Chainlink [LINK] spiked above $9.20 for the primary time shortly, registering a three-month excessive regardless of the risky market scenario. The coin was additionally capable of put a smile on buyers’ faces because it registered a promising weekly achieve of over 12%.

At press time, Chainlink was buying and selling at $8.72, with a market capitalization of over $4.2 billion, as per information from CoinMarketCap.

____________________________________________________________________________________________

Right here’s AMBCrypto’s Value Prediction for Chainlink [LINK] for 2023-2024

_______________________________________________________________________

In response to Santiment’s tweet, a number of on-chain metrics had been additionally in favor of LINK, which implied in direction of a continued worth hike over the approaching days.

? #Chainlink spiked all the way in which above $9.20 for the primary time since August thirteenth, a ~3 month excessive regardless of very risky markets. This rise has been supported by the biggest quantity of lively $LINK addresses in 5 weeks, and merchants are longing aggressively. https://t.co/ZxsZnveURm pic.twitter.com/lia6XAgSar

— Santiment (@santimentfeed) November 8, 2022

Aside from Santiment’s aforementioned replace, Chainlink additionally witnessed varied developments final week that might be liable for the continuing pump. As an illustration, Chainlink went by means of with 14 integrations throughout 4 chains, specifically Arbitrum, BNBChain, Ethereum, and Polygon.

⬡ Chainlink Adoption Replace ⬡

This week, there have been 14 integrations of 4 #Chainlink providers throughout 4 totally different chains: #Arbitrum, #BNBChain, #Ethereum, and #Polygon.

Reminder: Examine your Staking v0.1 eligibility now. https://t.co/Gdt5Fj7XGp pic.twitter.com/vUj2ykfzeq

— Chainlink (@chainlink) November 6, 2022

Metrics at play

In response to Santiment’s chart, LINK obtained important curiosity from the derivatives market as its alternate funding fee hit a document excessive since August. Additional, the coin’s handle exercise took the identical path and registered a large uptick, which might be thought of as one other optimistic sign.

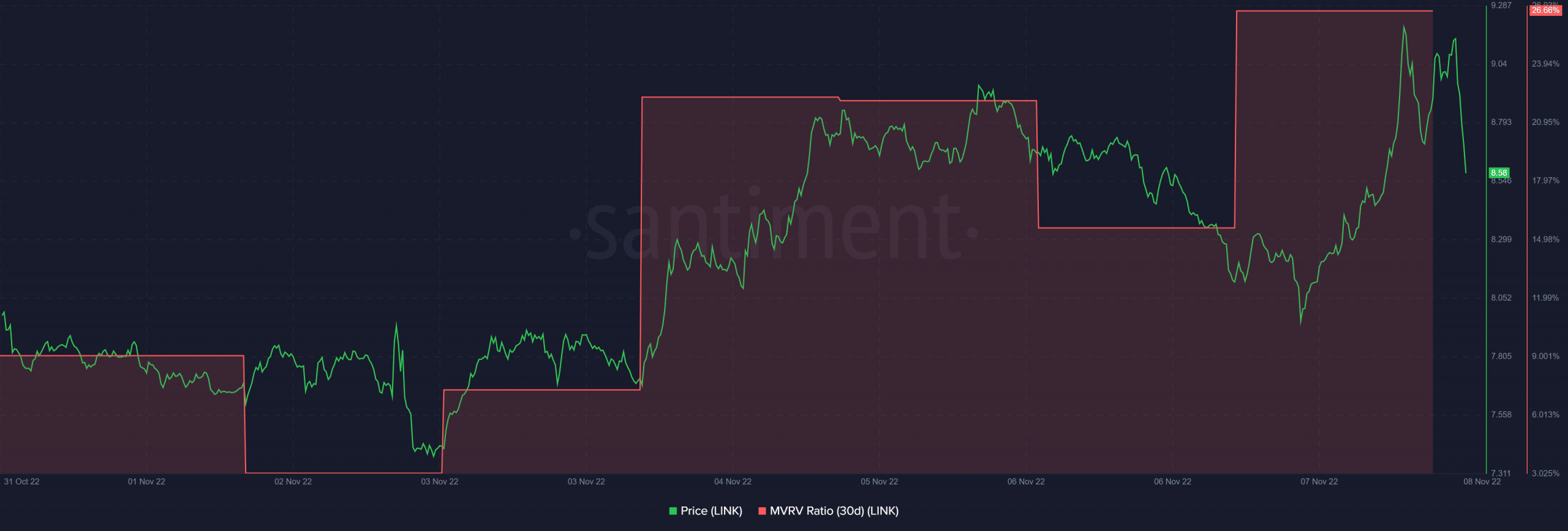

Nevertheless, the opposite metrics may hassle involved buyers as they indicated an upcoming pattern reversal. As an illustration, LINK’s Market Worth to Realized Worth (MVRV) Ratio was significantly up. This indicated a doable market peak.

Picture Supply: Santiment

CryptoQuant’s data additionally revealed that issues had been about to worsen, as LINK’s Relative Power Index (RSI) was in an overbought place. This elevated the possibilities of a selloff within the days to return. Furthermore, LINK’s alternate reserves additionally witnessed an increase, which was a bearish sign that indicated greater promoting stress.

Ought to buyers pack their baggage?

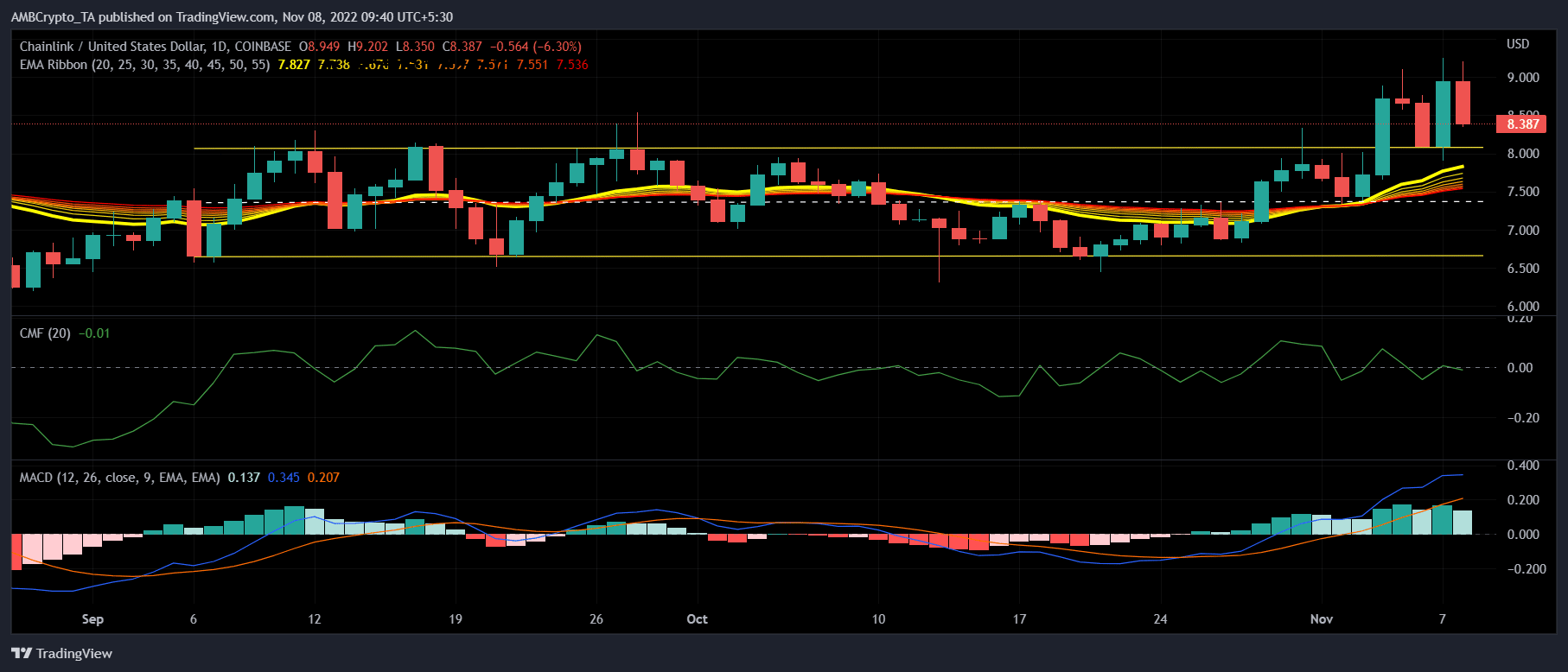

Possibly not, as LINK’s each day chart revealed an attention-grabbing image. LINK, after sticking to a sideways route for a number of weeks, broke out and turned its resistance into a brand new help stage. The opposite metrics additionally seemed fairly bullish. For instance, the Exponential Shifting Common (EMA) Ribbon revealed that the bulls had a large higher hand out there. This was as a result of the 20-day EMA was nicely above the 55-day EMA.

Furthermore, the Shifting Common Convergence Divergence (MACD)’s findings additionally supplemented these of the EMA Ribbon, because it too instructed a purchaser’s benefit. Nevertheless, the Chaikin Cash Circulation (CMF) was resting close to the impartial place, which may have LINK go both means.

Picture Supply: TradingView