prepared to reply.

In a latest be aware, Citi’s Adrian Lemme and James Wang famous there are headwinds for the Australian shopper nevertheless the energy of stated shopper can be understated.

Going ahead, each analysts consider meals retailing will normalise (sustained make money working from home demand to be offset by enter inflation) whereas fewer lockdowns ought to imply the sustainable return of brick and mortar retail (though foot visitors has stalled).

That bullish reasoning should clarify why they’ve a purchase score on ten (sure, you learn that proper) retailers. They’re:

- Coles (ASX: COL)

- Woolworths (ASX: WOW)

- Tremendous Retail (ASX: SUL)

- Harvey Norman (ASX: HVN)

- Nick Scali (ASX: NCK)

- Beacon Lighting (ASX: BLX)

- Premier Investments (ASX: PMV)

- Metropolis Stylish (ASX: CCX)

- Lovisa (ASX: LOV)

- Michael Hill (ASX: MHJ)

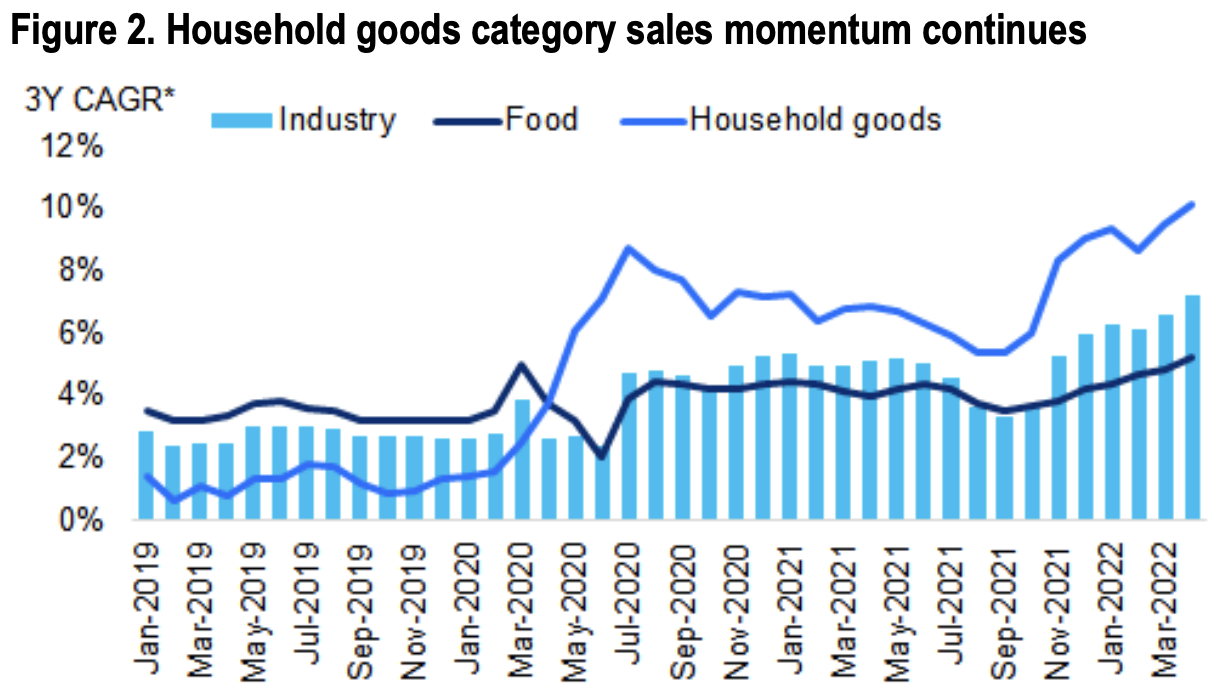

On the factors round HVN, NCK, and BLX, they level to continued gross sales momentum for family items relative to the business as an entire. This chart backs up their thesis.

Lastly, a fast be aware on Bubs (ASX: BUB) whose share worth soared yesterday on information it had secured a provide cope with the Biden administration. I famous this as a inventory to observe within the very first version of Charts and Caffeine – and have a look at it go now!

the charts

Now that we’ve talked about Australian retail corporations, it is solely proper that we broaden the dialog to the retailers themselves. To do that, I’ve borrowed two charts that show how tough it’s to maintain up with hovering demand. In a earlier article, I famous that provide chains proceed to stay strained for absolutely anything from automobiles to furnishings. The results of that might manifest in greater capital prices – or as Constancy has known as it, reglobalisation.

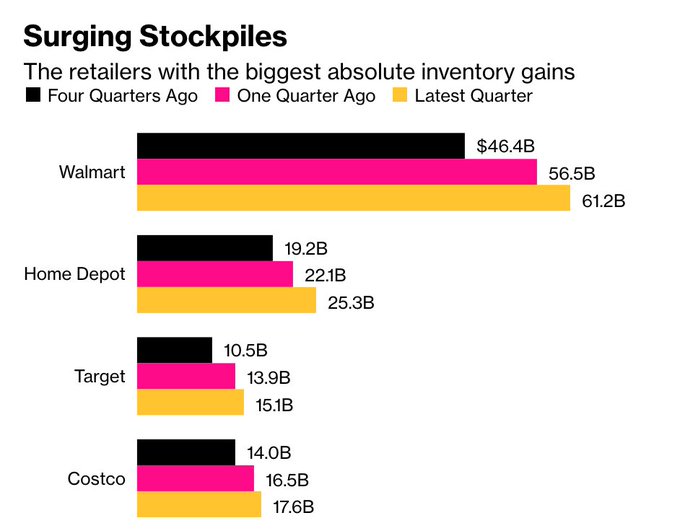

With that in thoughts, let’s check out two charts that inform the entire story – beginning with American retailers and their stock ranges. The bar chart beneath reveals the 4 largest of their respective fields – and the worth of the inventory they’re holding onto. Sadly, these purchases had been made with the patron of three months or perhaps a yr in the past in thoughts.

Now the patron has moved on, there could also be an impression on earnings on the best way as these corporations offload that very same inventory.

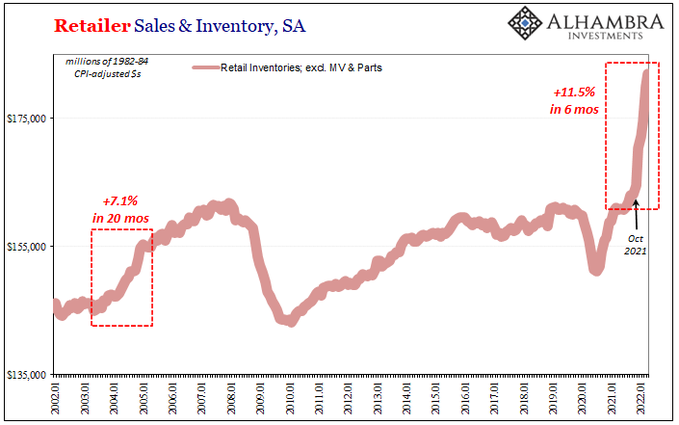

Now, check out the second chart. The identical theme will be seen right here, however as Jeffrey Snider of Alhambra Investments factors out, it is not all about costs. It is also about quantity – and most significantly, timing.

As Jeffrey factors out:

Whereas items proceed to surge into the US provide chain, increasingly it appears to be like like customers simply might have exhausted themselves … Individuals are incomes extra of their paychecks, collectively among the many fewer who’re working (in comparison with 2019), however it’s not maintaining with costs. Incomes considerably extra, paying much more, all to get barely much less for the spherical journey.

His whole reasoning will be adopted via this hyperlink. I extremely advocate the learn.

the tweet

Carl’s not flawed, is he? Musk did the majority of his selling cryptocurrencies through the increase (keep in mind Shiba Inu?) and Tesla was sizzling till the good valuation reset of 2022. The Shanghai lockdowns have solely added to the problem of delivering on car guarantees. Will probably be fascinating to see how Elon turns this story round, however now in a borderline recession.

the perfect in enterprise information

5 maps that present why China’s Pacific pivot is alarming (AFR): I like an explainer and these 5 maps inform me quite a lot of the most important story of our instances. Not simply why the consultants have known as this century the “Asian Century” however extra importantly, how we’re going to must be taught to reside with all of it.

Is the 60-40 portfolio mannequin nonetheless related? (Livewire – Glenn Freeman): This piece from my colleague Glenn is devoted to difficult a theme that has been round for a very long time. Is the easy recipe for developing a portfolio not relevant?

Get the wrap

We’re attempting one thing new round right here – a every day market preview with an clever twist. Should you’ve loved this version, hit observe on my profile to know after I publish new content material and click on the like button so we all know what you take pleasure in studying.